Asset Managers Are Pro-Bitcoin

Why they are so friendly to the technological asset, and which financial institutions might not have the same stance.

Dear readers,

Larry Fink, BlackRock co-founder and CEO, called bitcoin an “international asset” and spoke about the revolutions underway in finance. His claims are neither new nor interesting from an investment thesis perspective—sorry Larry, we already knew that bitcoin represents a hedge against discretionary money. Statements made in mainstream media forcefully endorsing bitcoin move the perception needle, but the latest remarks by Fink are recycled in the mainstream financial sphere and rejected by others. We will break down some history of bitcoin institutional adoption, which institutions are embracing bitcoin, which ones are rejecting it, and the why of it all.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com

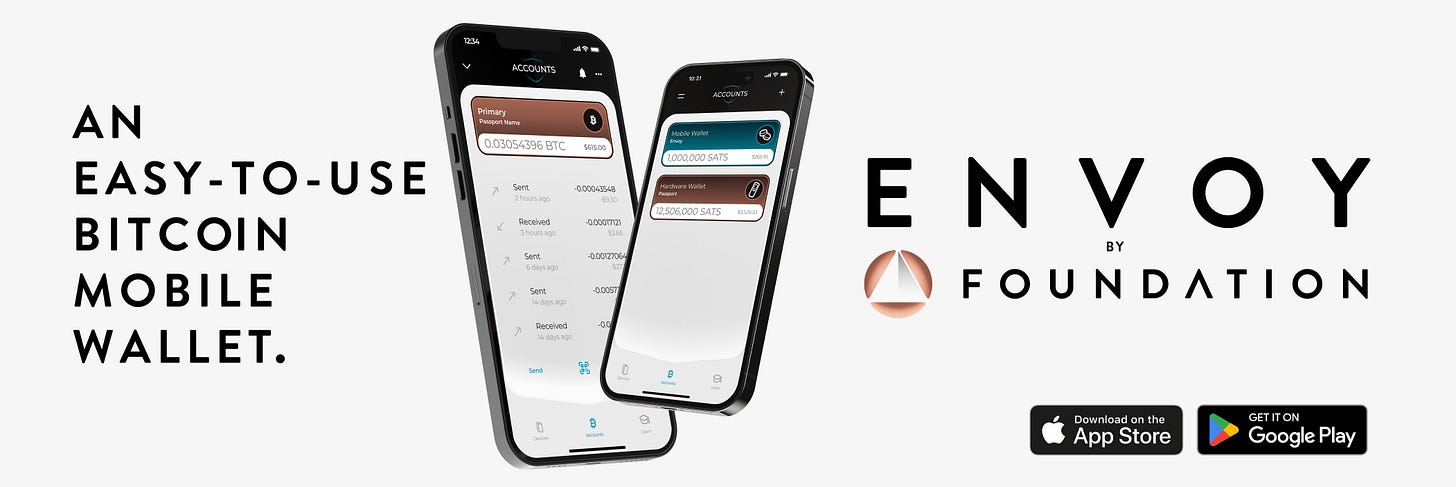

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

Asset Manager: Fidelity

In a 2016 scene from the techno-thriller TV series Mr. Robot, megabank E-Corp’s CEO laments:

The problem here is hard cash is fading rapidly. That's just the way of the world right now. And Bitcoin is spreading. And if Bitcoin takes over, we are all in a world of hell!

As the years go by and the fight over bitcoin freedom and regulation grows louder and more vitriolic, we would be wise to separate various actors across the financial landscape to identify which players would naturally gravitate toward pro-bitcoin approaches, and why. Only then can we triangulate institutional or bureaucratic angst toward it.