Good morning Readers!

Just like that, we have reached the end of Q1 for 2025, and given such a densely packed three months of action, we decided to take a step back and see exactly how well markets have performed throughout this year. Specifically, we compare risk asset versus safe-haven asset performance throughout 2025. Also, for the sake of our non-bitcoin-maximalist readers (we assume many of you have portfolios that aren’t 100% bitcoin), we dusted off the old Python and Modern Portfolio Theory skills to perform a mean-variance analysis and derive an efficient frontier and tangent portfolio containing only two assets: an S&P 500 ETF and bitcoin (using the period’s average US 10-year yield as our risk-free rate). Here’s the Python chart from our analysis:

Our goal with this experiment was to use the lens of an advisor using traditional finance models to add bitcoin into an all-equities portfolio. That said, here are this Weekly’s bullets:

QTD Performance of Risk Assets

QTD Performance of Safe-Haven Assets

TBL’s Bitcoin + Equities Portfolio Performance

So, without further ado, grab a coffee, and let’s dive into TBL Weekly #134.

As bitcoin's role in the global financial landscape evolves, understanding its potential impact on your wealth becomes increasingly crucial. Whether we see measured adoption or accelerated hyperbitcoinization, being prepared for various scenarios can make the difference between merely participating and truly optimizing your position.

This is why Unchained developed the Bitcoin Calculator – a sophisticated modeling tool that helps you visualize and prepare for multiple bitcoin futures. Beyond traditional retirement planning, it offers deep insight into how different adoption scenarios could transform your wealth trajectory.

What sets this tool apart is its integration with the Unchained IRA – the only solution that combines the tax advantages of a retirement account with the security of self-custody. In any future state, maintaining direct control of your keys remains fundamental to your bitcoin strategy.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Weekly Monitor

Weekly Analysis

Risk Asset Performance

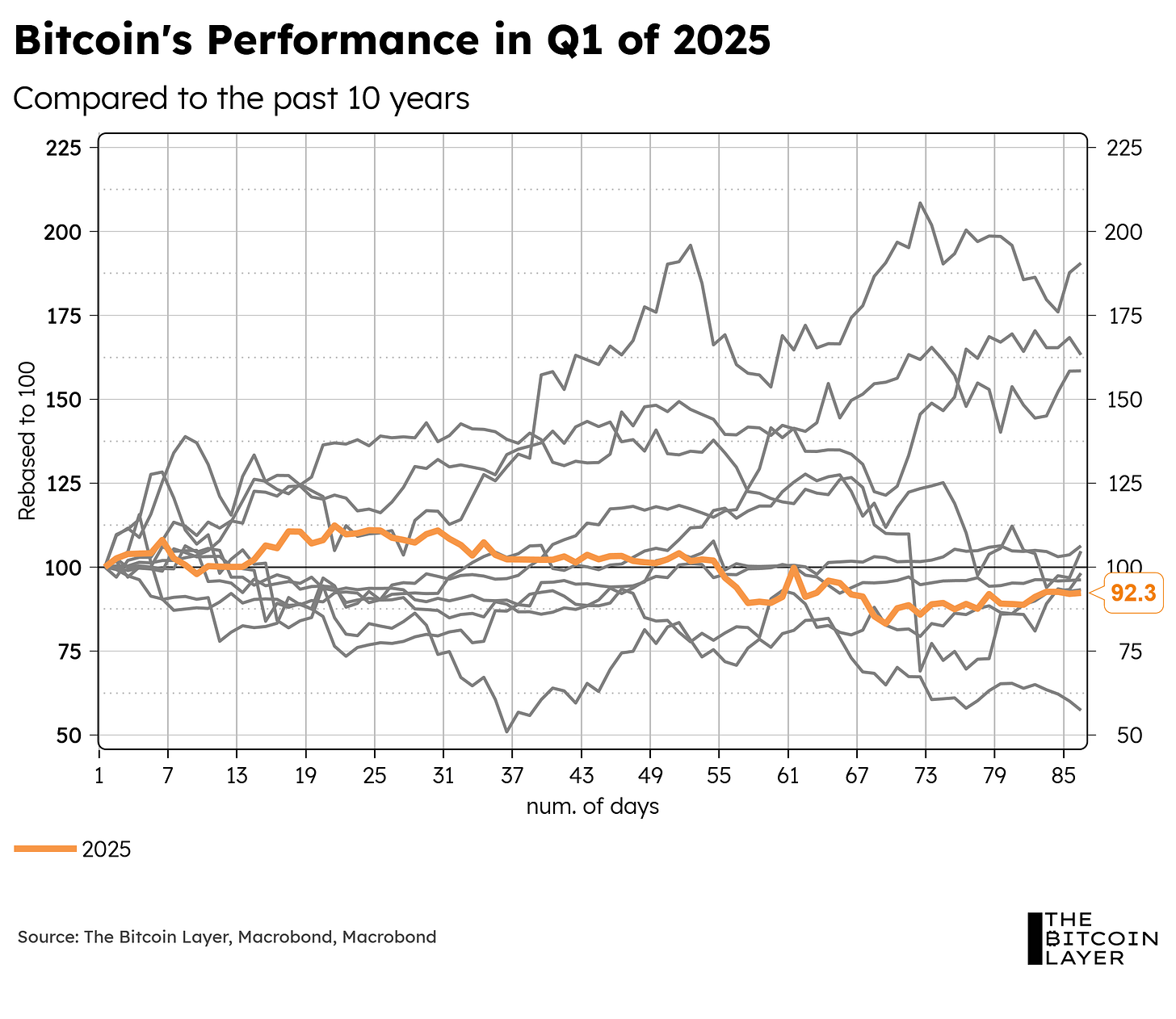

Starting with bitcoin, unfortunately, much like all other risk assets, we are headed for a negative Q1. As it stands today, 2025 has officially become the second slowest start to bitcoin over the past 10 years, with 2018 taking last place:

Something worth noting from the chart above, however, is that we are not too far away from where the majority of all other observations lie. Namely, when we look at 2016, 2017, 2019, 2020, and 2022, we are pretty much on par, except that this time, we are at higher price levels—a testament to bitcoin’s newfound floor at this higher valuation. In fact, when looking at Q1 statistics over the same historical time period, we fall just a little bit below the interquartile range, and the fact that the median is so close to the lower end of this range proves that today’s return falls very close to the norm; hence why we are not necessarily panicking despite the slow start.

Let’s now move on to equities.