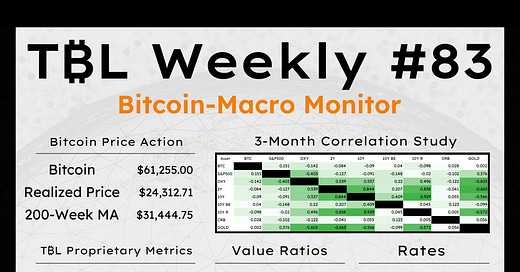

Welcome to TBL Weekly #83—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Just like this time last year, regional banks are sweeping news chyrons across markets, and not to report record-shattering earnings growth. A renewed set of fears as the Fed’s main emergency loan program is set to expire has left the market believing regionals are once again the harbingers of another crisis. We fully understand the emergency program still allows one-year loans up until the last day of eligibility, and that the Fed has dusted off the discount window, but we are unsure of how these two factors alleviate the current problem at hand.

New York City Bancorp, NYCB, which acquired Signature Bank last year discovered "material weakness" in how it tracks loan risks on Friday. This prompted its CEO to resign, and for Fitch to cut its credit rating to BBB- (junk) later in the day. Just four weeks ago, it announced a 526% increase in cash set aside for loan losses. It collapsed 30% at the open today on the loan oversight news to its lowest level since 1997:

Another embattled regional bank, Republic First, is now trading below 2 cents per share after a $35-million cash infusion fell through. This cash infusion is said to have not materialized, like NYCB, due to material weaknesses in internal control over financial reporting on credit and loans at the end of 2022.

An erosion of trust in the banking sector is like a mudslide: no matter how grand the beachfront estate may be, a mudslide can take it all out to sea in an instant. Regional bank stocks further slipping illustrates just how fearful market participants are, and just how flighty their deposit base is, making them more prone to failure. By the way, small deposit bases and reserve scarcity are related—if customers withdraw deposits and the bank has scant reservers, problems arise as the bank doesn’t have the ability to conduct interbank transfers.

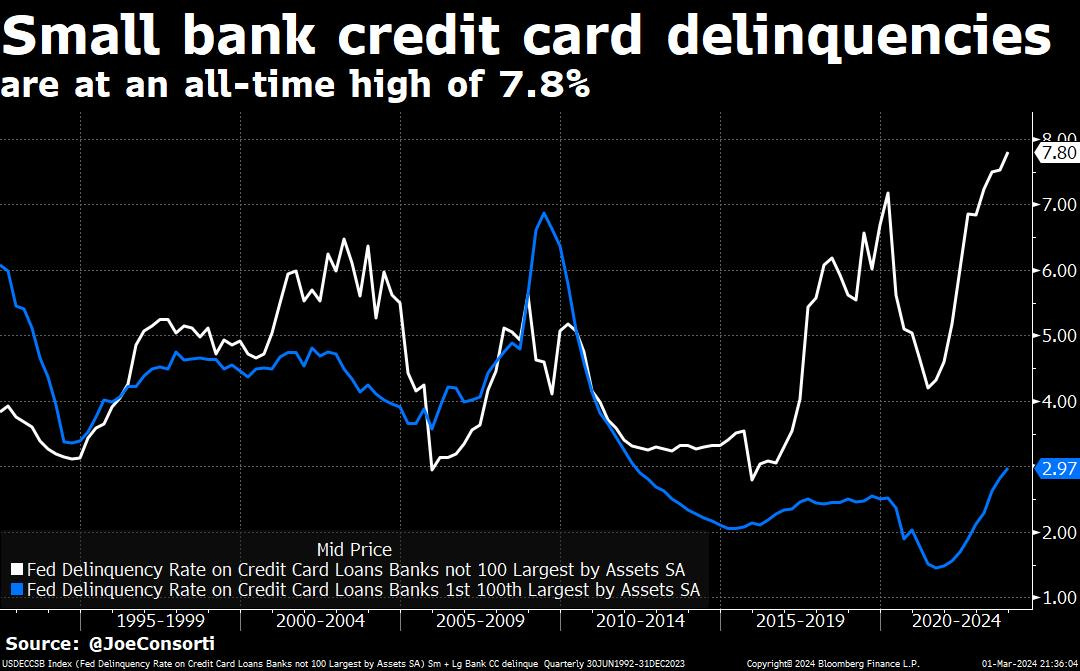

It doesn’t help that NYCB and other regionals have higher commercial real estate exposure than many larger banks, another fragile sector that has caused massive losses for banks holding their mortgages and mortgage bonds. It also doesn’t help than another source of revenue, credit cards, have their higher delinquency rates ever at these regional banks of 7.8%:

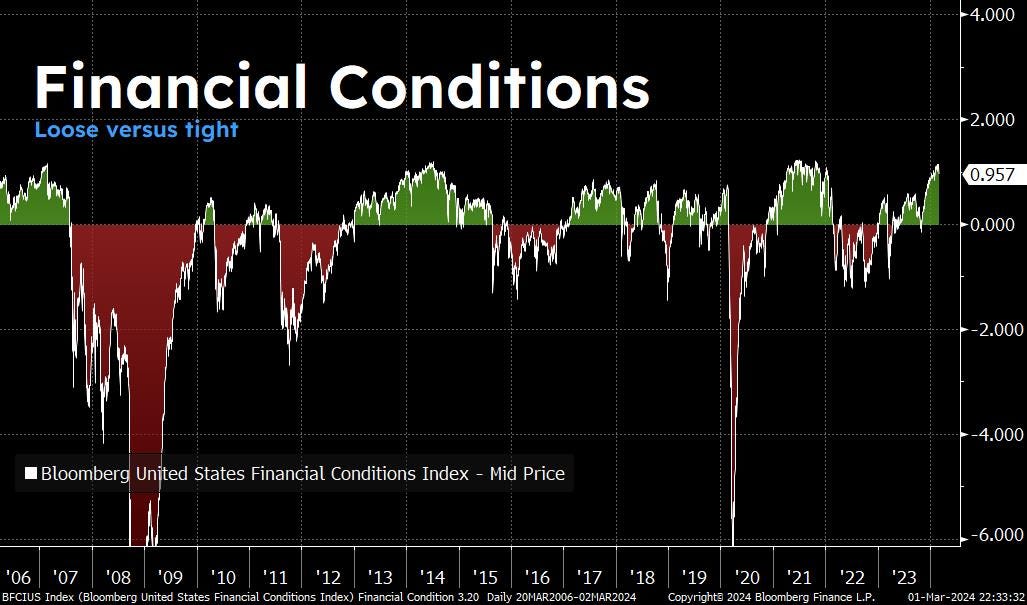

All of this is happening as the Fed’s bank term funding program, the savior of regionals in March 2023, is set to expire in just 9 short days. Participants are battering down the hatches and telling you that they smell blood in the water at these very same banks this facility was designed to save. Banks will have to use the discount window for further emergency loans after March 11th, getting loans at market value rather than marking their collateral at par value with BTFP—the key distinction that saved regionals from losses on their impaired assets last year. With two new kinds of impaired assets rising as top contenders for the largest risks regionals are facing, and no emergency facility to recoup those losses, it is not a stretch to suggest that the Fed wants bank failures and further consolidation of the system towards the top. A controlled demolition of sorts would allow deposits to be concentrated in a smaller number of large banks, helping the Fed reign in consumers when needed and more effectively transmit monetary policy, something it is desperate to do:

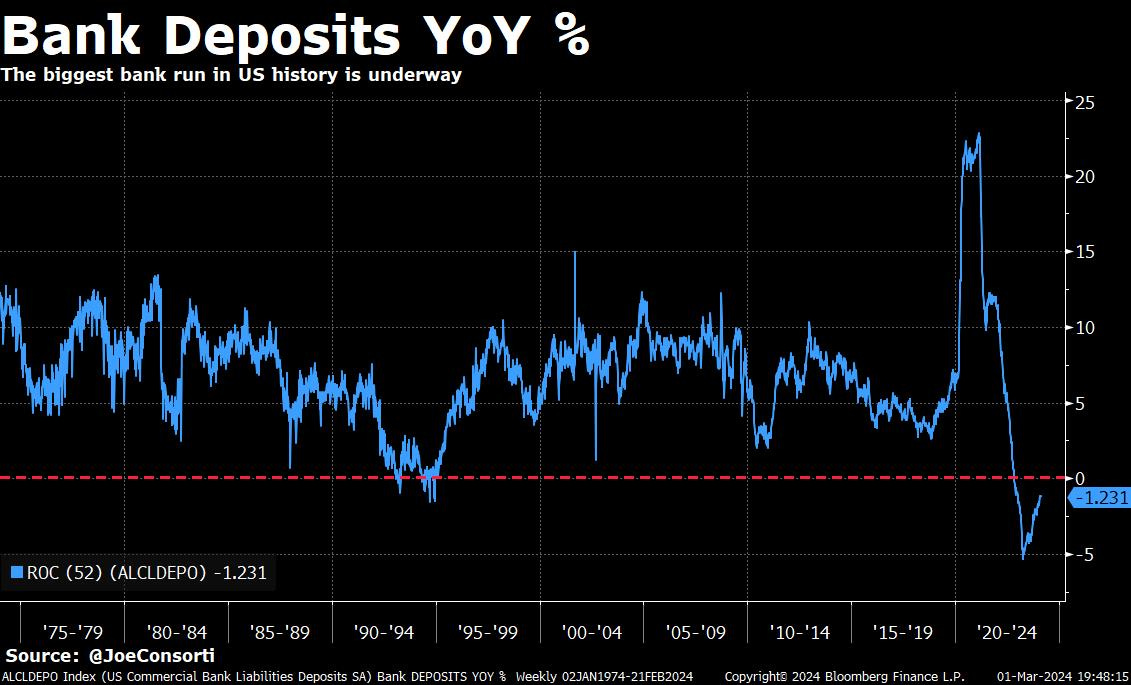

It may not be all doom and gloom though, with deposits still stable and in a marginal ~$200 billion uptrend from the March crisis last year:

Deposits are almost expanding yearly again, having risen from -5% deflation to a -1.2% annual pace—if BTFP ends without a hitch, deposits could once again start expanding on a yearly basis:

Soft data Friday prompted a spike in the odds for rate cuts sooner than later, after they have pared back since the start of the year thanks to strong economic releases. The University of Michigan’s consumer sentiment survey fell to 76.9 from 79.6 last month versus the 79.6 expectation. Within the survey, inflation expectations stayed flat, the sentiment toward current conditions worsened, and forward economic expectations fell to 75.2 from 78.4 last month versus the 78.7 expectation.

Consumers aren’t happy with the economy and they expect it to materially worsen in the year ahead, lining up with what we’re seeing now in business survey data. ISM manufacturing data came in at 47.8 versus the 49.5 expectation, and down from 49.1 last month (full video analysis, but if you prefer audio to YouTube, make sure to subscribe to our show on your favorite podcast platform below). Within the report, prices paid, new orders, and employment all fell. Prices paid fell by the least amount, indicating modest disinflation at the top of the supply chain with more meaningful declines in new orders and employment; hard economic activity decelerating faster than prices, i.e. stagflation, is not what the Fed wants to see.

The totality of Friday’s data releases sent 2s tumbling, with the market now betting on a full 25-basis-point rate cut by June and 50-bps worth of cuts by September:

On the flip side of a market fervently expecting rate cuts, the Fed is less enthusiastic about the proposition. Why? Well, financial conditions are just about maximally loose:

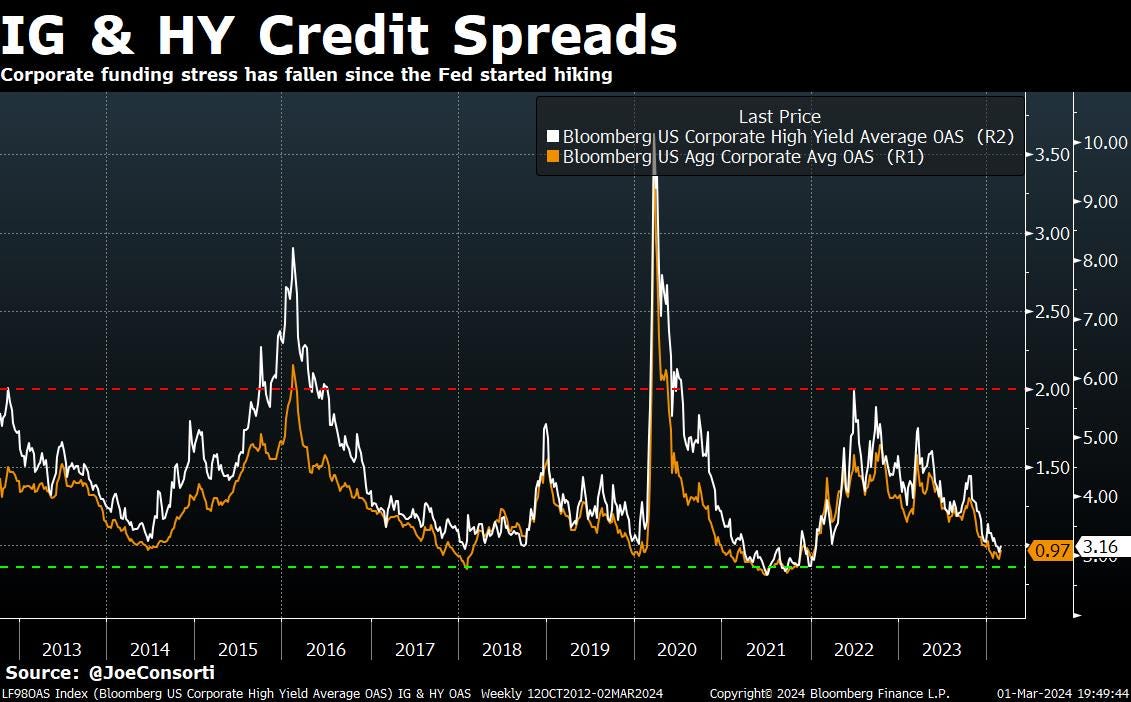

Credit spreads for both investment-grade and high-yield borrowers are at cycle tights:

To top it all off, you can’t think that Jerome Powell is too thrilled about headlines like these when CPI inflation is still stubbornly above his desired 2% target. By all accounts, the Fed has not achieved its desired level of restrictiveness, and has all but lost control of influencing market tightness and risk-taking effectively:

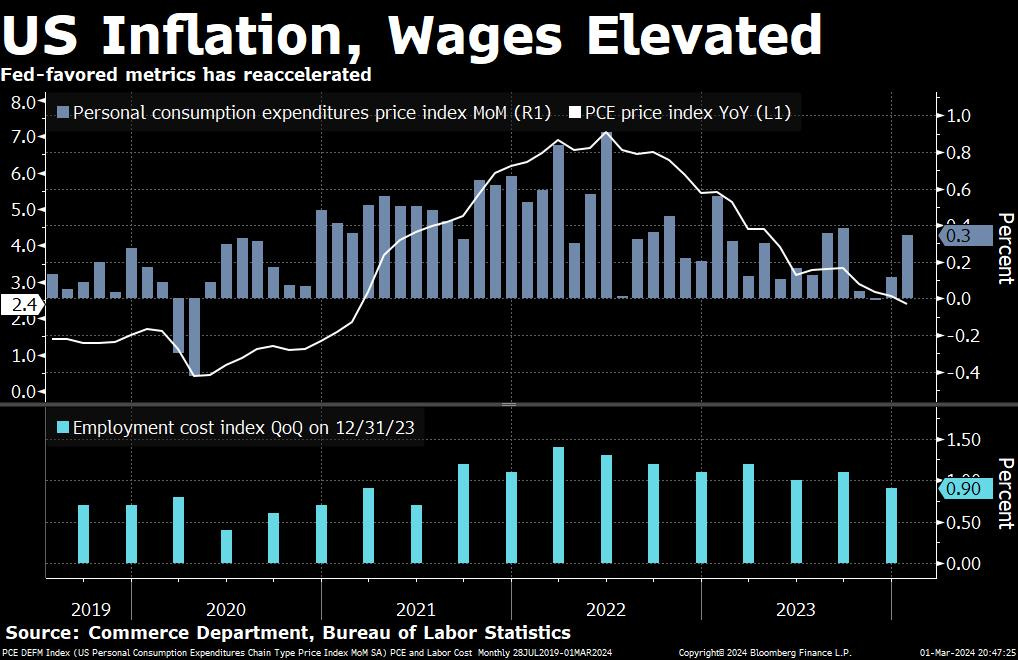

Core PCE rose from 2% in Q3 to 2.1% in Q4 this week. Headline PCE sharply rose month-over-month in January, along with stubborn employment costs which keep growing above the Fed’s desired level. Higher for longer still path of least resistance; the Fed is suggesting as much with Bostic saying he is “willing to wait” until inflation gets back to the Fed’s 2% target, and Kugler saying she is cautiously optimistic about a return to the inflation target without “significant deterioration” in the labor market:

To wrap the week the White House commented on Friday afternoon that the banking system is sound and resilient. Where have I seen this one before?

For more on bitcoin’s record-setting week, don’t miss our Thursday letter on the most important bull-market indicator we’ve seen this cycle.

Next Week

In the week ahead, we are presented with several high-signal economic releases, but market participants will likely be tuned in when Powell visits congress for semiannual testimony. We believe he will err to the side of “not done on inflation because it impacts everyday Americans” but will listen for any hints on monetary policy and notably the balance sheet. While the level of interest rates matters on a medium term, shortfalls in central bank liquidity can have instant and disastrous impacts on the financial system—it is for this reason we care about every single balance sheet move more than rates moves. Think back to BTFP last March—a positive outlook on risk markets once the balance sheet spiked would have been a very profitable position over the past 12 months.

To the data, and it’s safe to say we have a full suite this week. ISM Services on Tuesday, JOLTS and ADP employment readings on Wednesday, and NFP on Friday headline the week, but it would be safe to say that TBL is most focused on ISM Services and JOLTS:

Aside from immediate economic releases, our short-term outlook today truly does extend beyond the next five trading days. That is because once this upcoming week concludes, markets will be hit with 10- and 30-year auctions, February CPI, and the March FOMC meeting one after the other, not to mention the expiry of BTFP and realized impacts of altered Fed emergency facility usage. To echo our opening words this morning, last March brought us a dramatic mid-tightening crisis, leaving us wondering what this March will bring: spring flowers or market showers?

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik is joined by Jason Shapiro, a futures trader and hedge fund manager with 30+ years of experience. Jason breaks down his trading system, including how he uses speculative positioning and headlines to generate contrarian positions. He explains his current positioning, shares contrarian thoughts about a US recession, and discloses a long position in bitcoin.

Check out—Trading With Contrarian Indicators | Jason Shapiro

Tuesday

Folks, there are times in bitcoin where you can’t help but step back in awe of the price action. Monday provided longs some vindication that bitcoin is performing as intended: the apex financial asset for wealth preservation and capital appreciation. The mad dash for absolute scarcity is propelling us to brand-new all-time highs with a strength only rivaled by an angry bull charging at his matador.

Check out—Bitcoin Surging As Demand Has Never Been Higher

Wednesday

In this episode, Nik is joined by Bitcoin researcher David Seroy. David explains why a type of cryptography called "zero-knowledge (ZK) proofs" has the potential to bring scaling to Bitcoin. David argues that Lighting Network isn't enough by itself as a layer 2, and that ZK Rollups, sidechains, and BitVM might bring additional users to Bitcoin. He believes that in order to build a Bitcoin-based financial system and avoid excessive banking leverage, Bitcoin must add expressive transactions to its arsenal.

Check out—Building A Financial System On Bitcoin

Thursday

The Sheikh is buying! The Emir is buying! No, sorry, I don’t have evidence of this. And the title of this post is not meant to be taken literally, unfortunately. I don’t actually know who is buying, but I have a very strong idea. While Saudi Arabia, Qatar, and the UAE have all graced recent headlines suggesting a newfound association with the orange coin, ETF volumes and assets under management are establishing a new cost basis for bitcoin. Today, I want to suggest who is participating and the significance of these new entrants.

Check out—I know who the buyer is

In this episode, Nik is joined by Benobi, a Bitcoin researcher. Ben helps us understand the latest Satoshi Nakamoto emails, including why we have access to these communications for the first time, what we can conclude about Satoshi's identity, and why Ben believes there is powerful evidence Satoshi was a single person. Instead of trying to uncover the exact person behind Satoshi Nakamoto, this episode instead takes an intense look at the earliest days of Bitcoin.

Check out—NEW Satoshi Emails: Who Created Bitcoin?

Friday

In this episode, Nik brings us a massive chart pack from around the world of financial markets, global macro, and bitcoin. He begins with a recap on why debt monetization is TBL's underlying thesis looking forward, goes through manufacturing, home price, and inflation data, and spends time on weekly candlesticks from all the major markets. Finally, Nik concludes with some very high-signal data from bitcoin's on-chain data.

Check out—Bitcoin ON FIRE | Markets & Macro Update

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.