Banks report falling loan demand, the Fed's tightening is trickling into the economy

A chart pack that illustrates where we are in the credit cycle.

Dear readers,

We take a cycle-driven approach when we analyze markets here at The Bitcoin Layer. Fourteen months removed from the Fed’s first policy rate hike, our stage in the cycle is finally shifting into credit contraction, which begets an eventual economic recession.

Today we hit you with a fresh chart pack that breaks it all down. We look at yesterday’s SLOOS report from the Fed which showed tighter lending standards, falling loan demand, and a slowdown in loan creation, confirming the ongoing credit contraction and pinpointing our stage in the credit cycle.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Yesterday’s Fed survey unveiled a tightening of lending standards and a slowdown in credit creation from banks. The Senior Loan Officer Opinion Survey on Bank Lending, shortened to SLOOS, reveals that after a 14-month lag, the Fed’s higher interest rates have successfully transmitted to banks and their relationship with real economy via more expensive and reduced lending to businesses.

Interest rate hikes, which began in earnest last March, are finally catching up to the financial economy in the form of tightening loan standards, eventually choking off economic growth:

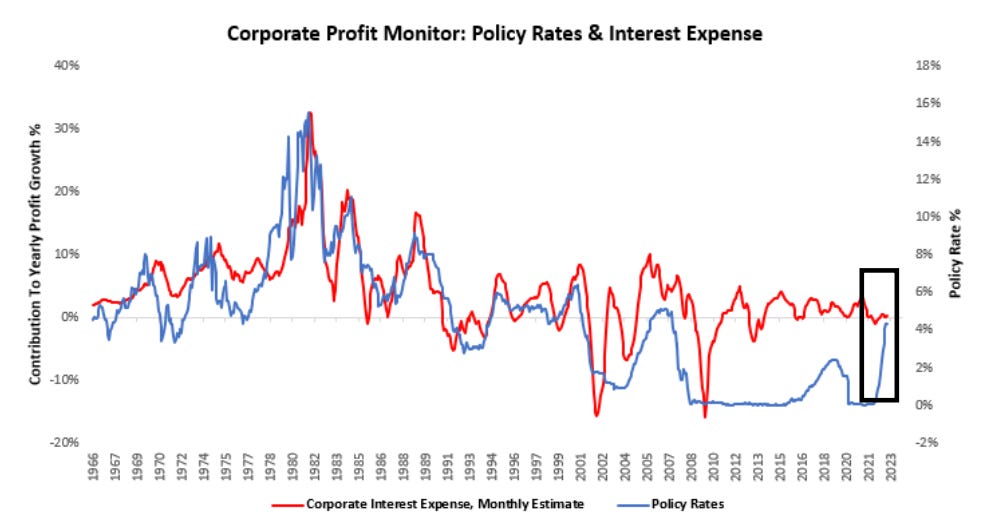

It is important to note that while loan standards are tightening—

a) total US bank lending is still rising, and

b) businesses have locked in low rates and pushed out their maturity wall, so the tighter loan conditions haven’t translated into higher corporate interest expense yet:

Credit spreads are elevated but have yet to blow out to credit crisis levels. Businesses were intelligent in 2020 and 2021—they took what the Fed and Treasury gave them in the form of near-zero interest rates and fiscal stimulus to secure low-interest term financing that matures over the next couple of years. Tighter financing for corporations is just starting to transmit to higher unemployment and a slowing economy; as corporate debt matures over the next year, it will likely accelerate. For now, tight credit is a slow trickle, a preview of what is to come—setting these circumstances to an easy-to-follow graphic, we are at the beginning of the downturn phase of the credit cycle:

Over 55% of senior loan officers at small & large banks are reporting a drop in business loan demand. Whenever credit demand gets this dry, the Fed is usually cutting rates to get it moving again. This time, the Fed is still hiking. Hiking straight into a brick wall: