Bitcoin and crypto aren't the same

Please, please stop asking me which crypto to buy next.

It can be baffling at times. I relinquished a career in fixed-income trading and interest-rate strategy, wrote a best-selling book about bitcoin, and even committed to an intermediate bitcoin price target of $500,000. But still, I get the same question everywhere I go:

“What other cryptos should I buy?”

[Loud exasperated sigh]. Let me be very clear in my response. Bitcoin and “crypto” are not the same thing.

Asset class differentiation

In my five years studying bitcoin, I have come across several types of advocates. One is the bitcoin-only zealot. This type of person believes that bitcoin is the only currency that will exist in the future. He or she thinks that all fiat currencies and altcoins will eventually succumb to bitcoin. On the opposite end of the spectrum, there is the multicoiner. This type of individual is convinced that bitcoin won’t be the end-all-be-all, that other cryptocurrencies will take a large slice of the pie, and that bitcoin might become the “Myspace” of the crypto world.

Instead of dissecting the theses of bitcoin maximalists and multicoiners, I’ll present my holistic vision of the future. Some of it can be found in Layered Money, but there’s plenty more to add. Where do Ethereum, altcoins, shitcoins, NFTs, and DeFi fit in? I strongly believe they will all coexist, and that these new asset classes are not going anywhere.

Price is truth

In the thirteen years since the bitcoin white paper was published by Satoshi Nakamoto, thousands of cryptocurrencies have been launched. While none of them have eclipsed the total market value of bitcoin, many have achieved impressive market values. I’m not the type to take food off other peoples’ tables, and I certainly won’t start with bitcoin-copycats. If price is truth, then a market capitalization of over $1 billion for over 100 different cryptocurrencies tells a story: we live in a multicoin world. But does that mean that bitcoin has competitors on its path to world reserve currency? No.

Bitcoin is a numerical commodity. It has no CEO, no headquarters, and no formal body that controls it. It is truly decentralized. This has earned it status as a “virtual commodity” in the eyes of the CFTC, the futures regulator in the United States. Additionally, the securities regulator (SEC) has been adamant that bitcoin is NOT a security. Can this be said for the rest of crypto?

Ethereum

If you spend a few minutes scrolling through my Twitter timeline, you’ll find endless animosity towards Ethereum. I have no such animosity—I see an asset worth $500 billion that failed to pass my own due diligence. In full disclosure, my “crypto” portfolio is 100% bitcoin. I have never owned Ethereum, nor do I intend to. The reason is quite black and white.

In 2016, when I was falling down the bitcoin rabbit hole and voraciously consuming every podcast episode, online forum, or rare book that I could to understand it, I learned about a new up-and-coming crypto called Ethereum. It had hype and excitement surrounding it, but within weeks of me learning about it, this happened:

The original Ethereum underwent a hack, resulting in a loss of $60 million, and the leaders of the project essentially attempted to undo the hack by “rolling back” Ethereum’s blockchain to before the incident.

As a freshly minted bitcoiner, I immediately knew this other cryptocurrency wasn’t for me. Bitcoin’s lack of center and authority attracted me. I looked across at Ethereum and saw a coin with leaders that possessed the power to change its supply. There was no way a currency that had a center could become a neutral, base-layer asset upon which to build a monetary system. While writing Layered Money, I concluded that gold was the monetary precedent that bitcoin was trying to chase down, and that neutrality was the only requirement.

Despite Ethereum having materially influential central points of control, it obviously attracts the demand of market participants. In fact, its network effect has become strong enough that the CME launched Ethereum futures contracts in 2021, approximately four years after it launched bitcoin futures. And the CME doesn’t play around.

My point about Ethereum is that I don’t view it as a neutral commodity. It resembles some of bitcoin’s commodity like features, while exhibiting a security-like management structure, with committees, an influential and public founder, and constant directives about a transition from proof-of-work (mining-based supply origination) to proof-of-stake (a system that somewhat mimics a shareholder structure). Nevertheless, half a trillion dollars later, segments of the market love Ethereum. This brings me to an analogy that I most frequently use when describing the difference between bitcoin and crypto: bitcoin is like gold, while the rest of crypto is like the technology startup world. These two asset classes are separate and distinct. One does not prohibit the other. The two can coexist. But I’ve never been a stock picker, and it’s not in my wheelhouse to identify and invest in startups that I believe will have an outsized impact on the technology world.

Altcoins

Continuing with the startup analogy, I spoke with a trusted former colleague earlier this year to catch up and talk bitcoin. He innocently suggested I look into a new crypto called Solana, and assured me that Solana was going to claw away some of Ethereum’s demand due to its technological advances. My goodness, was he right. Year-to-date performance of Solana is mind blowing—the coin is up over 11,000% in 2021!!! This is compared to an approximate 500% return in Ethereum (and a lowly 100% in bitcoin). Sure, I could have made outsized returns by being in either SOL/ETH versus BTC, but again, picking startups is outside of my skillset. I mentioned that my friend is somebody I trust, but trust alone was not enough to get me to part ways with my bitcoin for another crypto. I’m focused on the long-term implications from a new global neutral asset and the monetary hierarchy anchored by it, not how one crypto’s smart contracts are more functional than another’s.

Then, last week, I saw this headline:

Solana’s CEO said what? It doesn’t matter, I stopped reading at “CEO.” I love not having a CEO in bitcoin that can influence my investment. I am risk averse—my 100% bitcoin allocation might not seem risk averse to a fixed-income investor, but I look at “diversified” crypto portfolios with utter fright. I simply don’t want exposure to CEOs, foundations, and companies. Not my cup of tea. But if you’re willing to do the work and have a risk appetite, who am I to stop you? Different asset class.

Shitcoins

Anybody remember ICOs? This was the 2017 rage, only to be trounced this year by all sorts of dog-meme coins. Readers, please be careful with all of this stuff; you’re potentially better off studying the NFL and gambling at the Bellagio sportsbook. Once again, bitcoin doesn’t belong in the same conversation. Look at what happened yesterday, and this type of occurrence is commonplace:

Try that with gold? Try that with a shitcoin! A billion dollars, moving from one corner of the planet to another, practically free-of-cost, in minutes. Bitcoin is money and fulfilling its function as such. Meme-coins, flavor-of-the-month coins, and whatever the startup world comes up with next should not be compared to bitcoin. Is it starting to make sense that we’re not talking about the same thing? Please don’t try to use Dogecoin to send a billion dollars…

…it’s far from a nation-grade technology. My friend Alyse Killeen originated this term, and I continue to borrow it:

NFTs

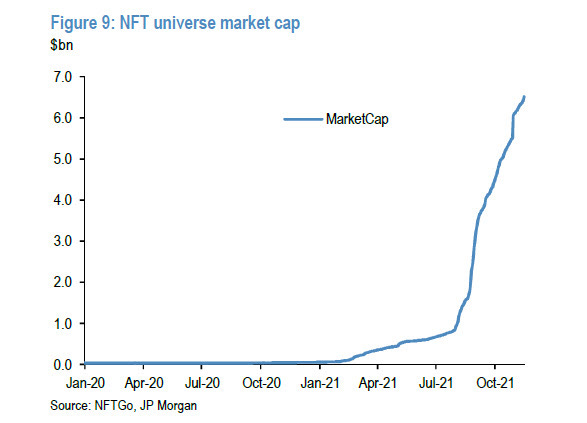

But what about NFTs?! I get this question a lot nowadays. I really liked this summation from JP Morgan’s research team on the new NFT asset class:

I completely agree with this assessment. NFT, short for non-fungible token, is a new type of digital asset that will likely disrupt many of the corners of the collectibles world, and beyond. I understand that world—I used to collect basketball cards as a kid (still have my Kobe Bryant and Allen Iverson rookie cards). Sure, sports memorabilia will likely find its way into the digital universe through NFTs. But why are we talking as if bitcoin and sports memorabilia are even remotely the same thing? The NFT crowd also suggests that Ethereum is a promising investment because it anchors much of the NFT world. While this might be true, this would equate Ethereum to an operating system or software platform, not a neutral commodity with purely monetary properties. The NFT universe is approximately $7 billion in size. Bitcoin’s market cap is above $1 trillion. That’s 0.7% in relative size.

Some times I feel like Iverson when people ask me about bitcoin and NFTs.

DeFi

Another new buzzword in the digital asset complex is DeFi, or decentralized finance. Bitcoin is a decentralized financial asset, but for some reason, DeFi has been used to describe many things outside of bitcoin. Ignoring the simple fact that businesses want to create new products and profit from innovation, the centralized counterparty system used in traditional finance can truly be disrupted by cryptography-based technology. From my vantage point settling fixed-income securities by fax machine as late as 2019, the legacy financial system has tremendous room for technological modernization. And this new category of DeFi might have a lot to do with it. However, knowing which software solutions will fix this or that problem with security settlement and loan origination is again outside of my area of expertise. I have little doubt that the DeFi movement will continue, but bitcoin stands alone as a reserve asset in this new experimental world. One of the reasons that Ethereum is not investable to me is that its problems will lead other projects to compete. In a recent and fascinating example of DeFi, a DAO, or decentralized autonomous organization, formed in order to bid on a copy of the US Constitution. While the bid failed, I found this little tidbit fascinating from the article titled “‘Buy the Constitution’ Aftermath: Everyone Very Mad, Confused, Losing Lots of Money, Fighting, Crying, Etc.”:

“Of the initial $200 we bought in ETH, $90 was eaten up in fees simply to donate to ConstitutionDAO.”

Yikes.

Bitcoin stands alone

You’re welcome to your own research. With that research, maybe you’ll be able to outperform bitcoin. But my mission is bitcoin education, because I believe that bitcoin is a world-changing force for good. I believe it can change the lives of billions for the better, giving the planet access to a savings vehicle isolated from centralized entities—a form of property rights to which the masses have never had access. This is also why privacy in bitcoin is so important; property rights are useless if oppressive governments can hunt you down and identify your bitcoin holdings at the drop of a hat. While many are ecstatic about the new Bitcoin City announcement out of El Salvador, more exciting to me is the idea that ARK’s Cathie Wood believes that 2% of the country’s GDP is already denominated in bitcoin. Are any of the altcoins we discussed on track to achieve that sort of metric? For all of these reasons, please stop asking me which crypto to buy next. My response has evolved to, “sorry, I am not invested in that asset class.”