For this week’s post, we want to analyze recent developments in the world of Corporate Bitcoin Treasuries. There has been a flood of news, notably the emergence of new competitors to Strategy, including a SPAC led by Jack Mallers. Semler Scientific is resuming its Bitcoin purchases, and Strategy released its first quarterly earnings incorporating the new FASB accounting rules and outlined new strategic targets. It’s time to dive in.

Passive Flows

At The Bitcoin Layer, our main focus is on macro, markets, and Bitcoin. So, why should we care about the earnings call of one particular publicly traded company? In our opinion, it’s less about the company itself and more about the broader movement it represents. There is a seismic shift occurring beneath the financial landscape. When Jack Mallers, CEO of Strike, announces a newly formed SPAC aimed specifically at acquiring as much Bitcoin as possible—to boost Bitcoin-Per-Share (BPS) and achieve a high Bitcoin-Return-Rate (BRR), pun intended—we listen closely. Similarly, when the largest Bitcoin Treasury company introduces new metrics designed to set standards for the Bitcoin Age, we pay attention, learning how to calculate and conceptualize them.

The world as we know it is rapidly changing, and it’s essential to stay alert.

To illustrate our point, take a look at this slide from Strategy’s most recent earnings call presentation. They’ve attempted to trace the ultimate beneficiaries of all outstanding common stock, estimating a staggering 55 million beneficiaries. The exposure to Bitcoin price appreciation that Strategy provides to millions of people is enormous. The passive flows generated from inclusion in ETF funds cannot be overstated. Strategy’s move to conserve purchasing power by converting a portion of these passive inflows into Bitcoin is truly impressive to witness.

Twenty One Capital

Twenty One is the newly formed SPAC created by iFinex (owner of Tether and Bitfinex), Softbank, and Cantor Fitzgerald. However, as Jack pointed out in his video, Tether (through iFinex) is effectively the largest owner of this new Bitcoin Treasury Company. Softbank holds a minority stake, while Cantor Fitzgerald’s involvement stems from their assistance in taking the new entity public through a shortcut: utilizing Cantor Equity Partners’ existing SPAC, trading under ticker $CEP. After the merger, the new entity will trade under ticker $XXI.

It’s too early to conduct an in-depth analysis of the company since it just launched. The filings currently reveal only basic motivations—why Bitcoin—and hint at intentions to create value through innovative leverage strategies. It appears Twenty One has already negotiated deals to issue convertible debt, with filings indicating an initial amount of $385 million. At launch, Twenty One’s balance sheet shows 31,500 BTC, primarily contributed in-kind by iFinex in exchange for its equity ownership.

We have one reason to remain cautious about expecting substantial bitcoin accumulation in the short term:

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Blockstream Jade Plus is the easiest, most secure way to protect your Bitcoin—perfect for beginners and pros alike. With a sleek design, simple setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes.

Seamlessly pair with the Blockstream Green app on mobile or desktop for smooth onboarding. As your stack grows, Jade Plus grows with you—unlock features like the air-gapped JadeLink Storage Device or QR Mode for cable-free transactions using the built-in camera.

Want more security? Jade Plus supports multisig wallets with apps like Blockstream Green, Electrum, Sparrow, and Specter.

Protect your Bitcoin, sleep better, stack harder. Use code: TBL for 10% off.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code: TBL.

The inability of SPACs to issue common stock At-The-Market (ATM). The SEC imposes specific restrictions for ATM offerings, including that a company must not be, or have recently been, considered a “shell company.” By definition, SPACs are shell companies until completing a merger or acquisition—commonly known as a “de-SPAC.” After completing such a transaction, the company must wait at least 12 months and satisfy additional requirements before it can raise capital via ATM offerings.

Without the ATM facility, it’s unclear exactly how they plan to acquire additional Bitcoin. The first year might involve frequent issuances of convertible debt. However, there’s a nuanced relationship between deploying fixed-income instruments and issuing common stock, which I’ll explain in greater detail later.

At Friday’s closing price (May 2nd), shares were valued at $47 each. Given their disclosed BTC holdings and outstanding share count, we can determine the Bitcoin-Per-Share (BPS)—a crucial metric for Bitcoin Treasury Companies, reflecting their primary purpose. With this metric, we can also calculate the premium or discount at which the stock currently trades. Based on Friday’s closing price, Twenty One is trading at a 4.12x multiple relative to its underlying Bitcoin holdings per share.

Semler Scientific

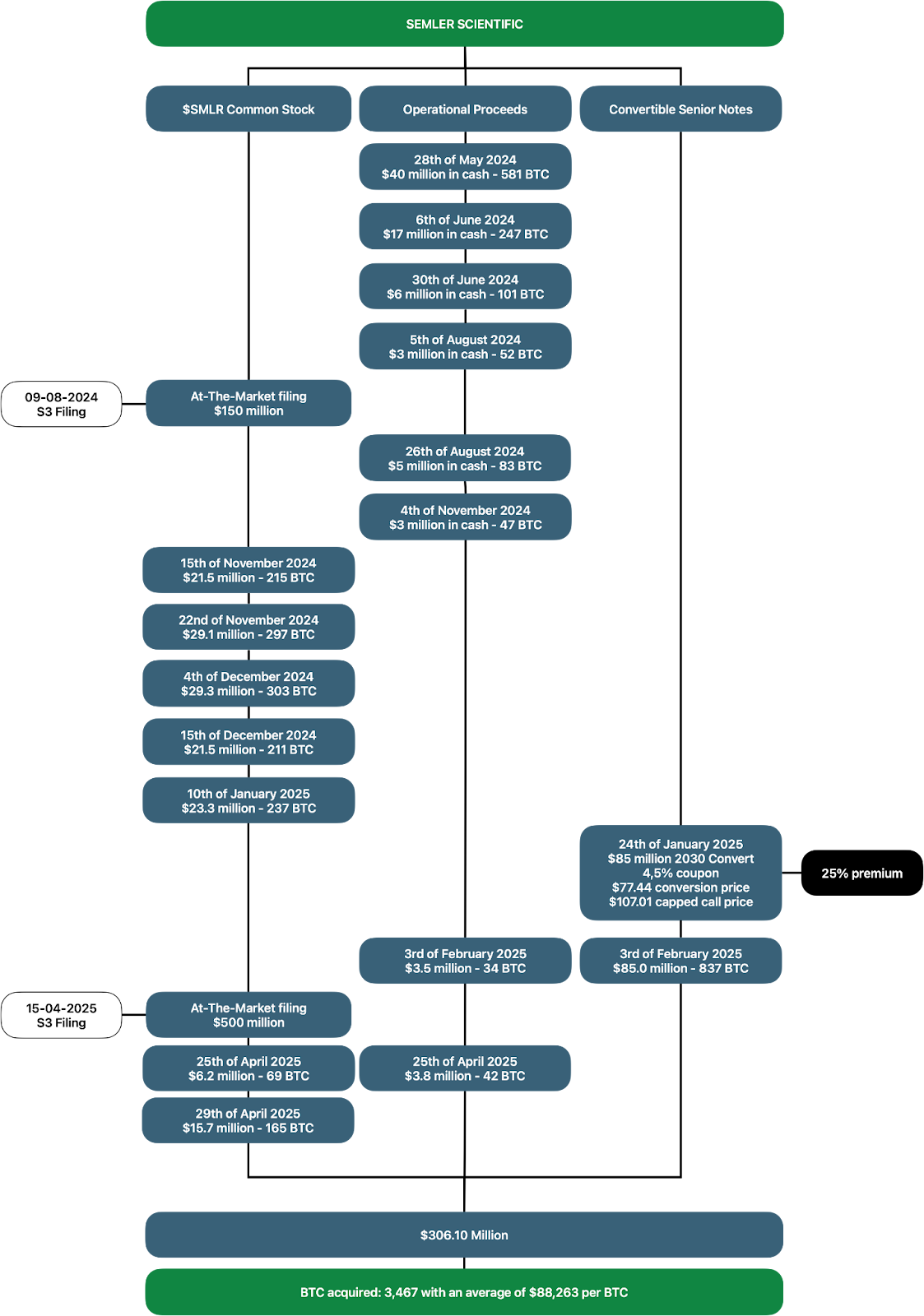

This timeline outlines all announcements related to Semler Scientific’s Bitcoin purchases. Semler initially revealed its new Bitcoin treasury strategy on May 28, 2024. The company began by purchasing Bitcoin with cash on hand, generated by its profitable healthcare business. Later, it expanded this accumulation strategy by first utilizing an ATM facility and, in early January, issuing convertible debt. In April 2025, they announced a new ATM agreement worth $500 million—more than tripling their potential purchasing power. However, it’s crucial to understand that issuing new shares requires sufficient trading volume to absorb these shares without significantly impacting the stock price. This explains why companies typically sell shares gradually over extended periods. Higher trading volume enables them to sell into the market without drastically affecting the share price.

When examining Semler’s filings, one particular detail stands out regarding their convertible debt offering: Semler chose to cap the call price, limiting the potential upside to $107.01 per converted share. The conversion itself occurs at a price of $77.44. To compensate for the capped upside, they offer a relatively high coupon rate of 4.5%. This approach contrasts with Strategy’s convertible debt issuances, which generally come uncapped but with near-zero coupon rates. Essentially, Semler is limiting future dilution of common stock but accepting higher annual interest payments as a trade-off.

Cost Basis

Another notable point is Semler’s unfortunate timing (to put it mildly) regarding the issuance of convertible debt and their significant Bitcoin purchases in January 2025. At approximately $100,000 per Bitcoin, this purchase represented about 25% of their entire Bitcoin holdings. To Semler’s credit, acting is better than doing nothing, but it may require some patience before Bitcoin’s price consistently exceeds $100,000. Allow me to elaborate: Semler’s average purchase price (cost basis) currently sits at $88,263.

Bitcoin does not have a fixed “fair value,” but historical data suggest some metrics can serve as reference points, or “mean values.” In bull markets, Bitcoin’s market price often significantly surpasses these mean values, while bear markets typically see prices dip below them. Over time, market prices display a strong tendency to revert to these dynamic mean values.

Semler’s current cost basis sits above every relevant historical metric. While not immediately problematic, this isn’t ideal either. For instance, Strategy has repeatedly (and incorrectly) been accused of facing liquidation whenever Bitcoin approaches their cost basis. Importantly, Semler’s Bitcoin was purchased primarily through equity and partially through debt. Crucially, this debt is nonrecourse, meaning the Bitcoin holdings are not collateral against the issued debt. There is no liquidation price forcing the sale of Bitcoin. Thus, as long as Semler can meet its interest obligations from its operational business cash flows, it faces no imminent pressure to liquidate Bitcoin holdings. The first significant risk arises only in 2030 if their stock price remains below $77.44, potentially forcing debt refinancing and the sale of Bitcoin.

It Takes Two to Tango

This scenario brings us back to the relationship I previously mentioned between issuing common stock and debt instruments. By issuing additional common stock, a company’s total asset base increases. Convertible senior notes rank higher in the capital structure; thus, if Semler Scientific were to default, convertible bondholders would be compensated before common stockholders (assuming sufficient assets remain). Increasing equity reduces the risk for bondholders without altering their potential returns, thereby improving the risk/reward profile.

Astute readers might already grasp another aspect. Issuing more common stock—particularly when shares trade at a premium relative to the Bitcoin holdings—and subsequently using those funds to acquire additional Bitcoin creates a positive feedback loop. This process increases the company’s asset base and thus raises the likelihood that its stock price will exceed the convertible debt’s conversion price. Why? Historically, Bitcoin’s annual appreciation has exceeded 50% since 2015. If this trend continues, in any form, Bitcoin acquired today has roughly five years to appreciate before the convertible debt matures. As Semler acquires more Bitcoin, the odds increase that their debt will convert into equity, eliminating the need to refinance.

This dual strategy—issuing both common stock and intelligently structured debt—is essential. Successful execution involves utilizing prudent leverage (nonrecourse debt) to capitalize on Bitcoin’s asymmetric growth potential while simultaneously deleveraging through equity issuance to manage risk exposure associated with this volatile asset. Indeed, it takes two to tango.

Two Times Twenty One

People tuning in on May 1st for Strategy’s earnings call were in for a treat. You can draw many conclusions from this call, but the fact that The Wall Street Journal chose to highlight Strategy’s unrealized losses in their headline is particularly telling.

While not technically incorrect, the focus on this loss is misleading. It’s noise, not signal. This quarter marked the first time Strategy applied the new FASB rules, valuing their Bitcoin holdings at market prices. Because Bitcoin was at $93,390 at the beginning of the year but dropped to $82,445 by quarter-end, Strategy reported a massive unrealized loss of $5.9 billion. However, by the time of the earnings call, Bitcoin had already rebounded above $93,390, making this unrealized loss largely irrelevant. Yet, the WSJ still chose this headline—and threw in “Crypto” to add some extra noise.

On the bright side, next quarter could bring explosive upside if the current uptrend continues. But, in fairness, if this quarterly loss is just noise, then any unrealized quarterly gain is equally noisy. With a volatile asset like Bitcoin, analysis should focus on longer-term trends. It’s a marathon, not a sprint.

What was the real signal from this call, in our view? The clear signal is that Strategy continues to accelerate aggressively. Their original $21 billion ATM offering was nearly exhausted, so they doubled it to $42 billion. Likewise, they doubled their issuance of fixed-income instruments to another $42 billion. They’ve revised their 2025 targets upwards to a Bitcoin Yield (BTC Yield) of 25% (previously 15%) and a Bitcoin Dollar Gain (BTC $ Gain) of $15 billion (previously $10 billion). BTC Yield represents the percentage increase in Bitcoin-Per-Share (BPS). Starting 2025 at ₿0.00158887, the target is now at least ₿0.00198608 by year-end.

The BTC $ Gain target of $15 billion is something most observers fail to grasp fully. It represents gains in USD from Bitcoin acquired without causing share dilution. For example, if Strategy trades at an mNAV of 2.25 and issues stock to buy Bitcoin, it’s effectively printing a $1 bill and selling it for $2.25—$1 of dilution and a $1.25 immediate gain. Achieving a BTC $ Gain of $15 billion in 2025 could propel Strategy into becoming one of the top 10 most profitable companies in the US stock market.

Rev’ it

The earnings call wasn’t merely about quarterly numbers—it was about vision. With the Formula 1 Miami Grand Prix taking place this past weekend and with Saylor’s engineering approach, a racing analogy seems appropriate. We identified the signal clearly: Strategy is accelerating. What does acceleration require? It requires torque. Simply buying Bitcoin with available cash provides a comfortable cruising speed—around 30% ARR. To move faster, you must accelerate, and torque gives you the instantaneous capability to change speed. Saylor describes the leverage obtained through fixed-income instruments as “BTC Torque.” More torque leads to greater acceleration (provided traction is sufficient).

Saylor presented slides showing that the most value-accretive instruments for Strategy are preferred stocks like $STRF and $STRK. Strategy would gladly issue more preferred shares, but issuance depends on trading volume. This is precisely what we mean by traction. Adequate traction is necessary to utilize torque effectively, thereby accelerating.

In simple terms:

Traction (high trading volume) + Torque (ATM issuance of STRK and STRF) = Acceleration (BTC Yield).

Saylor also explained why these preferred stocks stand out compared to other instruments. They offer higher dividend yields while carrying lower risk, primarily because of the substantial equity cushion on the balance sheet. As investor interest in these instruments grows, Strategy will have the capacity to increase its issuance significantly.

Pole position

Strategy’s Bitcoin cost basis is approximately $68,459, closely aligned with the historical True Market Mean—a significantly better position than Semler Scientific. Moreover, Strategy’s accumulated Bitcoin holdings are unmatched. It remains uncertain whether any other company will ever approach their holdings of ₿553,555—and even if one does, it surely won’t achieve a comparable cost basis around $70,000.

With Strategy as the construction team and Michael Saylor and Phong Le as drivers, the company clearly occupies pole position for the race ahead. Currently trading at a more attractive mNAV than competitors such as Twenty One Capital and Metaplanet, Strategy holds significantly more Bitcoin at a lower cost basis—and isn’t slowed down by the 12-month waiting period for equity issuance.

All instruments are set, tires preheated, game plan locked in, engine roaring, drivers focused, and communication crystal-clear. It’s time to hit the tarmac, find traction, and accelerate!

Become a TBL Pro member today and gain access to all of our paid research and monthly Zoom Q&As with the team!

It would have been good to include some analysis of Fold Bitcoin ($FLD).