Bitcoin cycles & gauging market temperature: TBL Weekly #120

Welcome to TBL Weekly #120 — grab a coffee, and let’s dive in.

Good morning Readers! Welcome to TBL Weekly #120 — grab a coffee, and let’s dive in.

From now until November 27th, get 30% off your first year as a TBL Pro member and enjoy:

Mean Median Mode - Our Bi-Weekly Risk Report analyzing what moves bitcoin

Live Zoom Q&As with Nik

Nik’s weekly letter for investors

Looking forward to meeting all our new TBL Pro members!

Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year.

Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order?

If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul.

Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way.

With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below:

Weekly Monitor

Weekly Analysis

As bitcoin’s latest—and incredibly majestic—bull run keeps pushing our own psychological and greedy limits, everyone in your family is probably asking you, “Should I sell now and wait for the next pull-back to buy some more?” In today’s Weekly, we travel backward in time to see how today’s bull-run environment compares to previous ones, and perhaps gain some understanding that enables us to remain cool amidst this seemingly hot hand we all find ourselves experiencing.

Let’s start with a chart:

Looking at the chart above, we used a trailing YoY change in bitcoin’s price to identify bull runs. In the bottom pane of the chart, we visually selected periods where red mountains were most prominent, meaning YoY growth was strong. Having found at least two candidate periods for this comparative analysis (2017 – 2018 & 2020 – 2021), we can now look at the usual TBL points of analysis at each point in time:

Bond Volatility

US Rates

Stock Volatility

The Fed

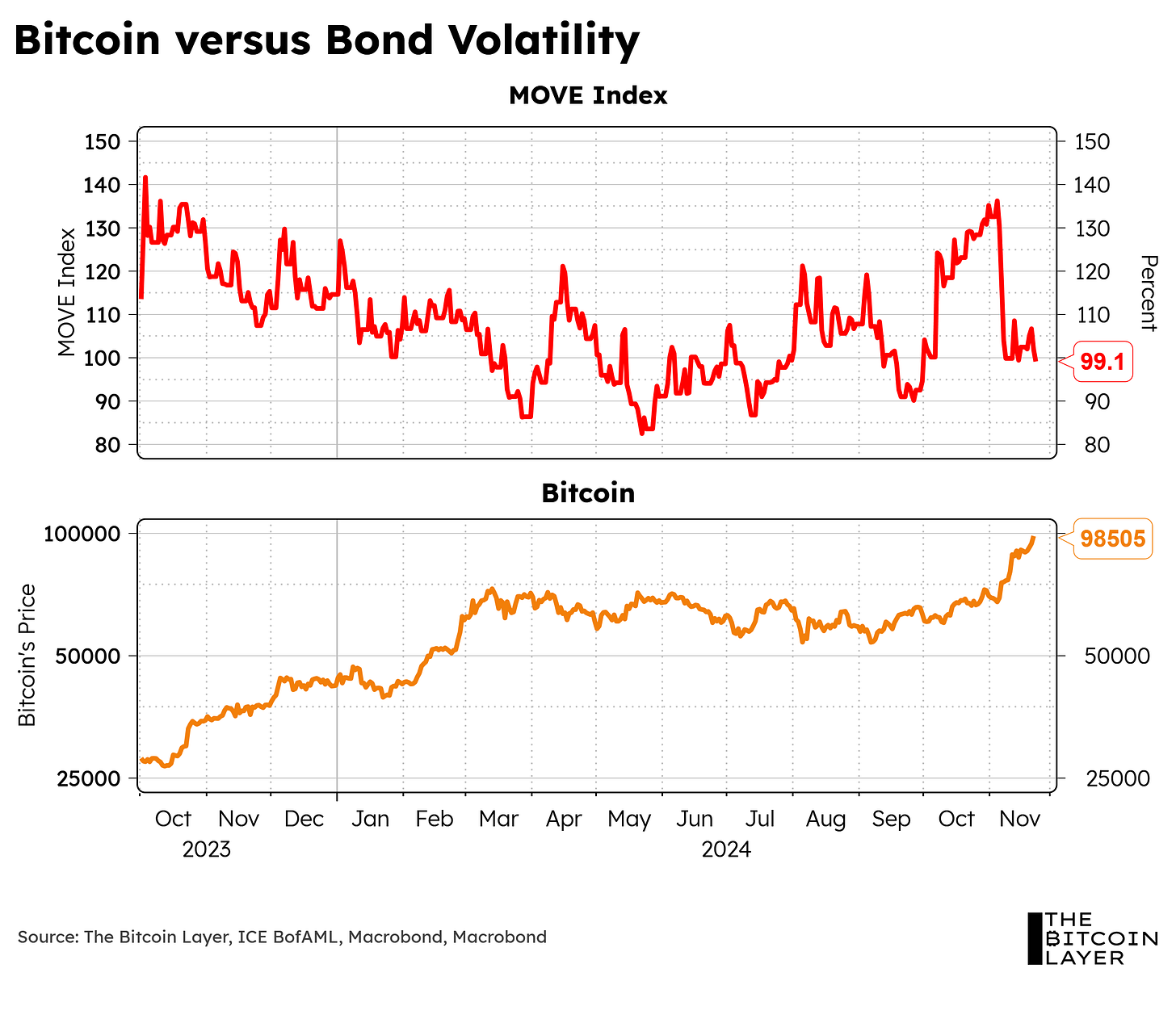

Bond Volatility:

Early 2017 – Late 2018:

In the 2017 – 2018 bull run, bitcoin ran almost counter to bond volatility. Looking the two panes, you see the MOVE Index with a giant smile while bitcoin carries a frown. This reflects our TBL liquidity narrative that the less volatile the bond market, the greater the collateral value, and the more liquidity. As you can see, In bitcoin’s peak during this time period, bond volatility reached a period-low.

2020-2021

The pandemic is obviously a difficult time period to use in a comparative analysis, as governments used extraordinary measures nominally beyond anything we’d ever seen; nevertheless, we can still derive some information from it. Looking at the chart during this time period, despite both panes displaying very similar trends in their respective lines, notice how the majority of bitcoin’s run-up (i.e., from September 2020 to January 2021) took place at a MOVE Index level of 40 (similar to 2017’s bull run). Once again, low bond volatility boosted bitcoin’s conditions.

Today

Looking at the same two panes in today’s run-up, we see that despite the high levels at which the MOVE index lies, bitcoin’s price has accelerated upwards—especially during times when bond volatility is the lowest within this time period. From October 2023 to March 2024, bond volatility decreased while bitcoin rose. This was then followed by almost 8 months of consolidation in both of these charts. Then, bond volatility increased to period highs, only to massively dip in November, where bitcoin’s current bull run is taking place. In short, historically speaking, bond volatility provides pretty decent clues for overheated markets, and right now, bond volatility seems to be on its way down. We believe that light bond volatility today suggests, by itself, there is no broad macro overheating condition on risk markets.

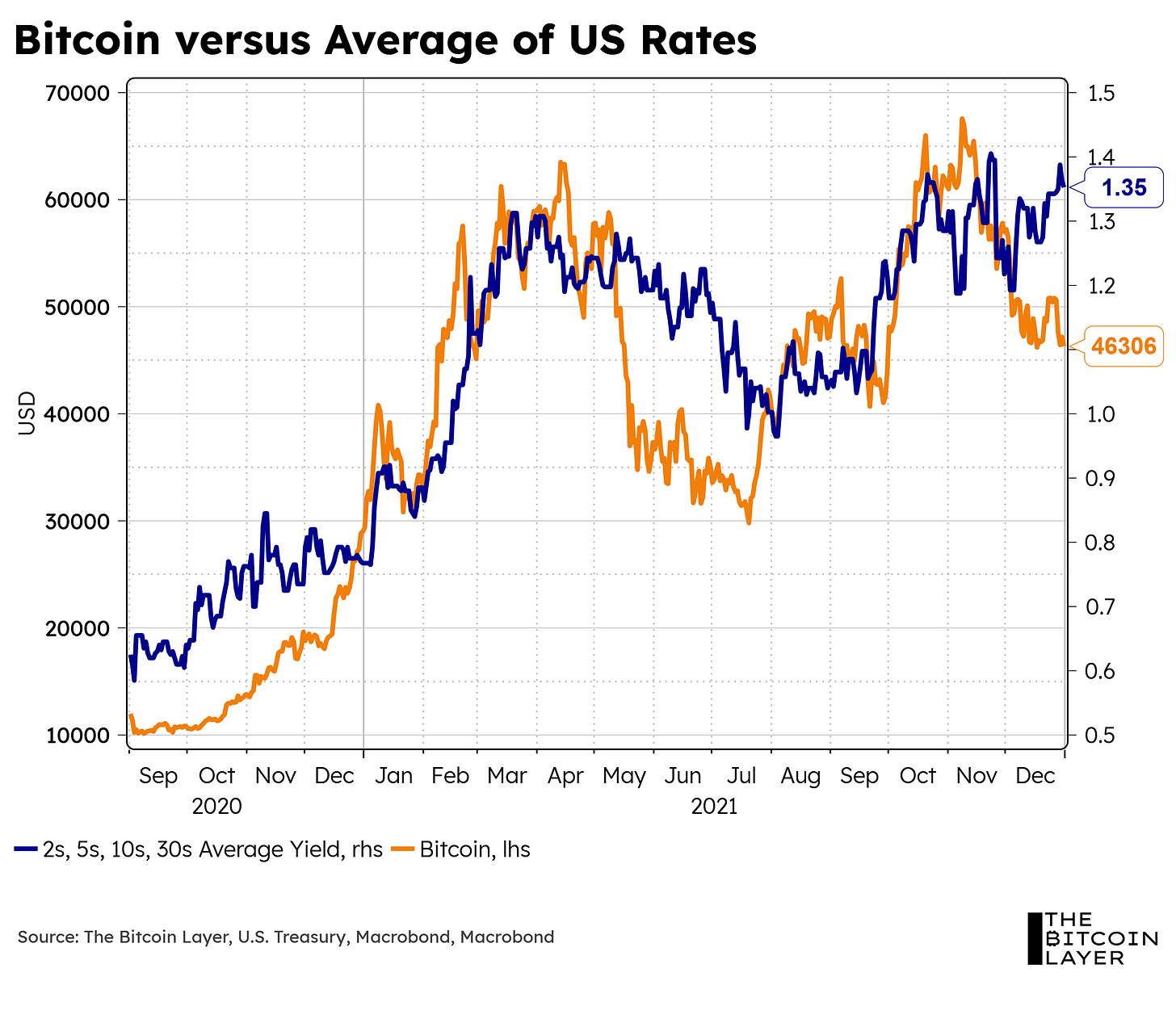

US Rates:

Early 2017 – Late 2018:

Our next piece of framework lies in nominal interest rate levels, instead of rate volatility, which takes pricing from options on Treasury securities. In the 2017 bull run period, during period lows (interest rates at 2%), bitcoin had a massive bull run. Then, 2018 saw rates rise above 3%, which was paired with a huge drop in bitcoin’s price. Although bitcoin ended the period in positive territory, make a mental note that the pattern seems to be that low interest rates are good for bitcoin—makes sense.

2020-2021

During the period following the pandemic, US Treasuries sold off from historical lows, which explains why higher interest rates did not really affect bitcoin. Going from a 0% interest rate to a 1.3% interest rate doesn’t necessarily mean tighter times—we were still at historically low levels despite the increase. Pair that up with low bond volatility to start this time period (as highlighted above), and you get pretty decent conditions for a bull run.

Today

Today, we lie at higher rate levels than the previous two bull runs—a high-interest rate environment that bitcoin has not seen before. Accordingly, this marks a new data point for all of us when we compare this time period to our future analyses. That being said, drawing a general conclusion from the previous two bull runs, we can see the same trend: US rates are on the decline—making lower highs each time—while bitcoin is on the rise. Again, low interest rates seem to be a common theme during bull runs.

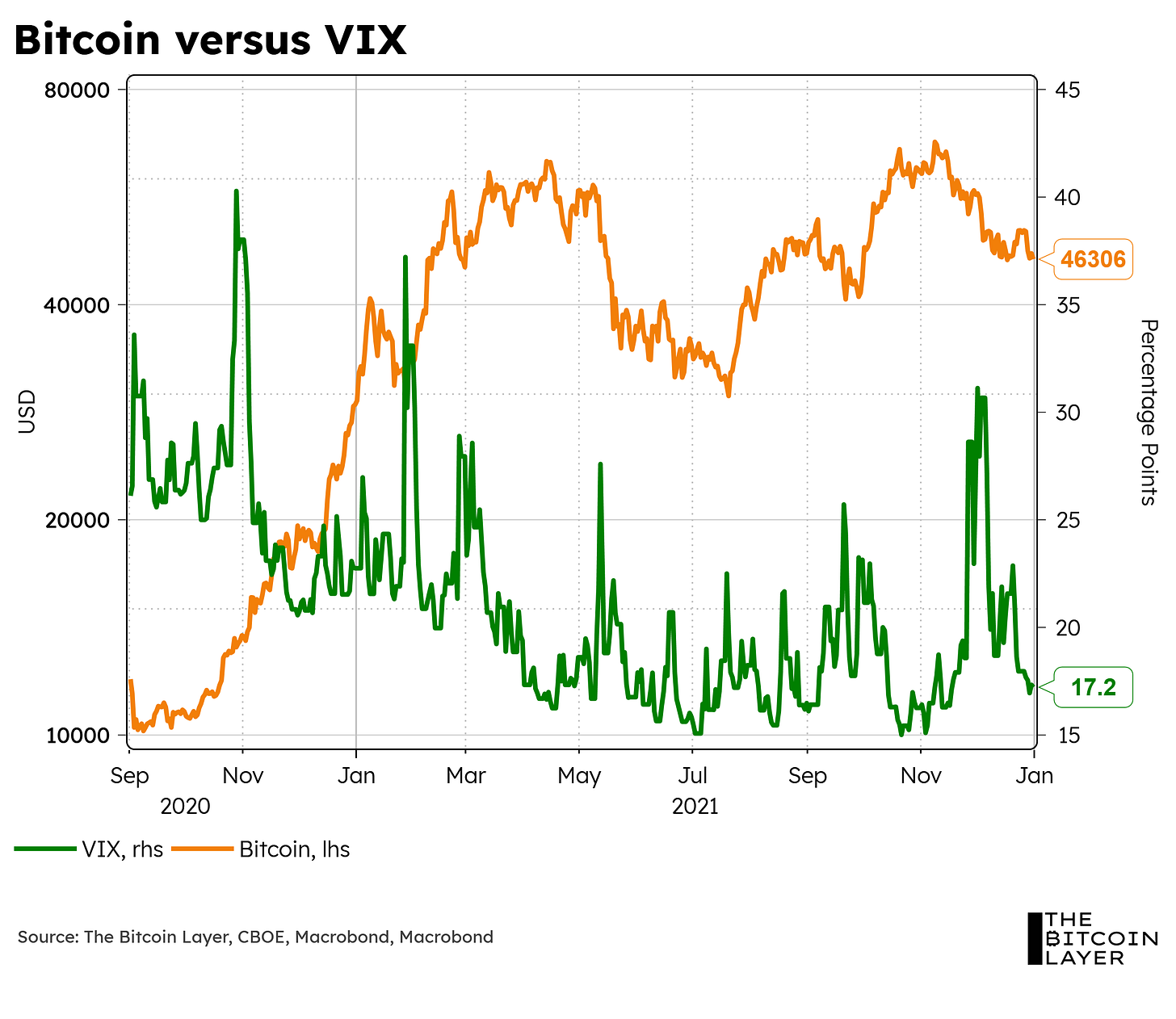

Stock Volatility:

Early 2017 – Late 2018:

Seeing as bitcoin trades like a risk asset, it is fair to establish the assumption that high stock volatility is bad for bitcoin, and this chart showcases just that.

During period lows in stock volatility, we saw a rise in bitcoin. Then, during high stock volatility, we started seeing a decline in bitcoin.

2020-2021

Similarly, in the 2021 period, stock volatility was generally in a decline, which saw higher bitcoin prices. Volatility then started to increase as rates increased and the stock market started to wobble heading into 2022, which was a bad year for both stocks and bitcoin.

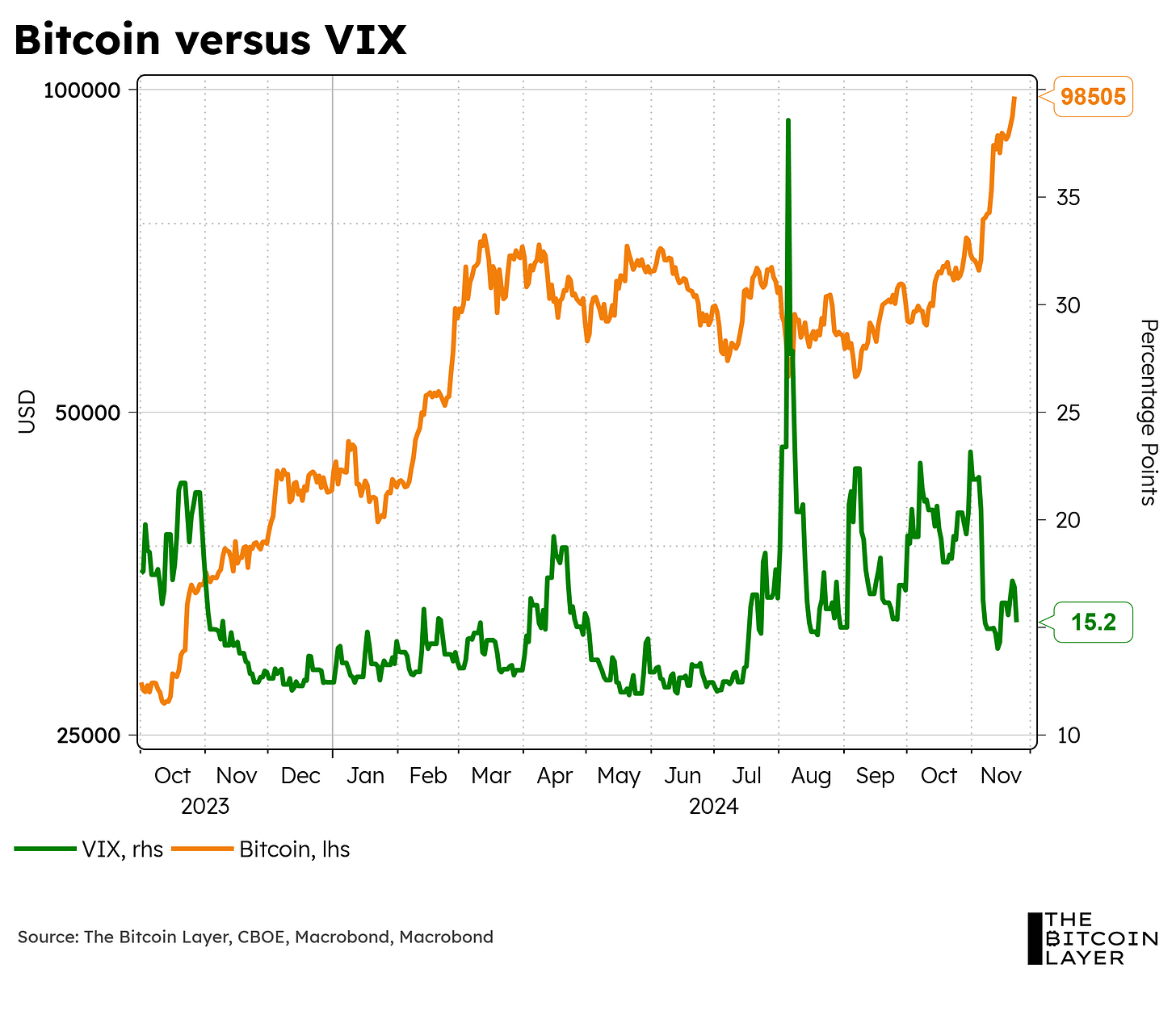

Today

During this bull run, stock volatility has been, on average, at lower levels than the previous two bull runs, resulting in positive risk asset conditions during this bull run. The appetite for equities is unquestionable, stemming from a combination of rate cuts, the prospect of tax cuts, a pro-energy incoming administration, and a President who will be focused on the stock market more than any other politician in American history. It doesn’t mean he’ll be successful, but it does get investors hungry for those uncapped returns.

Federal Reserve:

Early 2017 – Late 2018:

During this time period, we had a hawkish Fed trying to catch up with the rates market. However, as is usually the case for Powell, his hawkishness blew up on his face during the 2019 repo crisis, but that’s a story for another time. All we are trying to point out here is what the Fed’s sentiment was during this bull run.

2020-2021

After the pandemic, the Fed’s drastic measures pushed policy rates to near zero, and as established earlier, this is positive for bitcoin.

Today

Despite the Fed funds rate being at higher levels than the previous two periods, this is the only time within these three bull runs that US rates lie below the Fed funds rate. This is simply not sustainable, and as the Fed tries to close this gap by cutting rates, bitcoin rises.

In Summary:

To summarize all of our points, bitcoin bull runs can generally be associated with an environment where both stock and bond volatility are low (in their respective time periods), and interest rates are declining. That is what today’s environment can be characterized as. As such, through the use of TBL’s foundational framework, we remain bullish on the asset.

$100,000 bitcoin…see you soon!

🏷️ CYBER SALE! From November 23rd to December 3rd this year, enjoy 21% off your next purchase by using the code: TBL.

Get your Stamp Seed today!

In case you missed it: TBL on YouTube

The Bitcoin Classroom Part 1: Challenging a Bitcoin Professor on Monetary Policy

In this episode, USC professor Nik Bhatia answers questions from economics student Demian Schatt, exploring how Bitcoin could fit within modern fiscal and monetary policy frameworks. Demian asks thought-provoking questions about operating under a Bitcoin standard during recessions, such as how governments could stimulate the economy without increasing the money supply. Nik explains the role of fiscal policy, free markets, and Bitcoin’s deflationary nature in supporting sustainable growth, while contrasting it with traditional monetary systems. He also addresses inflation, quantitative easing, liquidity, and Bitcoin’s potential as a reserve currency, demonstrating how Bitcoin could transform the future of finance.

Here are some of the key insights:

Inflation and Bitcoin’s Contradictions: Demian asks how a deflationary asset like Bitcoin can be beneficial in an economy that traditionally relies on inflation to encourage spending and investment. Nik addresses this tension, contrasting the economic implications of inflationary and deflationary systems.

The Role of QE and Fiscal Policy in Inflation: Nik explains why quantitative easing (QE) in the 2010s didn’t result in significant inflation, while QE coupled with fiscal expansion during the pandemic did. He highlights how stimulus checks and direct government spending created consumer price inflation in 2020–2021.

Liquidity and Asset Prices: In response to Demian’s question about liquidity, Nik illustrates how money creation in the banking system fuels asset prices and investment decisions, offering insights into the connection between liquidity and market behavior.

Reimagining Fractional Reserve Banking with Bitcoin: The discussion explores the potential for a fractional reserve system backed by Bitcoin, comparing it to historical gold-backed systems. Nik outlines how such a system could operate in a freer market environment but notes the challenges posed by modern regulatory frameworks.

Government Debt in a Free-Market System: Demian inquires whether governments would be constrained in their spending under a free-market system without interest rate manipulation. Nik describes how creditworthiness would naturally limit borrowing and spending, contrasting this with the current reliance on manipulated interest rates.

Crisis Response in a Bitcoin-Based System: Demian asks how governments might respond to economic crises under a Bitcoin-backed system. Nik references historical examples, like the Great Depression, to explore potential challenges and the role of free markets in addressing slowdowns.

Bitcoin’s Place in a Fiat System: Demian concludes by asking about Bitcoin’s role relative to government currencies. Nik explains that Bitcoin is well-suited to coexist with fiat currencies, while improvements in fiscal and monetary policies could strengthen government-issued money.

Bitcoin Nears $100,000: How High Can It Go?

In this episode, Nik delivers a global macro update as Bitcoin surges to $99,000, nearing six figures after a major breakout. He analyzes the drivers behind this rally, including institutional demand, market cycles, and Bitcoin’s dominance over Ethereum. Nik reveals why recession fears are fading, with resilient housing and labor markets, booming corporate bond issuance, and anticipated Trump-era fiscal policies like tax cuts and infrastructure spending. Wrapping up, he explores Bitcoin’s path to multi-trillion-dollar valuation, its halving cycle, and the roadmap to $1 million Bitcoin, uncovering the critical dynamics driving this extraordinary moment.

Here are some of the key insights:

Bitcoin’s Consolidation Breakout: Nik highlights Bitcoin’s recent breakout from a $20,000 consolidation range that lasted three quarters, leading to its rise to $99,000. This move aligns with long-term technical analysis, which projected Bitcoin’s path to six figures.

Context for Bitcoin’s Valuation: At a $2 trillion market cap, Bitcoin still constitutes only 2% of global equities. Nik argues that this underscores its growth potential, with long-term valuations pointing to $5 trillion, $10 trillion, or even $20 trillion as it cements itself as a dominant global asset.

Volatility and Historical Patterns: While Bitcoin’s price movements remain volatile, Nik contextualizes this volatility within historical trends, emphasizing its alignment with previous halving cycles. He predicts another parabolic move in 2025, following Bitcoin’s established pattern of scarcity-driven price action.

Bitcoin vs. Ethereum: Nik contrasts Bitcoin’s dominance with Ethereum’s underperformance in 2024, attributing the divergence to institutional demand for Bitcoin and Ethereum’s perceived centralization.

Economic Boom in 2025: Looking ahead, Nik discusses the implications of a potential 2025 economic boom, fueled by tax cuts, energy infrastructure investment, and policies from a new GOP administration. He argues that these factors are likely to drive further asset growth, with Bitcoin benefiting from a favorable macroeconomic environment.

Recession Watch Lifted: Nik officially lifts his recession watch, citing resilient housing markets, a strong labor market, and robust corporate bond issuance. He emphasizes that the U.S. economy is showing signs of sustained growth rather than contraction.

Implications for Investors: Nik provides context for Bitcoin investors, advising them to focus on long-term growth while acknowledging the short-term risk management decisions that active traders may face. He also highlights the importance of understanding Bitcoin’s trajectory as a multi-trillion-dollar asset.

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we talk about how Democrats political plans backfired, as well as investments in the future of AI in the US.

Check out TBL Thinks here:

What TBL Pro Is Reading

Nik published his weekly letter, this time delivering his popular “Trader Notes” as we goes through resistance/support levels and directional bias across bitcoin, rates, and equities. Active traders and investors will enjoy this more technical post.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year.

Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order?

If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul.

Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way.

With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: