Bitcoin Flashing Signals, Cooling Economic Data, Fed Cuts: TBL Weekly #106

Welcome to TBL Weekly #106—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Good morning TBL Readers, happy Saturday ☕

We made it. And by we, I mean the five of us at The Bitcoin Layer without Joe Consorti for the last two weeks. Congratulations to the newly engaged young couple!

Bitcoin continues to lag under the pressure of, simply stated, lower highs. With the inability to escape above the low $70,000 range despite several attempts, shorts have dug in and are in control of the orange coin as we speak. Our correlation shows a relatively muted relationship between bitcoin and equities at the moment, and we’ll start there.

The historical correlation between bitcoin and stocks has many in traditional finance still believing that bitcoin is a high-beta risk asset, jumping when stocks rally and tanking when stocks decline. These people aren’t observing, however, the time series of correlation which has proven to ebb and flow.

That means bitcoin can rally when stocks decline or trade flat, but it also means that bitcoin can decline even if risk broadly is doing well. It also means that even though global macro matters (see the increasingly powerful TBL Liquidity), traders have their paws all over bitcoin. Longs battle with shorts over momentum and emotion, sometimes completely distinct and separate from what is happening in the “outside world.” This is all to say that bitcoin dances to the beat of its own drum, and that goes both bullish and bearish. Since March, there is a consolidation happening that has allowed a bearish undertone to creep into bitcoin market psyche. We’ll let our technical analysis keep our sanity, but it might result in a lengthy consolidation.

Given the choppiness of economic data throughout the year, this summer has consisted of investors awaiting the next piece of evidence to support their existing investment strategies—no landing and very long risk, or hard landing and very long duration (exposure to long-term Treasuries). This week, the no landing crew made a little bit of a comeback.

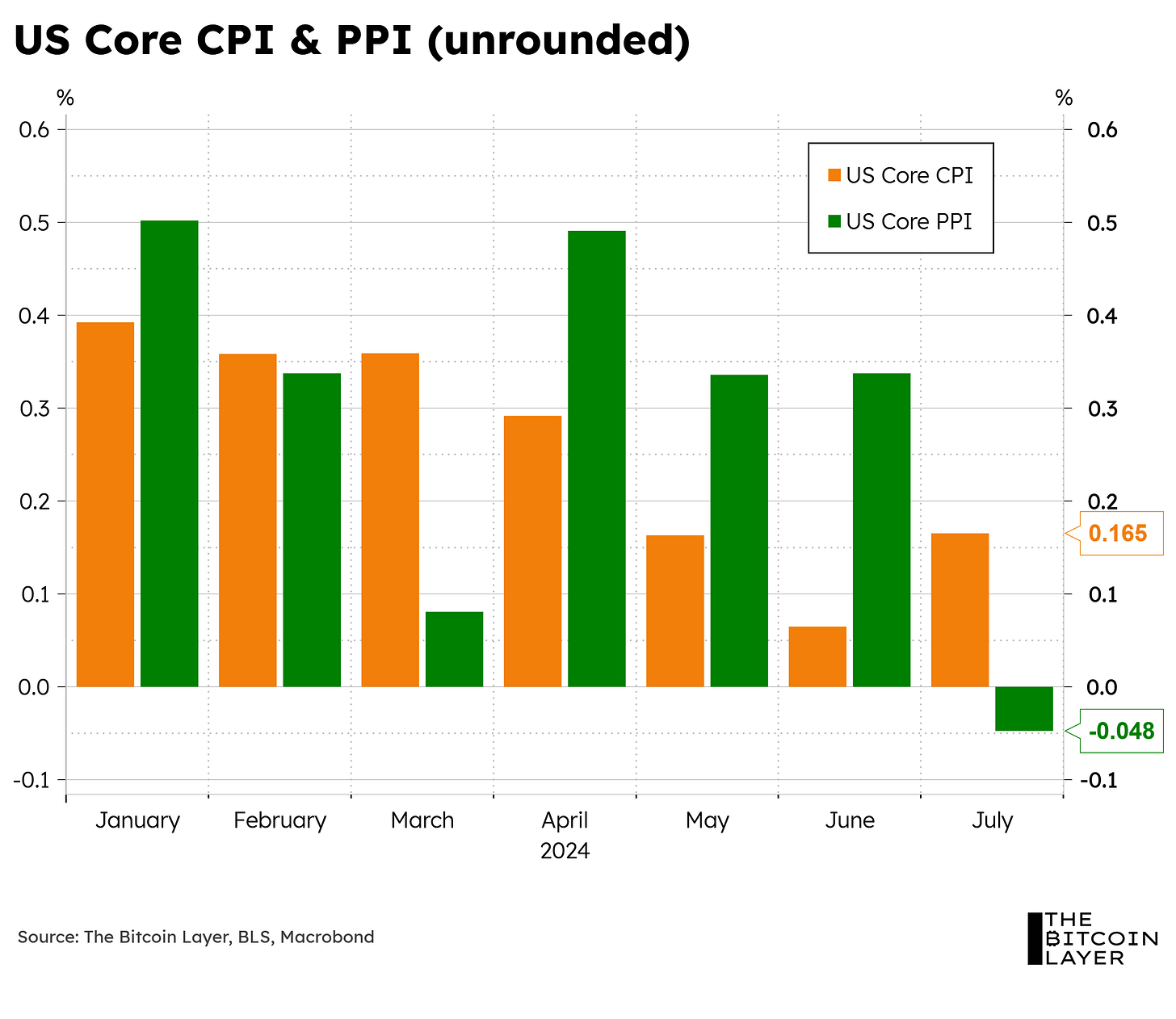

Markets and the Fed received more information on state of US inflation this week, starting with core PPI printing a lower-than-expected figure (0.0% actual versus 0.2% expected). Cooler PPI heightened expectations of a lower-than-expected core CPI print the following day, but the print matched expectations on a rounded basis (0.2% actual versus 0.2% expected). It was, however, lower than expected on an unrounded basis (0.1652%), which money market hawks like us tend to watch for.

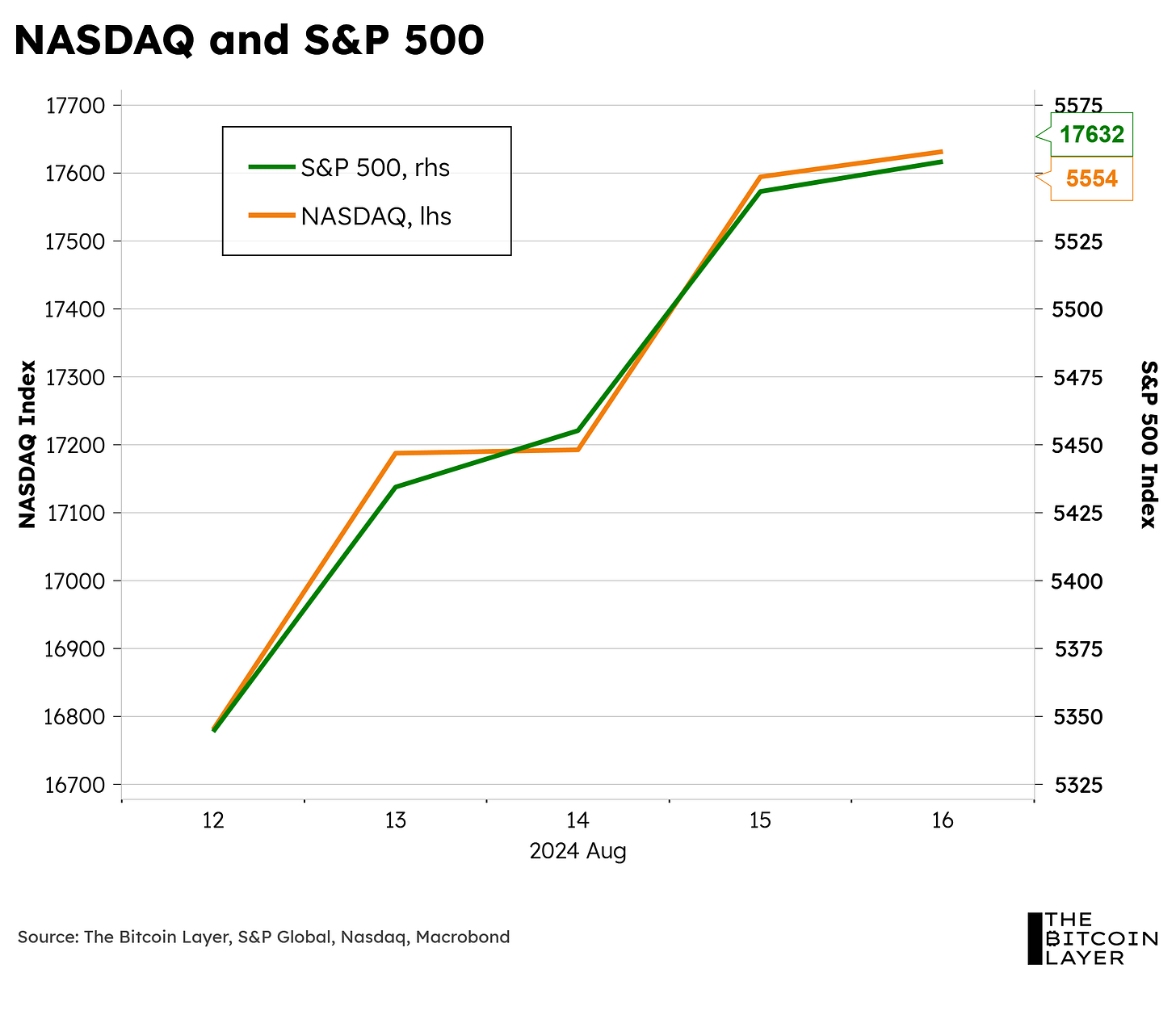

Equities continued to bounce all week and have fully recovered their “global market route” levels from early August.

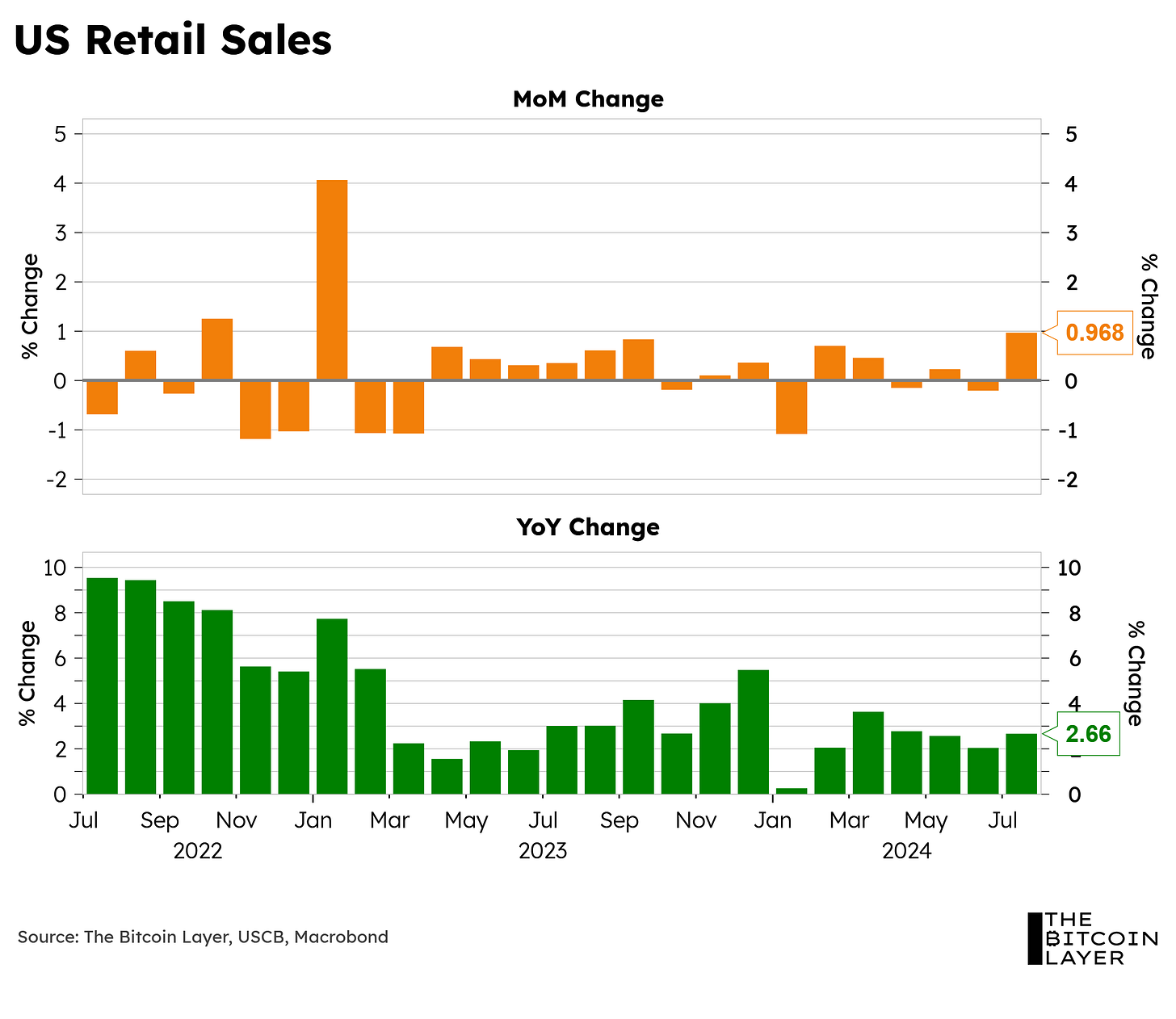

US rates, on the other hand, experienced a rather choppy week. Treasuries caught a bid on Tuesday and Wednesday, with yields on 2s sinking below 4% once again. However, the rally was short-lived due to better-than-expected retail sales and jobless claims on Thursday—retail sales saw their largest monthly increase since January 2023 at 1%. That being said, given the constant downward revisions, we take this 1% increase with a giant grain of salt.

Jobless claims also came out better than expected on Thursday, which brought forth some headwinds to the ‘cooling job market’ narrative, further enhancing the sell-off in Treasuries as we approached the end of the week. Continuing claims still near their cycle highs keep our bearish labor outlook and expectation that unemployment could soon reach 4.5%.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your crypto assets and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

Holistically speaking, jobless claims continue to show an upward trend for 2024, and retail sales are still on the chopping block for revisions.

To close out the week, the NAHB Housing Market Index (HMI), which measures home builders’ sentiment, had its lowest print of the year (which was also way lower than the expected 43).

Month-over-month changes in industrial and manufacturing production both went into negative territory and printed much lower than expected for the month of July.

All this to say, the devil hides in the details.

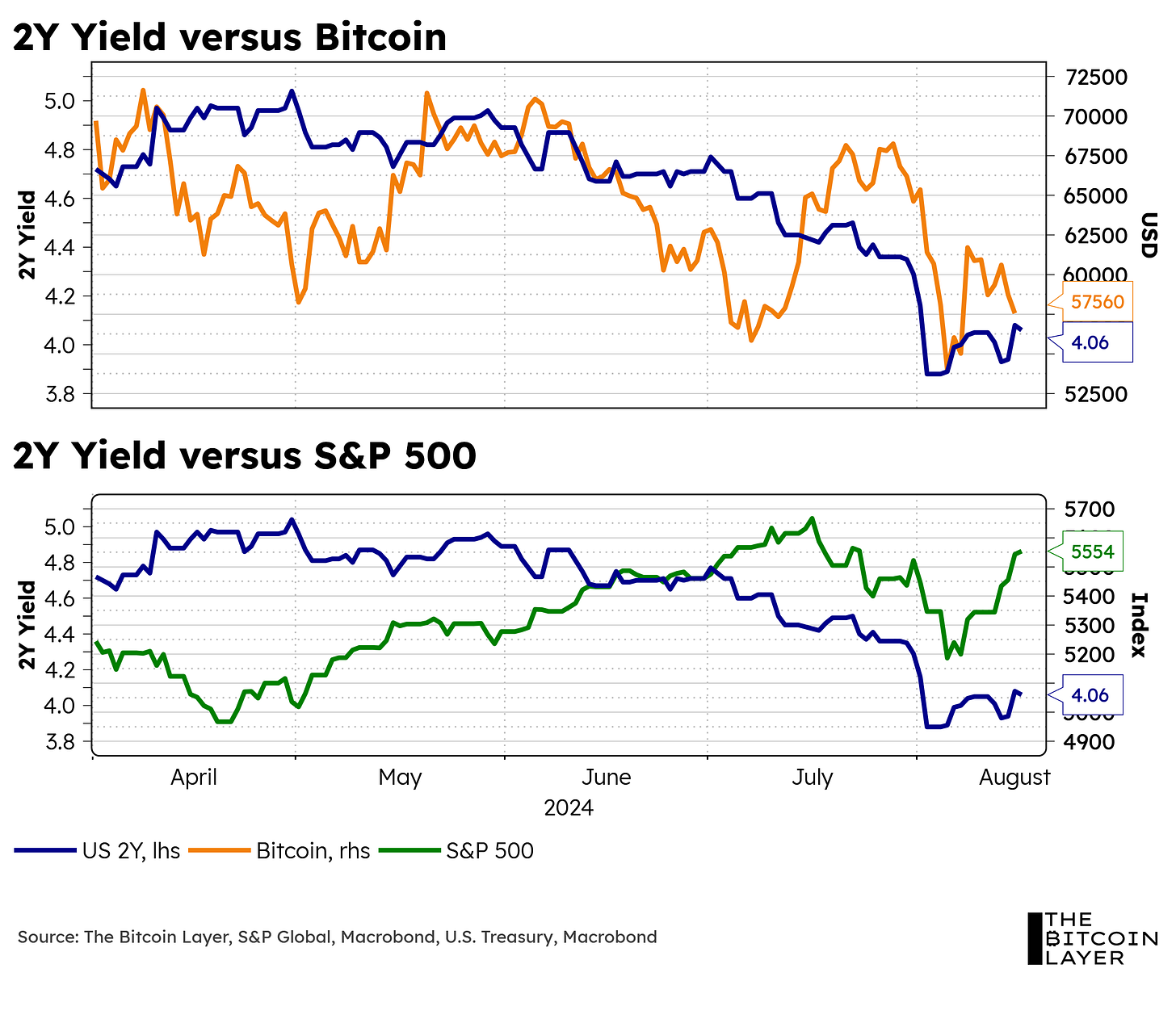

Bringing back the relationship between bitcoin and equities is further illustrated when you separately compare each to the US Treasury 2-year yield. Bitcoin has fallen as 2s have declined since April, but stocks have performed well.

We believe this brings forth the important distinction about bitcoin—it doesn’t and will not receive any liquidity support from policymakers if things go wrong. Stocks, on the other hand, are part of the Fed’s unofficial mandate. You can hear this anytime Fed members mention “financial stability”—what they really mean is “we don’t want our 401ks going down in value either.”

Looking at the chart above, with bitcoin on a downtrend alongside 2Y yields, while the S&P 500 has been trending upwards, this is a clear case in point of how the risk-on-risk-off sentiment is better measured using bitcoin as the risk-on asset. It also means that bitcoin is potentially the warning itself.

Now, given all this bearish data, where does that leave our rate-cut expectations from the Fed?

The market overreacted to the unemployment print that we received a few weeks back, so our base case, for now, sits at a 25 basis point cut in September. To fully inform the Fed’s decision, we have one more CPI print and one more important unemployment figure coming at the start of September before the FOMC decision.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Next Week with Nik

In the week ahead, the economic calendar is a dud, but Jerome and company fly to Wyoming for the annual Jackson Hole Symposium, hosted by the Kansas City Fed. We probably won’t learn anything because the market told us months ago, but Powell will get to explain to people why the Fed will start cutting rates in September. We’ve long mentioned how Powell generally doesn’t insult our intelligence, so it is likely he will border on some version of the truth, which is that the Fed must respond to the threat of a bad unemployment situation. What he won’t say is that the Fed will need to cut by at least 2% just to have any potential impact, leading to our bullish Treasury outlook.

We wish the entire speech (and Wednesday’s FOMC minutes) was about QT, because from our perspective, the Fed’s balance sheet size should continue to have a material impact on asset valuations. The Fed slowed QT earlier this year, setting up for the end of QT and the resumption of balance sheet expansion. Remember that they won’t call it QE this time, but if you know, you know. September’s meeting will likely have some mention on the plans for the balance sheet, especially because the Fed will be moving to easier policy on the rate side.

Easier policy from the balance sheet side is assured, especially given where we see the quantity of new Treasuries coming to market every quarter. This brings up a nuance of the Treasury market—even though the market might eventually digest the debt (all $35 trillion in existing debt trades around 4% without any worry of default), the initial swallow poses challenges. The primary dealer community is charged with this initial digestion and distribution, but the Fed will need to step in. SOFR volumes at all-time highs suggest that the bottleneck of issuance and repo financing needs a savior. We call this a nuance because it doesn’t say anything about investors’ appetite for Treasuries as an asset class to properly capture the compensation for the time value of money. Bitcoin certainly captures it for those willing to wait. It also tends to very crucially and successfully capture balance sheet expansion.

If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month.

Here are some quick links to all the TBL content you may have missed this week:

Monday

Bitcoin bounced off the lows but feels timid. Stocks have recovered, but are people too complacent? We suggest continued volatility in today’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

In this episode, Nik recaps an eventful couple weeks in financial markets. With heightened volatility across Treasuries, stocks, and bitcoin, Nik breaks down the path of Fed policy rates, yield curve inversion (and why it's still happening), how poor Treasury auctions impact our view on rates, and the potential for several months of choppy bitcoin prices. We also discuss some of the more extreme tail risks for bitcoin.

Check out—Global Markets Update: Bitcoin Consolidation, Macro Headwinds, & Treasury Auctions

Wednesday

In this episode, Nik discusses the latest news about Goldman Sachs allocating over $400 million to spot ETFs. He explores the wave of institutional investment expected to arrive in bitcoin over the next couple of years, explains why only imagination can cap potential future price, and discusses the latest CPI reading and what it means for interest rates and Fed cuts.

Check out—Goldman Sachs: $400 Million BITCOIN BUY

Thursday

Goldman Sachs bought bitcoin. This headline is simultaneously small ($400 million isn’t a lot of money) and enormous (Goldman buying bitcoin spot ETFs, for itself or for clients, sets a precedent), fitting in perfectly with our consolidation outlook. We’ll explore the risk outlook for bitcoin on both the upside and downside, and discuss allocation strategies.

The Bitcoin Layer is turning a corner as we step up our quantitative analysis. In an effort to bring more actionable data to you, we dove head-first into the Kaufman-Howell-Salomon school of liquidity, research that is finally paying dividends. Our liquidity model is now up to 52% correlation with the S&P 500—as it becomes more successful in capturing the change in asset prices, lessons from the repo market grow in importance. Today’s letter will feature the essential concept of wholesale banking. Let’s begin.

In this episode, Nik is joined once again by Daniel Batten to discuss overcoming ESG roadblocks to bitcoin investment at sovereign wealth funds. Daniel breaks down the math behind his projection that a 1% allocation from this pool of $35 trillion in capital could drive bitcoin's price higher by nearly $100,000 from here. He also explains how he is fighting the existing negative propaganda about bitcoin with new studies about the environmental benefits of bitcoin mining.

Check out—Sovereign Wealth Funds Could Take Bitcoin To $148,000

Friday

Its Thinking Time! Buckle up for a quick recap of global events. This week we cover European plane maker Airbus’ struggles to gain ground on Boeing, the Middle East’s increasing demand for strategic partnerships as Western funds vie for their business, Starbucks’ third CEO in two and a half years, and China’s challenge to Nvidia.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Congrats to Joe!

Nik, I watched your macro Econ video from today. What happened to the reverse repo market? Did it run out of money as it was expected to back in the March-April timeline?