Bitcoin is ready to challenge resistance: TBL Weekly #112

Good morning Readers! Welcome to TBL Weekly #112 — grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Weekly Analysis

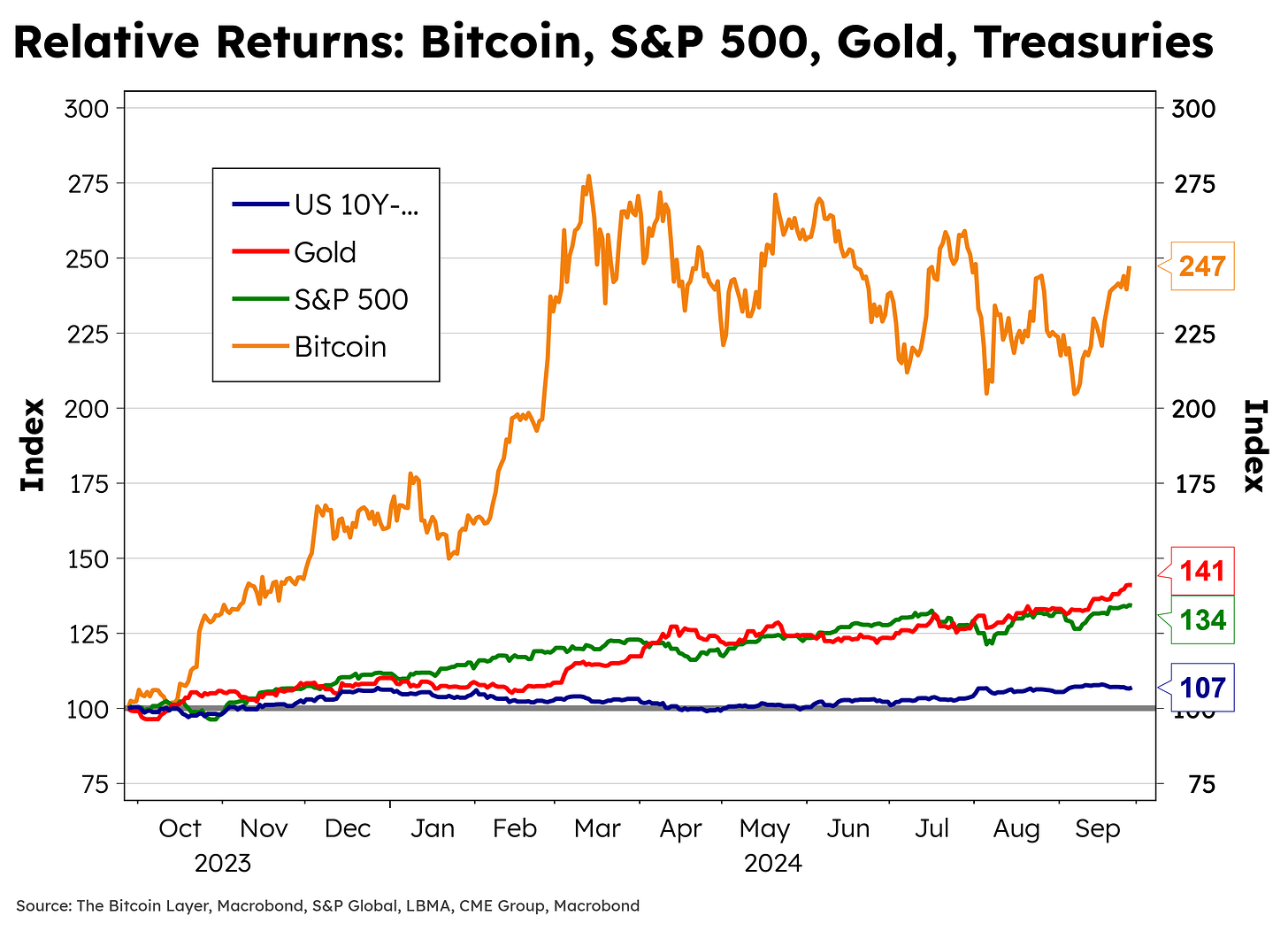

Global markets are bordering on euphoria ever since the Fed cut rates by 50 basis points on September 18th. All asset classes are putting in major gains, with bitcoin, stocks, gold, and Treasuries returning 147%, 34%, 41%, and 7% gains, respectively. Gold is beating out the S&P 500 over that time horizon, and US Treasuries are firmly in bull market form as well. Green means go for global markets.

Bitcoin hasn’t reached the all-time highs that US equity markets have, but that’s probably a healthy thing. Looking at bitcoin’s relative valuation to its realized price (MVRV), we can see a historically fair multiple. Forget overheated, bitcoin barely has the stove on.

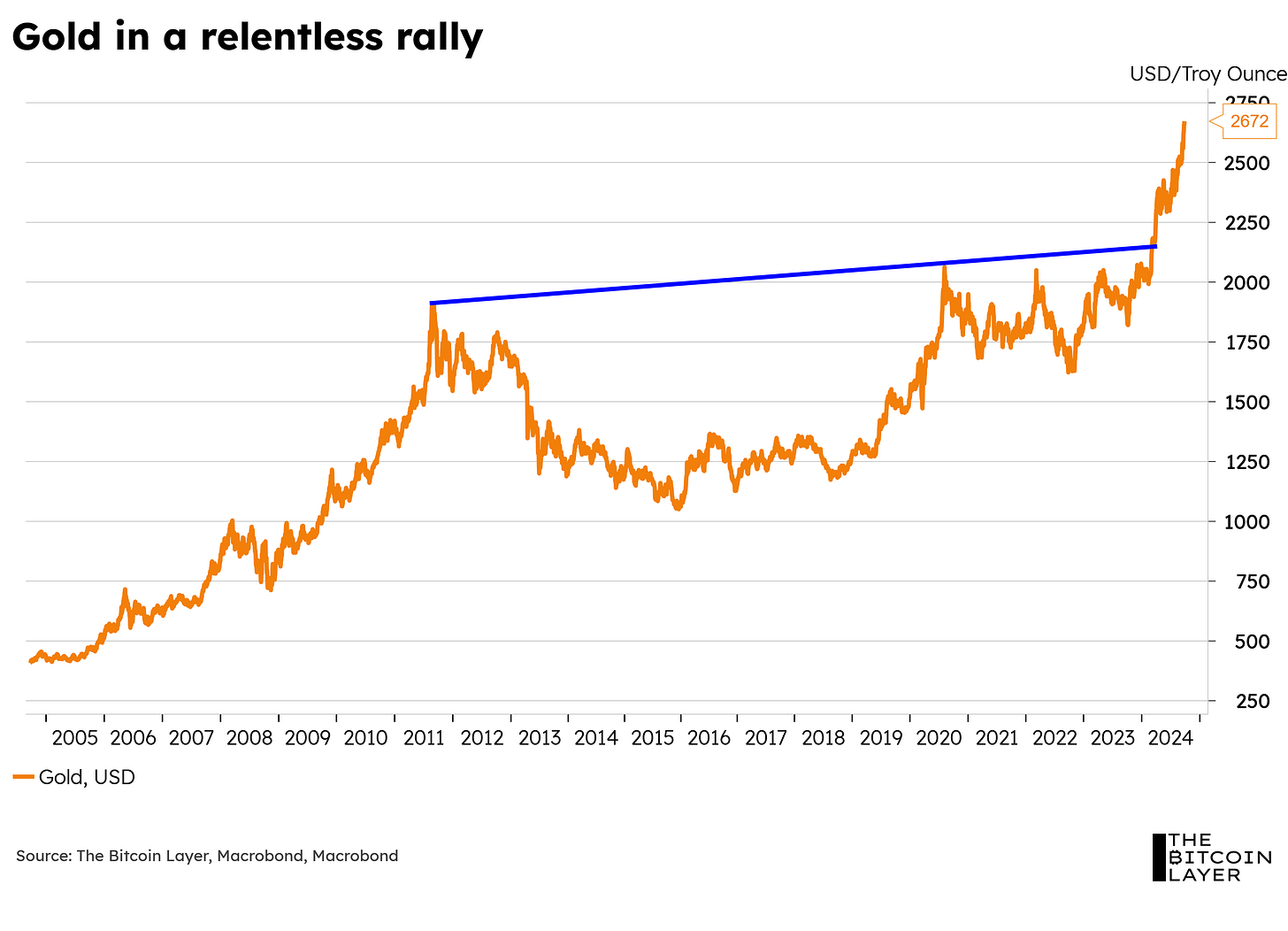

Gold has been lights out this year, but we don’t necessarily attribute it to monetary easing—the breakout occurred months ago. We feel gold’s rally this year reflects the increased demand for country-free money. Only a matter of time before gold trades with a 3-handle.

In Chinese yuan, gold prices directly contribute to the country’s wealth, and physical settlement in Asia seems to be the marginal price driver.

Don’t miss our episode this week with Matt Dines on China’s stimulus—Dines is a complex thinker who helped us understand the significance of the direct stock market assistance offered by the PBoC. Despite a large easing, China’s currency strengthened, showing us the power of capital flows targeting equity exposure. The implications of a stronger Chinese yuan are beyond the scope of this letter, but we must keep our eye on the dangers posed by a strong yuan, just as we do when the dollar is strong.

On the other side of a stronger yuan is a weaker dollar, and that is where risk markets are deriving their upside impulse. As the dollar weakens, global financial conditions ease, as dollar debt makes dollar strength more difficult to serve. Currently, the dollar is bordering on a more significant move lower. We believe this is why risk markets are currently doing so well—the threat of a stronger dollar has been minimized now that US rates are being lowered along with the rest of the world.

On the economy, whether or not we are heading for a recession doesn’t seem to matter much for the path of policy rates—they are heading below 4% regardless. Housing is in a slump, and lower rates are desperately needed for a boost to activity. The Bitcoin Layer remains firmly focused on the housing market as the most likely pocket of the economy to face major drags from 5% policy rates despite aggressive rate cuts over the final few months of 2024. Look at home sales over the past two decades—this is not an economy in the throes of a real estate boom—far from it.

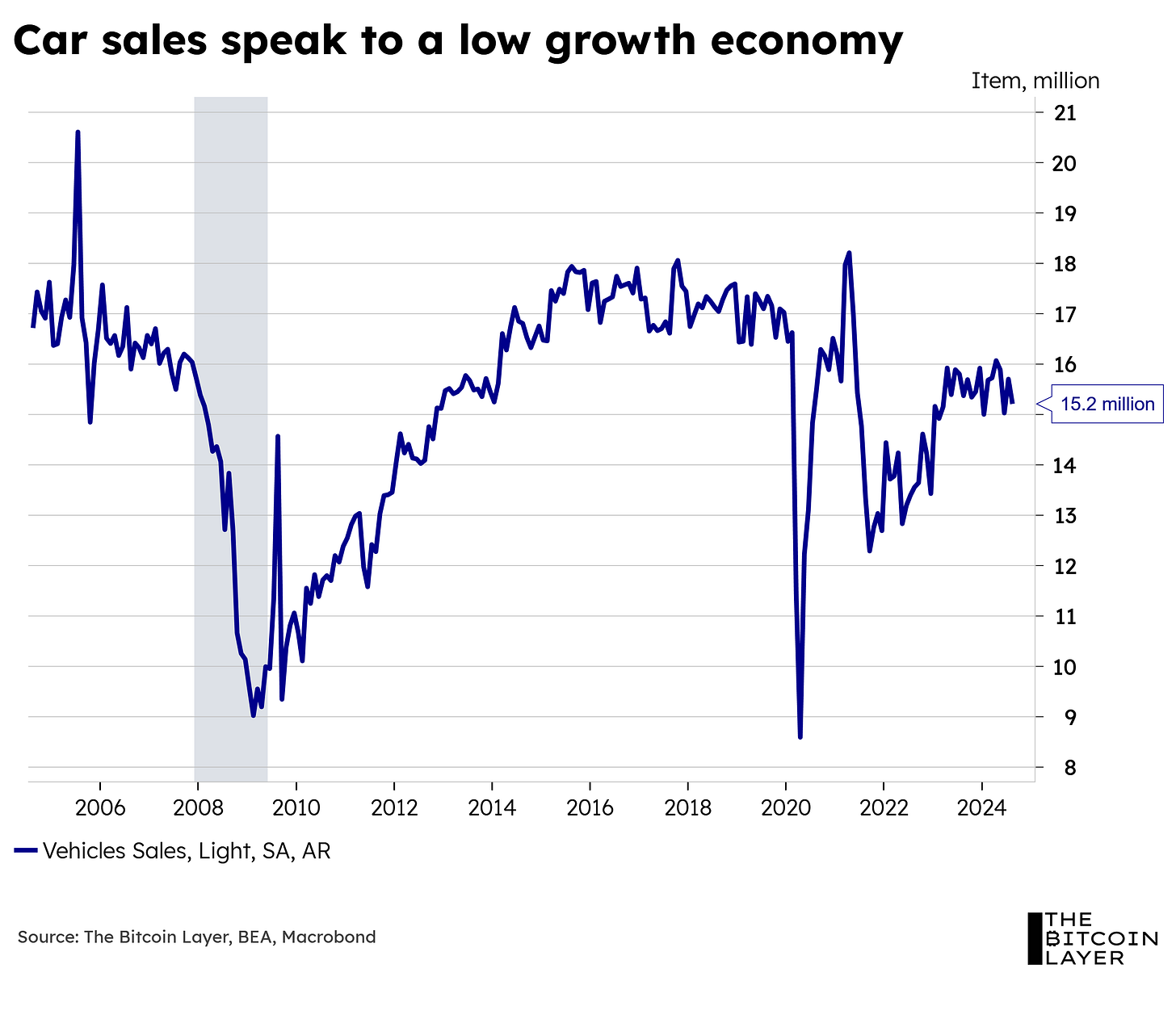

Auto sales over the same horizon tell a similar story—this economy is far off its peak. Jerome Powell and the Fed want much lower policy rates to avoid the economy deteriorating from its already mediocre state. Don’t fight the tape: Powell is telling you policy rates are heading straight to 3.5% on a recalibration effort.

US Treasuries are steepening out. Finally, two-year yields are falling below 10s to demonstrate that future growth expectations are no longer in absolutely restrictive territory relative to where the policy rate will be next year. The yield curve un-inverting is a clear sign that the Fed is finally ready to face the reality of policy too tight. It’s very important to remember that inverted curves make it extremely difficult to do business, borrowing short (expensive) and lending long (at a lower yield). Un-inversion will allow better risk-taking as repo charges decline.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your bitcoin and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

In case you missed it: TBL on YouTube

China Launches MASSIVE Stimulus, BlackRock & Coinbase on Bitcoin ETF Custody with Matt Dines

This week Nik was joined by Matt Dines to break down the latest monetary stimulus from China. This episode covers the Chinese central bank’s move to reduce rates and introduce measures to stimulate the economy, and the historical reason behind such moves. This episode also covers bitcoin custody at Bank of New York via a new Senate ruling and BlackRock & Coinbase drama over bitcoin ETF custody holdings.

If you don’t have 66 minutes to spare, here are some of the key insights:

The People’s Bank of China’s (PBoC) actions, including rate cuts and liquidity injections, are designed to stimulate economic growth amidst slowing conditions.

By reducing mortgage rates and down payment requirements, the PBoC aims to revitalize the housing market.

The introduction of a stock stability fund highlights a shift toward leveraging non-traditional assets for financing.

Historical contexts of John Law and the South Sea bubble serve as a cautionary tale about potential overreach in monetary policy, warning against the creation of speculative bubbles.

A positive response in gold and stock markets, along with a stronger yuan, indicates a thirst for Chinese assets.

Bank of New York’s ability to custody bitcoin signals a major step towards institutional acceptance. We view this as a major milestone for bitcoin.

Teaching Bitcoin Part 3: How Bitcoin’s Supply is Fixed

Nik is joined by Michael Howell in Part 3 of TBL’s Teaching Bitcoin series. This episode delves into the intricacies of Bitcoin, limited supply, mining mechanics, and the integrity of the network. It also covers the role of nodes in maintaining network security, the impact of government actions and the main differences between bitcoin, altcoins, and gold.

If you don’t have 70 minutes to spare, here are some of the key insights:

Bitcoin’s unique supply mechanism and decentralized nature give it value.

The competition in bitcoin mining increases security and difficulty, making it harder for malicious attacks while ensuring miners remain incentivized.

The age of bitcoins reflects market dynamics; older coins moving can indicate shifts in market sentiment, such as late-phase dynamics.

Compared to gold and US treasuries, bitcoin offers more transparency and ease of verification, positioning it as a superior asset class in the digital age.

As bitcoin’s ownership diversifies globally, it builds resilience against regulatory and geopolitical risks.

The emergence of financial products such as ETFs creates both risks and opportunities for bitcoin, leading to increased institutional interest while raising concerns about potential price manipulation.

For those looking for Parts 1, 2, and 3 all in one place, you can find the 3.5 hour lecture here:

Bitcoin Business Adoption is a Grassroots Movement with Sam Baker

Nik is joined by Sam Baker, a researcher at River, to analyze the growing trend of bitcoin adoption by businesses. This episode explores the motivations behind businesses adopting bitcoin, the implications of accounting and tax treatment, and the differences between public and private companies in their bitcoin holdings.

If you don’t have 28 minutes to spare, here are some of the key insights:

Businesses from various sectors are increasingly adopting bitcoin, demonstrating a grassroots movement that transcends high-profile cases, and reflects a growing recognition of bitcoin’s potential value preservation.

The majority of bitcoin adoption is occurring within small and medium-sized enterprises utilizing Bitcoin for savings and as a hedge against economic downturns.

Businesses currently hold around 3% of total bitcoin, but this figure is rising quickly, showing untapped potential for further institutional investment.

Recent updates from accounting bodies regarding bitcoin’s classification as a commodity are crucial, as they allow businesses to report their holdings without punitive measures.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we detailed the rise of electronic warfare and the use of hardware devices and software being used as weapons of mass destruction over the last few years. We also discussed financial measures introduced by the Chinese central bank to breathe life back into its ailing economy.

Check out TBL Thinks here:

What TBL Pro Is Reading

Last week was a sight for sore eyes with a rally in both bitcoin and equities as investors switched to a ‘risk on’ sentiment. Understand our risk outlook in this week’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Nik also published his weekly letter “Currency war returns, conditions favorable for bitcoin” in which he discusses various large moves in financial markets, and touches on Powell, China, the dollar, gold, stocks, and bitcoin. “Currency wars never stop, they just pause for a breather.”

Read more by going TBL Pro.

Next Week with Nik

On Monday, the week starts off with a bang and month-end/quarter-end. We care about the calendar because it affects funding markets. When banks and market makers face the prospect of having to disclose all positions for accounting, funding markets get tested. We’ll watch for any spikes in SOFR.

Starting on October 1st, we’ll receive ISM manufacturing and JOLTS data on the labor market. ISM is very signal-worthy to us, as it tells us where the economy is trending. Currently, services are mediocre, while manufacturing is sluggish.

On Friday, the unemployment rate and wage growth should inform investors on the economy and the Fed’s bias going into a November 50 basis point cut.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.