Welcome to TBL Weekly #100—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning TBL Readers, happy Saturday ☕

Welcome to a very special TBL Weekly: Issue No. 100!

We’ve now been publishing this free weekly newsletter for two years. Thank you for inviting us into your inbox every Saturday morning for the industry-leading rundown of all things bitcoin and global macro.

We’d also like to send a special thank you to River for being an amazing partner for the past year, sponsoring us from No. 52 right up until Issue No. 100. Can’t wait to see what the River team continues to build on Bitcoin and Lightning. The Bitcoin Layer is excited for our next chapter.

With all of that out of the way, let’s dive in.

Firstly, we’d like to touch on breaking news out of the Supreme Court.

The Chevron Doctrine, established in the 1984 case Chevron USA Inc. v. Natural Resources Defense Council Inc., laid out a framework for courts to defer to government agencies’ interpretation of the law when any statute was ambiguous.

Translation: it gave too much power to unelected bureaucrats, and undermined the sanctity of U.S. law as well as the judiciary’s role in interpreting it. The people we’ve elected to make our laws in Congress aren’t the ones actually making the laws, but rather, unelected bureaucrats in the administrative state.

Unelected bureaucrats at the 3-letter agencies in Washington D.C. now have less power than they did yesterday as it pertains to the laws in this country, and how they are written and interpreted.

For us bitcoiners, this is an unambiguous improvement. Decision-making powers are now out of the hands of bureaucrats and into the hands of lawmakers who answer to the American people.

For bitcoin, which has a murky and unclear regulatory landscape as it is, bureaucrats have used the leverage given to them by the Chevron Doctrine to arbitrarily steer bitcoin policy in the U.S. at their whim. Not anymore.

All that remains is to put the fate of the Federal Reserve in the hands of the American people too, then we’ll really be cooking with gas here…

Moving over to rates: rate cut bets are being locked in for this year as data confirms the growth slowdown.

This chart of weekly candles on the 2-year US Treasury yield was struck by Nik six months ago and recreated by me in the Terminal, and you can see this dynamic in action. We challenged and weren’t able to break back above the 5% level, and the top formation you see between each of the local highs has remained intact.

Now, as the disinflationary data like today’s cool Core PCE print continue to pile up, and add to the cyclical downturn in growth that data has begun painting for months, traders are bidding up the front end in anticipation of it finally being enough justification for the Fed to reduce interest rates incrementally twice this year.

Though we were up 4 basis points on the session thanks to stronger-than-expected consumer sentiment, this pattern for 2s is intact and the direction of the data is clear. We believe 2s will continue to trade lower on yield as disinflation persists in pockets of the economy and spreads deeper into the headline data. Powell is grasping at data points of disinflation to justify a cut, and more of them will appear in the weeks and months ahead:

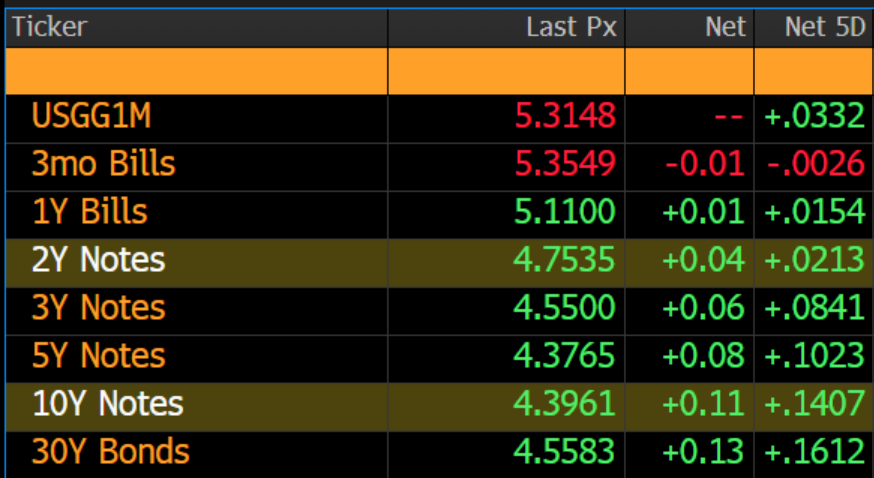

We saw a huge bear steepener over the last 5 sessions with most of the move coming today. Off of the stronger-than-expected growth story painted by consumer sentiment and a tepid rise in jobless claims, traders sold off the long end harder than the front end due to economic resilience overpowering the rate cut narrative at the margin. Fed rate cut pricing has been pushed back slightly, from one 25-bps rate cut by November and a second one by December, to a 64% chance of a December cut, now locked in by the January 2025 meeting:

The growth story is well encapsulated with the weekly candles on 10s. The 11-bps move this week drove 10s back above the 4.30 level marked by Nik a few months back. We’re now just 2 weeks away from this ascending triangle seeing some kind of resolution. We have been in the camp that 10s are moving lower, with disinflation becoming the dominant force in the story as the weeks and months trudge along. However, price action around this key technical area will be indicative, and we can’t avoid associate steepening with the likely result in November (even higher deficits under Trump):

Bitcoin is knocking on the $60,000 level, for the 6th time in the last 3 months. It already broke cleanly below short-term holder cost basis and the 200-day moving averages, two key floors for bitcoin’s price on an on-chain and technical level. Now, bitcoin is trying to break underneath $60,000. Seasonality for the second half of the year in risk is generally positive, which we’ll talk about in a moment. Nothing to be concerned about here from the standpoint of bitcoin reversing course and ending its bull market. This is simply a protracted correction, for now:

Miners are under pressure, but relief is coming. With bitcoin’s price stagnating and stumbling, a huge downward difficulty adjustment is priced in just 6 days from now. This should take some weight off of miners’ shoulders, easing bitcoin selling pressure that would otherwise come had Satoshi not been so wise as to programmatically adjust the protocol’s difficulty based on blocktimes. Perfect money:

The S&P 500 and other stock indices are pumping the brakes today as we round out Q2. As far as a correction goes for the S&P 500 this is a small one—down 80 points from its local top. Zooming out to October when the latest leg of this bull market began in risk, spoos have had 2/3 noteworthy corrections, all ranging between 2 and 6% before advancing still higher:

The second half of the year for the S&P 500 rises on average by 6% when the first half of the year for the index is positive. During an election year, that average drops to 4.2%. Even if this consolidation we’ve experienced for the last two trading weeks is protracted, like it is in bitcoin, all (most) signs point to continued strength for the United States’ main equity index, and that’s the camp that we fall into:

Core PCE, the Fed’s preferred inflation measure which doesn't include volatile food and energy costs, increased by a mere 0.08% in May. This is the smallest rise in over two years. More cannon fodder that persistent inflationary pressures have almost subsided. At the same time, consumer spending demonstrated strength, growing by 0.3% following a decline in April.

This uptick, along with robust growth in household earnings, suggests that inflation could be tamed without significantly impacting consumers. Soft landing? Crazier things have happened. We have other data that suggests consumer excess savings may be much weaker than they appear, but clearly, it isn’t slowing them down yet:

The last data point given to us on Friday was the University of Michigan’s consumer sentiment survey. Within the report, year-ahead inflation expectations decelerated to 3%, converging with the more stable 5-10-year inflation expectations. This is a very good thing for the Fed. Inflation expectations are a large component of what drives price inflation—the other part being, of course, the shameless printing of trillions of dollars from thin air. As near-term inflation expectations converge with those seen up to a decade in advance, consumers will likely be less hasty to buy now in anticipation of prices rising in the future, adding wind to the disinflationary sails for the Fed:

Next Week with Nik

Next week is a banger, and we aren’t talking about the fireworks. Monday brings our favorite ISM manufacturing, while US Independence Day is wrapped on Wednesday and Friday by some incredibly important economic releases. Treasuries have traded well as the slowing growth and rate cuts trade takes hold, but bad news must develop for the Fed to actually pull the trigger. This means job losses and a failing consumer. So far, we have avoided both, even though looking closely shows early signs on each.

One of those signs has been JOLTS data, the release that tells us openings, hire, and quits across the economy. Jerome Powell cites quits regularly as a sign to him that the labor situation is weakening, so this release matters quite a bit for policymakers. Remember, the Fed feels a need to cut soon but must receive confirmation from the data. By Tuesday, markets will have both the ISM manufacturing employment subindex and JOLTS to inform Friday’s nonfarm payrolls and unemployment rate. Our eyes are definitely on the 4% unemployment rate—if it ticks up, prepare for more Treasury strength and September’s rate cut odds increasing. Those odds still remain close to the 50-50 level. Remember that NFP can be noisy itself—we aren’t big fans—but it can move markets, especially a bad print.

On Wednesday, we’ll receive the June FOMC minutes which should be somewhat interesting even if lagging. But ISM services will have our closest attention, especially because services employment is in contraction. We’ll also get Thursday’s claims data on Wednesday due to the holiday. There is no shortage of high-quality data—look for my global macro update on Wednesday’s YouTube and audio platforms. Finally, we’ll see if reverse repo usage falls back to more normal levels after spiking for month end.

If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month. Simply reply to this email with any questions or business inquiries.

Here are some quick links to all the TBL content you may have missed this week:

Monday

We’ve been building. Our first Virtual Q&A was a mega success, and our next one has been scheduled for July 25th—find the link to register for July’s Zoom below. Now, we debut a weekly quantitative report to summarize the information that really matters: bitcoin price analysis, global macro narratives, and what we think must be captured on a Monday morning to position investors and bitcoin watchers with the data that matters.

This report is inspired by my hedge fund days as a lowly analyst, refreshing Excel tables and updating conditional formatting for our chief risk officer so that he knew exactly where his portfolio stood. What mattered was documenting each individual risk so that surprises happen infrequently. We admit that this debut is but a fraction of what will eventually be covered—this report targets the largest financial institutions in the world while being completely accessible to you, the individual. We present the first version of Mean, Median, Mode—your weekly bitcoin & global macro risk report.

TBL Pros will receive it every Monday morning. Here is a glimpse of what is included:

Check out—Mean, Median, Mode: Our New Weekly Quantitative Report

Tuesday

In this video, Joe explores several crucial factors influencing the bitcoin market. He begins by addressing the Mt. Gox FUD and its historical impact on Bitcoin's price, explaining why most creditors are unlikely to sell their recovered Bitcoin. Joe then discusses recent net outflows from Bitcoin ETFs and their connection to declining cash-and-carry trade premiums. He briefly touches on NVIDIA's recent market performance before delving into a price study of Bitcoin's moving averages. A significant portion of the video analyzes the Short-Term Holder Cost Basis and its implications for investor confidence. Joe concludes by discussing macro trends affecting capital flows, emphasizing Bitcoin's role as a liquidity proxy, and reminding viewers to maintain a long-term perspective on Bitcoin as the apex monetary tool.

Check out—Bitcoin Market Insights: Mt. Gox, ETF Flows, and Short-Term Holder Analysis

Thursday

As a bitcoin research firm, constant macroeconomic analysis is conducted because bitcoin represents a mirror for the legacy system. Why bitcoin goes up and down in the short term is driven by many idiosyncratic factors, including the direction of the stock market. But on a longer-term basis, we believe bitcoin increases in value due to the understanding that further money creation by governments and central banks is inevitable.

For this reason, every time we sense a money creation policy response, the whole case for bitcoin to occupy the portfolio theoretically increases. One might isolate our letter today on US residential real estate and think: 1) home prices decline, 2) the economy goes into recession, 3) stocks go down, and 4) bitcoin goes down. We, on the other hand, think something more like: 1) home prices decline, 2) Congress moves to shore up Fannie/Freddie, and the Fed becomes unable to exit the mortgage-backed securities market, 3) fiscal and monetary accommodation set the government on a path to higher deficits and the Fed to expand its balance sheet, and 4) investors around the world rush to bitcoin in response.

Individual economic outcomes each cause short-term market movements, as a change in conditions can affect yields and trickle into every asset class. They also affect the long-term path, and most notably in terms of problems in the financial system, boosting the global case for bitcoin as a non-banking, non-government instrument. In summary, there are many things that worry us about the economy, but most of them end up favorable for the digital asset with mathematically precise and energy-bound scarcity.

Check out—How economic outcomes cause bitcoin outcomes

In this episode, Nik is joined by real estate developer Kelly Lannan to discuss his vision of Bitcoin Urbanism. Kelly walks us through a history of residential real estate in the United States and skillfully explains why government policies and central banking have driven extreme distortion. He covers the reasons for a drop in building quality, describes the multi-trillion dollar infrastructure gap, and concludes with a vision of how bitcoin can contribute to a renewal of beauty and craftsmanship within homes and cities.

Check out—Bitcoin's Urban Revolution: Fixing Real Estate's Fatal Flaws

Friday

It’s Thinking time. This week we cover US efforts to bring home and beef up production of ammunitions, the shrinking size of single-family homes, and a KKR bet on apartment buildings.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Check out—TBL Thinks: US Weapons Production & Shrinking Homes

In this episode, Nik is joined by housing analyst Melody Wright to discuss the US residential real estate market. In a sweeping analysis of why the housing market is heading for a very troublesome 2025, Melody details the inventory issues in Texas and Florida due to pocket listings, private equity, and other forms of distressed borrowing arrangements. She also explains what Americans should do in their search for a home, especially in new construction. Also discussed are millennials' investments in Airbnb properties, trends in rents, the Fed's interest rate path, and Freddie Mac's home equity underwriting program.

Check out—Housing Market Update: Price Declines & Inventory Woes with Melody Wright

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Hey guys. Great update. Where is the link to sign up for the July 25th Q&A? Thanks!