Bitcoin Liquidations, Volatility, and Flows Chart Pack

A 5-minute read to catch you up on bitcoin & breakdown what's next

Good morning TBL readers,

We’ve got a rapid-fire bitcoin chart pack for you. We dissect how much leverage has been purged from the market, where coins are moving, and what the rest of the year has in store now that volatility is back on the menu.

Grab a coffee and let’s dig in.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Open Interest

A sudden price movement last Thursday began a self-reinforcing feedback loop of forced selling that extended into Friday morning, wiping out hundreds of millions of dollars in offside leveraged bets on bitcoin in the process.

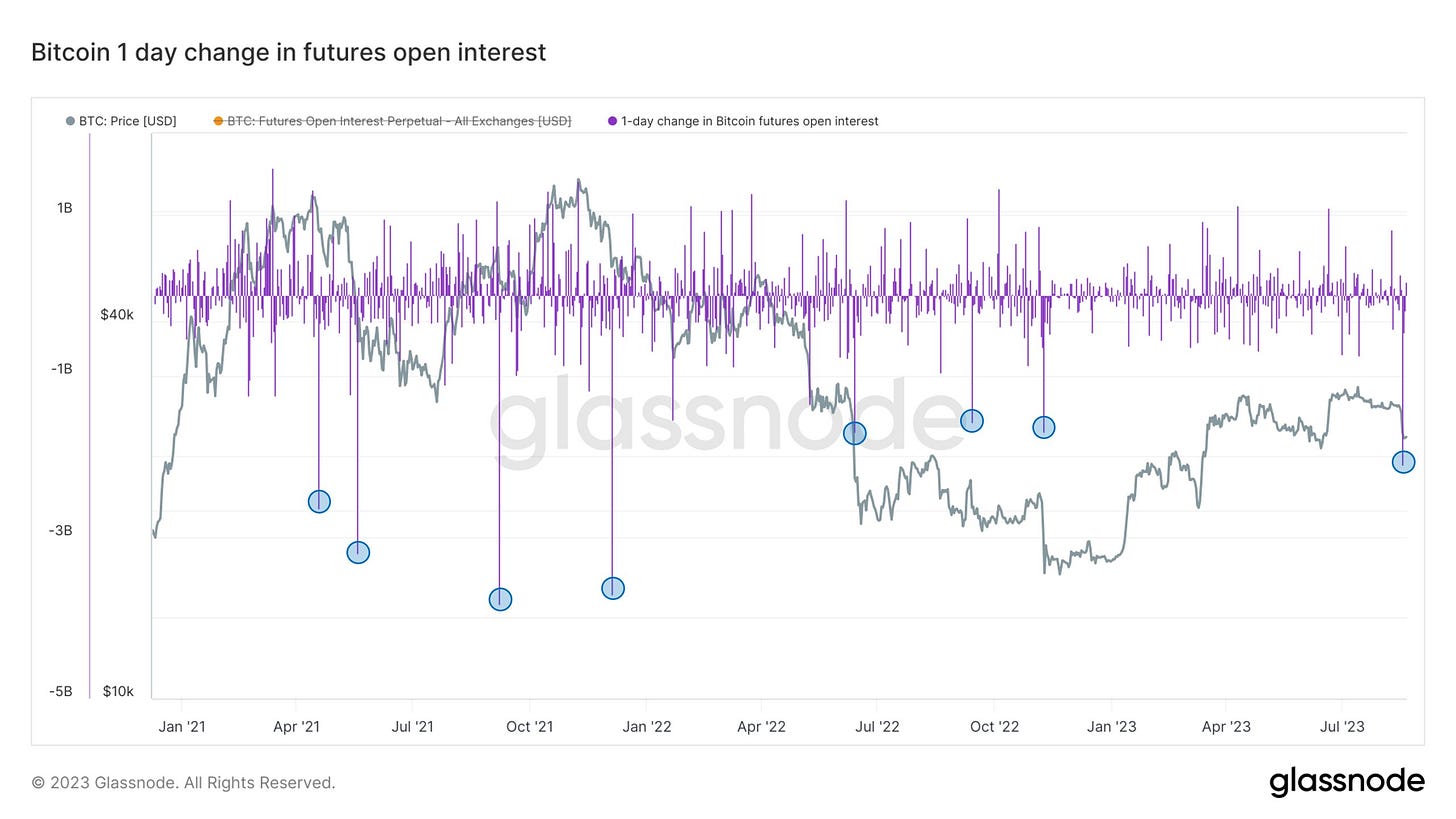

In fact, that big reduction in leverage last week is one of bitcoin’s largest on record. Zooming out over bitcoin’s full derivatives history, this is the 5th-largest decline in bitcoin futures open interest in a 24-hour period:

Looking at both futures and perpetual rolling futures, $3.3 billion in open contracts were wiped out last week—that’s a huge reduction in bitcoin leverage, clearing the way for a more stable spot-buying foundation to be built, one far more resilient in the face of sudden price shocks:

Liquidations

As mentioned in Friday’s TBL Weekly #58, the Thursday-Friday leverage purge was huge in dollar terms, too. It was the highest single-day liquidations in bitcoin derivatives since December 2021 after bitcoin notched its all-time high above $69,000. Note how its green and red candle representing liquidations out of short and long positions respectively towers up and down:

All told, the week was still peanuts compared to the extreme derivatives activity that propelled bitcoin to its all-time high throughout Q1 and Q2 of 2021—just look at the sheer size of liquidations back when a much larger proportion of buying activity was dominated by nothing but leverage:

1-Month Realized Volatility

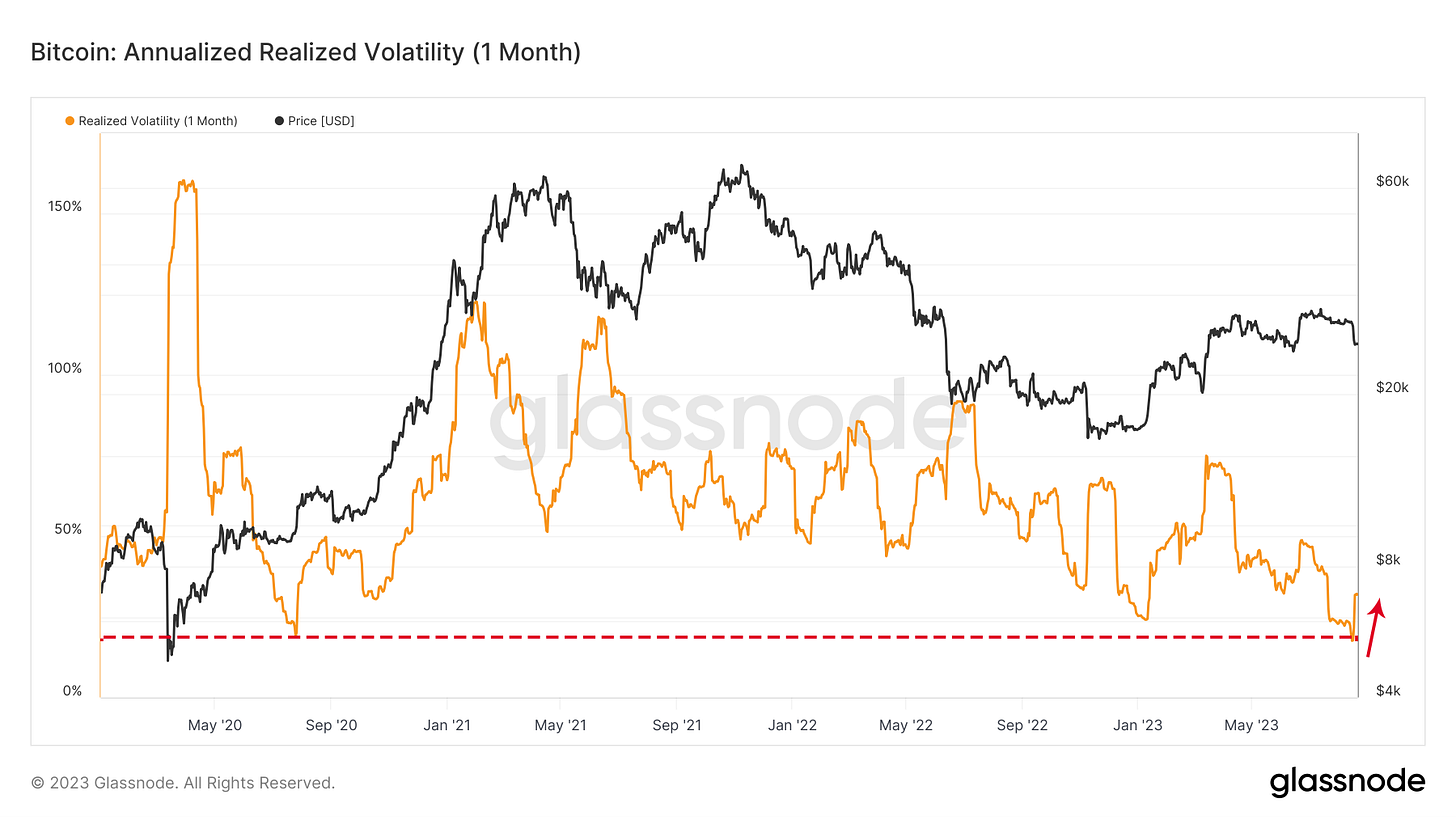

The Thursday-Friday leverage purge reintroduced some long-needed action into a mundane bitcoin market. Realized volatility, or deviations from the average price action over the last 1-month period, finally jumped up to 32% from an over two-year low of 18.5%. Unlike when volatility began ramping up two years ago at the start of a bull run, this volatility spike was accompanied by a big move in the opposite direction—a trend we don’t expect to be bucked now that the path of least resistance for bitcoin and all other risk assets is down:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

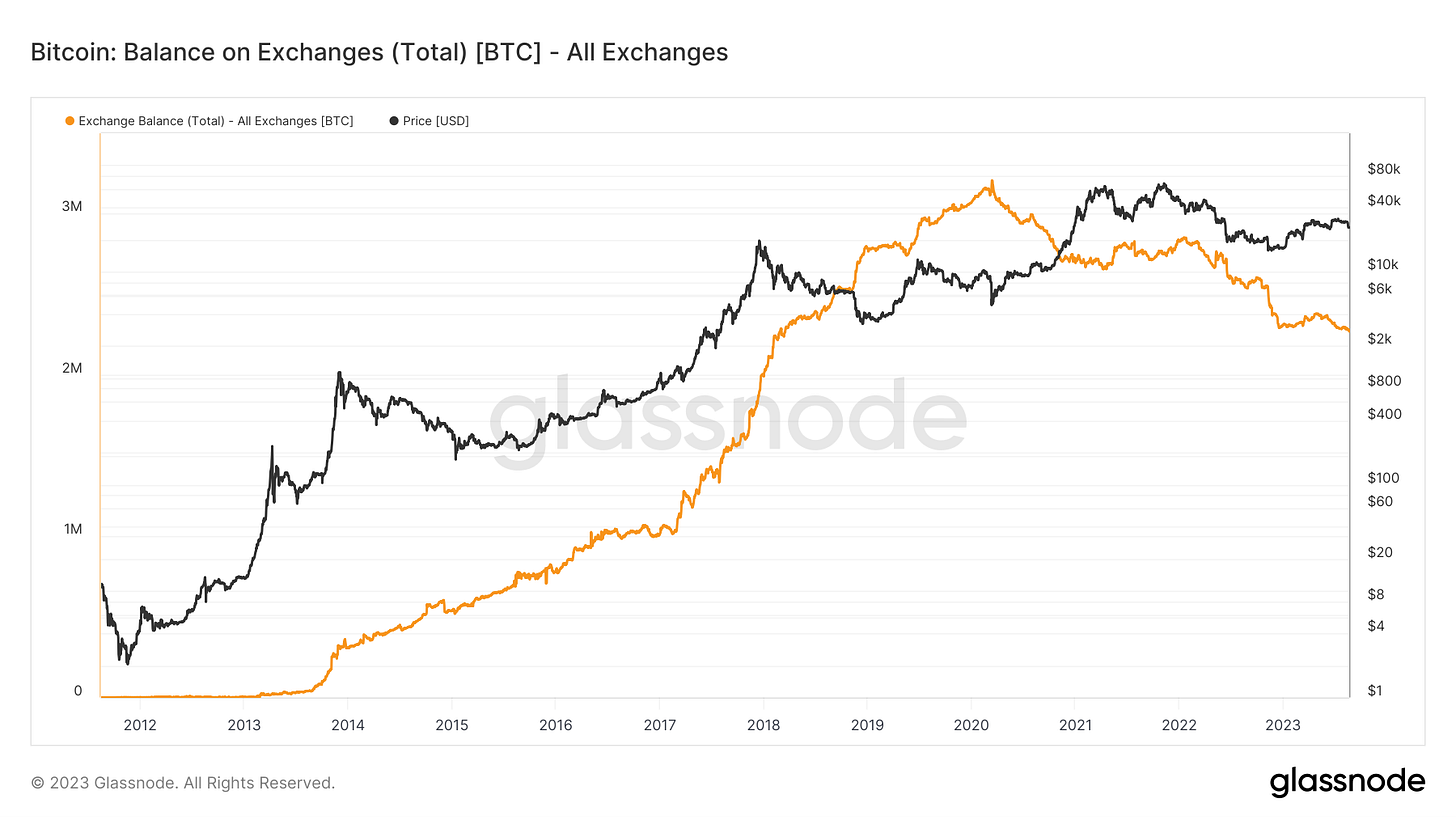

30-Day Exchange Flows

Bitcoin is starting to come back onto exchanges on net over the past 30 days. The deep negative trough of exchange flows has been coming back to positive territory, meaning that coins are beginning to come back onto exchanges and will soon make up the majority of flow activity. The downside is that coins are coming back onto exchanges to be sold, more likely than not, as fears of global recession mount and a derisking is underway to safer assets:

Underneath the surface-level data though, there are some large and intelligent buyers using the period of drab price action as an accumulation phase. As those who starve for USD liquidity are dumping their bitcoin for safe horizons, larger entities with more of a stomach for bear markets are deploying capital:

All told and despite the cyclical hiccup of coins moving onto exchanges to be sold, the balance of bitcoin on exchanges is still in a secular downtrend. Bitcoin continues to flow off of exchanges and into the hands of private investors and individuals. The way that bitcoin was intended to be used, as neutral and digital money which the owner can bear themselves, is proliferating in popularity:

Other Catalysts

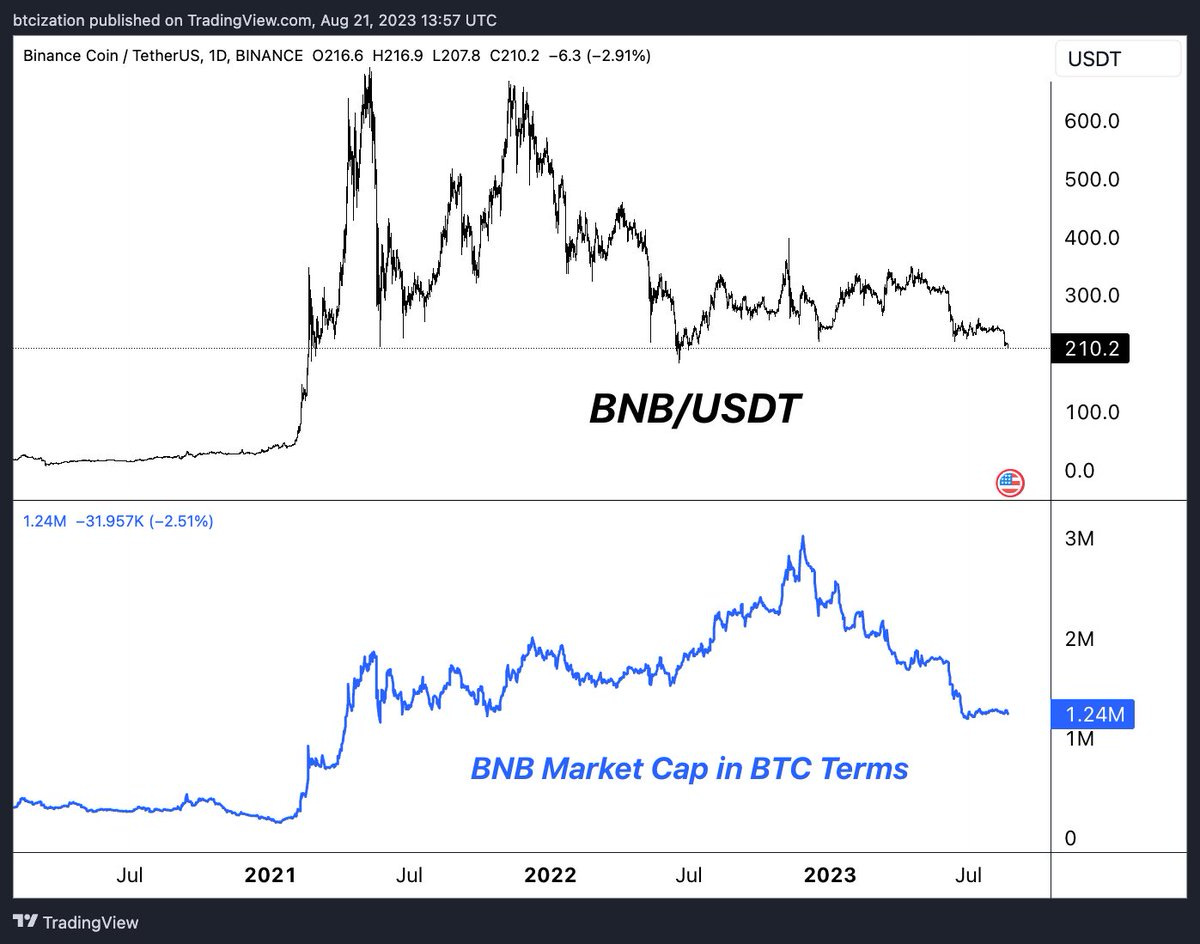

As discussed in Friday’s TBL Weekly #58, Binance has likely been selling spot bitcoin, whether its own holdings or its customers, in order to maintain the price of its Binance Coin (BNB) and stave off a liquidation on a long-rumored loan or loans collateralized with BNB that faces margin call around the $215-220 price level. In other words, as long as BNB’s price is threatened, Binance’s sell pressure will continue to exert a downward force on bitcoin’s price.

Binance Coin is not worth 1.24 million bitcoin. If this extreme overvaluation is going to come back down to earth any time soon, Binance won’t be going down without a fight—a “fight” in this case is selling all of the bitcoin it reasonably can without failing as a business or being apprehended by regulatory authorities:

My personal favorite view of bitcoin through a macro lens is this chart juxtaposing the volume of negative-yielding debt and bitcoin’s price. The volume of negative-yielding debt has risen as government debt, corporate debt, consumer loans & mortgages were issued at an interest rate below the CPI inflation rate over the last decade.

This is garbage debt that fuels unbridled risk-taking—it represents people borrowing because you’re literally losing money if you don’t borrow. Now that real yields are at multi-decade highs and nominal yields are no longer below the CPI inflation rate, negative-yielding debt has been wiped out and the euphoric and misallocated risk-taking it fueled is coming back down to earth too. This includes the price of bitcoin, given that it is traded as a high-beta risk asset:

Another view of the same dynamic is bitcoin juxtaposed with global central bank liquidity. As money is proverbially and literally printed, asset prices rise. With bitcoin being a low-market cap and highly risky asset, it appreciates by many orders of magnitude when new money floods the world economy.

Now that money is being vacuumed out of world financial markets and liquidity is falling, so too is bitcoin falling. The good side of bitcoin, outsized appreciation in times of monetary easing, unfortunately comes with the bad, outsized depreciation in times of monetary tightening as we’re experiencing now:

And that’s all for today’s bitcoin update. Have a great Tuesday, everybody!

Until next time,

The Bitcoin Layer

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.