Bitcoin-Native Venture Capital Deals Trounced Crypto Deals in 2023

Analyzing the latest bitcoin-native venture capital report from TVP

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good afternoon readers,

Trammell Venture Partners, an Austin-based venture capital firm and long-time friend of The Bitcoin Layer, released its 2nd Annual Bitcoin-Native Startup and VC Ecosystem Research. We were fortunate enough to receive a copy of the research during its embargo period. Now that the embargo is lifted, let’s unpack what they’ve put together, analyze the growth of bitcoin-native VC deals relative to crypto VC deals, and map out the trajectory for startups in this ecosystem in the years to come.

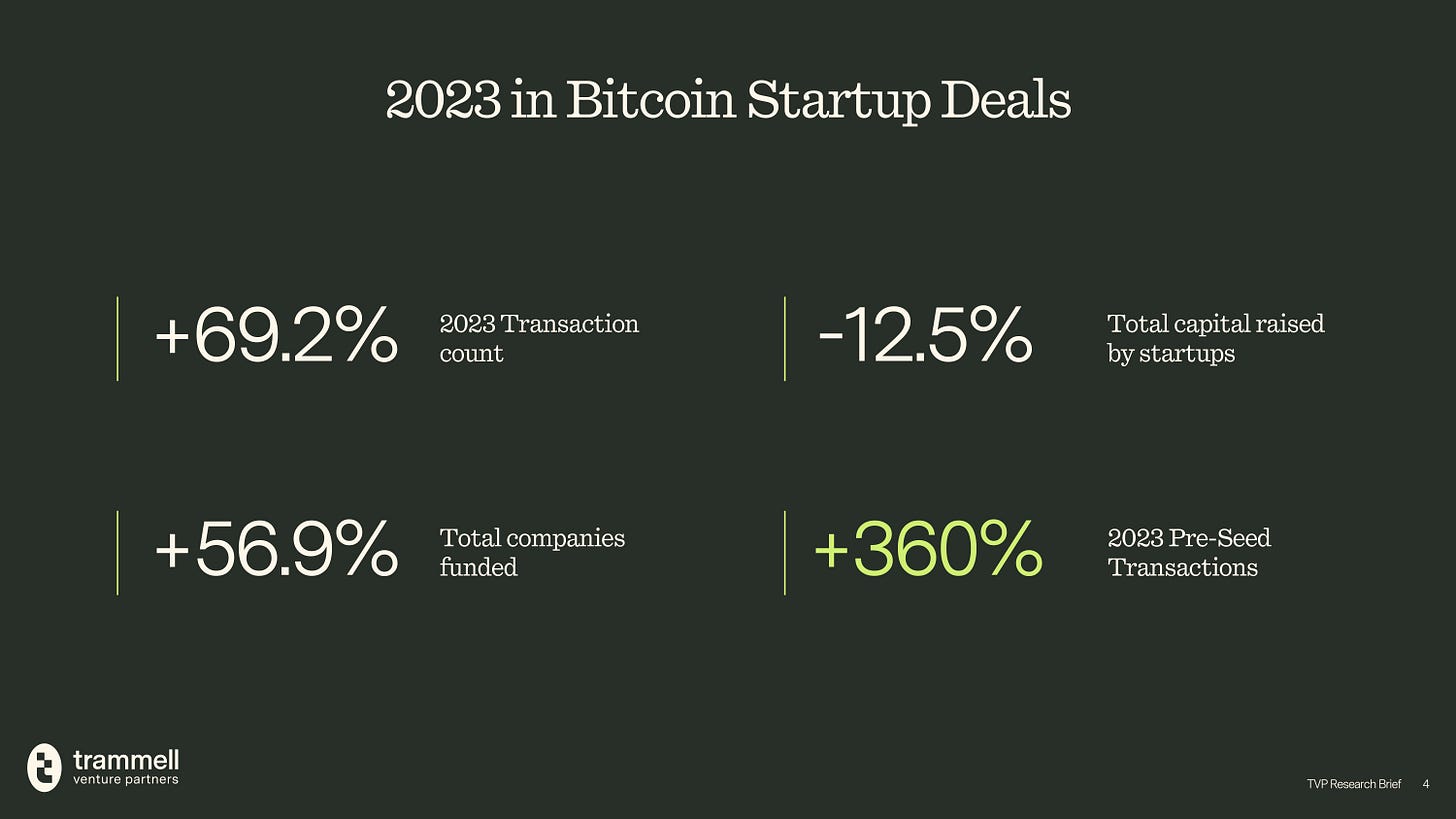

In 2023, there was a 12.5% year-on-year decline in total capital raised by bitcoin startups—however, the number of deals taking place skyrocketed dramatically. It was a breakout year for bitcoin startups in their earliest funding rounds, with a 360% surge in pre-seed transactions. Deal size may be down, but deal frequency is accelerating, an encouraging growth metric for the long-term viability of the space:

Even as total capital raised by BTC-native companies fell, deal count is up nicely. Bitcoin-native venture capital deal count rose 69.2% from the prior year, while crypto VC deal count fell 35.3% over the same period. Despite the backdrop of a 10-year low in venture capital exits and a severe decline in crypto deals, more bitcoin companies have managed to secure funding. The maturation of bitcoin as an asset and technology in the eyes of the market is slowly but surely distinguishing it from the ZIRP-enabled affinity tech that is crypto—we’ve a long way to go on this front, but the dislocation in deal count is a monumental step:

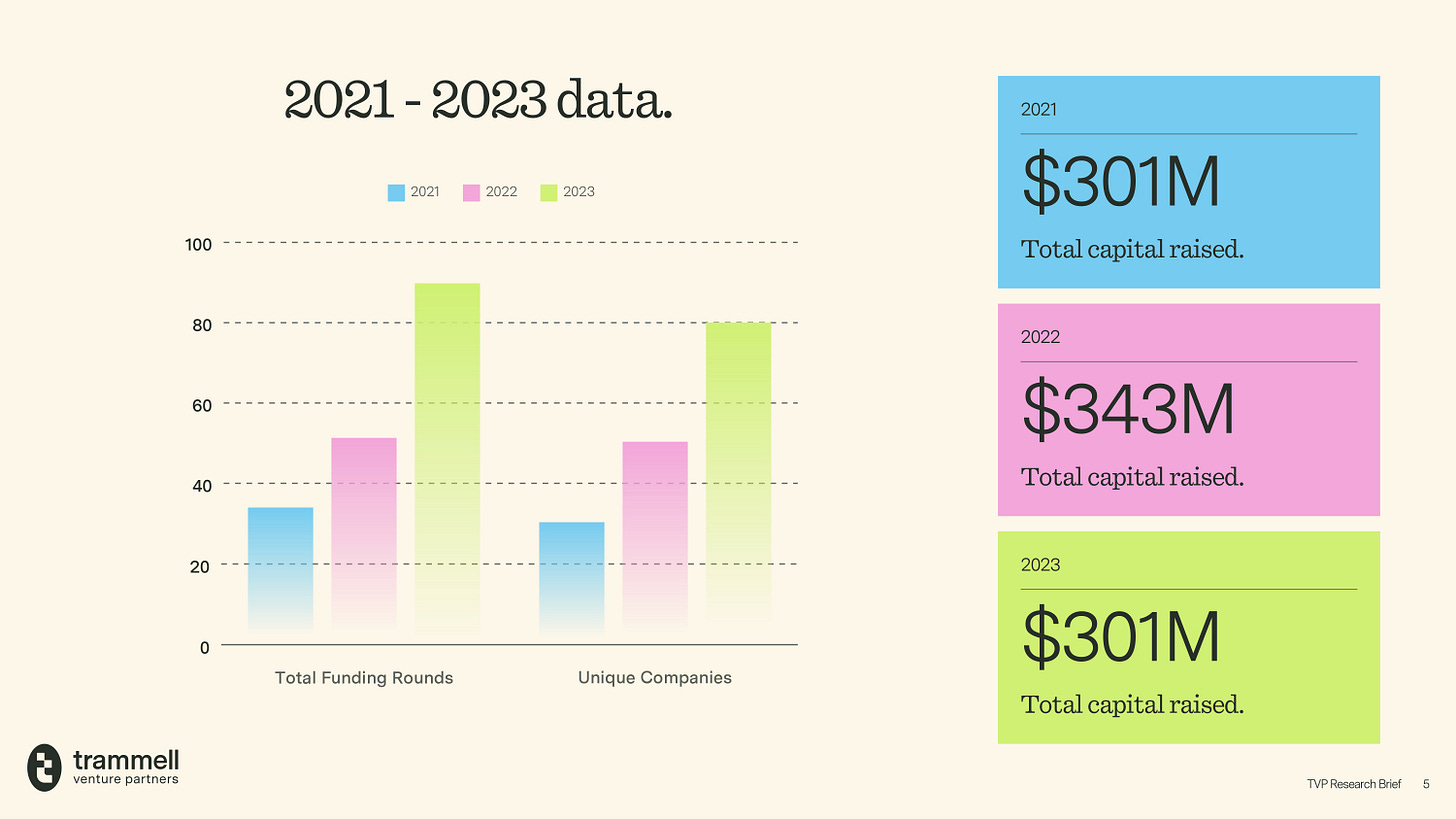

Delving into size, while only $301 million in capital was raised in 2023, on par with 2021, the growth in total funding rounds has accelerated with each passing year. There was roughly a +15-round increase from 2021-2022, and a +30-round increase from 2022 to 2023. The number of unique companies securing funding has also risen linearly over the same 3-year period. Bitcoin’s market price may falter from time to time, but the number of companies building on bitcoin only knows one direction:

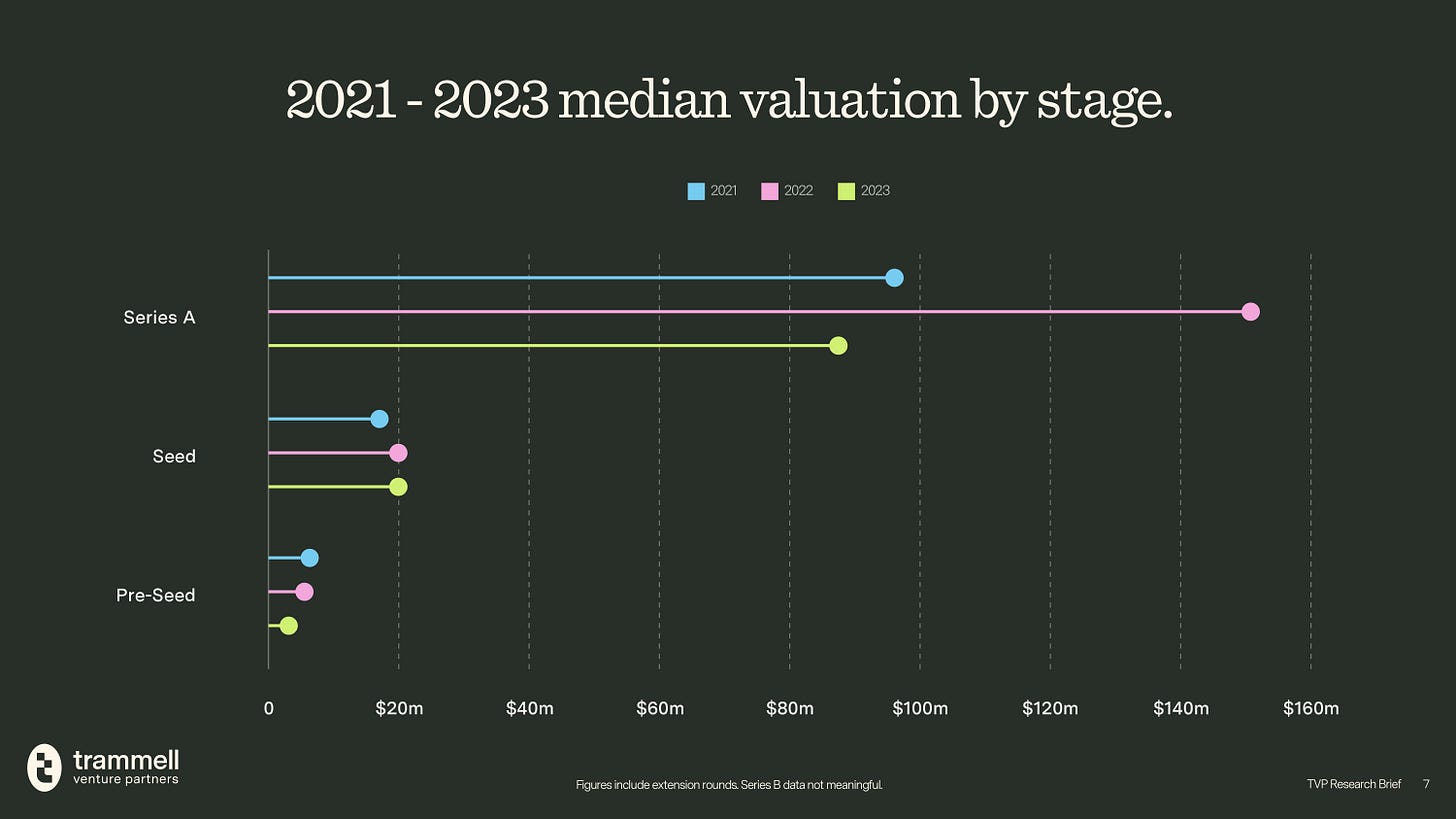

Funding at the pre-seed level has been decreasing and is now at its lowest over the last 3 years in 2023. This doesn’t come as a surprise, as the value proposition post-FTX for any crypto-adjacent companies to secure funding has had to be much stronger, and despite bitcoin being an entirely separate asset from the rest, it is understandable that increased trepidation and decreased funding size has resulted from the fallout. Still, by the time the Series A funding round rolls along, bitcoin-native companies are able to secure a higher median funding size than any year prior. Caution at the outset, then more funding leniency as companies prove themselves, is the name of the game in bitcoin-native venture capital these days:

The post-FTX and crypto fallout is also readily visible in the median valuation of bitcoin companies, impacting not only the market price of bitcoin, but the perception and value proposition of companies building on it. At the Series A-level, the median valuation fell from ~$150mm in 2022 to ~$90mm in 2023:

Our final chart today, and the most damning chart for crypto as compared to bitcoin, is 2023 bitcoin versus crypto investment. In the same way that bitcoin’s monetary properties are not yet accurately reflected in its market price, the deal count and venture dollars invested in BTC-native companies relative to the crypto ecosystem have yet to reflect bitcoin’s superiority on every level. Despite holding 51.6% of the total crypto market cap, bitcoin represented only 3.2% of venture dollars invested and 5.36% of the deal count across the ecosystem in 2023:

Discouraged? You shouldn’t be. Bitcoin is starting to gain on crypto VC investment at the margin. Compared to 2022, bitcoin’s share of total crypto deal count has more than doubled, and its share of venture dollars invested has almost tripled. Silicon Valley has long been enamored by the prospect of yield-generating crypto businesses, NFT projects, and the ambiguous idea of building X or Y on the blockchain, but that is clearly starting to change. Just as bitcoin is gaining in market dominance relative to its imitators, so too will it one day subsume all crypto funding:

There is a clear acceleration in bitcoin-native companies seeking funding. The sustained linear growth of bitcoin companies and accelerating trend in total funding rounds, paired with the marginal gain in bitcoin deal count and dollars invested relative to the crypto ecosystem, all signal that the future of finance is in fact being built on bitcoin. With venture capital giants such as General Catalyst, Valor Equity Partners, Y Combinator, Goodwater Capital, and more joining the BTC-native investing class in 2023, we’re only just getting started.

Until next time,

Joe

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.