Welcome to TBL Weekly #102—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Good morning TBL Readers, happy Saturday ☕

Before we get started, take the opportunity now to lock in your lifetime price before we raise prices to $499/year! Download our new risk report here to see what we’re building.

What a week it has been, ladies and gentlemen. Only hours after last week’s TBL Weekly #101 (without the Dalmatians) went live, a former US President was nearly assassinated. As we ponder the infinite possibilities of what such an event would have done to the geopolitical order, commodities, interest rates, and frankly civil unrest here in the United States, we are instead relieved that such a moment did not come to pass.

Instead, markets opened on Monday to the Trump trade. The anticipated second Trump term is driving markets to price themselves accordingly—moving in anticipation of policy decisions that will affect relevant industries. Oil and gas are up, banks are up, and trucking is up. Cannabis is down, solar is down, and alternative energy more broadly is down.

The other component of the Trump trade is the huge swing higher in bitcoin. BTC is climbing thanks to its own native factors: huge ETF net inflows and spot buying from investors who are setting the bottom, the risk of miner capitulation abating now that price is moving in their favor, and momentum as we crest the middle of summer and approach the next Fed meeting in 2-weeks’ time.

Bitcoin is enjoying most of these risk-on gains afforded by week one of the anticipatory Trump trade. BTC rose 7.75%, the S&P 500 rose 0.81%, and the Nasdaq 100 fell -0.81%. Bitcoin uniquely outperformed this week compared to one of the most risk-sensitive stock indices, the Nasdaq 100, which fell. Remember: bitcoin is not a stock, even though it somewhat trades like one; these native factors that are now flipping in bitcoin’s favor and have driven this week-long divergence must be studied and incorporated into your framework if you want to understand its price action clearly:

We have said that this year would likely continue its choppy, upward trend resembling stairsteps that has been the hallmark of this bull market. Compared to cycles past, this bull run is earmarked by far less froth and far more mature, less fairweather money. Less flighty investors make for more tame price action; albeit still volatile due to its size and the nature of a 24/7 market. Lo and behold, that’s exactly what has happened:

The 35% drop and subsequent +25% recovery are very tame compared to the price action in previous cycles. Compare last cycle’s massive rocketship-esque run from $10,000 to $64,000 in 9 months to this cycle’s move from $16,000 to $70,000 which took a year and 4 months. Bitcoin’s current price level is on much sturdier legs than last time we were here. This is also evidenced by the magnitude of the local drawdown last time (-54%) to this time (-26%). In each cycle, bitcoin’s floor moves higher and higher. Will we ever see the $10,000 level, or even the $20,000 level again?

As I said in Tuesday’s video, bitcoin’s price is positively correlated with Trump’s election odds. Bitcoin had an initial 2.5%-pop when Trump’s odds rose 10 points, and it has now extended its rally from the bottom by ~26%. We are so back:

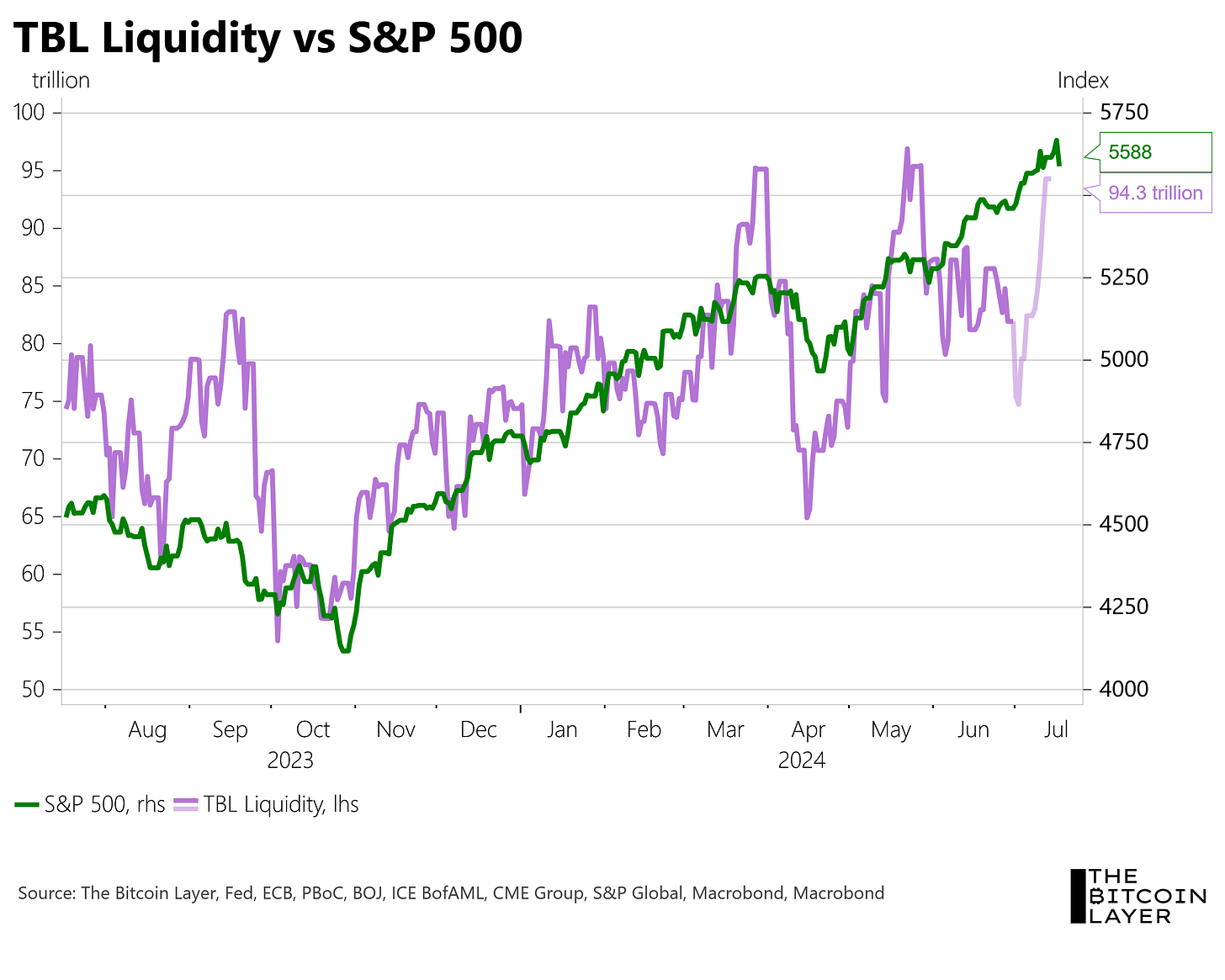

It’s also a liquidity move, the same move higher in liquidity that has driven risk assets higher over the last 2 years, this one mostly driven by lower yields:

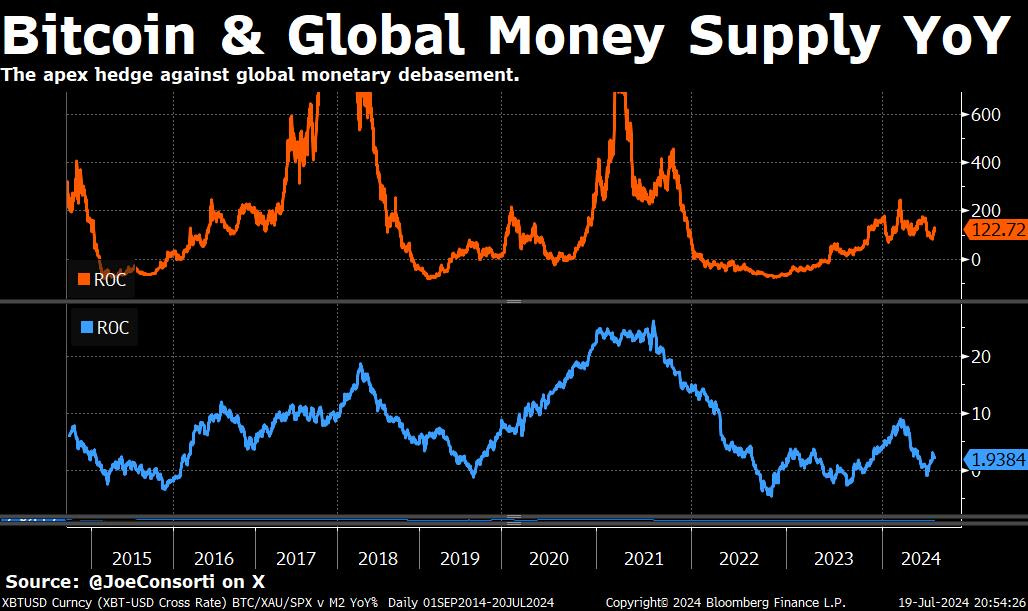

Here’s another liquidity chart, this time the yearly % change of plain old global M2 money supply (bottom pane) and bitcoin (top pane). Very tightly related:

Let’s zoom in. As global liquidity is inflecting higher with the world’s central banks moving from a tightening/on-hold bias to an easing bias, liquidity is again expanding. This is another tailwind for bitcoin, which stands to continue inflecting higher as the rate of new money coming into the global fiat complex accelerates (rate-of-change rising higher into positive territory). This is great, until and unless the downstream reason that CBs are easing (recession/deflation fears) come to pass, then this may turn into a flight to safety trade. Eye on what comes next, always. For now, enjoy the show!

Overnight index swaps, derived from the market's expectations of the average overnight interest rate (for example, the federal funds rate) over a specific period. The fixed rate in an OIS contract reflects these expectations. By looking at the fixed rates in the OIS market for future periods, we can plot the path for where the market thinks the Fed is going to take interest rates.

One 25-bps rate cut is an absolute lock for September—at 92% odds with 8 weeks to go—it’s an absolute certainty, ceteris paribus. The lagged effects of rent inflation are finally being reflected in the CPI and dragging it down. Ideally for the Fed, back down within striking distance of its 2% long-run annual target.

From September onward, the path for rate cuts is more in flux. Powell and crew have been data-dependent for the whole cycle, so anything more than one meeting out is not nailed down. If the first maintenance (incremental) rate cut goes over well, expect a cadence of one 25-bps cut per meeting into 2025 and beyond, until the Fed believes it has arrived at the neutral rate:

Next Week with Nik

In the week ahead, markets will potentially care a lot about the release of GDP and PCE in the back half of the week, but not us. We are fairly confident on the path of the consumer (slower, but hanging in) as well as the path of inflation (not much higher than 3.5%). Any surprise to the downside on inflation will further rally the Treasury market, but the trade is already in motion. I firmly believe the turn to lower rates began weeks ago, and seeing Treasury yields with a 3-handle is part of our intermediate future. The path might be bumpy, but directionally, let’s just say, borrowers might want to check their loan docs for refinancing opportunities some time between Halloween and Valentine’s Day.

Some interesting economic releases have the potential to catch our eye, but we’ll more closely be watching the nearly $200 billion in Treasuries to be issued between the two- and seven-year part of the curve. As cuts come into view (Joe explained why September is a lock), Treasury investors will be more willing to secure yields above 4% now before they potentially trek back down to 3.5%. Bond buying comes and goes, mostly driven by the economic cycle. When things are hot and inflation is kicking, the last thing investors want to own is fixed income. But when the economy slows, they lock in that yield.

With the FOMC meeting on the horizon, economic releases until then will mostly be glossed over, allowing the market to focus on the election cycle, Trump trades, and any signal derived from the path of Treasury yields. Tens closed the week at 4.24%, a hair below the 4.25%-4.33% range we have watched so closely. Continue to watch this area for indication on where yields are heading—a close above 4.33% would spell an end to this current Treasury rally, while a close below 4.15% would suggest the unemployment wave has already arrived.

If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month—find the link in our Monday letter.

Here are some quick links to all the TBL content you may have missed this week:

Monday

Stunning and tragic events over the weekend directly impacted the bitcoin price, and rates fell sharply after a sluggish inflation reading. Understand our risk outlook in today’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. Don’t forget to register for our next Virtual Q&A, scheduled for July 25th—link for July’s Zoom is below.

Check out—Mean, Median, Mode: July 15th, 2024

Tuesday

In this video, Joe discusses bitcoin's 2.5% pop following Saturday's assassination attempt and tragedy, and the 11% gain in the days since. Trump has been an outwardly pro-bitcoin candidate, stressing the importance of bitcoin self-custody and mining as a way to bolster U.S. energy independence. He walks through all of the positive statements Trump has made about BTC on the campaign trail. He also discusses JD Vance, the Senator that Trump has chosen for VP, and his pro-bitcoin policies enacted while in office, as well as his own personal bitcoin holdings. We indicate that while we should be skeptical of politicians, JD has put his money where his mouth is. Joe concludes by highlighting that the strong performance of bitcoin following Saturday's events is a preview of the environment for bitcoin's price if we get another 4-year Trump term come November.

Check out—Bitcoin Update: Trump & Vance Establish Pro-Bitcoin Presidential Ticket

Thursday

We’re ready to share our liquidity model—a measurement of money sloshing around the world that should, in theory, help us measure the quantity of money available to flow into bitcoin. Our first version isn’t perfect, nor have we performed all the necessary regressions (don’t worry, we will), but I’m quite happy with the initial visuals. Lastly, a special mention to our new partners at Unchained—if you’re looking for the full suite of bitcoin financial services, we couldn’t be more excited to point you toward their team. Now, let’s dive in.

Check out—TBL Liquidity and our Bitcoin Indicator, part 2

In this episode, Nik brings us a timely update on the path of interest rates in the United States, including a look at Treasury yields and the yield curve, an exploration into the "Trump trade" of a yield curve steepener, the latest with Fed cut expectations, and some bitcoin valuation analysis. Make sure you get your mortgage refinance applications ready, as rates are coming down.

Check out—Interest Rates Update: Get Ready To ReFi, Bitcoin Valuation

Friday

It’s Thinking time! This week we cover how immigration affects the US job market, hidden debt affecting growth in China, rich Chinese picking Hong Kong over Singapore, and Zimbabweans’ preference for US dollars over local currency ZiG.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Check out—TBL Thinks: Immigration, hidden debt, Hong Kong's red carpet, & flying cash into Zimbabwe

In this episode, Nik brings us a markets update on bitcoin and traditional assets. We discuss the potential for bitcoin to become a strategic asset for the United States, BTC's 20% price pop after the early July selloff, and introduce our TBL Liquidity indicator to measure the world's monetary firepower. Nik also analyzes the latest moves in gold, oil, and Treasury yields.

Check out—Bitcoin & Macro Update: BTC Spikes 20%, US Strategic Asset, Measuring Liquidity

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

well done again guys.