Bitcoin Postmortem: All One Trade

Macro we can learn from bitcoin's latest obituary

Dear Readers,

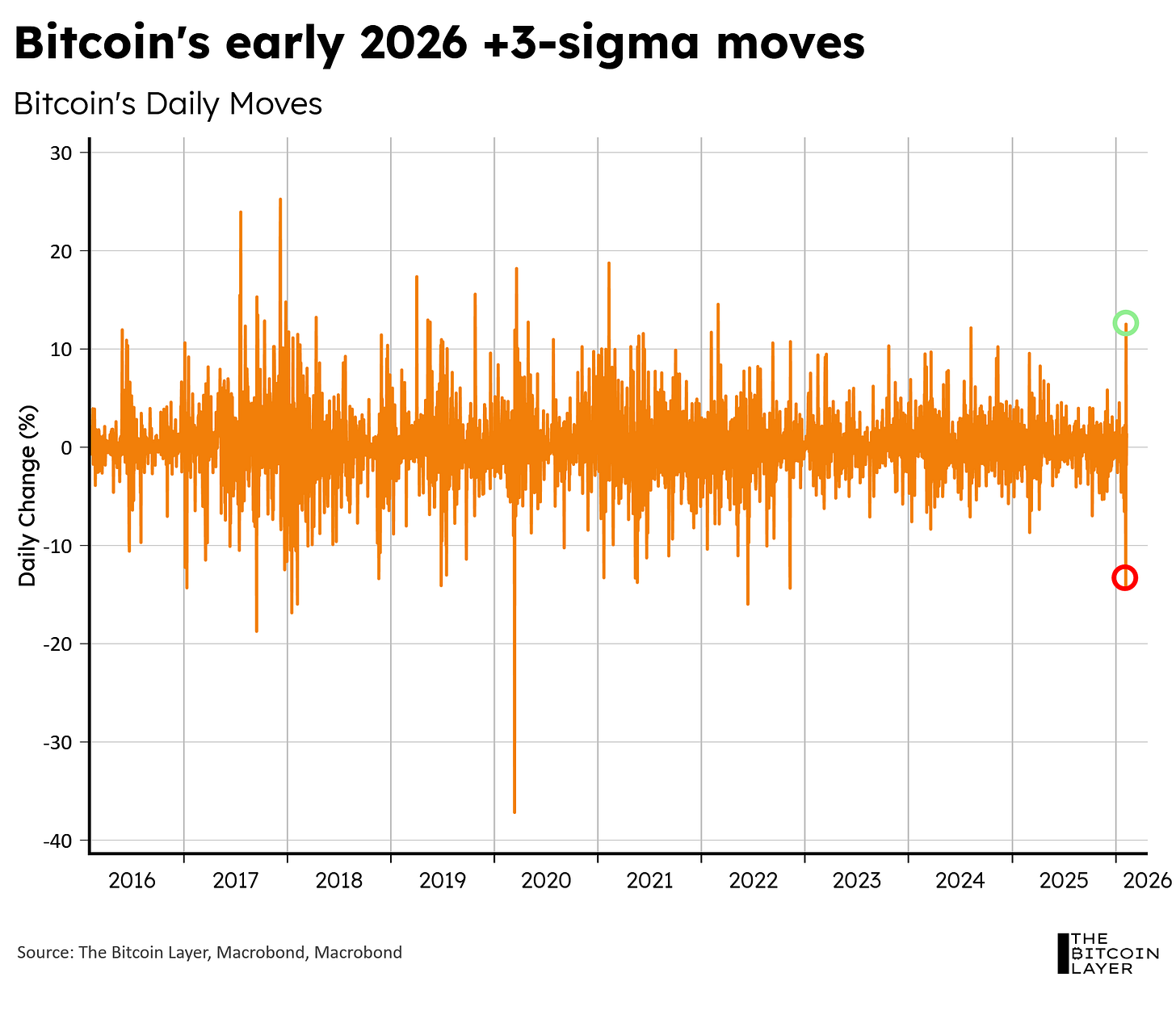

Last week, all hell broke loose. Bitcoin had a +three-sigma move to the downside and a +three-sigma move to the upside from one day to the next (chart below):

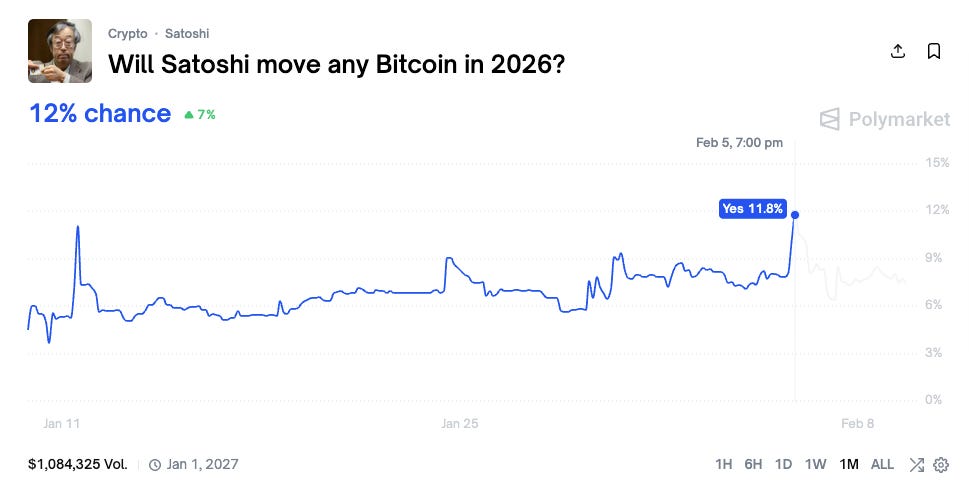

Such low probability moves even prompted some spectators out there to raise the odds on Satoshi himself moving some coins this year, reaching nearly 12% before resetting back to their sub-10% usual (chart below):

Heck, it even got the Financial Times to write yet another doomer piece on bitcoin’s value:

Of course, we add these things simply to lighten the pretty dampened mood in bitcoin right now, but the point stands: last week’s moves were not ordinary. There are plenty of developing theories out there, but one of them specifically caught our attention. Jeff Park’s hypothesis in this informative post can be broken down into two sections: (1) the catalyst and (2) the fuel. While the ‘fuel’ helps us understand the violence of last week’s moves, we’ll primarily focus on the catalyst, as that contains some of the grander macro narratives out there right now. Note, there’s definitely a lot more nuance in Park’s article, so please check it out if you can.

🚨Please take some time to answer the poll at the end of this article. It would be extremely useful for us and our content going forward ✍️

The foundations of money are shifting in ways that are easy to feel but harder to name.

Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

In The Debasement Trade, James Lavish explains why currency debasement is structural, why traditional portfolio assumptions are being tested, and why gold tends to move first while bitcoin often moves further as the implications compound.

The report covers:

Why debasement is not cyclical

How inflation and financial repression stress familiar portfolios

Why gold signals early—and bitcoin expresses the shift later, with more asymmetry

The technical catalyst

In a broader sense, Park’s catalyst is something even we, at TBL, have been developing as a working theory over the past month: it’s all slowly becoming one trade.