Bitcoin Rips To $48,000 & Debt Monetization Is On The Way: TBL Weekly #80

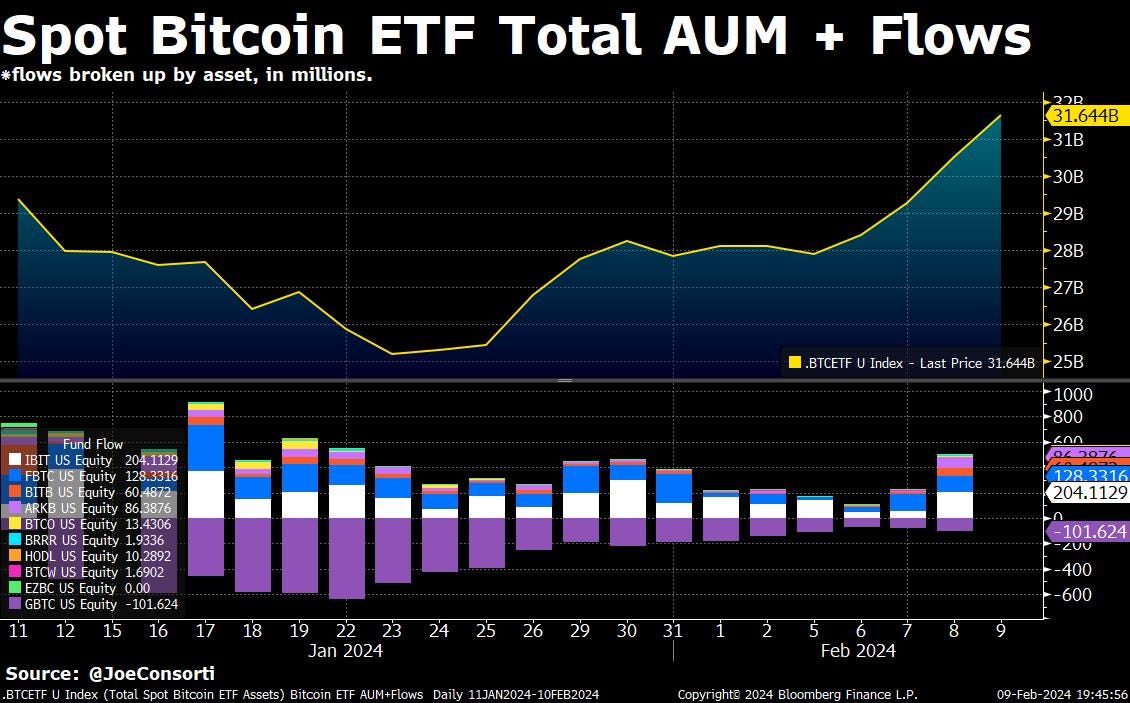

Record-breaking first-month inflows for the 9 new spot bitcoin ETFs.

Welcome to TBL Weekly #80—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning everyone! Happy Saturday ☀️☕

The first month of trading for spot bitcoin ETFs here in the US has concluded, and the 10 ETFs have amassed $31.6 billion in assets between them, some 670,000 BTC. It is worth noting that some ~$22 billion of this is part of the Grayscale Bitcoin ETF, a product that has been around much longer than the 20 trading days of its counterparts:

As the 9 new ETFs surpass the holdings of Microstrategy, and combined with GBTC they more than triple it, it is safe to say that Wall Street is now the single-largest owner of bitcoin that isn't Satoshi. Owner on behalf of its clients, of course. Since their compliance in a situation of civil asset forfeiture is certain, however, it is quite accurate to say that they own the bitcoin. We beat the drum that we’ve been beating since long before these products launched: don’t buy these ETFs unless your money is locked in a brokerage account. Bitcoin’s properties of unseizable money only function if you hold it yourself—these products are for price exposure and nothing more.

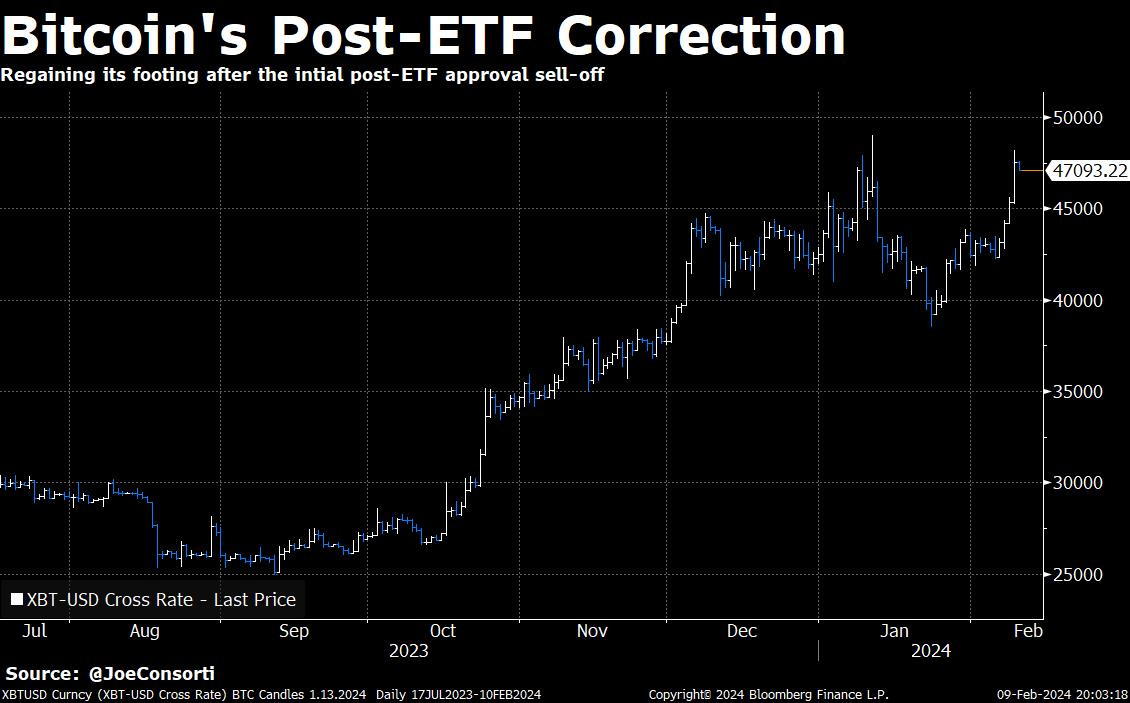

The record-setting ETF flows drove bitcoin as high as $48,187 mid-day Friday, before paring back some of its gains and hovering just above the $47,000 mark:

On Friday, Joe had the pleasure of sitting down with Michael Howell, CEO of CrossBorder Capital, for a discussion on global liquidity. We will be publishing the full conversation on Monday, but the subject matter is important enough that we felt it warranted its own section in today’s free newsletter. Let’s walk through some of his thoughts about what is ahead for markets in 2024.

Howell thinks that US Fed liquidity could surge over the coming months as the US Treasury forces the end of QT, both for political reasons and out of necessity due to a lack of buyers and a need for the Fed to step in and fulfill funding needs.

This lines right up with Nik’s analysis outlined on Thursday that QE is a lock. A political liquidity surge is characteristic of election years, where ahead of a US election, the Treasury is on high alert to make sure financial and asset markets are supported to gin up as much positive press as possible for the incumbent’s Presidential bid:

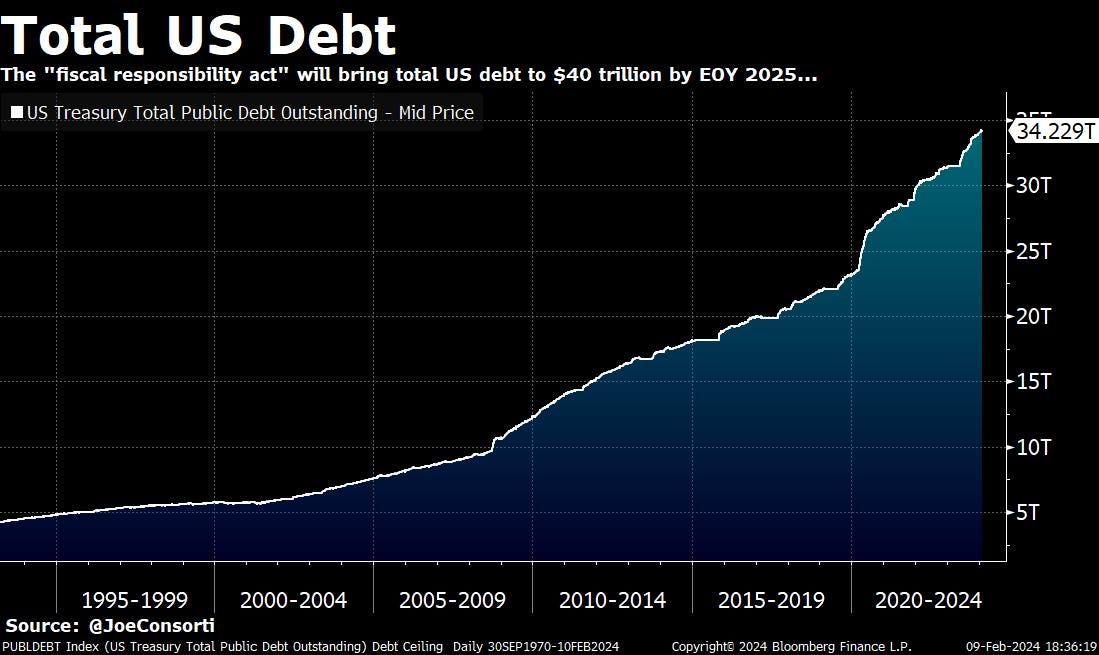

Not only does the election factor it, but so do the basic funding necessitates of the US government. While a strong tax season through April will be great for the US, its funding needs primarily come from debt issuance, as deficits have become the norm—tax revenues simply don’t cover government expenses. The Congressional Budget Office projects the US’ total debt to rise to $50 trillion by 2034. Having risen +$2.8 trillion in the past year, we are currently on track to hit $35 trillion by June:

Howell talks about the debt problem at length and concludes that the marginal buyer must be the Fed in some capacity, particularly as other funding sources dry up.

Banks won’t be able to buy all of them. Total deposits are falling and banks have little to spend on building their Treasury portfolios as delinquencies and charge-offs rise. This means an introduction of outright buying of US Treasuries by the Fed, and larger auction add-ons. Howell believes that the Fed’s RRP facility, the main source for US Treasury-buying right now, will level off towards the end of Q1, at which point, liquidity troubles will begin in financial markets:

The prevailing thinking is that the Fed needs to monetize Treasury debt. It cannot continue running down its balance sheet once these other funding sources for US Treasuries run dry, lest it risk financial instability and an undoing of its progress in tightening monetary policy while skirting recession.

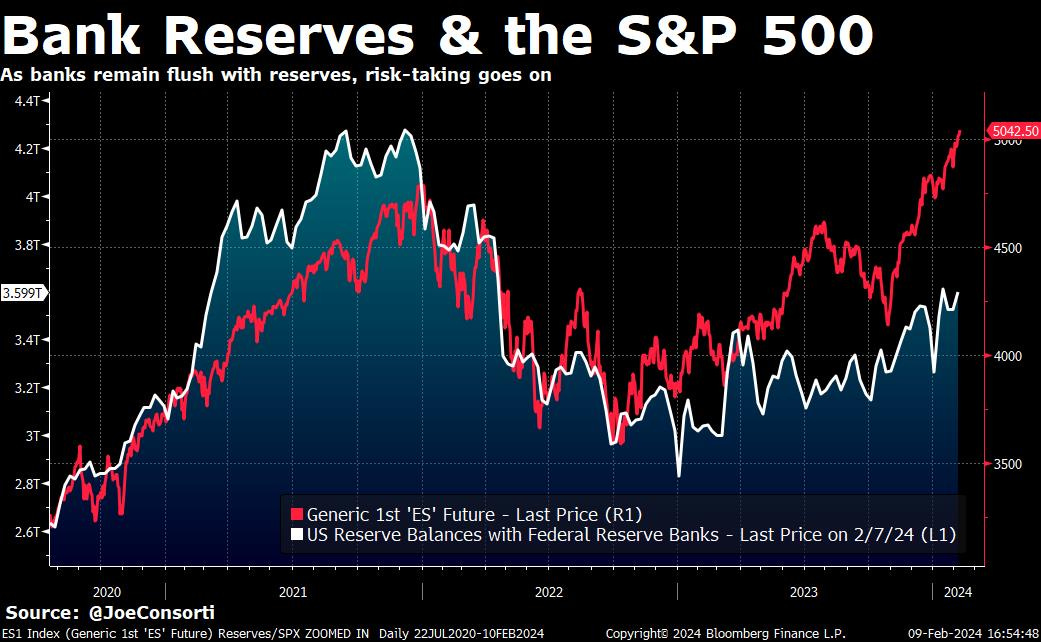

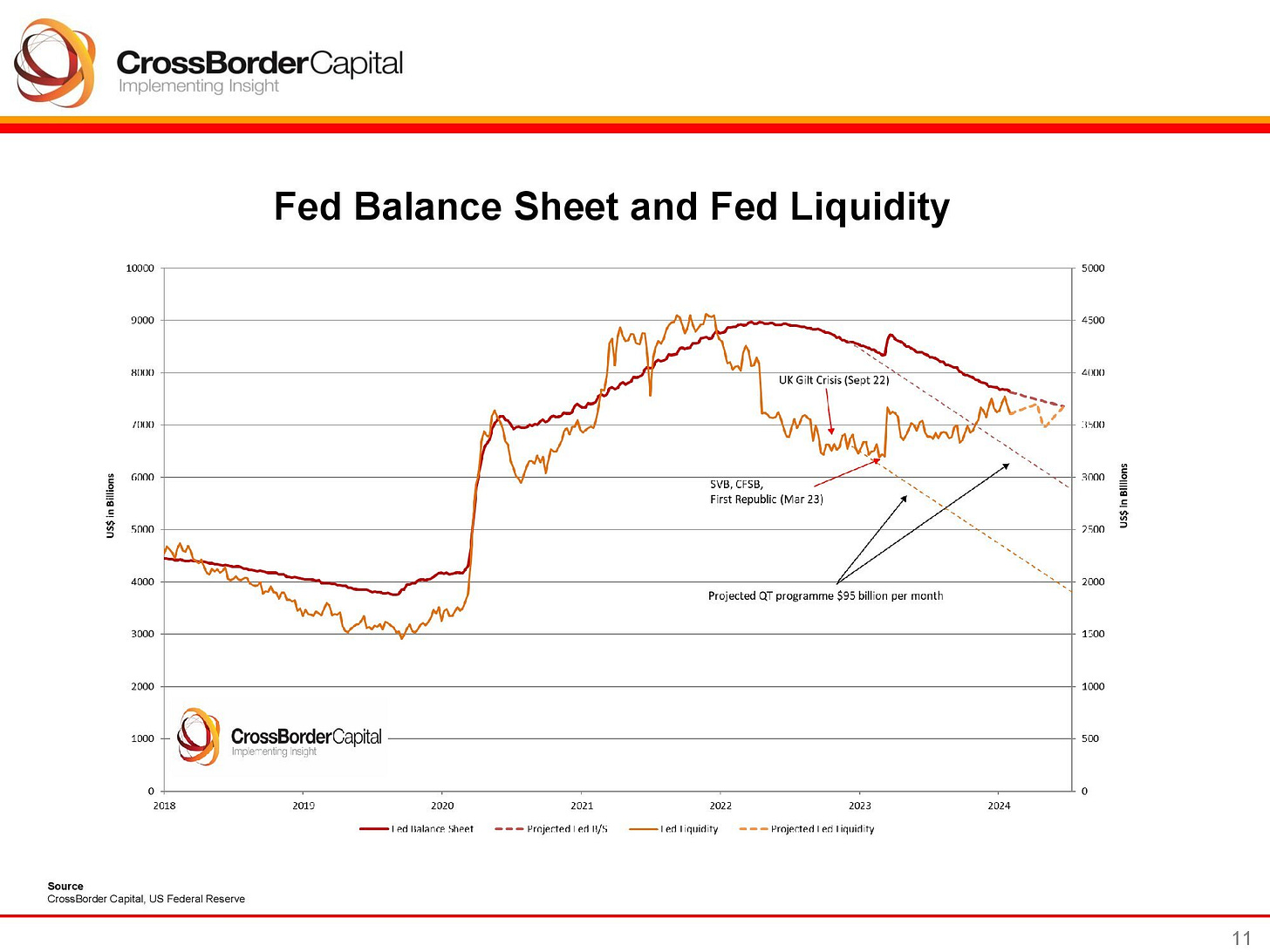

Fed liquidity is correlated tightly with bank reserves, and a crisis could happen once more if the Fed allows the level of ample reserves, projected to be around $2.5 trillion, to be breached. The same level at which the UK gilt crisis and March 2023 bank failures occurred is within striking distance, and it is up to the Fed to maintain stability and inject liquidity provisions if need be to prevent this from happening:

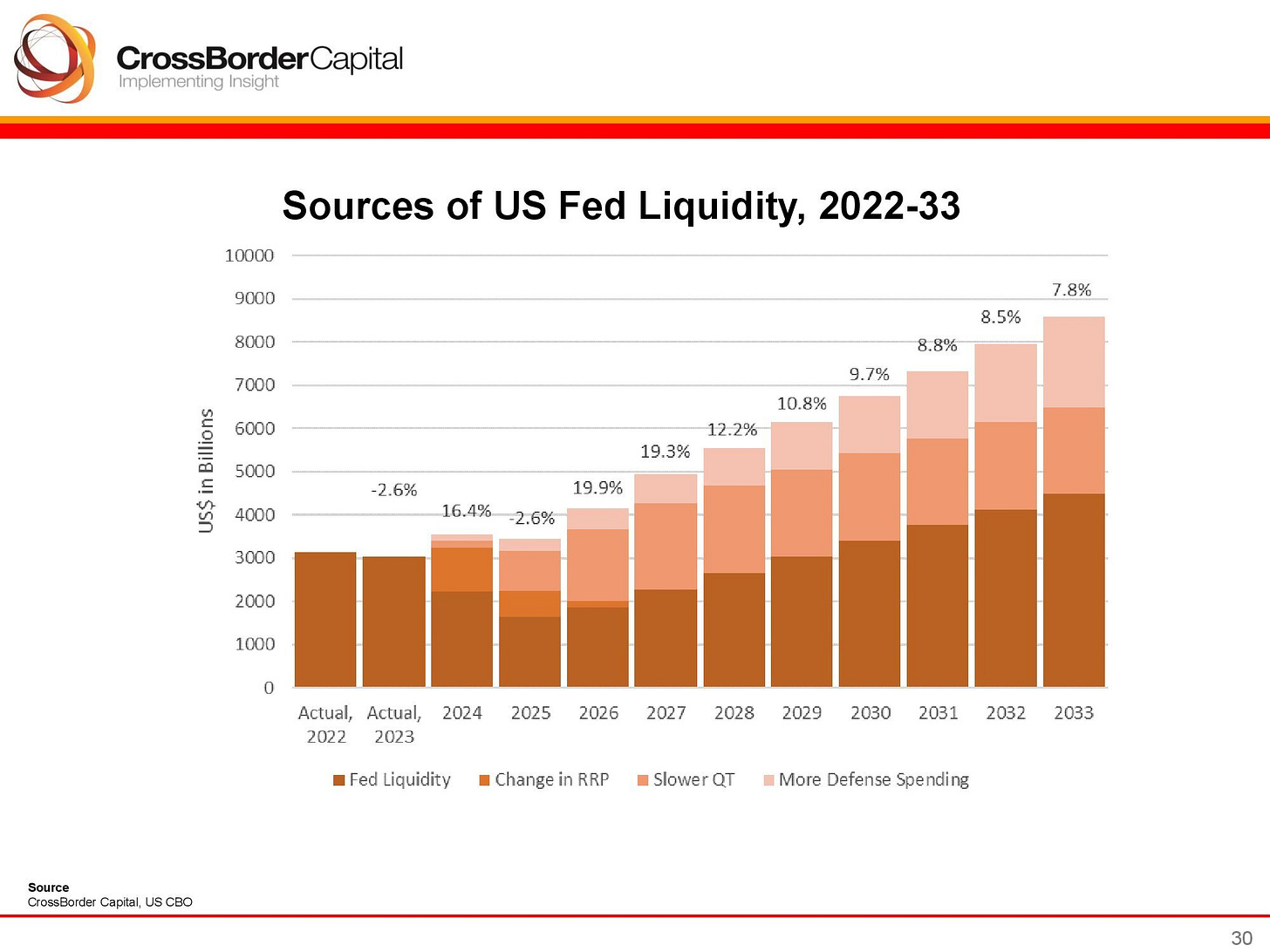

According to Howell, the Fed will support financial market functioning over the next decade through a combination of direct liquidity injections such as asset swaps, a reduction in the pace of QT, adjustments to the RRP facility, and more defense spending:

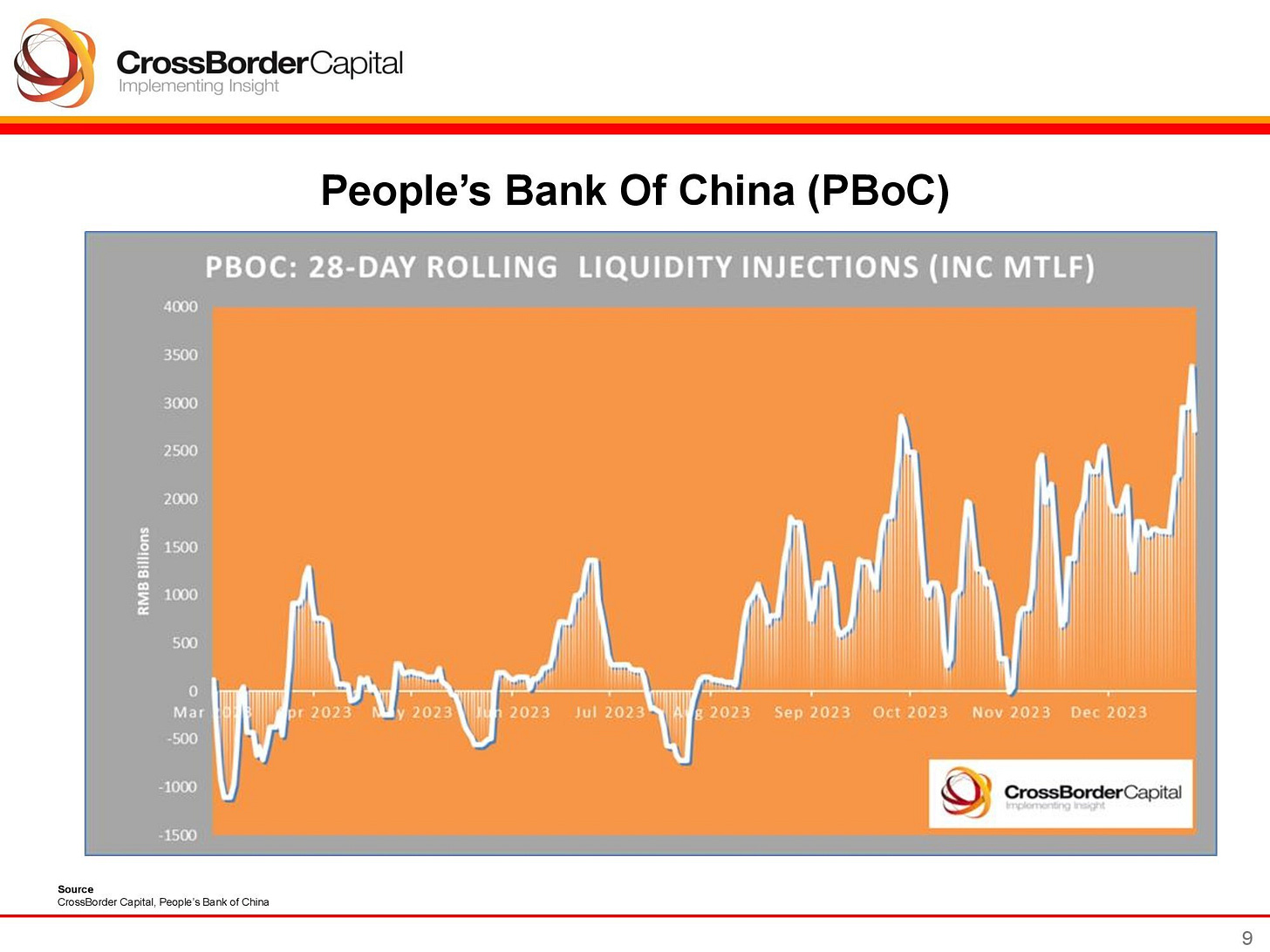

China is currently in the process of its own crisis, with 7.5 trillion RMB injected into markets since mid-2023 to encourage capital inflows to the region. Alas, this has yet to yield any positive results, and new investment into the country is barely hanging on:

As China injects massive amounts of liquidity into its own markets to encourage investment and fight deflation, it provides a huge boon to global liquidity, global asset prices, and the functioning of global financial markets. In the face of the Fed’s debt monetization which is expected to resume soon, this will be complementary:

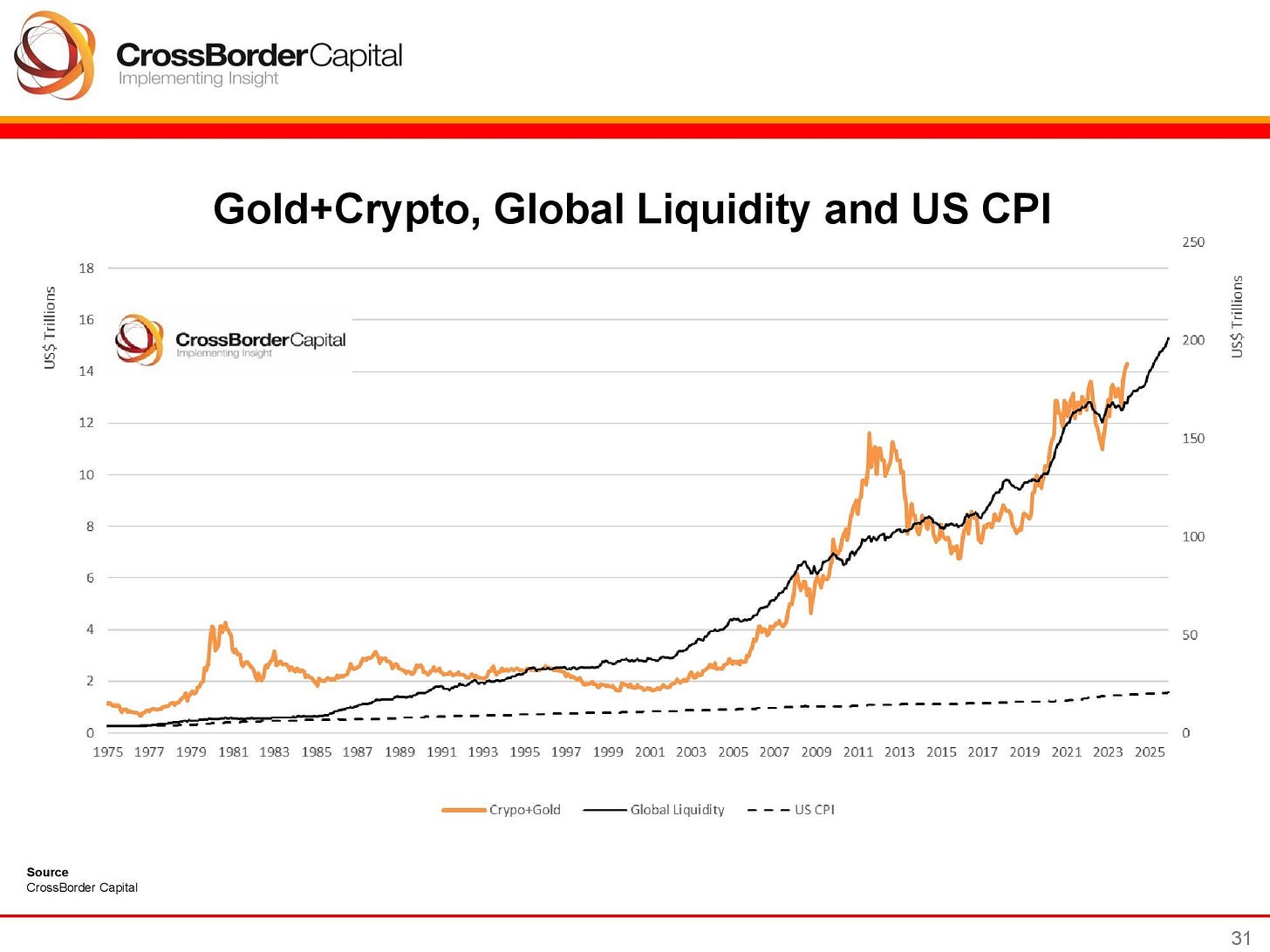

In a period of debt monetization from the Fed, you don’t want to hold bonds, as Howell points out, you want hard assets. See how gold and “crypto” (bitcoin) have moved in lockstep with global liquidity through the cycles, preserving your purchasing power through the central bank and US government’s joint devaluation. As we are on the cusp of yet another period of debt monetization from the ouroboros in Washington, you know exactly where you should be allocated:

Next Week

In the week ahead, the main event is once again CPI. A viewer recently noted that we pay too much attention to statistics such as CPI, which are highly manipulated by the government in order to achieve objectives. While we are sympathetic to this view, we are primarily market practitioners—this means our focus is always on asset prices. From an asset price perspective, the result of CPI versus the expectation of CPI matters a lot for the path of interest rates, the policy decisions at the Fed, and the decisions we all make as investors. We also don’t love the seasonal adjustments and shenanigans of the Bureau of Labor Statistics, it is one of the most informative series to practitioners that we have. Core CPI is expected to increase 0.3% month-over-month, a print that seemingly will not contain the rent disinflation that has been so well forecasted by Fed officials, including Powell at his press conference, of late. For the record, the Fed’s continued messaging about rate cuts later this year have a fair amount of disinflation-due-to-rents in their consideration. We are eager to find out if this will become realized. Retail sales should also give us some understanding on the consumer’s start to 2024. On the labor front, we believe our best two indicators are jobless claims (every Thursday) and the internals of the JOLTS report, including how many hires, quits, and listings register in the metrics. We’ll have to wait for the next JOLTS report, but claims arrive every Thursday.

On US Treasury supply, the conversation has never been more interesting. Thursday will be a settlement day, with our eyes always on the repo markets to see how securities balance with the need to fund them. Our money markets background influences us to watch repo rates (SOFR) closely as we continue on the path to balance sheet normalization.

Auctions went splendidly well last week, but they didn’t have an outright influence on yields which continued rising—this is often the case, as just auction activity alone tells us little about the aggregate demand dynamics for Treasuries as an asset class. Treasury yields are nearing levels we believed were possible to start the year (2s to 4.5% and 10s to 4.33%). At a point, likely soon in yield terms, buyers will emerge and be ready to lock in yields that will be above the policy rate come the end of 2024. Delinquencies by consumers and office vacancy-induced commercial real estate writedowns put banks in a tough place today, but when impairments turn to insolvencies, they will force a Fed easing faster than the Japanese government can issue a statement about a certain musician’s flight plans from Tokyo to Las Vegas.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

On Sunday night, Jerome Powell’s interview with 60 Minutes was released, one that mostly featured nothing he nor other Fed members haven’t already told us. Powell reiterated that the Fed would keep rates where they are until it is more confident that price inflation is heading down to its long-run target of 2%—notably, he said that price inflation didn’t have to fall for rate cuts to start, only that the Fed was convinced that 2% is where it is going. We won’t have to wait for immaculate disinflation for rate cuts, in other words, only for signs of a slowdown in the rise of CPI.

Check out—Inflation suddenly reignites

Wednesday

In this episode, Nik brings us a global macroeconomic and markets update from around the world. He begins with the incredible concentration of equity returns in the Magnificent 7 (Apple, Amazon, Google, Facebook, Tesla, and NVIDIA), addresses problems in commercial real estate and renewed banking contagion, and concludes with a revelation about bitcoin ETF ownership disclosures. The Fed's QT program, volatility, and the dollar are also covered.

Check out—Magnificent 7 Lead Stocks To Record, Banking Contagion Is Back

Thursday

Last night, while teaching the monetary history and plumbing portion of my fixed income course at USC, I brought up the classic example of the Roman Empire devaluing its currency by replacing a coin containing 98% silver with one containing only 5% silver over the course of centuries. Through this process, the state is stealing money from its lenders because when it pays back debt in coinage, each coin is worth less than each coin borrowed (due to the reduced precious metal content). “Isn’t this what the Fed does when it creates currency during QE?”, a student asked. An insightful question without a straightforward answer. It inspired me to write more about today’s QT period and why, mathematically speaking, I don’t see an alternative to eventual QE. Got bitcoin?

Check out—Why QE is a lock

Friday

In this episode, Nik is joined by Andrew Poelstra, head of research at Blockstream. Andrew presents his argument for Bitcoin covenants and why he believes introducing OP_CAT via soft fork is a sensible first step. In a fascinating dive into bitcoin's cryptography and inner workings, Andrew teaches us about vault construction and rate limiting, why he believes OP_CAT as a soft fork is low risk, and some of the greater implications of covenants on Bitcoin.

Check out—Bitcoin Covenants with Andrew Poelstra

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

“…projects the US’ total debt to rise to $50 billion by 2034.”

Should this say $50 trillion instead of billion?