Welcome to TBL Weekly #70—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good morning, and welcome to November 11th—also known as 11/11.

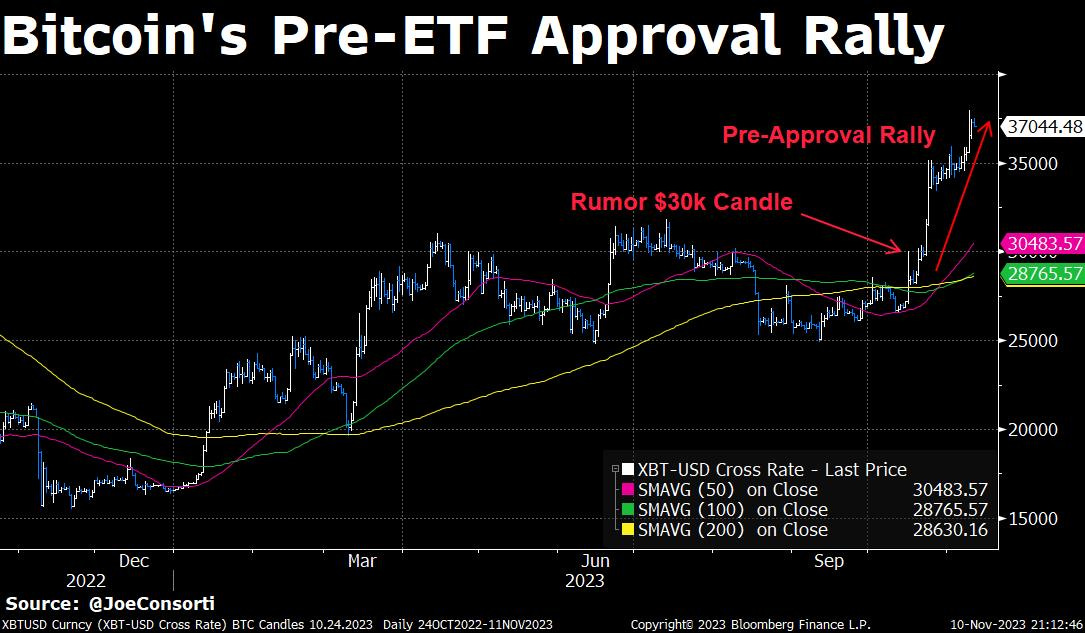

Have you made a wish yet? You may not have to, because bitcoin has had rather magical price action as of late. Forced puns aside, bitcoin’s pre-ETF approval rally continues to have serious steam behind it. It has had several consecutive legs higher since its initial green candle off of Blackrock’s planned spot ETF ticker being made public—making it less of a rally, and more of a trend reversal:

The comment period for more than half of outstanding spot Bitcoin ETF filings ended on Wednesday, wherein rebuttal comments must be submitted by the SEC—the firms that filed were Blackrock, Bitwise, WanEck, WisdomTree, Invesco, Fidelity, and Valkyrie. With the SEC nearing the end of the tricks it can use to delay spot Bitcoin ETFs from being approved, the market continues to front-run institutional-sized flows that are expected to follow their launch, as indicated by the aforementioned pre-ETF approval rally. In fact, Bloomberg’s ETF Analysts anticipate all 12 outstanding applications will be approved at once.

Floodgates opening, indeed.

The market is also pricing imminent spot ETF approval via the GBTC closed-end trust—which, expected to be converted into a spot ETF, is being bid up and converging on its net asset value as investors look to capture future 1:1 spot bitcoin exposure at a discount before it closes forever:

James Seyffart and Eric Balchunas from Bloomberg Intelligence continue to be the foremost authorities on all things related to spot bitcoin ETF approval timelines—we’d recommend giving them a follow on Twitter.

One of the week’s highlights was the 30-year US Treasury auction, which tailed very badly. Clearing levels were at least 5 basis points above the indicated yield moments before, making the result one of the largest misses in Treasury auction history. Some dramatic bearish price action ensued, but by the end of the week, 30s were basically flat on the week. Here is our take on such a terrible auction: while the rumors about a Chinese banking glitch/hack are plausible, the auction was indeed eyeopening. But Treasuries had rallied strongly in the days before the auction, and the general yield range on 30s and the massive size of the auction suggested that from a risk perspective, Treasury buyers had never been tested quite like this:

The auction’s tail (how large the difference between clearing price and pre-auction price) was certainly a sign to Yellen & Co. that hitting the market with this much duration is a dangerous game. Future auctions might struggle as well. With that being said, what matters most for Treasury prices is how they trade in response to changes in growth and inflation expectations, and thus the path of monetary policy. The jury is out on whether the US fiscal deficit can overpower the effects of recession on Treasury yields—readers know our assumption remains that yields will fall in response to rate cuts.

The Fed’s latest BTFP emergency bank loan program hit a new high of $112 billion. This comes after 12+ weeks of virtually no new banks tapping the facility. Historic volatility in the US Treasury market is crippling banks who limp to the Fed for a lifeline.

Granted: this is still now, and these increases are paltry compared to the $2 trillion limit the Fed has placed on the facility. It is clear that banks, particularly regionals, are reluctant to use it or other emergency loan facilities for fear of stigma:

On Thursday, Jerome Powell remarked "just close the fucking door" after a climate activist crashed his speech at the 24th Jacques Polak Annual Research Conference in Washington DC.

Even the unelected elders who control the cost of capital hate these people:

Leave it to college-educated climate activists to make one of the most hated figures in American politics a highly likable individual in the span of 15 seconds.

The Honorable Jerome H. Powell. Like an album cover.

After Thursday, Powell is gunning for Volcker’s spot as #1 least-hated Fed Chair:

—and now back to your regularly scheduled skepticism of central planning.

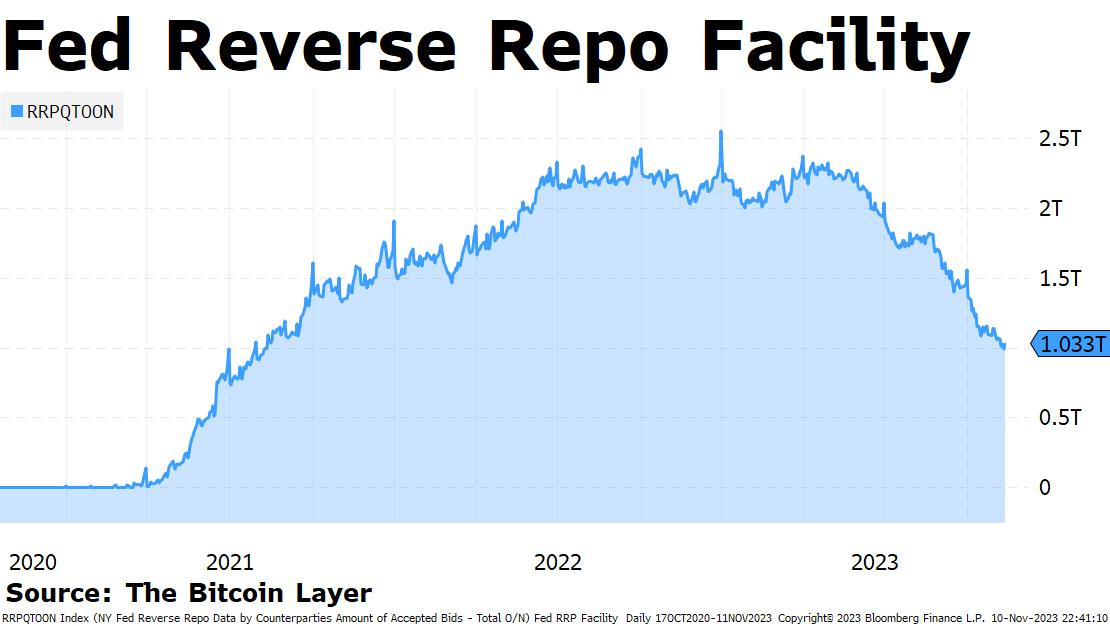

Speaking of which, the Fed’s overnight reverse repo facility briefly dipped below and is now hovering around the $1 trillion threshold. As Yellen issues fresh bills that overwhelm money markets with supply and undoubtedly will continue to trade cheap relative to the rest of the money market complex, capital will continue to be sucked from this facility.

Once it hits zero in the first quarter of next year, where will the cushion come from for T-bill issuance, Treasury repo, and other necessary recipients of money market funds? It certainly isn’t the Fed’s balance sheet:

A shutdown of the US government is reportedly imminent (yes, another one).

As the US straddles its citizens' tax dollars between funding two foreign wars and continued deep deficit spending, Moody’s has cut its outlook for the US’ AAA credit rating to negative.

The world’s economic leader is on the verge of a credit downgrade because the people in charge are more concerned with funding endless foreign conflict than the livelihood of its citizens who bear the brunt of price inflation.

Next Week

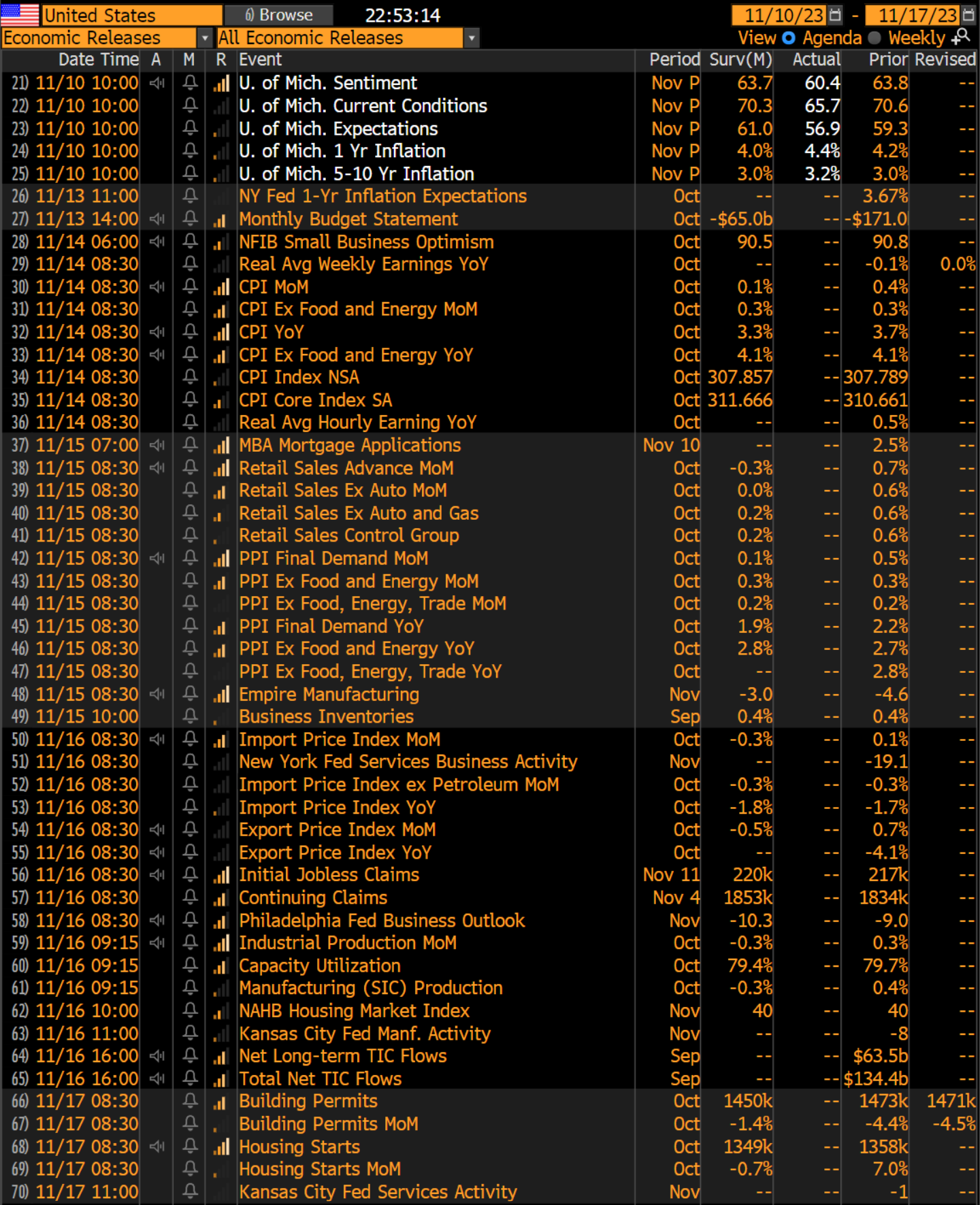

In the week ahead, we finally get back to tier-1 data with CPI on Tuesday. Expectations have fallen significantly, with a near-zero expectation on the month-over-month reading. A reminder that we don’t believe that CPI is a main driver for monetary policy any longer, mainly because the overall level is no longer threatening 4-5% and higher. At closer to 3%, CPI readings are not necessarily a danger zone for central bankers. For this reason, we believe the Fed is much more focused on keeping the markets wary of further hikes so as to not tempt them to price in rate cuts. A silly game of psychology, but after all, psychology has been the greatest tool of Powell, and his predecessors Yellen, Bernanke, and Greenspan—after all, it was Greenspan who made us understand that even though the Fed doesn’t have all the data in real time, it must act like it is control and thus guide markets and monetary policy with a degree of being blindfolded.

October’s retail sales have early indications of being awful; we are closely watching October data to see if any of the equity market’s terrible performance had a feedback loop on spending via the wealth effect or overall consumer confidence. University of Michigan consumer sentiment numbers this week were terrible (November preliminary) and could show up elsewhere. We’ll receive housing and employment data as well, and overall the market will have a fair share of data to digest. The way to think about economic data now has changed—earlier, strong data would warrant hikes, and weak data would be ignored. Now, strong data is somewhat ignored, and weak data brings in aggressive “rate cuts” trades to money markets. We expect this to continue to play out, as traders are itching to press the Fed on rate cuts but don’t have enough ammo yet to pull it off. We anticipate a week with at least some fireworks:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, we are joined once again by Glassnode on-chain analyst Checkmate. He walks us through a series of charts in which we see holder behavior and exchange flows consistent with the transition from bear market to bull market. We also learn about Glassnode's preferred metric to realized value and MVRV.

Check out—Glassnode Analyst: BULLISH On-Chain Fundamentals For Bitcoin

Tuesday

On Monday we had October’s release of SLOOS, or the Senior Loan Officer Opinion Survey on Bank Lending Practices, for those of us with acronym aversions. This is one of, if not the most consequential report about the health of credit markets in the United States. Trading desks around the world involved in US markets will be poring over SLOOS and positioning themselves according to the data on corporate and consumer lending standards contained within.

Prognosis? Negative.

Check out—Loan officers drop the US' economic anchor with more loan tightening in Q3

Wednesday

In this episode, we are joined by Riot CEO Jason Les. Jason walks us through what it's like operating one of the world's largest mining facilities, legislative efforts throughout the United States to support miners, and why bitcoin can contribute to the stabilization of energy grids.

Check out—Riot CEO: Bitcoin Mining Stabilizes Energy Grids

Thursday

Oil is down about 17% in the past two months. But it’s also up 14% from the year’s lows. It would be unfair to characterize this as an oil crash, but the price action is certainly alarming. It also brought an opportunity to discuss oil as a leading indicator, given our focus of late on equities and sentiment to tip us off on economic contraction—after all, GDP is still 5% on a lagging and preliminary basis. After some reflection, let’s just say that oil is the tell. And this spill is telling us something.

Check out—Oil spill: why and what's next

Friday

In this episode, Nik gives us another timely global macroeconomic and markets update. He explains the recent weakness in oil price by using recent news from FedEx, transportation employment data, and used car prices for context. He also walks us through why the terrible Treasury auction requires further investigation and explains the Fed's reverse repo facility for beginners.

Check out—Oil Crashes, Treasury Auction Disaster, & Fed's RRP Falls Below $1 Trillion

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.