Bitcoin Strength, Chinese Struggles, and Uptober Delivering: TBL Weekly #115

Good morning Readers! Welcome to TBL Weekly #115 — grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Weekly Macro Monitor

Weekly Analysis

Monday:

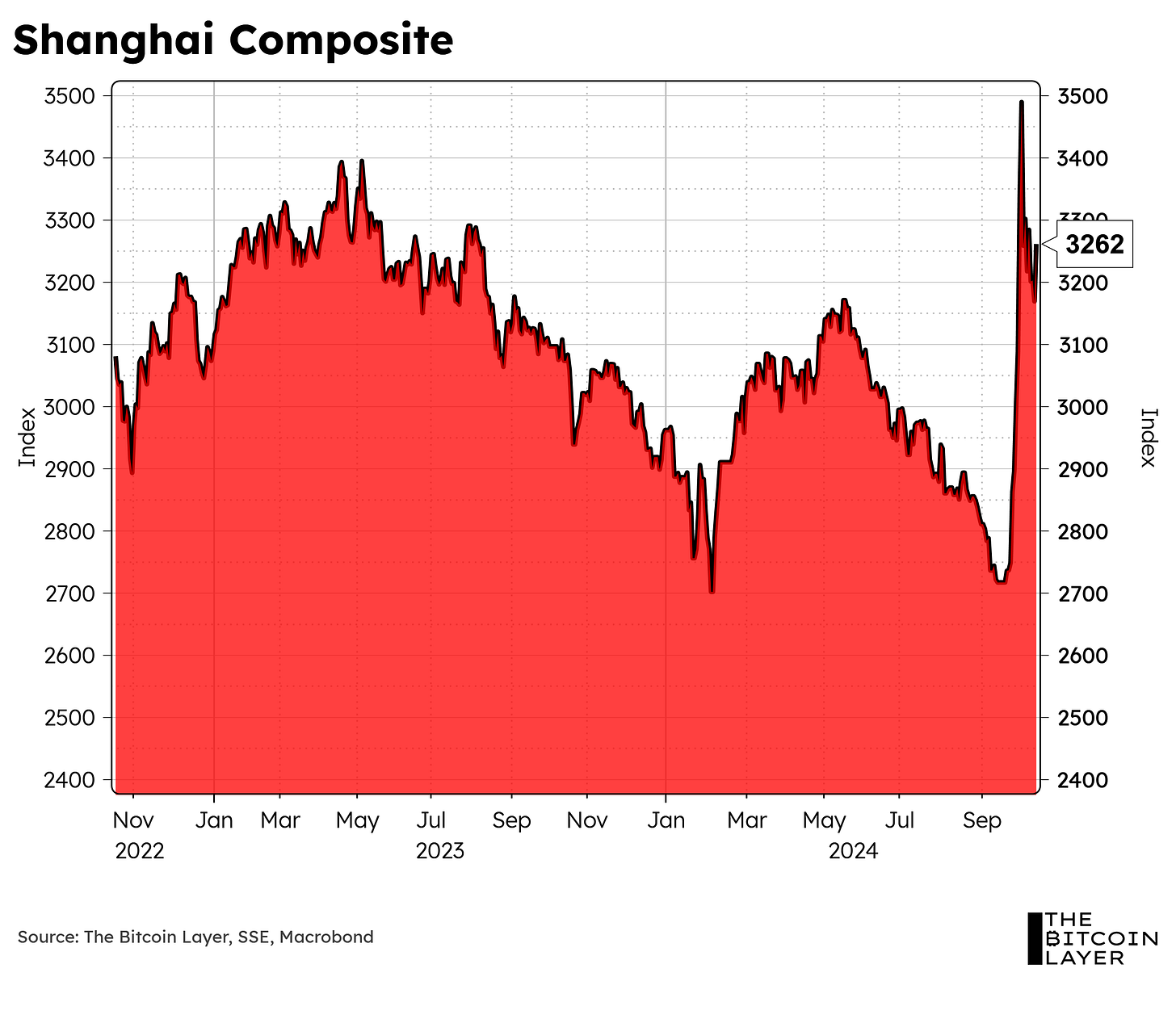

We started the week with some cooler-than-expected inflation prints in China, which has increased pressures on the Chinese government to roll out more stimulus to re-ignite economic activity. Remember that China already has targeted the stock market, primary mortgage market, and has indicated a willingness to issue about $1 trillion (USD) worth of government bonds (6 trillion CNY).

After a powerful September, October’s headwinds are proving strong for Chinese equities, down nearly 7% since October 8th. Perhaps some profit-takers amidst a natural correction after September’s sharp rally, or perhaps negative economic outlooks.

Conversely, on the other side of the world, US equities and bitcoin appear to be benefiting from highly anticipated “Uptober” historical patterns. With earnings season at its peak right now, we continue to see strong momentum in tech as a result of positive productivity outlooks given the AI boom—Nvidia is at all-time highs, battling with Apple for the title of Wall Street’s most valuable company.

Tuesday:

Tuesday saw bitcoin’s price test the resistance line of our consolidation wedge, which continued knocking as the week closed.

These tests higher in risk-assets have been accompanied by a sell-off in Treasury markets (higher interest rates), leading us to believe in a regime shift wherein the seemingly omnipotent positive correlation of the past couple years between risk assets and Treasury prices is finally losing steam. In other words, investors have been increasingly absorbing the textbook theory of moving out of safety (Treasuries) to buy risk (equities and bitcoin) since mid-June.

Wednesday:

Taking a look at European markets, the UK received a cooler-than-expected CPI print on Wednesday. Apparently, every other economy is struggling, while the US remains resilient as its election approaches. Cooling data has added pressure for the Bank of England to press the gas pedal on rate cuts—much like its ECB counterparts did later in the week. The wave of global rate cuts we promised you earlier this year has delivered and gathered steam.

Thursday:

Going back to the US, Thursday was undoubtedly the most important economic day of the week with a much hotter-than-expected retail sales print. While the monthly number impressed the market, the annual trend tells the tale of a consumer in growth, but subdued, below 2%.

This caused a bear steepener in the US rates market on higher growth expectations, building on that new regime shift of bullish stocks, and bearish Treasuries. We want our readers to understand that a curve only steepens when the future expectation for growth and inflation extends beyond where the forward policy rate is. That’s what’s happening now—the Fed is finally willing to cut to 3.5%, and that is supporting the expectation for growth several years from now. The opposite, an inverted curve, happens when a policy rate too high stunts those same growth expectations. Now you can see why rate cuts un-invert the curve.

Friday:

Following the bullish theme, gold’s price reached all-time highs on Friday. Gold is on an incredible run, and we could tell that the breakout would send gold to a 3-handle. It’s only a matter of time, and all of this recent price action has occurred with a US dollar that is sharply spiking on higher US rates relative to the rest of the world.

Are the lagged effects of monetary policy arriving soon? US economic data refuses to say so.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your bitcoin and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

In case you missed it: TBL on YouTube

Global Macro Update: Bitcoin Surges as China Stimulates and Trump's Trade War 2.0 Looms

In this video, Nik dives into what could be a perfect storm brewing in global markets. He unpacks Bitcoin's sudden 5% surge due to major economic shifts. To do so, he explores China's massive 6 trillion yuan bond stimulus and its global ripple effects, alongside the potential return of Trump's aggressive trade policies. Nik discusses the shocking scope of Trump's proposed tariffs and what that might mean. As the US and China continue clashing, this video explains the overall effects this will have on bitcoin and global markets.

Here are some of the key insights:

Bitcoin experienced a 5% surge to $66,000 after China announced a significant fiscal stimulus plan involving 6 trillion yuan ($1 trillion USD) in treasury bonds over three years, aimed at revitalizing its slowing economy.

The Chinese bond issuance strategy is being likened to money printing due to its expansionary effects on the financial system and overall liquidity in the market.

Markets are currently factoring in a "Trump trade" scenario, with attention focused on Robert Lighthizer, Trump's former US Trade Representative, as a potential Treasury Secretary in a future Trump administration.

Speculation is growing about possible trade policies under a new Trump presidency, including potential 60% tariffs on Chinese goods and 10% across-the-board tariffs, with Lighthizer's aggressive stance on US-China relations suggesting increased trade tensions.

Bitcoin currently sits in a consolidation phase with $66,500 identified as a crucial breakout level, while traders watch for potential inflationary pressures that could arise from escalating US-China technology competition and trade tensions.

Bitcoin’s Power Law Path to $1 Million

In this video, Nik dives into the mathematical heart of Bitcoin's future with statistical wizard Stephen Perrenod. They unravel the complex relationship between power laws and Bitcoin's market, and explain why bitcoin's growth isn't exponential, but follows a fascinating power law pattern that could push its value to $1 million by 2033. From the diminishing impact of halvings to the mysterious Lindy effect, this deep-dive analysis compares bitcoin's volatility with gold, explores market bubbles, and reveals how simple mathematical models can predict trajectory.

Here are some of the key insights:

Bitcoin's growth pattern has consistently followed a power law since its creation, with growth scaling with time rather than following the constant rate typically seen in exponential models, while its adoption rate (measured by non-zero balance wallets) grows approximately as the cube of time.

Historical analysis shows that each Bitcoin cycle demonstrates progressively smaller returns, which aligns perfectly with the power law trend, contradicting earlier theories that characterized Bitcoin's initial growth as exponential.

Looking ahead, predictions suggest Bitcoin could reach between $1,000,000 and $3,000,000 by 2040, potentially matching the total value of all gold mined throughout history.

The Lindy Effect principle supports Bitcoin's long-term viability, suggesting that its continued survival since inception increases the probability of its persistence well into the future.

The power law growth model indicates greater stability compared to exponential models, with Bitcoin expected to maintain superior long-term returns compared to traditional assets, despite the declining rate of growth.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we covered the pinch that US households are feeling given borrowing delinquencies, the potentially higher deficits under a Trump administration, and what Congress is doing to remain crypto-friendly.

Check out TBL Thinks here:

What TBL Pro Is Reading

Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Read more by going TBL Pro:

Exclusive content: access to the weekly "Mean, Median, Mode" risk report

More in-depth analysis not available in free content

Timely information for assisting in investment decisions

Monthly Q&A sessions with the team

Community access to a network of like-minded Bitcoin investors

Full access to our proprietary metric TBL Liquidity

Next Week with Nik

Economic data always lightens up towards the last week of the month, but we aren’t short on interest given the levels at which markets head into the weekend. Bitcoin rests slightly above descending trendlines in place for the past several months, making any pop in its price a potential trigger for big-time momentum.

Stocks are at all-time highs, as is gold, all while economic data suggests the Fed shouldn’t be in any rush. The goldilocks scenario for risk assets—supportive liquidity as the US stays deep in deficit, falling interest rates as the worst of inflation is conquered, and no big buyers cut off from liquidity, creating no shortage of asset buyers—marches on. We have our eyes on falling levels of the Fed’s reverse repo program and repo rates to indicate any need to abruptly stop QT, but those hiccups aren’t manifesting into anything troublesome either.

TBL readers, above all else, will be watching the bitcoin price. Flirting with these levels near $70,000-$75,000 for three years, bitcoin is preparing long-term holders for the elusive sixth digit. Sometimes, the only catalyst needed is price itself, so our eyes remain on one trendline.

On Tuesday, I’ll be joining Voltage for a webinar on Lightning Network:

The Lightning Network has seen phenomenal growth, expanding access by

550% from 94 million to 615 million accessible users worldwide. With this surge, global exchanges and neo-banks are now capable of saving over $2 million annually. Don’t miss the chance to learn how to harness this technology.

Join industry experts Bobby Shell and Nik Bhatia as they dive into the Lightning Network’s explosive growth and the unmatched benefits it offers. Discover how Lightning Payments technology powers faster, low-cost transactions while enhancing privacy and compliance—all while driving significant revenue.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.