Welcome to TBL Weekly #67—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good morning, TBL readers!

Bitcoin crested $30,000 for the first time since August off hopes of one or many spot bitcoin ETFs being approved by the SEC. The dynamic—buyers flooding into BTC to front-run potential institutional inflows—has been a hallmark of the endless will-they-won’t-they-when-will-they spot bitcoin ETF approval saga. Following Monday’s fake ETF approval news which saw bitcoin spike then lose its gains, it steadily climbed in the days following and has now regained those post-fake-news highs near the coveted $30,000 mark:

GBTC’s discount to its fund’s net asset value has also risen (less negative) all the way to -8.5% off of the renewed ETF optimism, as people rush to buy the discounted product before it converges with NAV upon ETF approval. Insiders always trade insider information: there’s a reason we’re seeing such extreme optimism for an SEC approval: one must be right around the corner. The market's optimism for bitcoin spot ETF approval from the SEC is rapidly rising, having risen all the way from a -50% discount to NAV late last year to almost in-line with NAV today:

We seem to have underestimated the magnitude of inflows waiting in the wings for a spot bitcoin ETF in our last post. Turns out that it’s there, clearly, as seen by how close GBTC is to convergence with NAV. We didn’t get a taste of it on the fake ETF news fakeout due to it only being ~15 minutes long, but rather we got a hint at the directionality—and boy oh boy, is it hopeful for bitcoin once a bull market is in full-swing and this spot ETF is a brand new onramp for those institutional ETF buyers clearly chomping at the bit for one-click exposure.

On the rates front, Joe Biden approved $106 billion in emergency funding for Israel, Ukraine, and the US-Mexico Border. That third item received the least amount of funding and was more of a footnote to placate those US citizens who are catching on to the fact that their tax dollars are being spent on everything else besides the very country to which they’re paying them.

As we mentioned on Tuesday, Janet Yellen and the powers that be are deadset on funding both of these proxy wars, regardless of whether the US has a direct interest in either of them. That means raising the UST debt issuance schedule. Which means yields get sent higher. And the $1.675-trillion hole across banks' balance sheets gets bigger.

This ramp-up in the already crammed borrowing schedule for the US Treasury is another upside impetus for rates, adding to the bond vigilantism sweeping the market of unfettered UST selling pushing yields ever higher:

Speaking of bond vigilantism, money is flying out of money market funds. There were $98.8 billion in outflows this week, the largest flight since 2020. The constant up-only inflows into the US Treasury bill-holding MMFs was due for a pullback at some point, but one this stark suggests perhaps capitulation in other areas that forced holders of MMFs to sell—either way something disruptive caused this flight. One suspicion based on other flow metrics and hints of capitulation in the major Treasury bond ETF, TLT, is that the money market fund outflow could be funding the locking in of 5% Treasury yields (sell MMF to buy Treasuries), but we aren’t exactly sure:

Stocks are responding to the high yields, so it seems, at last. They have stumbled considerably this week—in stark contrast to bitcoin which is rallying materailly on renewed ETF hopes. This is seemingly due to the selloff in rates finally hitting the credit market. Investment-grade corporate bond spreads have risen to their widest levels since June, as junk bond spreads are at their widest in a year. The S&P 500 puked heavily this week and closed below its 200-day moving average to finish the week—unless it finds support nearby, it’s look out down below:

As bonds signal distress and the S&P 500 is finally dealing with the pressure of higher rates thanks to worsening corporate credit, BTFP is not suggesting that banks are feeling the temperature rising at all. Outstanding emergency loans from the new Fed facility are flat at $108.8 billion:

This means that BTFP has worked as intended. The tail risk of a fire sale in the US Treasury market has been eliminated for now.

With banking stress abated, having been able to weather the storm of devaluation from interest rate hikes’ pushing UST yields up, did BTFP stave off the risk of deflationary impulse in asset markets? Probably not for the entire cycle, but there has to be a curve at the bottom of the sine wave that is global markets before a new cycle can begin. Otherwise stated, there is no discrete state change in cycles. At the very least, it delayed it.

The Fed has outlined four areas of risk in a recent financial stability report:

Asset valuations: Equity prices climbed faster than expected earnings. Residential and commercial property prices remained high.

Borrowing by businesses and households: The Fed said household debt was at “modest levels” relative to gross domestic product and concentrated among prime-rated borrowers.

Leverage in the financial sector: The banking system remained sound and resilient, with risk-based capital ratios staying close to average levels in the past decade. However, high interest rates were depressing the fair value of longer-maturity, fixed-rate assets. Also, leverage was still high at the largest hedge funds.

Funding risks: Most US banks had stable funding and high levels of liquid assets. But some of them faced funding pressures, “reflecting concerns over uninsured deposits and other factors.”

- Bloomberg

So will we even see an end-of-days-esque selloff in stocks and bitcoin before a new bull market? Or, is this the bear market we’re getting—a tepid and deflated selloff rather than annihilation, one enabled by a still-strong corporate landscape supporting financials, while the Fed props up banks to keep their earnings intact?

Perhaps this is a new paradigm, but we do not think so. We cautiously look to the Fed’s RRP rapidly having drained from $2.2 trillion to $1.2 trillion in mere months, and know that when it drains to $0, money to fill Janet Yellen’s wartime coffers will have to come from somewhere else, namely all other assets.

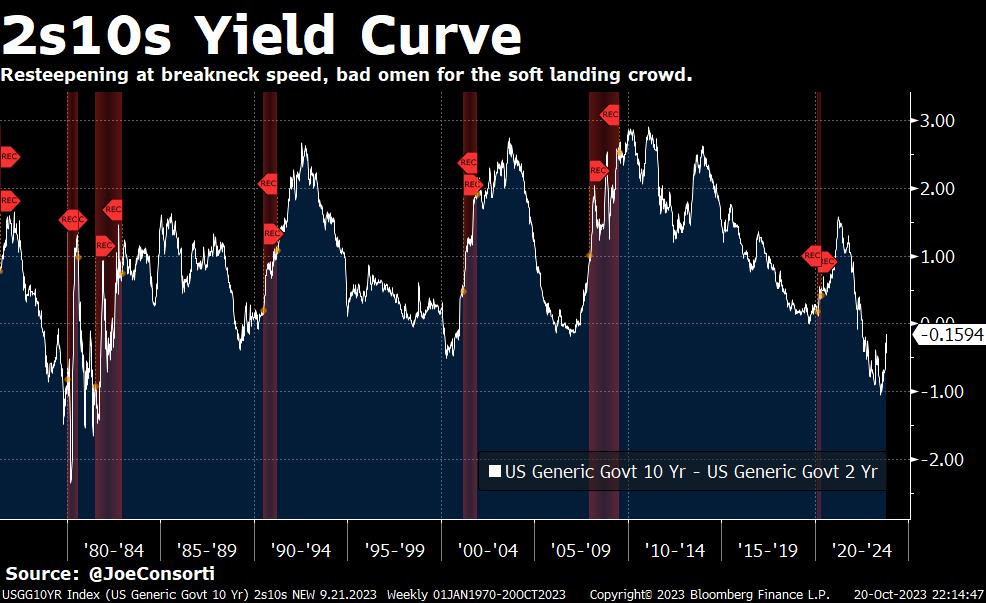

Cycles have to end; whether they go out with a bang or a whimper is the question. Judging by the state of the yield curve, the operative word is closer to bang. It is re-steepening frighteningly quickly right in time for Halloween, and do you know what comes every single time the yield curve normalizes?

Here’s a hint—those red, shaded areas rhyme with secession:

Next Week

In the week ahead, the US economy’s third quarter growth will come more clearly into picture. GDP is expected to top 4%, while some of the regional live GDP trackers are above 5%. If we are writing so much about recession, how is 4% GDP growth consistent with incoming economic doom times? It isn’t, which is why the stock market’s bearish action of late is something at which to dissect. The response of equities to Powell’s higher-for-longer mantra tattooed into our brains is expected—higher rates make corporate finance generally more difficult, and seeing GDP prints above 4% are almost guaranteed to keep Powell reciting his mantra. It is for this reason that we aren’t necessarily watching the home sales data or even business sentiment—until GDP falls and unemployment spikes, the current dynamic remains.

While Personal Income and Personal Spending on Friday highlight the week in economic data after that 4%+ GDP release due on Thursday, the coming week is another during which we will much more closely pay attention to financial markets. Equities are cracking (small caps are now down over 4% YTD even though the S&P 500 is still up 10%), the Treasury curve is uninverting causing severe losses for duration holders, and risk sentiment is turning bearish. We will also be watching the reaction function of Treasuries to lower stocks—even though higher yields have caused falling stocks, falling stocks caused falling yields on Friday. And don’t forget our suspicion that this prior week might have seen capitulation by Treasury holders. Sorry economy, we are focused on markets:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Nik answers the question everybody is wondering: is 2024 going to bring a recession along with it? He goes through economic data on the consumer, housing, business sentiment, and manufacturing and determine that the economy is showing many signs of recession despite some bright spots. Nik also shows us the massive inflow into cash instruments which generally indicates investor fear.

Check out—Recession In 2024? Most Likely.

Tuesday

Monday morning, bitcoin proponents collectively gasped as news broke that iShares/Blackrock’s spot bitcoin ETF application had been approved by the SEC. This turned out to be a false alarm, as we’d speculated during the fleeting moments of uncertainty, considering that Bloomberg had not reported on the matter, and the SEC had not issued a press release.

Check out—The Fake Bitcoin ETF News Was A Fire Drill

Wednesday

In this episode, Nik is joined by Sam Wouters, Research Analyst at River. Nik asks Sam about his latest report detailing the exponential growth in Lightning Network (LN) adoption over the past two years. Sam explains that LN is here to stay, how it expands the capabilities of bitcoin, and why bitcoin and LN complement each other. Watch to learn more about the game-changing nature of Lightning Network for global bitcoin adoption.

Check out—Bitcoin's Lightning Network Is EXPLODING

Friday

In this episode, Nik is joined by United States Senator Cynthia Lummis to discuss Bitcoin and digital asset regulation. Senator Lummis explains why she believes Bitcoin is a commodity, but more importantly, why there is so much momentum throughout the government on understanding Bitcoin's correct classification. We also learn about the latest legislative efforts across stablecoins, illicit financing, and whether Bitcoin will be included within agricultural commodity regulation.

Check out—Senator Lummis: Bitcoin Is A COMMODITY

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.

Thanks, Joe. To finish off on this thought, are you saying that banks drawing from the RRP need the cash to shore up their solvency and is therefore a signal banks are less likely to buy the newly issued Treasuries that Yellen is hawking?

Basic question here. How does the continued reduction of available cash in the Fed’s RRP make it more difficult for Yellen’s Treasury to continue spending?

I tried to ChatGPT my way to answer and got spun in circles. 😔