As we turn the corner on three years as a publication, a lot has changed for TBL. The company has come a long way since I used to write an opinion piece only once a week. Now, we publish four times per week, disseminate several videos, host interactive Q&A sessions, and boast a motivated and razor sharp team of six people.

One of those team members, Joe Consorti, has agreed to create content exclusively for his new company. We couldn’t be happier for his career ascent, and we’ll miss his writing and video contributions to The Bitcoin Layer. Thankfully, Joe isn’t going anywhere and has agreed to continue building this research firm from behind the scenes.

That also means a little shakeup in the Weekly that you all know and love—our goal is to continue providing you extremely high-signal bitcoin and global macro analysis for free every Saturday morning, but it’ll have a slightly different feel. Welcome to TBL Weekly #109 — grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

What just happened to bitcoin and stocks?

Friday was quite the red-candle day across the outer end of the risk spectrum. Bitcoin is now testing the lows and must hold support around $51,400 or experience another air pocket lower.

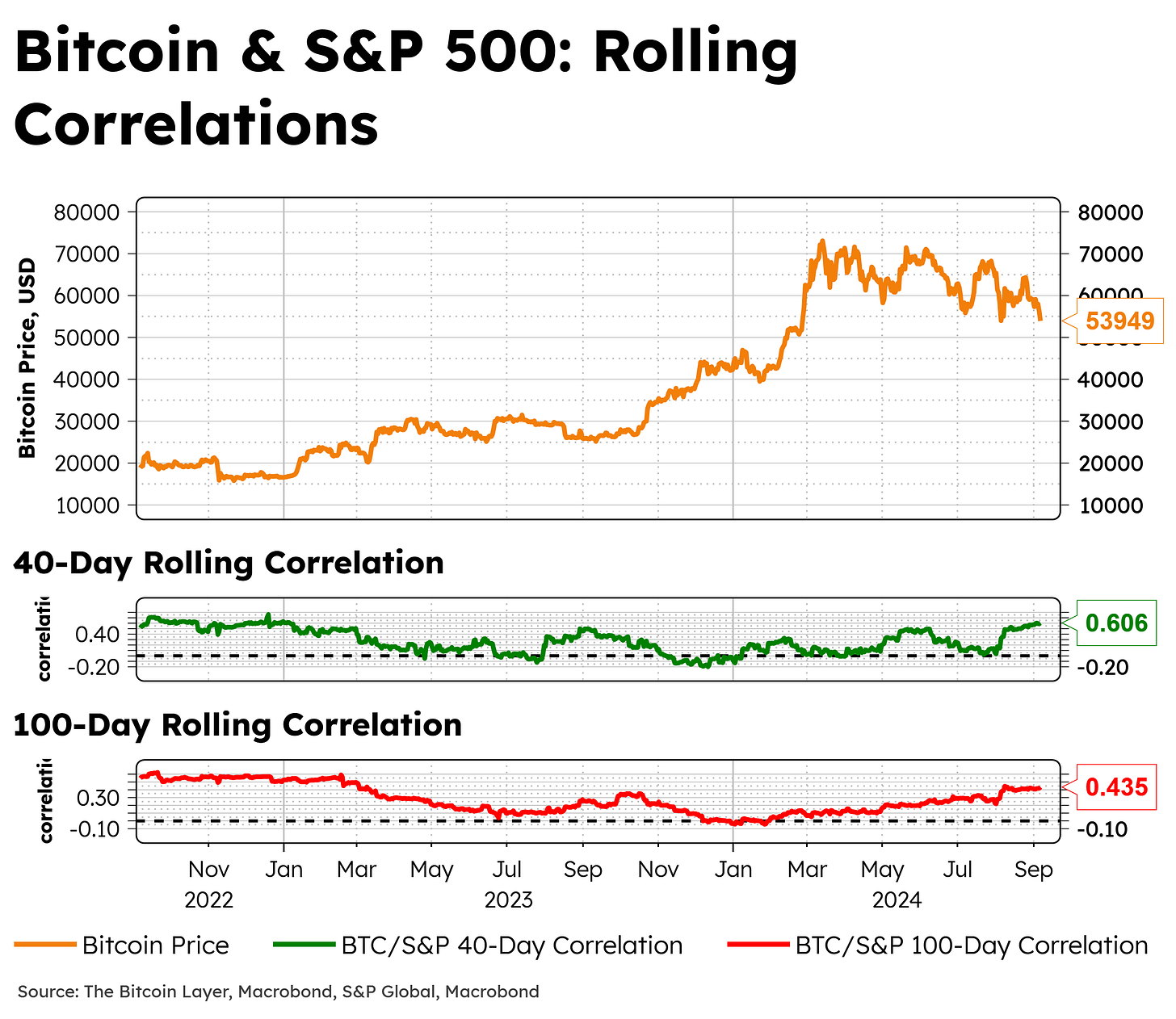

It doesn’t happen in isolation. Bitcoin is often completely controlled by global macro flows. While its own fundamentals give bitcoin its own unique return profile, directionally it trades with stocks, especially when correlations rise.

We observe that short-term and longer-term correlations are not only high but have been rising of late, indicating that the overall “flow” of the market is in charge of bitcoin, rather than any individual story or fundamental.

Stocks are under immense scrutiny as the Fed gets started on rate cuts in less than two weeks. Baby rate cuts aren’t going to solve the problem that 5.5% policy rates pose to the economy. Only mega cuts will begin to address the slowdown to come. Yes, today’s economy is avoiding a recession, but the threat of an intense one grows with every basis point we move lower in the long end of the Treasury yield curve.

The headlines will read “worst week for stocks in a year or two,” but we go deep into the details, dangers, Fed reaction, and unknown timing of it all. For a full breakdown, don’t miss our global macro update from yesterday, complete with seven themes and tons of audience questions submitted by yourselves via social media Friday morning. Thank you for helping guide my analysis. These Friday updates have become the flagship videos of our growing channel and represent my best effort to summarize the week.

And if you don’t have the 50 minutes to spare, here are some of the key insights covered in the video:

Bitcoin’s critical support: Bitcoin’s price behavior at $51,400 will be crucial; failure to hold this level could lead to deeper losses, with potential dips into the low $40,000s. This volatility reflects broader market sentiment and risk appetite.

Impact of yen carry trade: The unwinding of the Japanese yen carry trade threatens liquidity in global markets, as investors close positions in risk assets, leading to a broader market sell-off.

US dollar dynamics: A strong dollar complicates conditions for global financial markets, as it can lead to tighter financial conditions, impacting both stocks and bitcoin.

Declining Treasury yields: Falling yields indicate a market preparing for potential cuts; however, low rates may not be sufficient to offset economic weakness and rising recession fears.

Labor market weakness: The labor market is showing signs of slowing, with job openings decreasing, suggesting that the broader economy may be heading toward recession.

Stock market sentiment: The stock market’s recent performance suggests a topping pattern, indicating potential instability and increased investor fear, which may also negatively affect bitcoin.

Recession fears and bitcoin: As recession fears rise, many wonder how bitcoin will respond; historical patterns suggest that severe market downturns can lead to rapid recovery once liquidity is injected by the Fed.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your bitcoin and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

In case you missed it

We kicked off the week with Nik’s interview with mining queen Amanda Fabiano who walked us through her foundational work at Fidelity and how the mining industry is shifting as miners seek geopolitical stability and lower energy costs. Amanda also talked about the importance of collaboration and education in bridging the gap between miners and policymakers, and trends to help miners secure capital. Of course, we asked her about how she helped orange pill President Donald Trump. Her answer is important in terms of how the industry is approaching November.

Check out— Bitcoin’s Mining Queen Amanda Fabiano

If you don’t have the 36 minutes to spare, here are some of the key insights covered in the video:

Legacy of leadership: Amanda Fabiano’s title as “Mining Queen” reflects her significant contributions to bitcoin mining’s early development, particularly at Fidelity, which legitimized bitcoin in institutional finance.

Fidelity’s influence: Fidelity’s proactive approach to Bitcoin education and mining set a precedent for institutional involvement in the sector, highlighting how major financial institutions can drive the adoption and understanding of new technologies.

Geopolitical considerations: As miners seek optimal locations for operations, the geopolitical landscape significantly influences decisions, emphasizing the need for miners to stay informed about local regulations and energy costs.

Financial resilience: The mining sector’s recent bankruptcies serve as a cautionary tale about the dangers of excessive debt.

Emerging financial products: The introduction of innovative financial products, like hash rate hedging, signifies a maturation of the mining industry, allowing miners to better manage risks and optimize their operations.

Education and collaboration: Bridging the gap between miners and policymakers is essential for fostering a supportive regulatory environment. Education plays a key role in dispelling misconceptions about mining and its benefits.

Advisory opportunities: Amanda’s new consulting role allows her to leverage her expertise to help clients navigate the complexities of the mining landscape, illustrating the demand for specialized knowledge in this evolving industry.

Next, Nik interviewed housing market expert Melody Wright to discuss the current state of the housing market, specifically in Texas, Florida, and California. Melody explained how a decline in available inventory may be misleading, as many new builds remain unlisted, creating an illusion of scarcity. We also covered how high delinquency rates highlight a potential crisis brewing, and how a decline in foreign investment, particularly in California, puts additional pressure on home prices.

Check out—Housing Market Crisis is Developing with Melody Wright

If you don’t have the 34 minutes to spare, here are some of the key insights covered in the video:

Impact of inventory trends: Shadow inventory is everywhere. Melody gets into the number of new build projects that hide from inventory statistics but could drag down all prices.

Economic interventions: Government interventions can slow down price declines temporarily, but sustained economic pressure will ultimately lead to significant market corrections.

Focus on delinquencies: High delinquency rates highlight a potential crisis brewing; these delinquencies suggest that many homeowners may struggle as economic conditions worsen.

Foreign investment decline: The drop in foreign buyers, particularly in California, has put additional pressure on home prices, indicating a shift in market dynamics. This was a fascinating corner of the housing market to learn about.

Loan modification risks: While loan modifications may prevent immediate foreclosures, they can lead to longer-term problems for borrowers, especially if home values decline further.

Construction employment vulnerability: A slowdown in the housing market will not only impact home buyers but also significantly affect jobs in construction and related services, amplifying the economic downturn.

Long-term market outlook: The housing market faces a long-term decline, with a focus on 2025 as a crucial year for potential double-digit price drops across various regions.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Every week, we bring you our global events recap TBL Thinks. In our latest edition, we covered how smaller sized startups are changing the US economy with an increase in small businesses but a decrease in the number of people they employ. We also discuss increased scrutiny of AI companies and explained the Japanese yen carry trade and its potential to dictate risk direction.

For those that aren’t familiar with carry trade, here’s an excerpt from our letter to explain its basic mechanics:

As the yen strengthens (it did after Japanese rate hikes attracted currency flows), yen borrowings must be paid back in depreciating currency (a declining USD), triggering the closure of long risk trades funded by cheaply borrowing JPY. If the roll of the carry trade becomes too expensive (a higher interest rate this time versus last), risk is sold and the yen is purchased to repay JPY loans.

Next Week with Nik

In the week ahead, markets only need to contend with one major economic input with CPI on Wednesday, but we believe the markets are essentially “over it” in terms of the inflation story. The labor market is now the only concern of the Fed, and investors will wait to see how dovish the Fed will be on September 18th when rates are cut and QT is potentially nixed altogether.

Treasury will auction 10- and 30-year securities, but don’t be fooled by charlatans nitpicking weak internals—Treasury yields that have been falling for months are the only signal you need on the appetite for these instruments. While nobody has ever looked at the US fiscal situation of late and tripped over their shoelaces to get a chance at the primary market, investors are clearly fighting with each other over their Treasury allocations nonetheless. Buyers of supposedly weak auctions over the past few months are laughing all the way to the bank, but more importantly at their fixed-income manager competitors that told clients rates would remain elevated amidst sticky inflation. Lower yields simply express the market sentiment over the time value of money—4% is a gift for 5-year Treasuries when rolling T-bills will only yield 2% by the end of next year (well within our range of expected outcomes).

It does look like the Fed will begin with a 25 basis point rate cut so as to not spook the market that it is intensely worried. Only modestly. And in that debate between 25 or 50 basis point cuts, we are reminded of the stupidity in trying to forecast the Fed’s next move. The better strategy is to interpret the data so that you can see the next several months of action way before the Fed even knows it. We don’t have some crystal ball, just the Treasury market, some candlesticks, and a more-than-intermediate understanding of our layered money system.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Hey Nik, and team, if you had to put odds to the Fed dropping QT where would you put them? Thanks so much, Jeff