Bitcoin's first major recession: Part One

A recession is coming. At 13-years old and a $0.5 trillion market value, how will the orange coin fare?

Dear readers,

Demand destruction is imminent. I mean real demand destruction.

Not some March 2020-esque selloff, followed by an immediate Fed-awarded rescue parachute to markets—we’re approaching an unfettered inflationary recession, and the Fed is fighting it with deflationary pressure. Nobody is coming to save the markets.

With Q2 GDP expected by some to be negative, the US could plunge into a technical recession. Bitcoin was birthed out of a financial crisis—now that it’s a teenager, it’s time it comes face-to-face with its first major recession.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud.

Today’s topics

Recession-leading indicators are screaming bloody murder.

Tightening financial conditions are making matters worse.

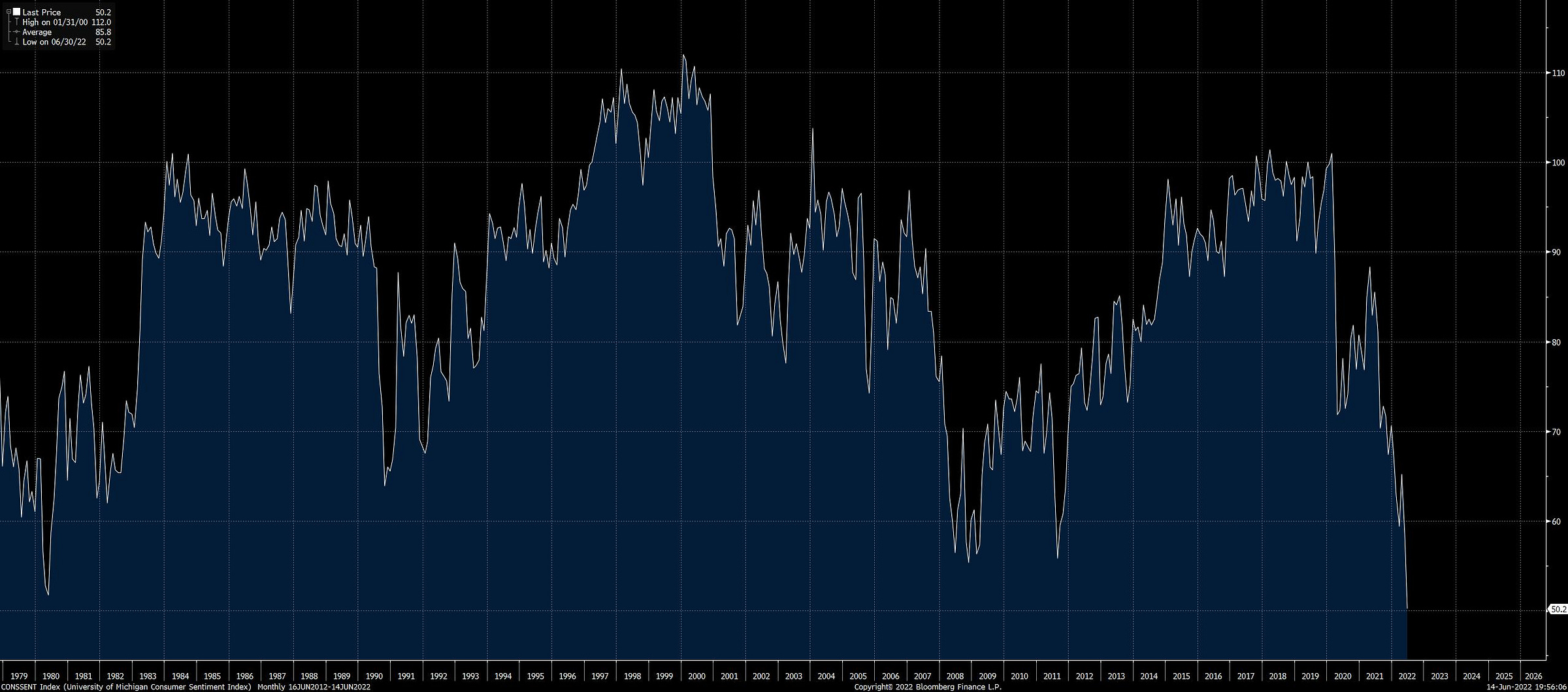

Consumer sentiment is the worst it has ever been.

Alarm bells are sounding

While a recession is technically defined as two consecutive quarters of negative GDP, there are clear signs of a looming economic downturn.

Let's take a look at economic indicators to paint the picture. The Fed needs to fight inflation through tightening-induced demand destruction, but gas prices busting through all-time highs is destroying demand on its own. A $5 national average gas price is a tax hike on the consumer and will broadly slow demand elsewhere in the economy, which will certainly help the Fed with its mission of slowing inflation:

Rates for 30-year fixed-rate mortgages have rocketed past late-stage Great Financial Crisis levels. Housing has to slow down. We aren’t predicting a nationwide decline in housing prices, but the rate of activity is sure to meaningfully decline:

Homeowners have poured into new mortgages or refinanced at very low rates since the pandemic, causing home prices to soar. Now, mortgage rates are rising alongside Treasury yields, crushing affordability which is showing up in other housing metrics: the Pending Home Sales Index has been declining month-over-month since October 2021 and has plummeted by 9.1% year-over-year. Prohibitively high home prices and mortgage rates have exhausted buyers.

Now to the Fed’s grand bargain around unemployment:

The economy appears working at or above full employment—not a lot of spare capacity. The unemployment rate is 3.6%, hovering in the range of pre-pandemic levels. You'll notice that the US has reached this area for the fourth time in the past 25 years, indicating that full employment is close or has already arrived.

As of Wednesday’s FOMC meeting, the Fed said that the committee is strongly committed to returning inflation to its 2% objective. It’s a gargantuan task to normalize inflation to levels 6% lower than where it is today, and a hard bargain to try and cap unemployment at 4% when it’s already 3.6%. We believe threading this needle will be extremely challenging for the Fed.

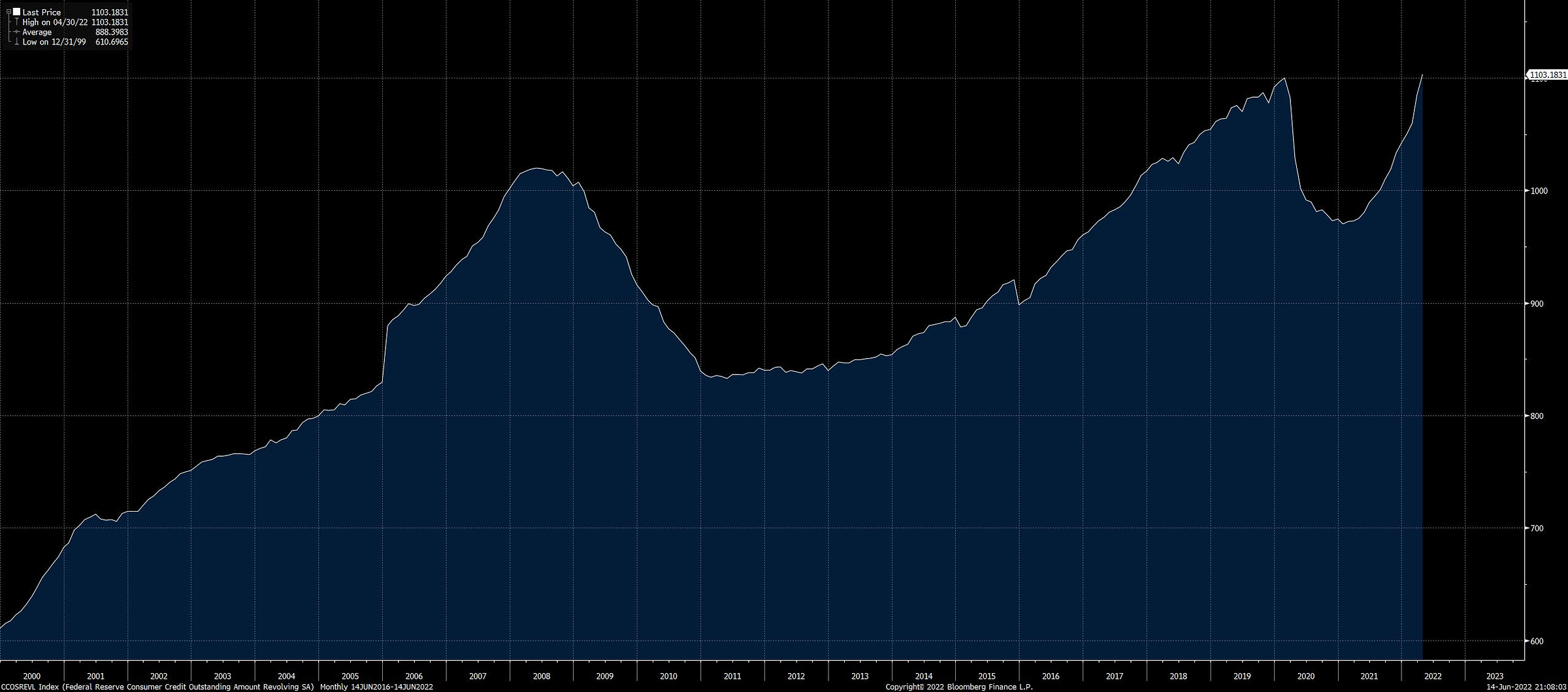

Consumer credit usually explodes higher just before a major bust. Of recent, consumers appear to be borrowing all that they can before a recession begins. Just look at the peaks of 2008 and 2020:

The dollar has just strengthened past 2016 highs. A strong dollar increases the servicing burden on dollar-denominated debt—bad for sovereigns and corporates abroad. Here’s the emerging market sovereign debt picture:

Sovereign debt has declined significantly in value this year, which means precipitously higher borrowing costs for already fragile economies. Insolvencies are potentially on the horizon, and credit risk can become systemic: when one country defaults, another three will default because they were lending to the first.

Speaking of corporates, US corporate credit spreads—the premium paid by corporate borrowers relative to Treasury yields—are widening as buyers of credit shy away, another tightening financial condition.

We’ll be watching how quickly rising servicing costs for corporates leads to a deflationary deleveraging—just what the Fed ordered.

Demand destruction is imminent—the consumer is feeling the heat. Look at the University of Michigan Consumer Sentiment at 40-year lows and in freefall:

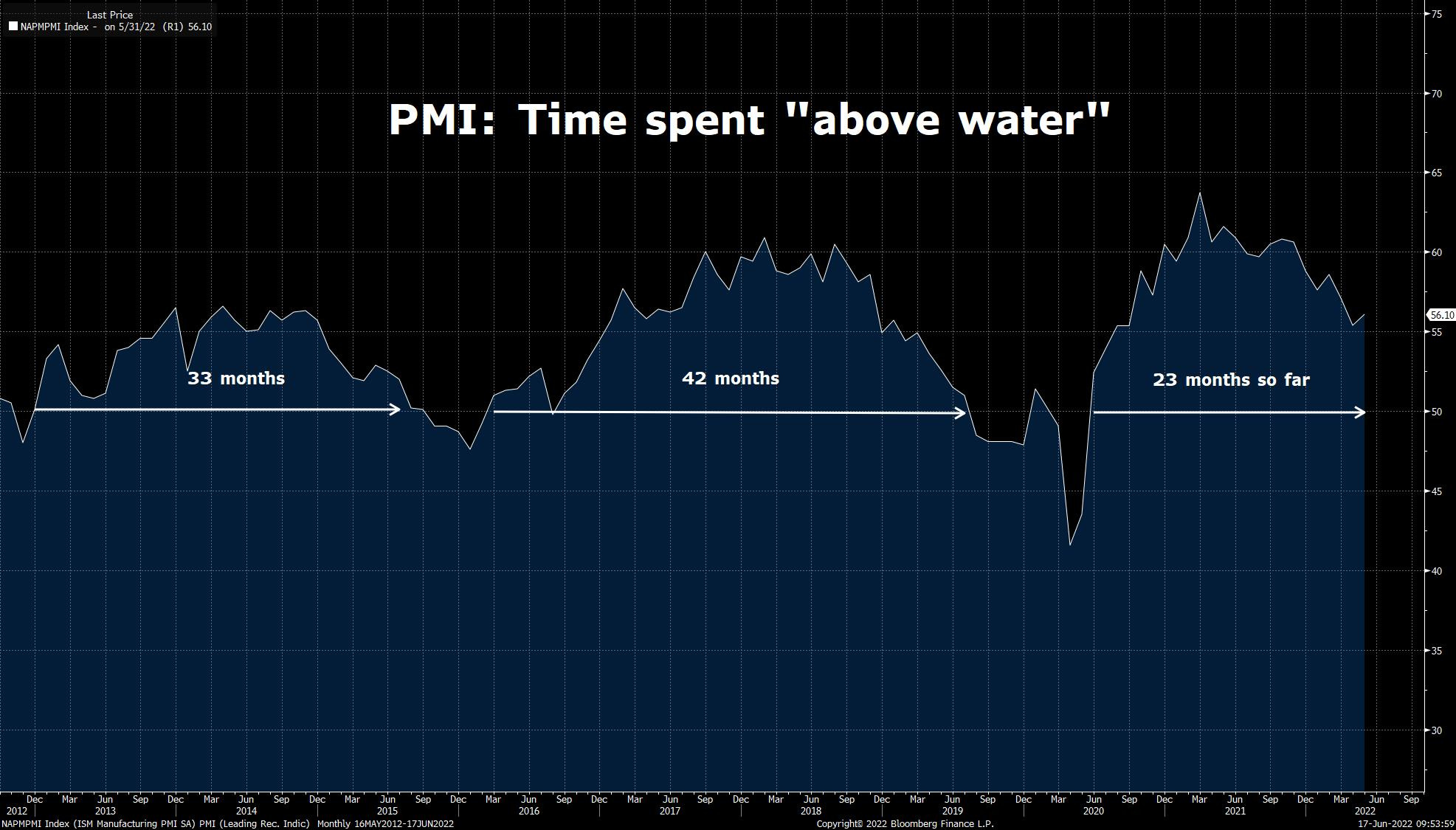

And last but certainly not least, the ISM Manufacturing Purchasing Managers Index is trending towards 50 but remains above water. A drop below 50 will signal a true recession here in the US, not just a 2-quarter-negative-GDP technical one:

There’s a very strong possibility that recession is on the horizon or has already begun. The business cycle is the primary driver of investment returns, so understanding where we are in the cycle is crucial. How deep will this recession be, and how long will it last? Harder to know the severity than to predict a contraction, but answering these questions will help when trying to decide at what point investors should resume risk-taking behavior.

In tomorrow’s “Bitcoin's first major recession: Part Two,” we’ll explore the effects of a contractionary economic climate on bitcoin. How will bitcoin trade during the recession, and more importantly, how will it emerge in the eyes of the world: a speculative risk-on asset or the idealized risk-off savings technology? Come back tomorrow for another free post to find out!

Until next time,

Nik & Joe

This post was sponsored by Voltage, provider of enterprise-grade Bitcoin infrastructure.