Bitcoin's first major recession: Part Two

A recession is coming. How will bitcoin come out the other end?

Dear readers,

This is Part Two of our newsletter exploring how bitcoin will fare in the upcoming recession. Make sure you read Part One first:

In today’s issue, we look at the direct impact that a prolonged recession may have on bitcoin, monetarily and in the eyes of the beholder. Buckle up.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud.

Today’s topics

The Fed is vanquishing potentially sticky inflation, taking risk assets with it.

We believe there is more than meets the eye to bitcoin’s correlation with risk assets—a source of informational asymmetry.

Protracted periods exist in which bitcoin separates itself from every other asset.

Bloodletting risk to kill inflation

George Washington’s physicians removed over 40% of his blood in 12 hours to bring down the inflammation in his windpipe. They succeeded—by killing the President.

Risk assets respond negatively to contractionary monetary policy. We’ve been in a face-melting two-year bull run in equities, as credit has been created at near-zero cost. Since the Fed’s announcement that it would be hiking Fed Funds at least 50 basis points per meeting starting in March, the music has come to a screeching halt, sending risk assets spiraling.

Hiking Fed Funds eventually translates into higher borrowing costs for corporates. In turn, fewer projects are pursued, valuations tank, and heavily debt-financed companies in sectors like tech feel the most pain. The Nasdaq is down more than 33% from its December highs.

The Fed is sprinting to fight inflation. As a function of its tardiness, the Fed is willing to tighten credit as quickly as possible, not caring about slaughtering risk assets in the process. In fact, Fed officials seem to be fine with the pace of the decline given their silence on the matter of late.

The Fed’s dual mandate is to maintain full employment and stable prices. It has clearly botched the latter, and it’ll impact the former to correct it.

Volatility in equities has impacted bitcoin in an outsized way, due to bitcoin’s smaller market capitalization and high correlation to risk. As liquidity deteriorates throughout the economy, bitcoin will continue to serve as a leading indicator for overall market health.

Bitcoin trades with risk, for now

This is the truth, as much as we hate to admit it.

Bitcoin has had a 90% positive correlation to the Nasdaq since January 1st, 2017. Institutional allocators that have driven this correlation with their algorithms have traded it as a speculative risk asset.

During the current deleveraging across all financial assets, bitcoin has fallen harder and faster than its traditional finance compatriots. Why? Bitcoin has very low liquidity (~$0.5 trillion in total market cap) relative to other asset classes (over ~$100 trillion in total global equities), often extremely high leverage, and no bailout lender of last resort.

Bitcoin’s liquidity dynamic: Low liquidity + excessive leverage = high-intensity wipeout in a market-wide liquidity destruction event.

Bitcoin has had roughly $1 billion of aggregate futures liquidations in the past three days, as well as a 45% reduction in open interest since April. It seems that bitcoin’s 50% decline in just 43 days has wiped out a substantial amount of leverage in the system. There are still a few unknowns (namely Three Arrows Capital's potential insolvency), but with most of the bad debt cleansed from bitcoin, is the marginal seller getting exhausted?

The aforementioned liquidity dynamic of bitcoin means that it moves before equities, so maximum pain would happen right before or at the beginning of a recession. This is not to claim we are near the absolute bottom—bitcoin dipped below its previous halving-cycle high for the first time ever overnight, making investors cringe with nerves.

An overdue paradigm shift

A key dynamic to observe in this cycle is whether or not the market begins treating bitcoin as a safe-haven asset. The market hasn’t awarded anything as a risk-off asset this year other than the dollar versus other traditional currencies (dollar at decade+ highs)—Treasuries have seen miserable returns, gold has struggled, and bitcoin is in a deep bear market. We might believe in the narrative of bitcoin as a risk-off asset, but the market certainly doesn’t.

Regarding bitcoin’s high correlation with risk assets, we have a twist in the narrative: positive correlation doesn’t necessarily matter because short periods of intense decoupling and true negative correlation with stocks happen during bitcoin’s otherworldly parabolic advances. Look at these three-month moves in bitcoin in which it at least doubled—correlation declines to negative territory as stocks move marginally and bitcoin does its best rocket ship impression:

During bitcoin’s many parabolic advances, this strong correlation to equities is temporarily dissolved, and bitcoin experiences tremendously outsized returns. While strong correlation may be there 90% of the time, all you need is one of these major legs-up per year to achieve bitcoin’s astronomical compound growth profile. Despite prolonged regimes of strong correlation with equities, the protracted periods of extreme appreciation separate bitcoin from every other asset in history.

Bitcoin’s decreasing inflation rate and increasing adoption dynamics could widen the decoupling between bitcoin and equities, and we’re already seeing that decoupling play out before our very eyes. It’s hard to see with the naked eye, but the statistics paint a picture:

The correlation between bitcoin and Nasdaq is waning over time—a trend that has accelerated over the last year, just as we’re experiencing worsening market conditions. Could this be indicating a gradual paradigm shift for bitcoin, from a speculative risk asset to a risk-off asset in the eyes of the majority? Risk-off has always been the hope but rarely the reality. So far, correlation has been inescapable for bitcoin. But the hidden protracted breaks in correlation are, we believe, a significant informational asymmetry.

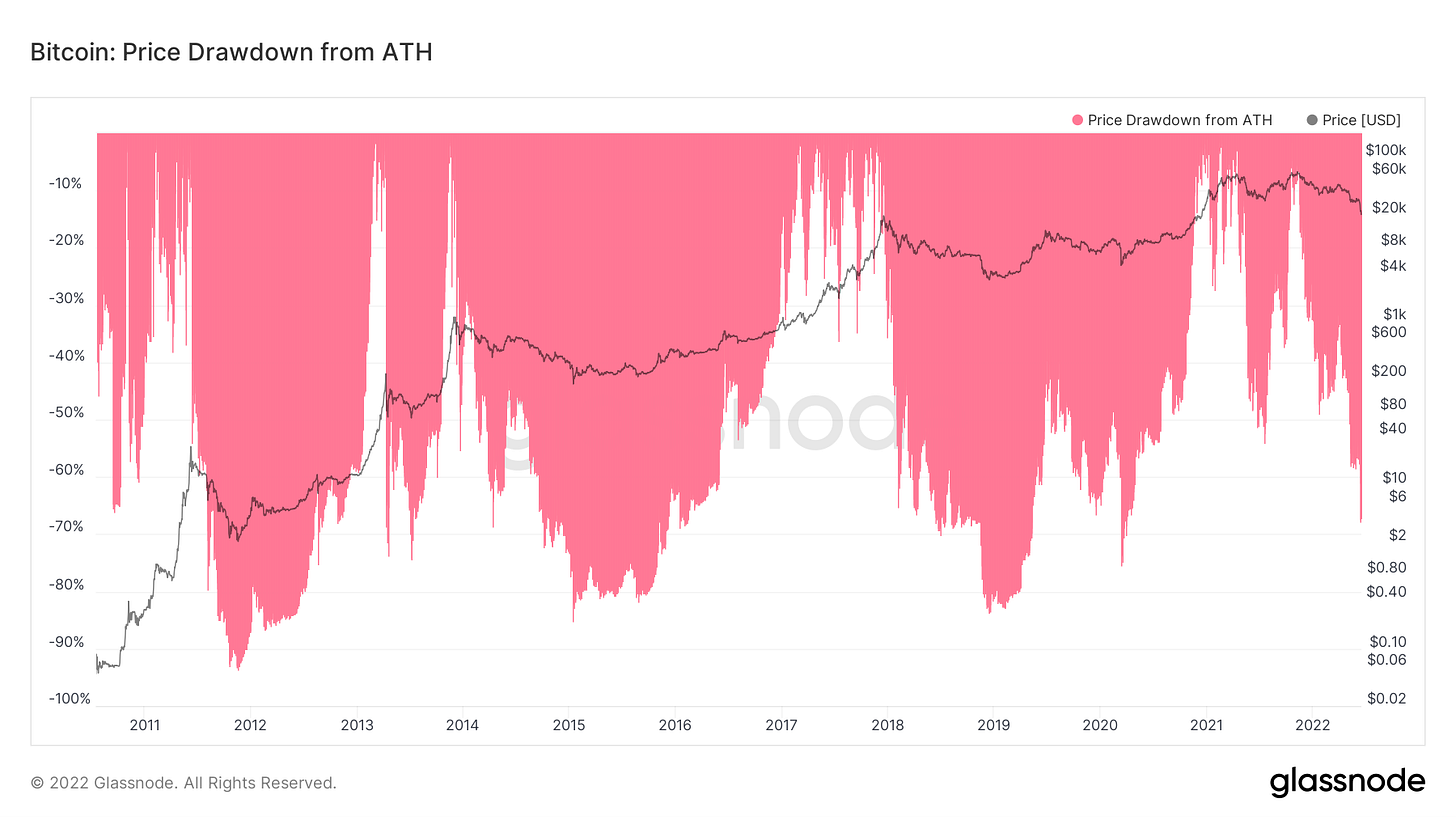

Past drawdowns in bitcoin

Bitcoin has faced 12 drawdowns of this same magnitude in its history, and yet it’s still here:

Bitcoin may not be behaving as a safe-haven asset, but our strongest conviction is that bitcoin is a safe haven from central bank cronyism, authoritarian transaction controls, and currency debasement. It is rarely discounted relative to our Fair Valuation Framework, and continued legacy market liquidity contagion could send it even lower.

Keep your arms and legs inside the vehicle, folks.

Until next time,

The Bitcoin Layer

This post was sponsored by Voltage, provider of enterprise-grade Bitcoin infrastructure.