Bitcoin's first major recession: Part Three

The recession is here. How will bitcoin fare?

Dear readers,

Last June here at TBL, we wrote two pieces forecasting the recession we now find ourselves in, and how bitcoin, an asset only just now entering its teenage years, would behave during its first prolonged recession.

Now that the recession is here, let’s renew our analysis to see how bitcoin will fare over the coming months as the Fed pause, contraction, and follow-up easing unfolds.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Today’s topics

Bitcoin is slated to outperform all major equity indices during the Fed pause rally.

When credit stress and economic deterioration finally give way to rate cuts from the Fed, that’s when bitcoin will take a tumble.

The next economic upturn could align with Bitcoin’s supply schedule reduction next April.

Phase 1: Fed Pause Rally

The Fed pause rally is a term we’ve identified to describe how equities and other risk assets like bitcoin respond to the Fed pausing its rate hiking cycle at its peak, known as the terminal rate.

While an elevated policy rate is not accommodative of companies or equity pricing, the shift from rate increases to no more rate increases is enough for the market to start moving out on the risk curve and start bidding equities again, sparking a rally.

Here is the performance of risk assets (S&P 500) starting from the first day that the Fed pauses its rate hikes, until the end of the pause:

The Fed pause rally is well underway across risk assets, especially in the highly market-sensitive BTC, which has liquidated $97.3 million worth of short futures positions in the last 24 hours as it reaches the $30,000 level for the first time since last June when we wrote the first two parts of this post:

This transitory rally has gone on for over a year in past cycles—but we think it'll be shorter this time around. This cycle began with aggressive tightening, and after a several-month lag, it is manifesting in the form of an equally aggressive and sudden credit contraction.

Bitcoin has heightened sensitivity to market movements, or high beta, due to its low liquidity profile and excessive leverage in futures, swaps, and options compared to other assets. When market participants bid risk, the minuscule $500 billion bitcoin appreciates far more on a relative basis than the gargantuan $34 trillion S&P 500. During risk-on periods, bitcoin temporarily decouples with equities to the upside and goes on an outsized rally—take a look at the waning correlation during the last time the Fed was on-hold and in the current Fed pause rally:

Whether or not the Fed hikes once more for the road is immaterial because the risk-taking that’s characteristic of the Fed pause is here. Listen to Confucius:

We’re in the middle of the Fed pause rally now—what comes next?

Phase 2: Credit Crunch Hits The Economy

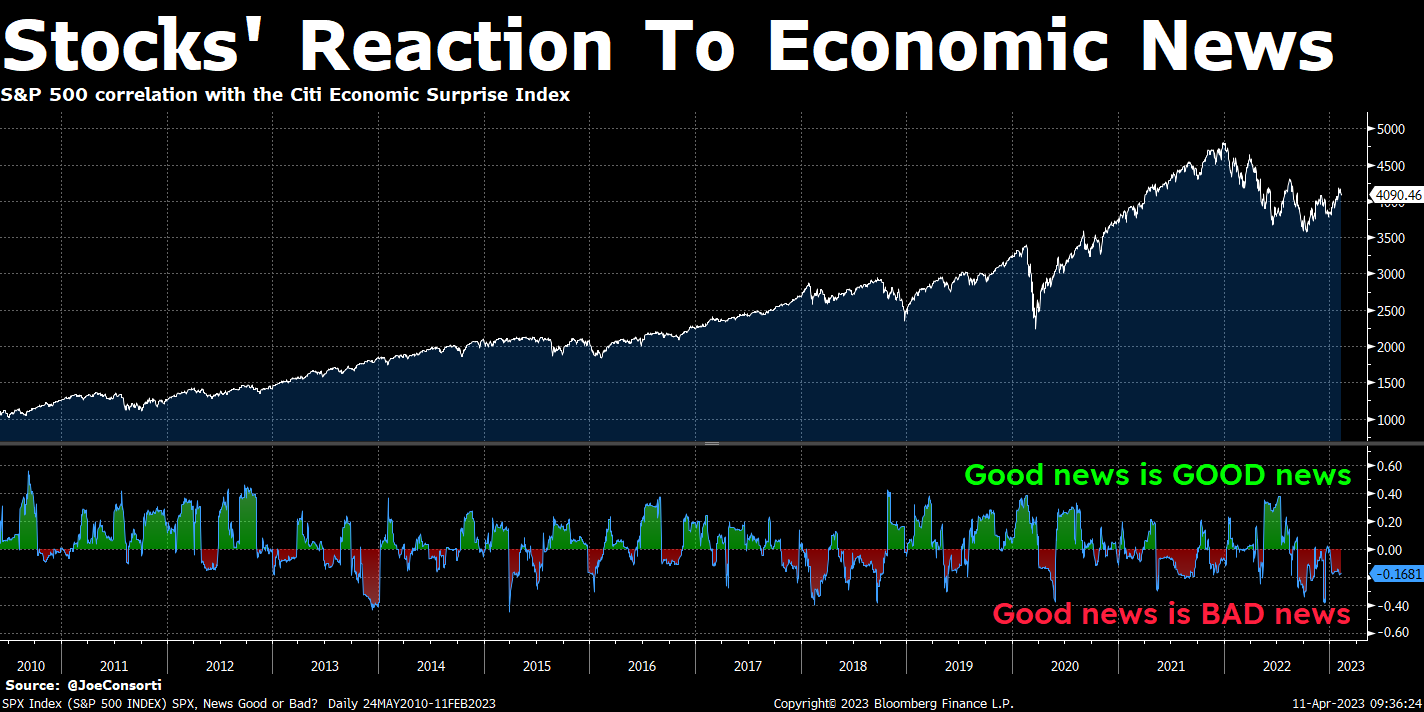

During the Fed pause rally, bad news is good news for risk assets. As economic data deteriorates, equities are bid up on the assumption that the Fed's reaction function will be easy policy. This is shown with the negative correlation between the Citi Economic Surprise Index and the S&P 500:

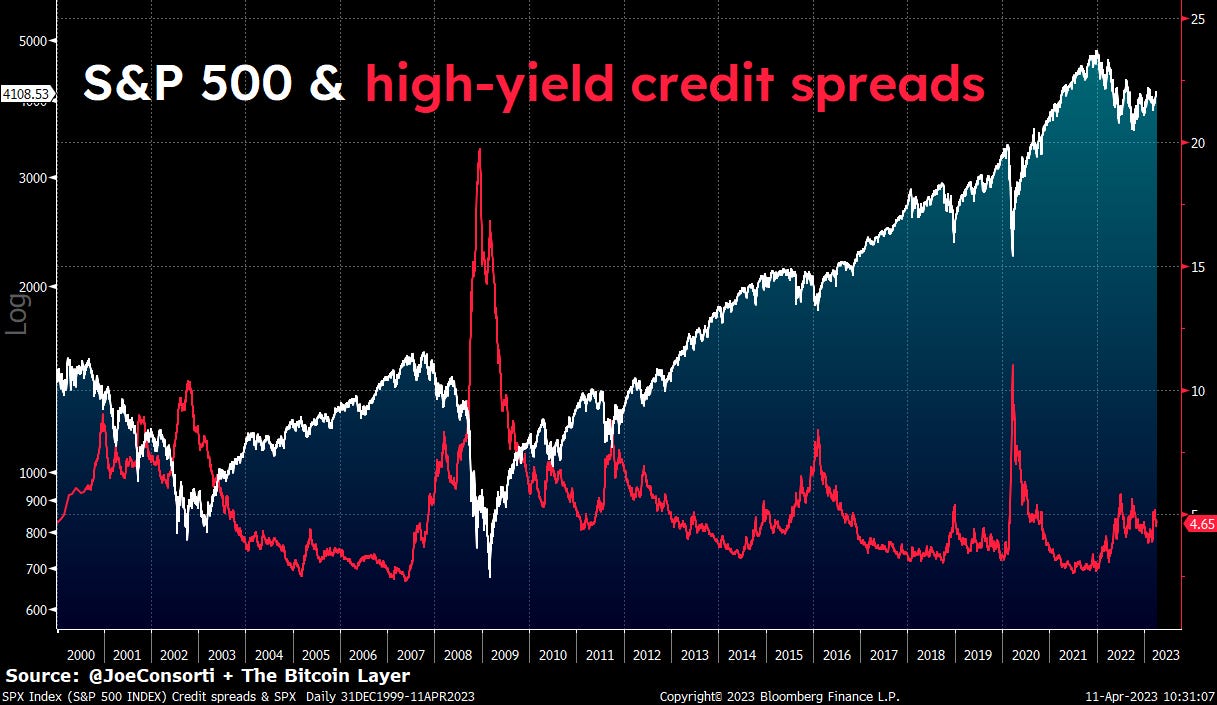

As the months go by and credit stress starts to hit the real economy and labor market, bad news will eventually be bad news again. When credit stress explodes higher, risk-taking evaporates from the market and risk assets fall rapidly. Take a look at the S&P 500 each time high-yield credit spreads have blown out—a rapid selloff occurs:

How bitcoin will behave during this deflationary bust will be determined by how much of the current market structure is driven by leverage or buy spot buying—the levered aspects of bitcoin found in futures or options have a much higher sensitivity to rising credit stress, while a market structured around buying spot bitcoin without the use of leverage is directly unaffected by it. Thankfully, the current bitcoin market structure is largely driven by spot buying, lowering the overall volatility and arguably making it more resilient by the time the big kahuna selloff occurs.

Shortly after credit stress hits levels that threaten to unwind the labor market and cause economic devastation, the Fed cuts its policy interest rates.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

Phase 3: Rate Cuts

It is widely believed that when the Fed cuts rates, risk assets enter a bull market. Allow us to dispel that notion for you.

Risk assets do not rally when the Fed cuts rates, they puke. The Fed cuts rates in response to a credit event, dysfunction in financial plumbing like money markets or interbank lending, economic or labor market deterioration, or a toxic combination of all three. None of these are bullish!

Here is the performance of risk assets (S&P 500) starting from the first day of Fed rate cuts, to when the Fed reaches its cutting target and stops:

Here is a chart highlighting the Fed pause rallies in green and the Fed cut busts in red:

Bitcoin’s low liquidity profile and excessive leverage make it more sensitive to the booms and busts of market cycles—when the bust that comes in the wake of a sullen economy and Fed rate cuts comes around, all bets are off. This will play less of a factor as bitcoin beefs up its liquidity profile over time, surpassing gold at $10 trillion and the market cap of all US equities at $40 trillion will make it more resilient to market cycles, but that is several years if not decades away. For now, we’ve got to take the good with the bad, embracing bitcoin’s eyewatering outperformance during risk-on phases, with its larger selloff during risk-off phases.

When the bust across risk assets comes, what are the levels bitcoin could test? Bitcoin's price falls by a lower percentage after each new all-time high. Its peak-to-trough drawdown from the 2012 all-time high was -93%, in 2015 only drew down -85%, then -83% in 2019, and -76% in 2022. As bitcoin matures in the eyes of the investing public, people are buying cycle bottoms sooner, meaning that the level at which BTC is considered 'inexpensive' is only rising.

When the March 2020 bust across all asset markets happened, bitcoin only fell ~75% from its all-time high, keeping this trendline intact:

Another metric to watch during a Fed cut bust is bitcoin’s MVRV ratio, dividing the spot price by the average network purchasing price to calculate a reliable floor for bitcoin’s price. In the last Fed pause rally, bitcoin appreciated to four times its cost basis, before crashing back down below one during the March 2020 flash crash and Fed cuts. With bitcoin already breaking above realized price as the Fed pause rally persists, it will serve as a key floor if and when a Fed cut busts comes:

Phase 4: New Cycle Begins

On the other side of the oncoming recession is the start of a new economic cycle. Expansion follows contraction, regardless of the severity of the upcoming economic downturn.

If we avert a multi-year recession like 2008, in the months following the Fed’s interest rate normalization, markets should return to normal and react positively to easier monetary policy, allowing risk-taking to resume and expansion in the economy and financial markets to begin anew. It just so happens that next April, bitcoin’s supply schedule is set to be cut in half from 6.25 bitcoin issued every 10 minutes to 3.125 every 10 minutes—a supply shock occurring right around the time that risk-taking could resume in markets. While the timing is still uncertain, it’s a fascinating prospect that the expansion phase of the next market cycle could like up within just a few months of bitcoin’s latest halving cycle:

For the time being, the Fed pause rally should not be ignored. Markets trade behaviorally, and whether the risk-on behavior is rational or not, you have to ride the wave. What we’ve laid out for you today is when the wave may come crashing to the shore, how assets will behave when it does, and what levels bitcoin is likely to test.

Markets are turbulent, thanks for entrusting us as your guide to navigate them.

Until next time,

Joe & Nik

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.

One of the TEAMS best yet

Thanks for the lucid analysis. This is very helpful.