BTFP = Stealth QE, banks in extreme distress, bitcoin > $27,000: TBL Weekly #36

Welcome to TBL Weekly #36—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Banks are experiencing extreme distress

Last week saw the largest single tap of the Fed’s emergency lending facility in history, as depository institutions used the Fed’s discount window for a record-high $152 billion in emergency loans—the hurricane siren is blaring:

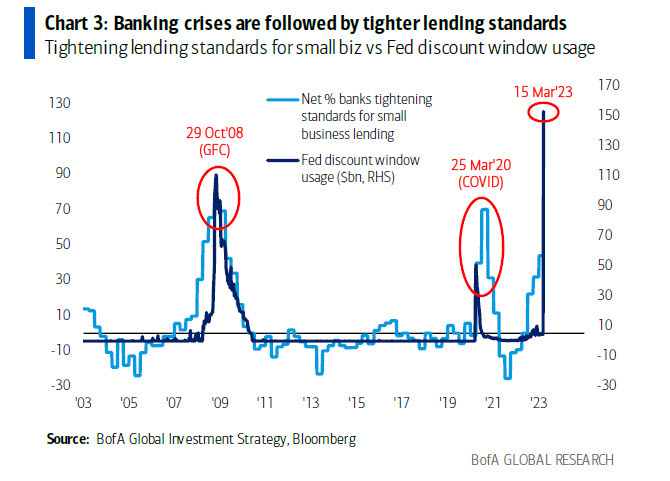

As banks grow cautious of their riskier counterparts, they stop lending to them, which contracts consumer credit creation and puts those banks in a tough position: they still need to fund themselves. Where do they go? The banks that cannot wait it out or find other counterparties go to the Fed’s discount window, but this is a rarity given the negative stigma attached to having to borrow from the Fed. If it was under-wraps that you were in a fickle position beforehand, when you use the discount window the cat’s out of the bag—now there’s an even lower chance you’ll be able to find counterparties outside of borrowing from the Fed directly. This stigma can give rise to a self-reinforcing feedback loop of tightening funding standards that forces more banks to use the discount window—a recipe for a credit catastrophe.

There is extreme interbank stress. Banks don’t just tap the discount window nonchalantly: the fallout from publicly disclosing your weakness means that banks only use it if they are in dire straits. The self-reinforcing spiral of tighter lending standards is well underway in the interbank market, and may soon help suppress consumer inflation into sharp disinflation as consumer credit begins getting destroyed:

BTFP is different, but has the same effect as QE

Powell needed to allow this to unravel, he needed to allow banks to fail, he needed to allow mark-to-market losses to destroy all poorly hedged financial institutions.

He did not.

Powell pivoted, for the second time, creating a brand-new emergency liquidity facility to backstop banks ad infinitum, and a new acronym to go along with it: BTFP, short for Bank Term Funding Program.

BTFP takes the US Treasury-collateralized lending of a standard repo transaction, and adds in the money-out-of-nowhere mechanism of QE to create a somewhat non-infinite liquidity facility. This facility allows banks to come as they please and pledge their distressed, devalued USTs and MBS as collateral, receiving the full value of those securities in cash in return.

The Fed isn’t buying securities per se, but it’s preventing the forced selling of distressed securities by allowing banks to borrow cash well in excess of the value of those securities—that money is created from nowhere, and while it must be paid back, it still has the same net stimulating, risk-taking effect of introducing liquidity into the system that is characteristic of past Quantitative Easing (QE) programs.

Lending against devalued collateral at par is stimulative. Whatever you want to call this money-from-nowhere UST-collateralized loan program, financial conditions have eased. Given that it must be repaid, perhaps a better name would be Quantitative Teasing…

By lending against distressed, deeply discounted assets at par, the Fed and Treasury are flooding new dollar value into the system over the collateral value. It’s a standard repo transaction, that has the same value-creation effect of QE—stealth QE.

Joe pointedly used this term prior to it hitting the headlines; we think it’s a byproduct of sitting in front of the Bloomberg Terminal for so long that all the world’s markets are tattooed on his prefrontal cortex. (More tests are required to properly diagnose.)

BTFP is big enough to theoretically cover all unrealized losses in the banking sector, some $650 billion, all of which can tap this facility unbeknownst to its counterparts. That’s right, the Fed and Treasury will not reveal who uses BTFP emergency loans until 2025 at the earliest. Remember the stigma associated with borrowing from the Fed we discussed earlier? Now banks have no way of knowing who’s in a fragile capital position, so they have no way of avoiding risky counterparties. The potential usage of this facility is staggeringly high, and neither the banks who deal with one another nor the public will know who uses it, introducing untold levels of highly dispersed, invisible risk to the banking sector, making an already fragile financial network all the more fragile.

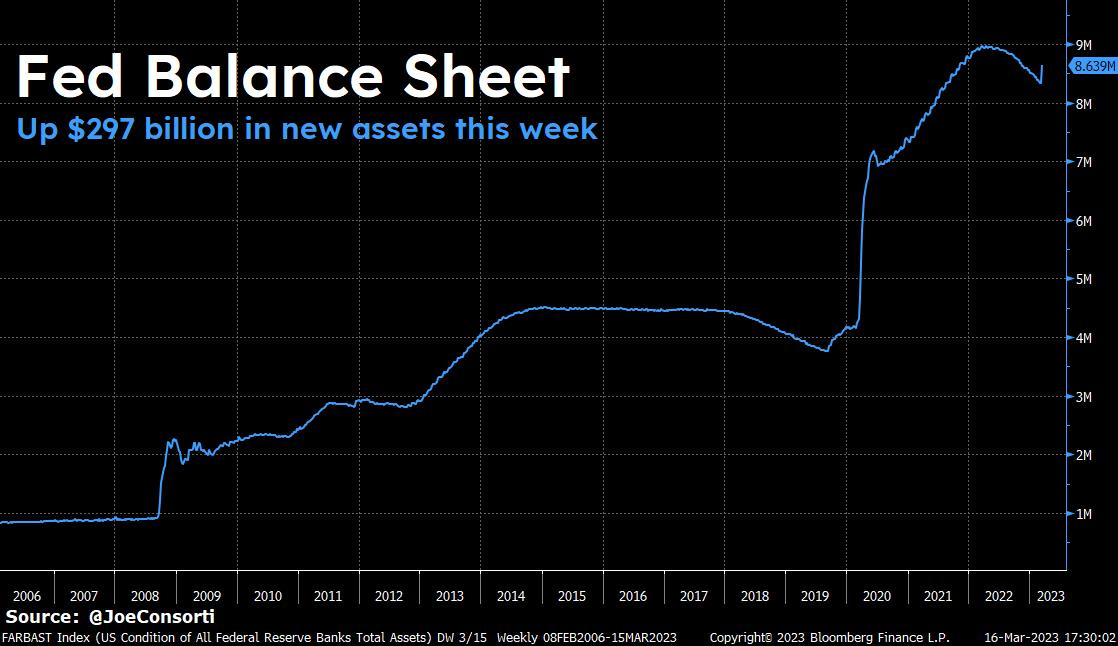

QT won’t meaningfully continue—any further balance sheet roll-off is performative as long as banks continue to tap BTFP forcing the Fed’s balance sheet to expand on net. This past week saw the Fed’s balance sheet expand by $297 billion, effectively erasing half of the QT it’s taken nearly a year to complete:

Saving a startup-serving bank was a jarring move to many, and has created uncertainty about the strength of US banks. Said differently, if the stability of the US financial system could be threatened by counterparties to Silicon Valley Bank receiving a ~20% haircut on their assets if the bank was allowed to fail and liquidate, just how fragile and interconnected is the US financial system?

We don’t have to look hard to find an answer. Banks were said to have ample reserves until they fell to ~$2.5 trillion—but when they faced $550 billion in deposit outflows last week, they needed a $251 billion rescue. Like in 2019 when the Fed stepped in to calm the repo market by reliquifying banks’ balance sheets, it is reliquifying banks’ balance sheets today to quell the fear and reality of rapidly deteriorating liquidity and funding conditions in the banking sector:

Central bank liquidity pumps asset prices, period. Whether you resent the notion that BTFP is stimulative, the market doesn’t lie—it interprets central bank liquidity injections as a shot of horse adrenaline for risk-taking. You know what happens next:

Here’s Janet Yellen explaining that the financial system is propped up on depositor confidence and not much else:

Horrifying words from one of the people who’s running the show, unveiling the shocking revelation: this train has no breaks, and its conductors are inept.

The (Upcoming) Regional Bank Massacre of 2023

BTFP will murder community banks that cannot participate in the program due to a lack of sufficient eligible collateral. Higher rates have already caused an exodus of bank depositors from institutions across the country, but it’s particularly devastating for smaller regional banks that lack a large deposit base to cushion the impact of immense outflows.

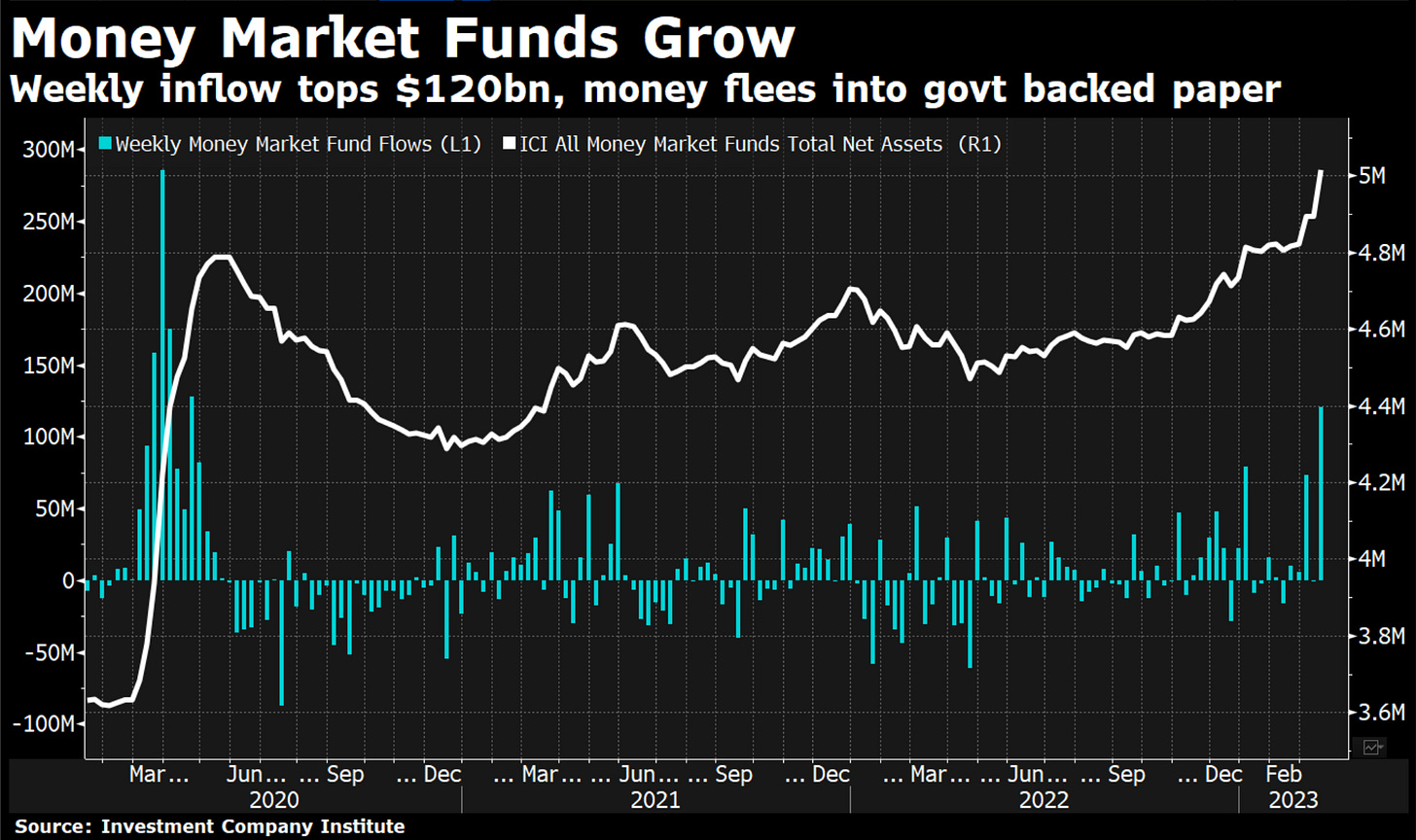

As depositors flee for Treasuries and MMFs yielding 5% (now, more like 4%), larger banks have been raising deposit rates to stem the depositor exodus for higher-yielding instruments, while smaller regional banks objectively won’t be able to raise deposit rates that high while remaining profitable.

Money market funds in the United States which yield anywhere from 3.5% to 5% saw $120 billion of inflows last week, and now have over $5 trillion in assets—much more liquid than many large US banks. Not much of a fighting chance for the family-owned and operated bank down on Main Street:

The equity market tends to agree, regional bank stocks are bleeding badly:

As the Fed destroys bank reserves by allowing securities to mature off of its balance sheet, large banks have had plenty of reserves on-hand to weather the storm. Meanwhile, reserves for small banks are at a dangerously low level, threatening to dry up this critical funding infrastructure and choke off small banks from survival:

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

We cover Treasuries because they are THE asset

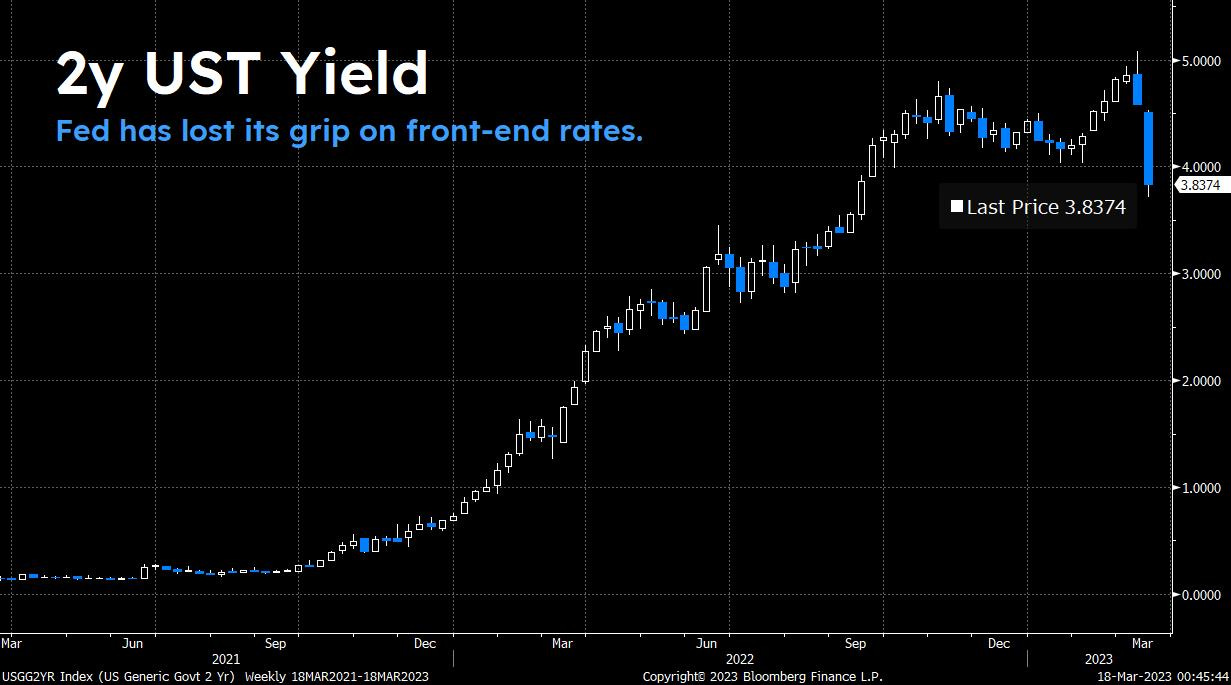

This week has been utterly historic for US Treasuries. The entire curve has set a record for the immense bid it experienced this week, with the front end dropping as much as 150 basis points in the single-largest bid in rates since Black Monday 1987. Now you understand: Treasuries are the asset class. In times that immense fear and uncertainty wash over markets, the safe haven flows to USTs are unmatched:

The Fed doesn't set interest rates—it attempts to influence them. When front-end rates are in sharp disagreement with the Fed's targets, it's indicative that the Fed has lost its ability to set rates accurately for the cycle.

Rates lead the Fed. What are they saying? Time for the Fed to pack it in.

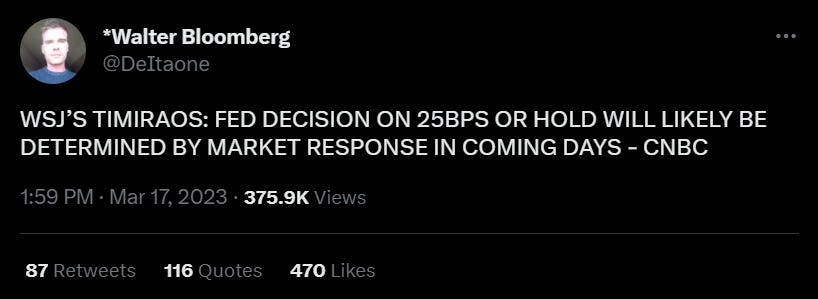

Per Nick Timiraos, renowned Fed leaker of the current market cycle, the Fed’s decision to hike by 25 bps or pause will be determined by sentiment in markets. We get the sense this is the leak before the leak that the Fed will pause:

After already intervening on Sunday and witnessing the fallout of its aggressive hiking on critical financial infrastructure, the Fed is now moving cautiously.

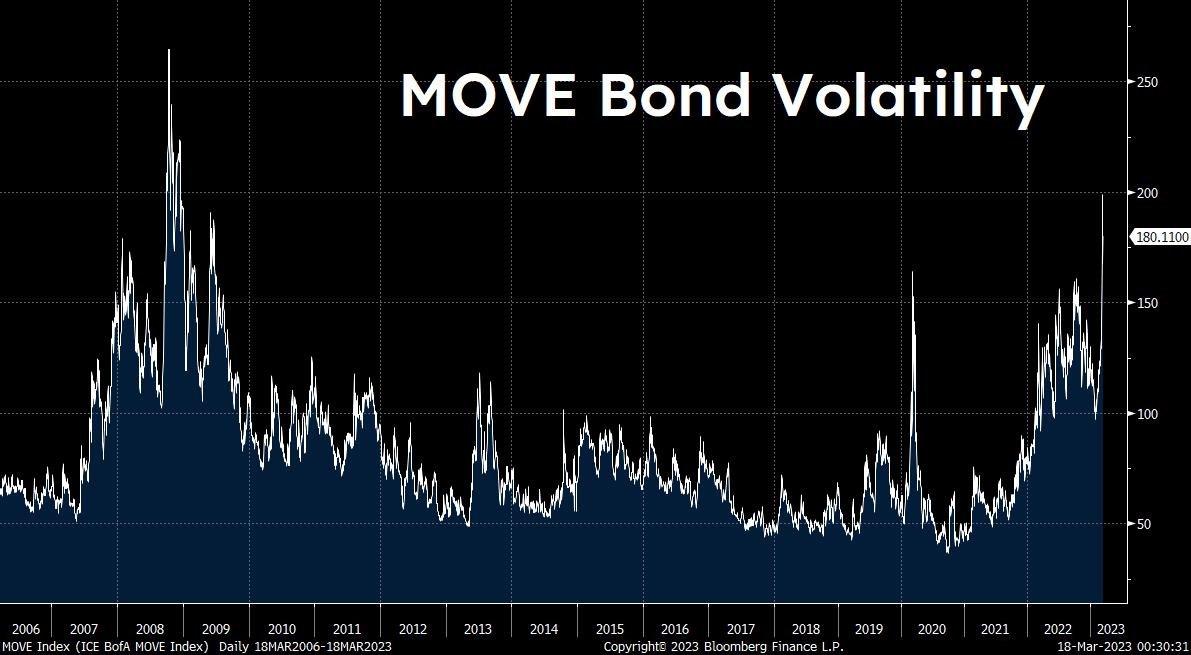

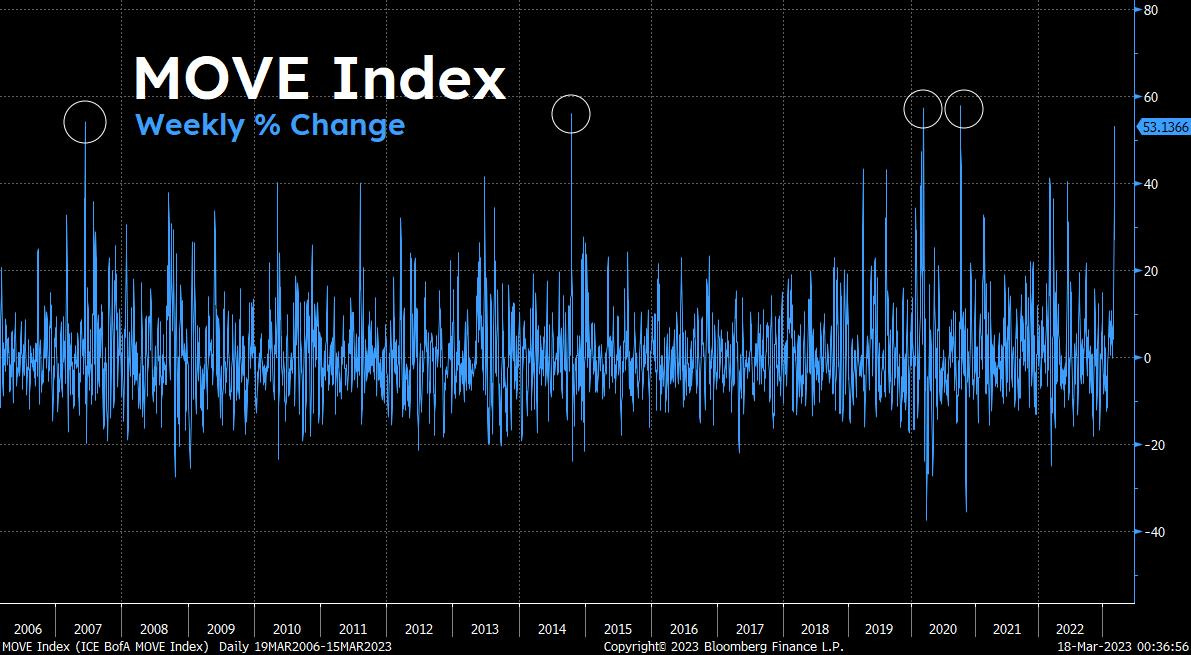

The MOVE bond volatility index made its 5th largest move of all time last week when it soared 53.13% to nearly 200 basis points. This is the type of once-in-a-decade bond volatility that catches some off-guard and blows up entire funds:

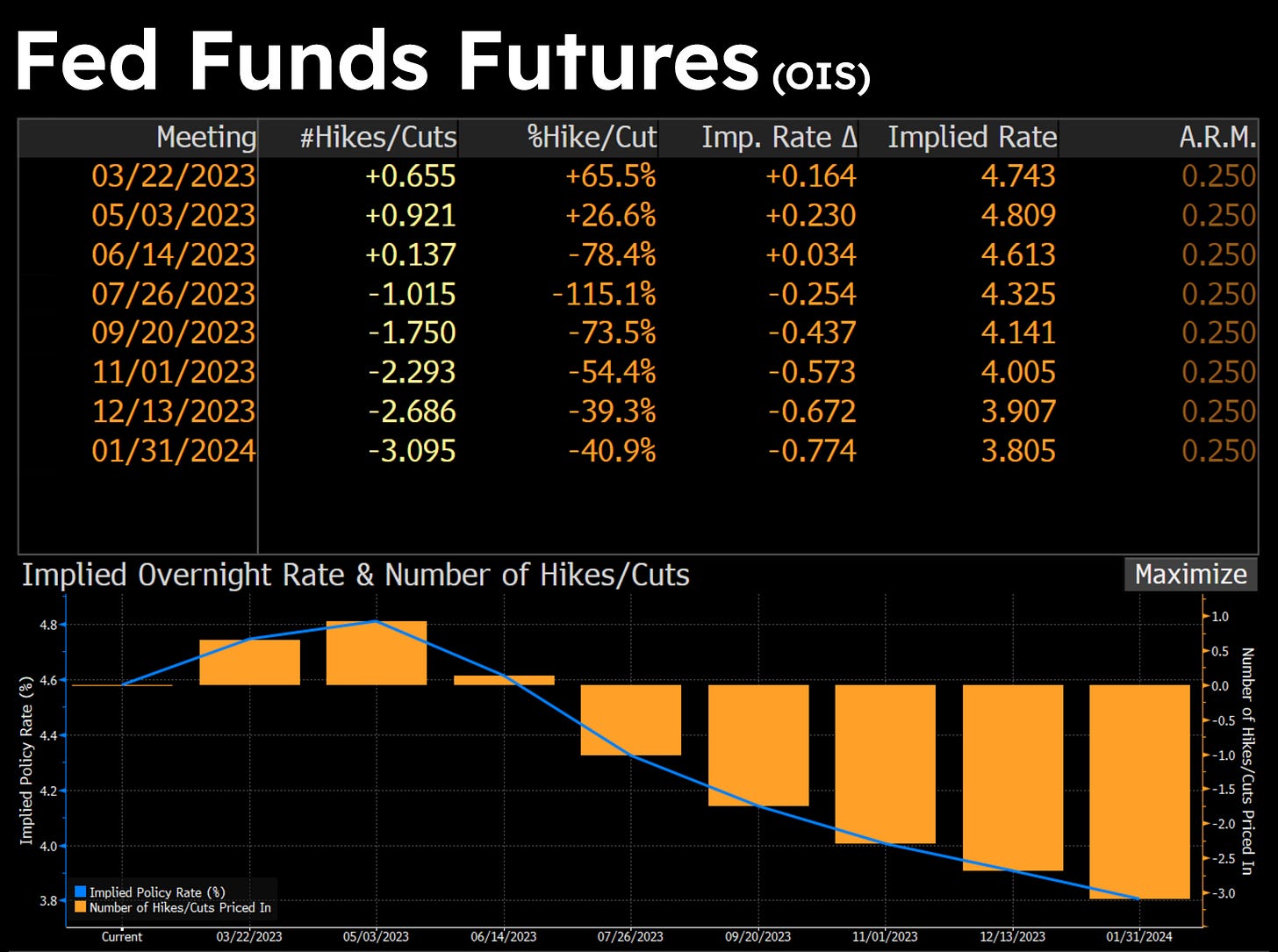

Fed Funds futures smell the blood in the water too. They are now deeply inverted for the first time this cycle dominated by upward-sloping policy expectations, pricing in 16 bps (50/50 that the Fed hikes or doesn’t hike) next week, and rate cuts in 2023:

Unpacking Bitcoin’s Rally

Bitcoin has soared a spectacular 37% in the past week from $20,000 to $27,396—a rally that comes at a poetic time, due to a garden variety of factors:

The inverse BTC/Rates relationship that demarcated 2022 is still intact. With the largest single-day and weekly drop in front-end rates in several decades, bitcoin has appreciated off the back of it. While we’d love to believe that this rally is due to depositors fleeing banks for bitcoin, of which a fraction of this price action may be from, it’s a rally almost entirely fueled by the dramatic interest rate repricing, and front-running the oncoming policy pivot. Remember: rates lead the Fed, and bitcoin leads equities. Bitcoin rallied higher and harder than equities this week as the consensus shifts to a rate pause from the Fed rather than continued hiking. During the on-hold period, risk assets love to rally, and bitcoin is the first to show it.

Fidelity has opened up bitcoin trading for all of its retail customers—that’s more than 30 million brokerage accounts that can now buy bitcoin directly from Fidelity’s website. The precedent is now set for the world’s largest brokerage firms to build out bitcoin onramps. Not to mention, this is a massive boon for bitcoin’s potential liquidity profile, as $3.9 trillion in client assets now have direct access to BTC.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

For a live-education experience, catch Nik in Los Angeles for “Bitcoin & The Future of Money” on April 29th.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Joe unpacks the Silicon Valley Bank implosion and discusses how the bank's asset mix, hedge strategy, and a myriad of other poor decisions led to the second-largest bank failure in U.S. history:

Tuesday

It’s never what you expect. It should have been high-yield credit, it should have been a crashing stock market, and it should have been a recessionary spike in unemployment. But instead, higher interest rates ultimately toasted poorly hedged banks with long-duration assets; an old-fashioned bank run ensued—as over $40 billion in deposits left Silicon Valley Bank for greener pastures, the entire premise of non-BofA, non-Citi, non-JP, non-Wells deposit banking entirely came into question. Not the question from the public the Fed was hoping for.

Check out Nik’s The Fed just got cooked

Wednesday

In this episode, Joe sits down with Dan Lawrence of OBM Inc. to discuss the mining landscape. Dan describes his miner management platforms serving North America and the largest mines in the world, the future of bitcoin mining, and how to evangelize Proof of Work while propagandists work to demonize it:

Thursday

Banking crises don’t take a few days to play out. They take a few months. Sometimes, they can take over a year—for example: in August 2007, the origin of the Great Financial Crisis began when BNP Paribas failed to publish the Net Asset Value (NAV) of its subprime mortgage investment vehicle, but it wasn’t until over a year later that the crisis culminated with the fall of Lehman Brothers.

To think that a Sunday bailout of Silicon Valley Bank followed by a Wednesday bailout of Credit Suisse will mark the end is reasonably foolish. This banking crisis isn’t over.

Check out Nik’s Risks are balanced, trouble in Europe

Friday

In this episode, Joe walks through the Fed and Treasury Department's new BTFP facility to prop up bank liquidity, how it functions as a hybrid between repo and QE, and what impact it's likely to have on asset prices given the stimulative nature of valuing devalued collateral at par:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.