Can't blink, won't blink

Rapid repricing of Treasury yields leaves investors stunned. Powell remains stoic for as long as he can.

Dear readers,

Hearts fluttered on Monday as the quarter opened with a very serious reminder that markets are in a new, more precarious regime. Headlines about breakout yields were autogenerated referencing 16-year highs in yields, but the details are much more important than the absolute yield levels—underlying market indicators suggest that risk assets are in trouble—the reemergence of volatility and the reintroduction of risk premium are here to shake things up. You’re not going to want to miss what comes next.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Speed brings convexity

When prices change, a narrator has a choice of words in order to describe the change. Sometimes, rates increase. Other times, they skyrocket. We can also use plummet, decline, step higher…you get the picture.

Right now is one of those times when the word “reprice” is most appropriate. A repricing, particularly in Treasury yields, indicates that the market has digested a new piece of information and must rapidly adjust the clearing level. But clearing levels don’t just alter on their own—they must be accompanied by the according change in investor behavior. For example, if rates are to reprice higher, that would imply a buyer base on strike, unwilling to purchase at current yields. These buyers essentially disappear from the market until prices fall (yields increase) far enough to bring them back to the counter.

What causes a buyer to go on strike? A fundamental shift in information, such as the Treasury’s willingness to issue more 10-30-year obligations than ever before. And that is precisely what we are seeing: a rapid repricing higher of yields directly after the early August announcement that we were about to receive the monsoon of a lifetime in Treasury issuance forced into the private market. These auctions begin next week, so it is our estimation that the repricing during August and September came just in time for Q4’s rainy season. This is not to make any call on yields and where they go from here, but to instead prescribe the recent move to the first-order effect of supply overwhelming demand.

Going beneath the yield increase, we are able to further prescribe the origin thanks to the TIPS market. TIPS, or inflation-protected US Treasuries, are government bonds that pay a yield + backward-looking CPI. Think of it like a bond that pays inflation with a kicker as well. That kicker is called the “real yield,” and the yield of the regular Treasury security is called the “nominal yield.”

Both nominal and real yields are observable in the market—they each come from traded securities. The two also combine to give us something called a “breakeven yield,” (in green) which is the difference between the nominal (in orange) and real yield (in black).

Here’s an example using today’s numbers, then accompanied by the visual of all three. The 10-year yield today is about 4.73%. This is the nominal yield, but you might just think of it as the yield without any qualifiers. The 10-year TIPS yield is 2.4%. That means the breakeven yield is 2.33%, which is calculated as the break-even level between nominal and real yields:

The important takeaway about the recent repricing in Treasury yields is that it has occurred entirely due to an increase in real yields—breakevens haven’t moved. This means the market is not adjusting the forward-looking CPI part of the equation. When yields rise, it is either because the future CPI expectation is rising (this would be an increase in the green line) or because investors are demanding more of a kicker (the black line) on top of the CPI calculation.

Now go back to the green line, and you can see that it increased materially throughout the 2020-2021 timeframe when inflation was out of control. Since 2022, however, breakevens are flat, meaning that higher future inflation is not a concern to investors.

So, why is the move in real yields happening, and what does it mean? Firstly, it means that the increase in yields is not due to an inflation scare. It’s due to this idea of a kicker.

With the world looking for an explanation, often times the simplest explanation is the correct one. And we do believe here that the raw supply increases coming onto the market in Q4 warranted the move higher—investors were not going to accept 2% real yields for $500 billion net new Treasuries to private hands with issuance increases and Quantitative Tightening in play (real yields moved up to 2.33%).

Now, how do higher real yields affect other asset classes? They make other investments look less attractive, because the kicker to own Treasuries above CPI is higher. The increase in real yields, said otherwise, demonstrates the genuine lack of willingness of buyers to participate. And this increase in real yield then makes other asset classes less attractive on a risk-adjusted basis. Those calculations then find their way into analyst spreadsheets on Wall Street and in Connecticut, resulting in sell orders throughout risk markets. It’s just math.

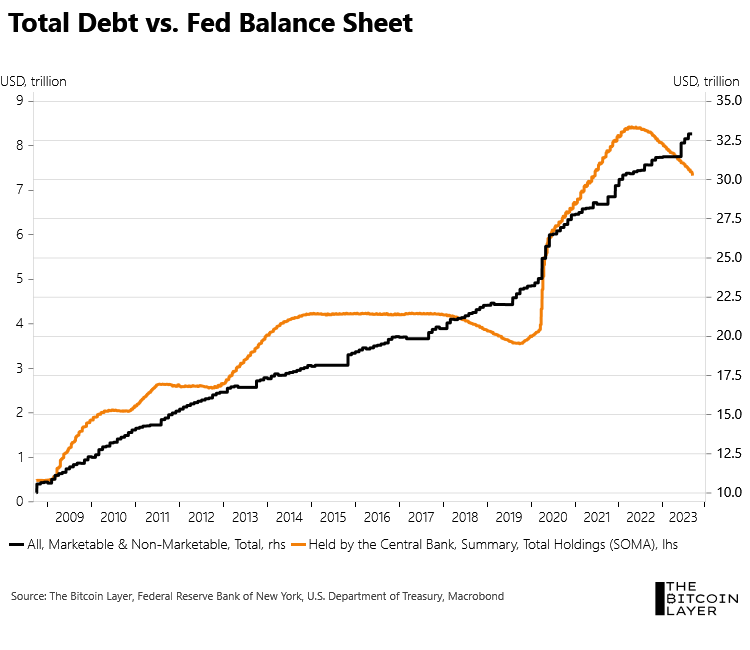

Bringing the Treasury supply increase in context with the Fed’s capacity to own Treasuries shows a divergence—Treasuries are hitting the market (black) but the Fed’s Treasury portfolio (orange) isn’t increasing anymore to accommodate. Only once before has the Fed tried to reduce its Treasury stock. It did not end mildly, yet here we are watching them try again:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

This brings us to an explanation of what we mean by speed brings convexity. The impact of higher policy rates and higher market rates is non-linear—each small increase in interest rates brings about the potential for large asset writedowns, layoffs, and bankruptcies, which can create a negative feedback loop in the economy. Think about it like this: if a company has $5 million in revenue and $2 million in interest rate expense, it has $3 million left over for operating expenses and profit. But if rates go up and debt service increases to $4 million, the $1 million leftover will be eaten up by operating expenses, leaving no profit. Then, if yields continue to rise in a linear fashion, the effects are non-linear because $1 million more in interest rate expense shuts the company and now there are 200 unemployed people instead of reduced profit. A convexity in economic risk as rates rise, you could say.

The full impact from tightening is clearly not entirely here yet as hikes are still going in Europe and even potentially in the US, but because the lagged effects of monetary policy can take up to a year, the attitude from central bankers almost becomes “we’ll know it when we see it, and then we’ll stop.” Not a great strategy, but there are no signs of doves regardless of where you look:

Ample Reserves Framework

QT2, currently underway, is only the second time that QT has been attempted in the modern era of the ample reserves framework. This is a monetary policy shift from the Federal Reserve to justify over a decade of QE. Policy used to be set by altering the price of money exclusively, done through the targeting of the Fed Funds rate by moving around discount, repo, and deposit rates for participants in financial plumbing. But since QE increased the Fed’s balance sheet to the multi trillions, the Fed now uses the quantity of reserves, strongly correlated with Treasuries held by the Fed, as a primary policy tool. We’ll translate the Fed’s framework: we’ll keep ample reserves, and we’ll do our best to guess when they might not be ample anymore.

Unfortunately, it is with this policy that we march into the next phase of QT in which the government is hitting the market with a double whammy—the Fed is already disappearing from the demand side at the same time the Treasury is bringing a trillion in fresh paper.

Reserve destruction, which happens in QT when Treasuries mature from the Fed’s balance sheet, is much different than an increase in Treasury supply and what higher real yields do to other asset classes. Non-linear effects come to mind when considering at what point ample isn’t ample enough. We believe this is part of what happened in March following the brief banking crisis. In essence, reserve destruction by the Fed leads to fewer reserves in the system, which can lead to issues within financial plumbing and particularly with leverage. If a percent move higher in rates affects profitability but a two percent move higher sends a bank into the grave, you can start to imagine the broader non-linear effects of QT even without the Treasury deluge.

We will see over the next few months if the market is prepared to digest this reserve contraction or if something will break instead. We can’t help but think about the days on which Treasuries mature and new ones settle, and how these are the days when the crowding out effect becomes most tangible—the money to purchase the net increase in Treasury supply has to come from somewhere. Next week’s long-duration auctions settle on October 16th.

In our final chart for the day, we present to you side by side the year-over-year performance of the S&P 500 and the year-over-year change in the size of the Fed’s government debt holdings. From a visual sense, we can certainly see a relationship—when the Fed is increasing the size of its Treasury holdings, stocks perform well:

When the change goes negative, however, we don’t have the greatest hope that stocks will be able to avoid the relationship on the way down. Yields can rise to the point where they affect equity valuations, which can trigger equity selling and even a rotation back into Treasuries themselves. But instead of preparing you for a fall in yields when we enter a recession, think instead about how risk responds in a non-linear way to financial tightening. Spooky season, indeed.

Until next time,

The Bitcoin Layer

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.