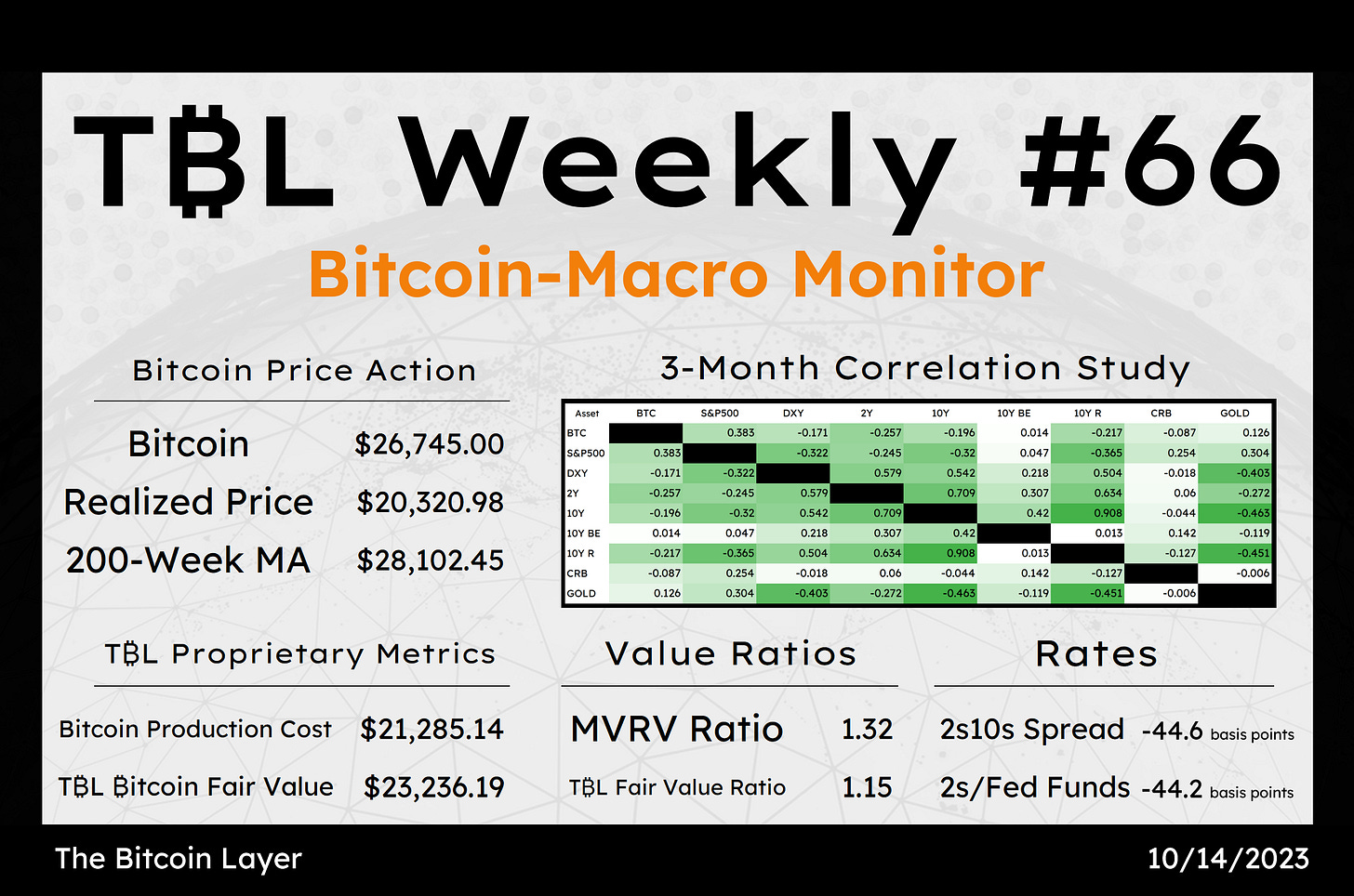

Welcome to TBL Weekly #66—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good Saturday morning, TBL readers!

This week was yet another action-packed one in markets as the geopolitical situation intensifies, and markets are making it clear that:

a) Treasuries still aren’t at their “tipping point” yield where investors fully derisk, pile into them, and send yields in a secular downtrend as a result.

b) The likelihood of another Fed hike hangs in the balance between where the US Treasury market thinks rates should be and where a weakening consumer and corporate landscape will allow them to be.

Yields are up 8bps on the 2-year and a face-melting 36bps on the 10-year US Treasury in the last 30 days—this is a bear steepening for the ages. We noted last week that this may have been the cycle top, with rising geopolitical tensions sparking a huge derisking impulse that would finally reverse the endless selloff in US Treasuries and a commensurate rise in yields. Well, we speculated that, but this cycle is truly unlike any other. The issuance tsunami came, and boy oh boy are investors’ appetites for USTs disappointing.

The Treasury auctions this week were quite weak, all of them tailing (final auction price below where the initial pricing was indicated), particularly on the long end—much to the chagrin of one Janet Yellen, whose hopes of funding the US government at a reasonable interest rate are resting on investors’ appetite at this stage in the cycle for some duration. Evidently, the market believes rates can head higher, with each auction this week experiencing embarrassingly low demand and sending yields soaring once more.

With these soaring yields leaving an ever-larger hole in global banks’ balance sheets, the question occurs: who steps in first, the market or the Fed? And how high will rates have to climb for one of them to blink?

Let’s shift gears to the US economy.

The University of Michigan’s consumer sentiment survey came in well below expectations—huge misses like these are typical of cycle downturns. We see more survey beats on the way up, and more survey misses on the way down. With the Halloween-Thanksgiving-Christmas triple header just around the corner here in the United States, the consumer is increasingly on edge. You know as well as we do that balancing higher prices with rising credit card rates is a balancing act that only ends in cutting back on spending, and that sentiment is shared all around the country at the moment with decorations, food for parties, and gifts galore set to be purchased.

We’ve had a few false starts with this recession indicator this cycle, just like every other cycle, but having fallen below the 68 contraction level once more, it seems like this time, the pullback in American consumers is for real:

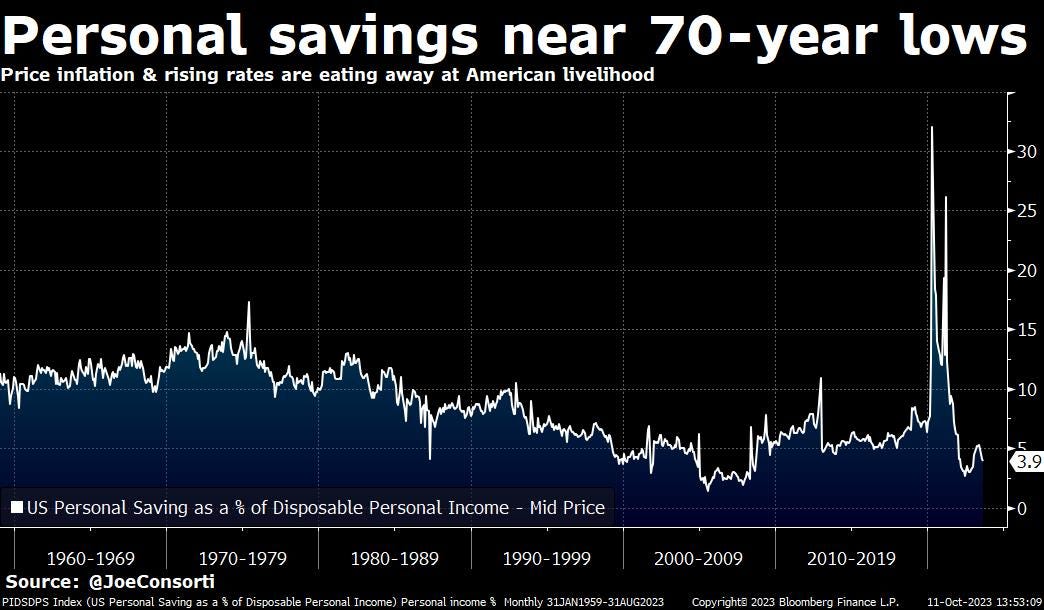

It’s no surprise consumers aren’t feeling great about the economic outlook, as personal savings are nearing a 70-year low at just 3.9% of income. We used to be able to set aside 15% of our income for retirement savings and rainy-day funds, now we save just 1/5th of that. Decades of endless price inflation has eaten away at American livelihood, and we are all feeling the heat in some way:

The strength of the consumer heading into a spend-heavy Q4 will influence not just economic growth, but also the outlook for big box and online retailers like Walmart, Target, and Amazon. A pullback in spending drags down GDP, but it also drags down revenue and growth projections for these firms, leading to layoffs, leading to a further pullback in spending. In a global economy whose measurement for prosperity is spending, measures of economic growth will likely be sounding the pain alarm over the next few months and into next year.

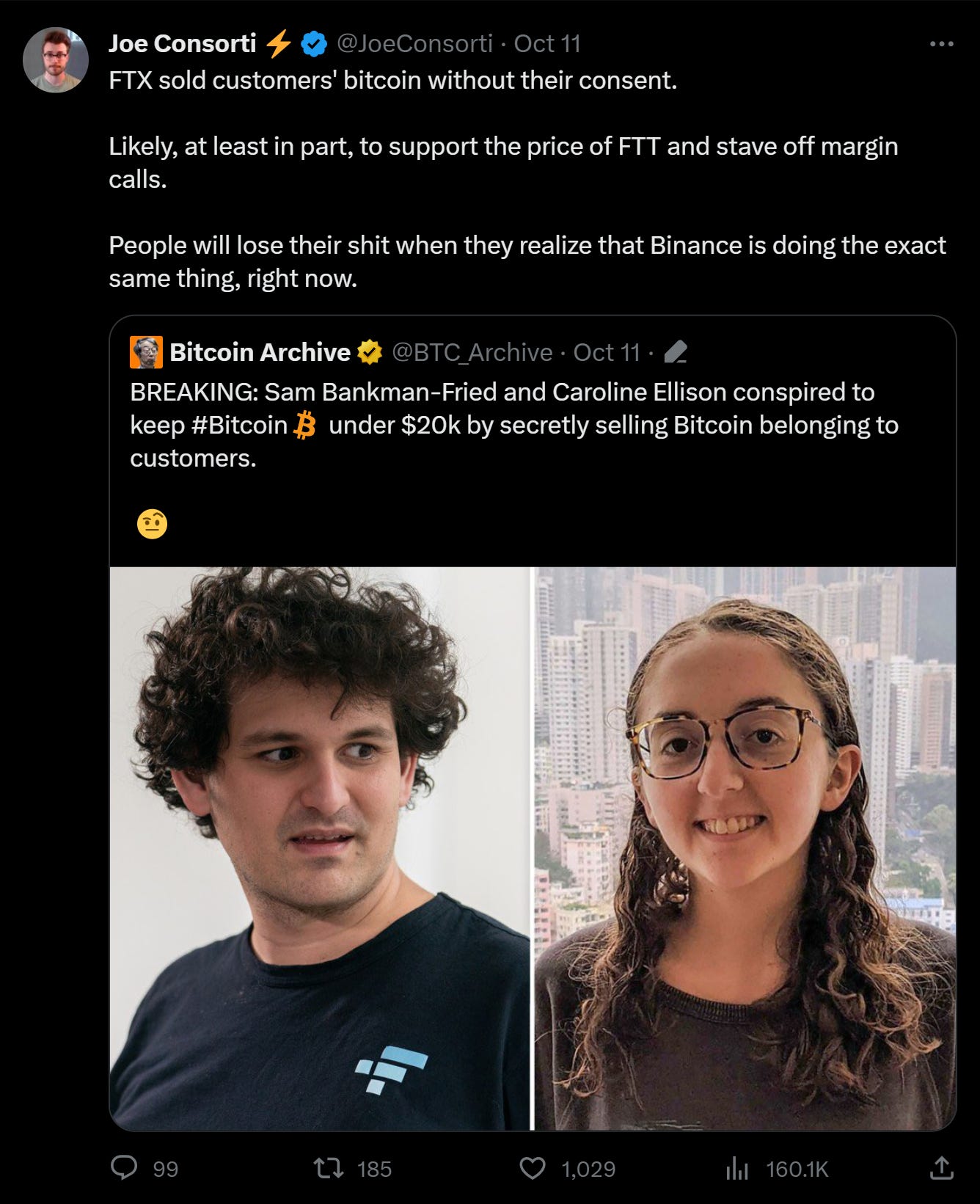

In the Wonderful World of “Crypto” Scams, the latest turn of events in the trial of disgraced FTX fraudster Sam Bankman-Fried saw Caroline Ellison spill the beans on her former lover’s shady backroom business practices.

One of the details revealed, not to The Bitcoin Layer’s surprise as we’ve firmly speculated on this several times, was that SBF conspired to keep bitcoin’s price under $20,000 by selling customers’ bitcoin holdings without their consent:

We’ve said ad nauseam that “crypto” giants don’t grow to the size that they have without borrowing against their assets, chief among them being vaporware exchange tokens like FTT in the case of FTX. When the value of this collateral drops rapidly, you’ll do everything in your power to stave off margin calls which, in a fragile industry like “crypto”, would likely spell collapse of the firm—anything and everything, including selling customers’ holdings of bitcoin directly out of their “wallets” without their knowledge or consent.

Given the similarities in company size and a shared ambiguous moral character between SBF and the CEO of Binance, CZ, we err on the same abundantly cautious side of getting your BTC off exchanges, before CZ sells them for you.

Next Week

In the week ahead, Monday’s Empire Manufacturing print will offer key insight into the speed of contraction in the upstream US economy, with analysts foreseeing a swift decline month-over-month. Industrial Production on Tuesday will offer similar insight and another expected dour print, while Retail Sales give us a glimpse into a consumer who’s split between the worlds of higher prices and increasingly higher borrowing costs in revolving credit and rapidly pulling back as a result, particularly heading into the spend-heavy holiday season. We will also have our eye on Building Permits and Housing Starts on Wednesday as the US housing market continues to stumble at a steady clip on the demand front with the national average for mortgage rates cresting 8%—we round out the week on Thursday looking at another round of labor market data which is expected to marginally worsen looking back at the month of September:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

A huge derisking bid is hitting Treasuries, the world’s preferred safe-haven asset, off Middle East geopolitical risk and dovish Fed comments. While some $1.6 trillion in unrealized losses have piled up this year due to interest rate risk, the “risk-free” moniker goes much deeper than interest rate risk and into the realm of liquidity and creditworthiness, two attributes that win out in every sovereign debt measuring contest. So as deficits run up in all Western nations and sovereign debt becomes less desirable as an asset for individuals, the US continues to reign supreme, particularly in high-tension geopolitical environments like the one we’ve just entered into.

Check out—Tales From The Curve: Economic Woes Ahead

Wednesday

In this short film, we walk around University of Southern California with Nik. He shares his deep family connection to @USC & @USCMarshallSchoolofBusiness , what he is trying to build as an educator, and how it all relates to the work done by The Bitcoin Layer.

Check out—First Ever BITCOIN CLASS At Major US Business School

Thursday

With the latest bout of volatility across asset classes, your neighborhood TBL researchers feel quite at home—our job is to amalgamate market movements into a clear and cohesive narrative for our readers. But today, instead of connecting asset classes through correlation study, we’ll attempt to isolate bitcoin, stocks, and Treasuries and then assign some cons and pros for each. This can be difficult, as we continually preach just how interrelated these markets are. Nevertheless, we believe that this type of exercise can help bring clarity to individual global macroeconomic topics, even if they don’t explicitly assist in predicting performance.

Check out—Bitcoin, Stocks, & Bonds: Pros + Cons

Friday

In this episode, Nik is joined by bitcoin miner Marshall Long, who has been involved in the industry since 2010. Marshall gives the audience a captivating mix of bitcoin mining basics and global experience, in which he discusses mining in China, power grid management, emersion technology, and his opinions on the global chip supply chain.

Check out—Bitcoin Mining Masterclass | Marshall Long

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.