Correlations Are Shifting & Bitcoin Touches $25,000

A regime shift is underway in cross-asset correlations, which begs the question: are these transient changes, or here to stay?

Dear readers,

The more things change, the more they stay the same—cross-asset correlations remind us of this. As markets ebb and flow, from risk-off to risk-on, from tight to loose, and from meager to ample liquidity, monitoring cross-asset correlations tells us about investor behavior, allowing us to reorient ourselves with both the current and forward-looking market environment.

Today we observe the shifting correlation regime across markets and extrapolate what they mean for investor expectations for the weeks and months ahead.

Comparing 2022’s & 2023’s Regimes

Last year was a secular risk-off year, in which the Fed aggressively ratcheted up the cost of capital and market participants adjusted their portfolios accordingly; selling equities and compressing the hot air out of P/E multiples, and selling US Treasuries due to heightened inflation expectations.

This year has been a secular risk-on year, so far, during which expectations for the policy rate have stabilized, and liquidity conditions remain favorable across financial markets.

Note how Treasury market liquidity (the ease at which people can trade in size in the UST market without disruption) has been rising off of its lows set last October:

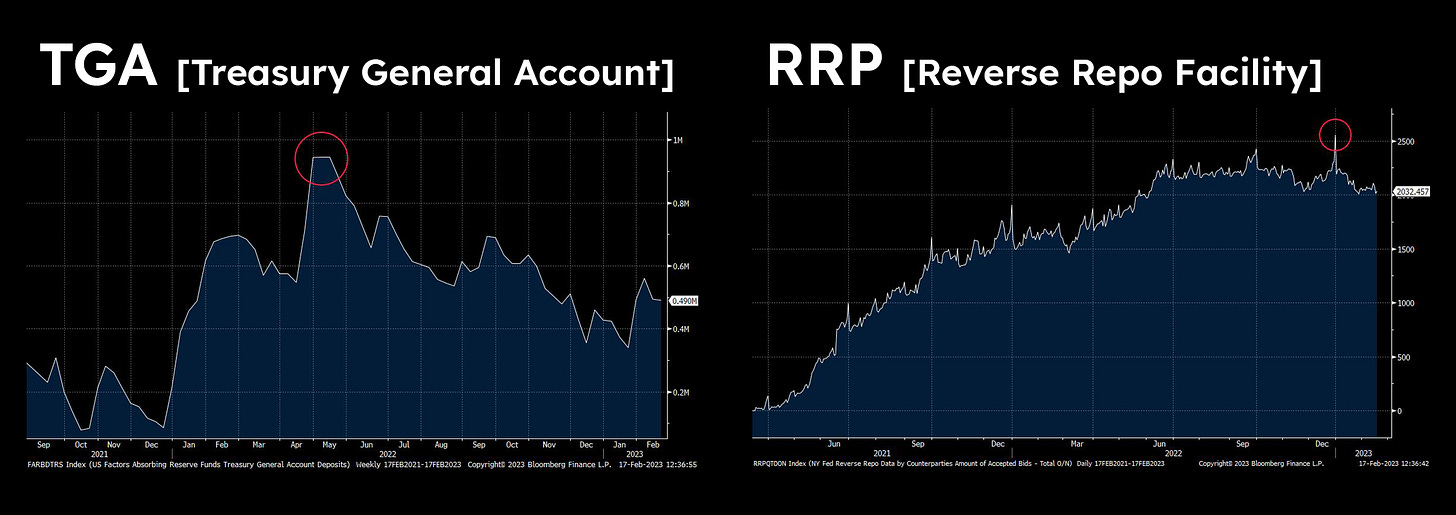

The level of bank reserves, which has a positive relationship with risk-taking behavior in markets, has also marginally risen lately as capital moves out of the TGA and RRP facility and back to Federal Reserve banks:

Whether this risk-on trend is a transient phenomenon as the Fed pause rally sets in or the start of a new bull market depends greatly on the path of inflation in the coming months—this path has shaped the Fed’s current policy more than anything. Tuesday’s minor upside inflation stickiness was a gut check that didn’t really harm risk markets—indicating that the market still believes disinflation will continue without hiccups.

As inflation falls while the labor market remains intact, a not-too-hot-or-cold “goldilocks” scenario, risk-taking is poised to continue. Over the coming months as the Fed holds tight, should one or both sticky inflation and economic deterioration occur, risk-taking may waver and reverse. We’re not making any explicit calls on the direction of stocks or Treasuries, only explaining the conditions that are causing this rally in stocks and selloff in USTs, and what may cause them to reverse. Oddly, or not, bitcoin is the only asset showing real strength and new local highs.