Dear Readers,

Time for some real talk. Today’s letter is partially a victory lap, but it’s a stretch to call it that. It’s more of a heart palpitation—I get them when something serious is going on, or about to go on, in rates. My nature, as a Treasuries analyst, is to understand when my asset class becomes en vogue. And that is almost always accompanied by trouble elsewhere. Let’s remove the sugar coating.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

A city oasis

You might be wondering why a beautiful California living room is today’s cover picture. I’ll explain after the not-so-victory lap. Let me take you back to the beginning of the year. The 2s10s yield curve had reached the negative teens—I thought an uninversion was imminent (it wasn’t), and that the market would be correct in assuming cuts would arrive by mid-year (they didn’t). TBL Pros can go back and audit my analysis, something I do a few times per year in hopes of becoming a better analyst and writer:

Here’s where I didn’t really miss, and I’ll explain shortly why this is so important for today’s letter:

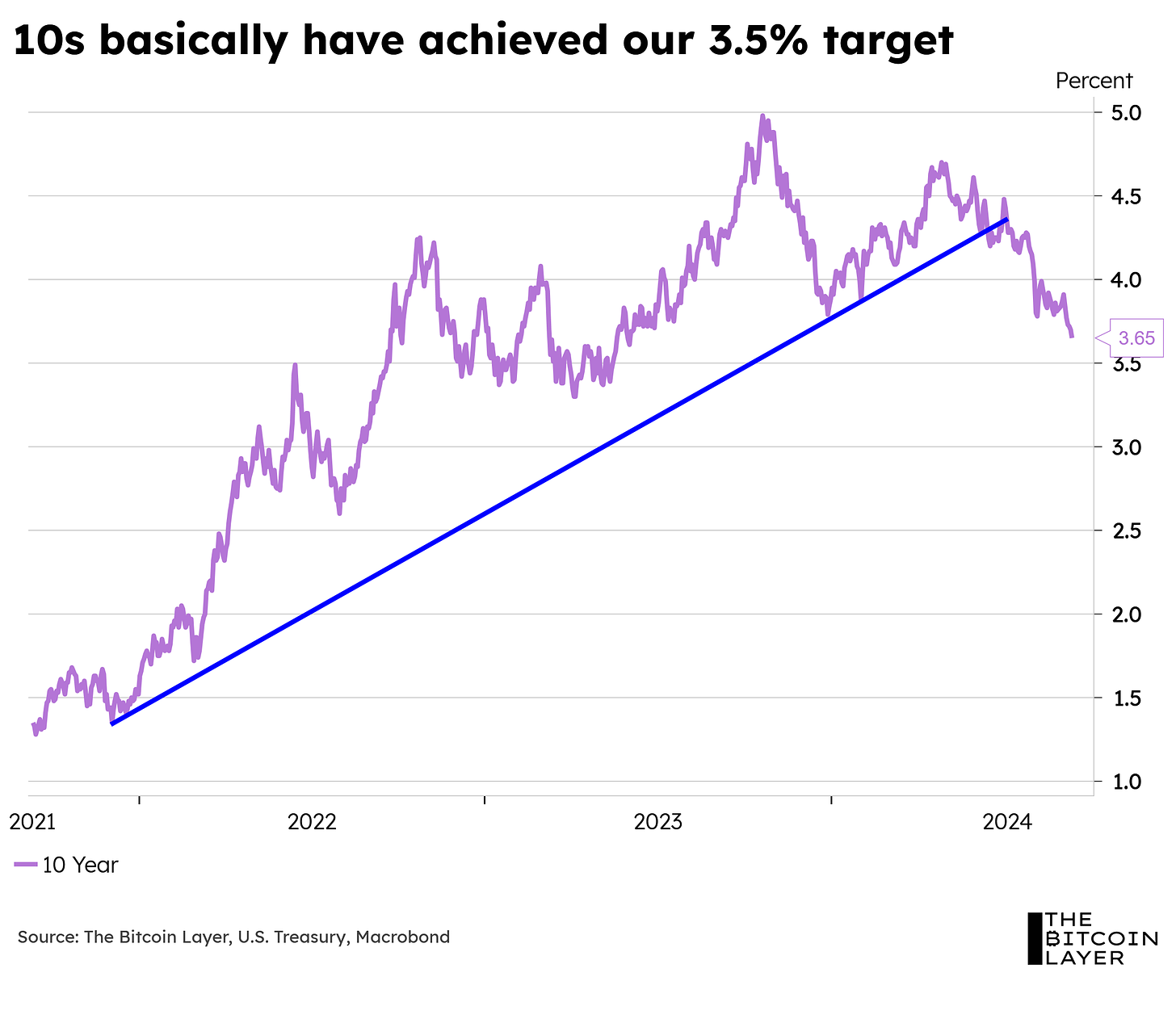

The price is the truth here on rates. I see the lack of conviction from bond bears as a big signal: rates path of least resistance this year will be lower, even if the current value is fair. Said otherwise, I don’t think 10s scream to 3.5% anytime soon, but that’s where the probability would lie over the course of the year.

The call was for 3.5% on 10s, and I’m going to place a checkmark next to that one as we’ve tagged it within a few basis points:

Even though rates would trip higher after my January letter before coming back down, I never wavered in my target and outlook that restrictive policy rates and very attractive outright yields on Treasuries would support a slowdown: an allocation away from risk, and the exact lagged effects of monetary policy on the economy desired by the Fed.

Of late, the trigger for a decline in Treasury yields has been the slowing of the labor market, but I’m here to tell you that might not actually be the case. And it has to do with that living room.