Dear Readers,

As we close out the week, some tariff-turmoil relief has been felt across markets as more countries come to the table to negotiate with the US on their Liberation Day tariffs. These levies initially seemed to isolate America from the rest of the world and its closest allies, especially with the overall global reordering strategy still thin on details. However, Treasury Secretary Scott Bessent put it best in his speech at the IIF this week and clarified: “America first does not mean America alone.” Given the specific policy guidance that the Trump administration has taken, as well as some good earnings numbers from Mag-7 companies, the S&P 500 reverted back to a 2021-like path:

One thing worth noting here is just how much impact Mag-7 companies have had on the current correction. It is the very performance of these Mag-7 companies that exacerbated the latest market sell-off. When looking at an equally-weighted S&P 500 index, you can see the overall market of stocks outperforming these giants through the turmoil.

In fact, the latest dollar sell-off moved almost in tandem with the Mag-7 sell-off; this during a time when US Treasuries were also selling off and gold surged to all-time highs, signaling an escape from American capital markets:

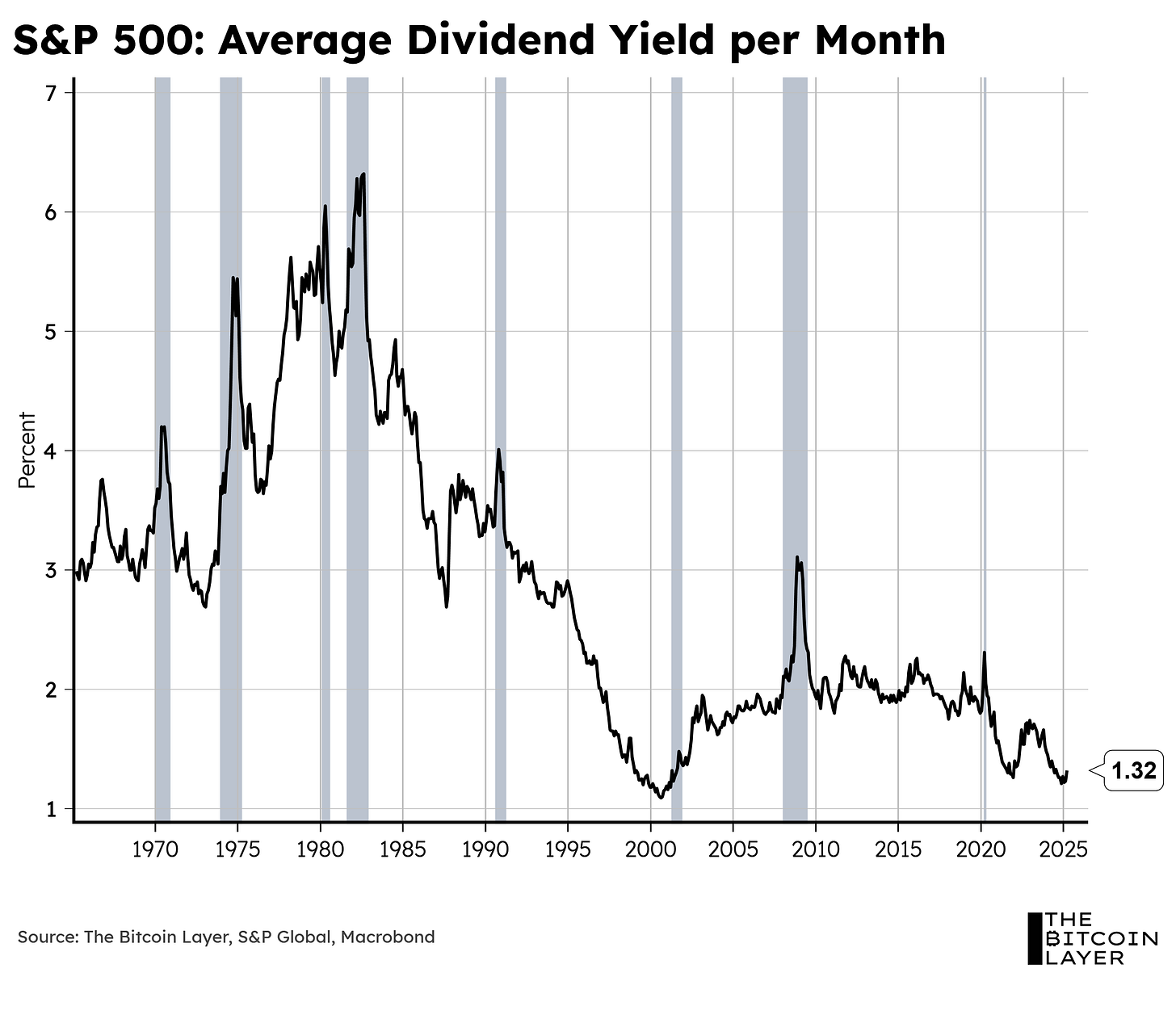

This sell-off makes sense as, historically speaking, low dividend yields are associated with economic peaks, and today we stand at one of the lowest levels in history. Low dividend yields are a function of expensive valuations:

Some analysts out there are taking the current rebound in stocks as a sign that the worst is behind us. Can this be the case? Can the roaring 2020s continue on? Let’s take a deeper dive into some behavioral finance. Welcome to TBL Weekly #138.

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Weekly Monitor

Behavioral Expectations

As shown in the previous chart, dividend yields are a fairly good predictor of stock returns in the future. Why is this the case? Well, let’s think about all of this in terms of economic peaks and troughs.

During an economic peak, we theorize the following: