Economic Cycle Wayfinder

Combining our three favorite surveys to identify the economy's current position within the business cycle.

Dear readers,

We’ve spent a lot of time covering the yield curve’s ability to predict an end to the economic cycle, but now we must use proper economic indicators to confirm or deny the thesis. With hundreds of indicators published monthly, how do we decide which ones to follow? And once that is decided, how should we interpret them? Today, we’re going to simplify monitoring the economy for you. And we’re also committing to providing readers a regular compilation of all our best global macro and bitcoin metrics and indicators, both public and proprietary. Our chart pack is evolving, folks!

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud.

As goes American manufacturing, so goes the economy

We discussed the ISM Manufacturing PMI survey in last Friday’s post—in short, this indicator uses a survey of managers from over 300 manufacturing firms, asking questions to gauge the state of each of their businesses; it’s used as an indicator to determine whether the US economy is in expansion or contraction:

Let’s point you to two notable aspects of this chart:

Borrowing a feature of charts from the Federal Reserve, we will be shading areas during which the US economy was in recession. This is determined on an official basis, after the fact, by the National Bureau of Economic Research (NBER). Our goal, of course, is to show you ahead of time what the NBER tells you much after assets have priced in changes in the economic cycle.

Unlike the 50 level we generally follow for PMIs to gauge economic expansion or contraction, the level that matches more closely this expansion/contraction threshold on ISM Manufacturing PMI is 47. We have drawn a horizontal line in this chart to mark this empirical level. Expectations for this Friday’s data release are for ISM to fall to 54.5—this is still firmly in expansion territory yet is a rapid and continued decline from last year’s cycle peak.

ISM Manufacturing PMI is one of the most reliable economic indicators available and our personal favorite to identify our place in the cycle.

We’ve surveyed manufacturing firms, but this can’t be our only gauge of the economy. Who else can we ask? Consumers make up over 70% of the economy, and small businesses employ about half of America’s private workforce—we should probably ask them how they’re feeling about things.

The people and their businesses

In this next iteration of our economic indicators framework, take a look at the University of Michigan’s consumer sentiment survey and the National Federation of Independent Business’ small business optimism survey, while we keep the ISM Manufacturing data series in there for comparison:

Some more observations from this chart:

Our three favorite economic indicators clearly track the business cycle—we determined that through several cycles, each strongly correlates with economic growth and can have predictive power in identifying recessions.

Three indicators on one chart are probably two too many—looking at so many data points at once is something we hope to avoid doing. This chart is meant to demonstrate that the business cycle can be identified using an array of survey data, but it’s begging to be simplified.

Consumer sentiment and small business optimism are both in free fall and seem to be reflecting something about the economy that isn’t yet showing up in ISM Manufacturing. It reminds us of the importance of having more than one economic indicator in your framework.

Consumer sentiment is very deeply negative given historical readings despite relatively full employment. Why? To venture a guess, the rise in living expenses is making it prohibitively expensive for people to go about their lives. Despite having a job, they’re increasingly unable to meet their basic needs. Lagging indicators such as GDP and unemployment data might lead you to believe that the economy is doing fine—this is simply not the case.

How the people and their businesses are holding up at a granular level is more indicative of economic future health than the current GDP and unemployment levels.

ISM - Broad manufacturing supply chain health

NFIB - Small business health

UMich - Consumer health

These three indicators all rise and fall with one another because they reflect the same emotions of the business cycle.

Economic Cycle Wayfinder

To clearly visualize the undulations of the real economy, here’s all three our of favorite indicators combined in a roughly weighted average, with NBER technical recessions highlighted in grey. We have drawn our expansion/contraction line of this proprietary metric at around 57:

Takeaways:

Combining all three gives us an economic cycle oscillator using the sentiment of big executives, the average consumer, and entrepreneurs.

Our Wayfinder can give false recession indicators (2012) and can slightly miss recessions (in 2001 the indicator declined but didn’t materially cross our threshold), but it still nails the direction and momentum of the economy—sufficient for identifying shifts in the cycle and times to make a shift in asset allocation (the primary driver of investment returns).

The economy, according to our Wayfinder, is already in recession. In fact, it is weaker than it was during the protracted recession of 2020. Equity markets are certainly reflecting this already, as is the UMich consumer sentiment survey. Manufacturing firms not so much, but look out below over the coming months.

The decline we are experiencing over the past few months is either partly or mostly due to the rapid tightening of financial conditions (higher interest rates, wider credit spreads, stronger dollar), which in turn is due to Fed hikes and expectations of Fed hikes thanks to soaring inflation. While the source of that inflation almost feels like a philosophical debate, the tightening is upon us. Objectively, we are currently experiencing an inflationary economic contraction.

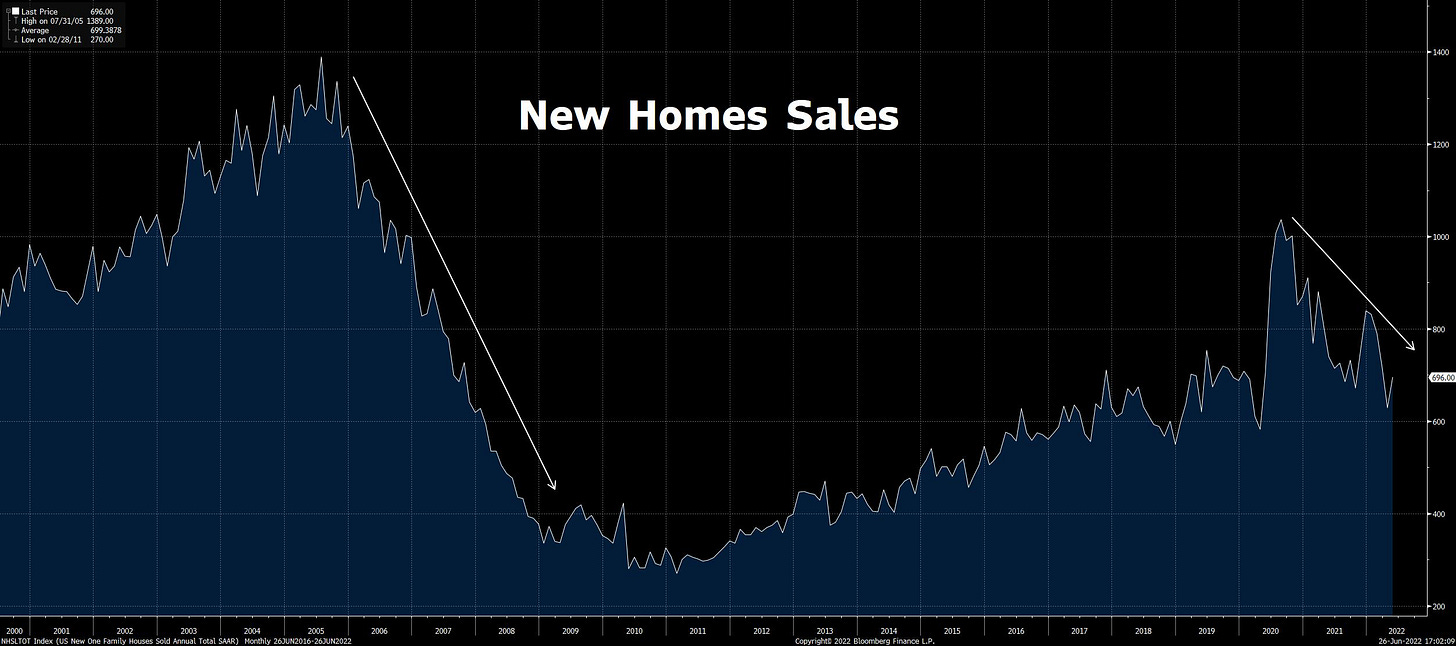

Bonus indicator: housing

The American housing market has an outsized effect on the rest of the economy, and while we do not use any housing data in our Wayfinder, we must glance over at housing to once again confirm or deny our thesis on the economy’s position within the cycle.

Housing is the most interest-rate-sensitive sector of the economy. Mortgage rates have skyrocketed of late and affordability has plummeted. Demand is clearly slowing, but this hasn’t shown up in home price declines—yet. We will keep our eye on all housing data and continue to work through indicators to sift through all the noise. For now, look at declining new home sales. Housing is slowly rolling over:

And one last glance at mortgage rates. Think about the behavioral impact of this spike, and consider that behavior will take months to play out in the real economy. There is more slowing ahead:

Conclusion: economy slowing, but have markets priced in the worst?

The average rate on 30-year mortgages in the US recently crested 6%. Inflation is at 40-year highs. Pandemic assistance, both fiscal and monetary, has left the stage. It’s no wonder that consumer sentiment and small business optimism are in the toilet. But the $100 trillion question is whether equities (and bitcoin) have already priced in the recession. Asset managers are an extremely forward-looking bunch—the intense selling over the past several months is a result of investors identifying what we’ve been writing about here at The Bitcoin Layer: the economy is entering a recession. But these same investors will identify the end of contraction before it occurs and resume risk-taking behavior. And that’s why we watch prices to tell us the story ahead of time. But using economic indicators is an essential part of any investment framework, even one that leads with market price study like ours.

We look forward to continuing the unpacking of our entire global macroeconomic framework for investing. Price study and a cycle-driven approach require an understanding of economic indicators, and filtering out noise can be of extreme value.

Keep asking yourself, where are we in the cycle?

Until next time,

Nik & Joe

This post was sponsored by Voltage, provider of enterprise-grade Bitcoin infrastructure.