Good morning Readers! Welcome to TBL Weekly #118 — grab a coffee, and let’s dive in.

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Weekly Monitor

Weekly Analysis

Last week, the TBL team practiced the art of ‘not staying glued to a screen,’ and let me tell you, it wasn’t easy. An election, economic data releases, Treasury auctions, and an FOMC meeting—this week had it all, and it feels overwhelming to even attempt a one-post digestion of all the new information. Markets themselves are processing something that has now become a reality…the sliver of a chance that the GOP would sweep power is now the American future for at least the next two years. If you have experience watching markets, you might have felt a sea change occur. We ourselves are trying to process it all—our gut reaction is that something enormous has happened. An S&P 500 casually rising above 6,000 and notching 25% gains year after year is signal. Are you listening?

The best way to dissect this week is by looking at our framework, step by step:

Markets and Bitcoin’s Price

TBL Liquidity

US Rates

Fed

Markets and Bitcoin’s Price

Our TBL Pro members are probably sick of seeing this wedge in our Mean Median Mode risk report, but this week marks the exact reason why we have trusted consolidating prices within this wedge. We’ve long held the view that $73,000 was an extremely important marker in addition to the wedge itself, and breaking above them would lead to a momentous bullish run up to $96,000. We obviously expect corrections along the way, but we must again stand by this seemingly all-knowing wedge, which gave us a $23,000 consolidation range for the past 8 months.

We saw the largest daily return in the S&P 500 since November 2022, and a 9% daily return in Bitcoin, which is something that has only happened a few times over the past two years.

It is also worth noting that bitcoin ETFs bought approximately $1.35B worth of bitcoin yesterday, which represents the largest ETF inflow ever—more fuel for this rocket to $96,000.

TBL Liquidity:

Bond volatility experienced a huge drop after a near-term peak in Treasury yields might have occurred right after the election.

You can start to see our TBL liquidity index absorb those huge decreases in the MOVE index. We will talk more about dip-buying points in the Treasury market below, but suffice it to say that money is starting to flow back into Treasuries, which means stronger collateral, which means more liquidity.

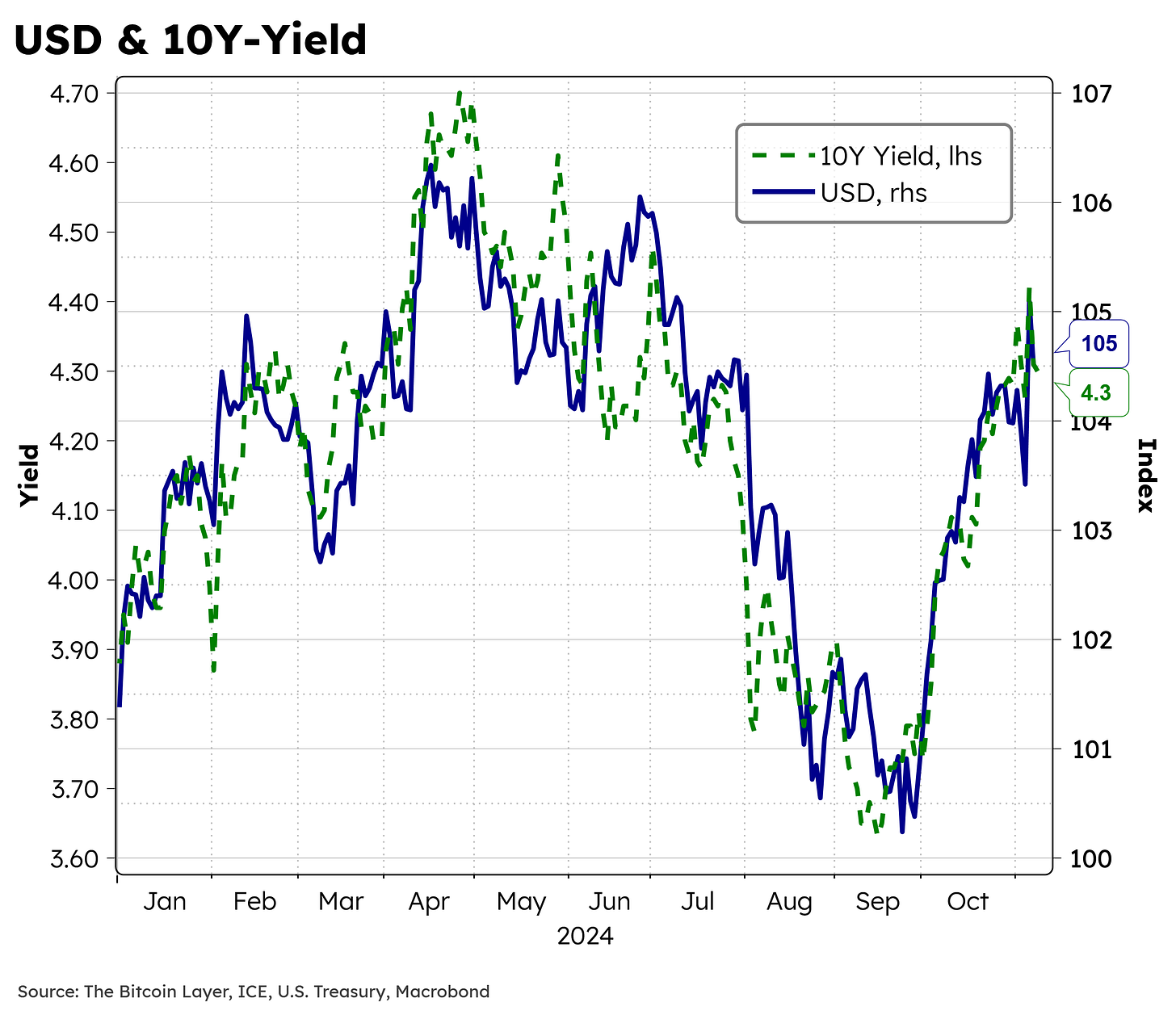

The dynamics that will play out as the Trump administration takes over in just a couple of months are yet to be seen, but we have a strong hunch that this administration will take advantage of the US Treasury reserve asset status and issue debt en masse. Here are some questions we have about Trump’s impact on the dollar and Treasury yields, and we look forward to conversations with experts over the coming months to help us speculate:

Could that send yields higher, therefore driving the dollar higher?

Will tariffs drive the dollar higher?

Will massive dollar supply increases due to Treasury issuance and bank lending weaken the dollar in a GOP effort to make America great again from a manufacturing and competitiveness perspective?

We believe Trump wants cheaper debt (lower yields) and a cheaper dollar (American products more attractive abroad), but there are too many moving parts to pinpoint a thesis yet.

US Rates:

Looking at both 2Y and 10Y Treasuries, we have reached dip-buying levels; 2Y yields have surpassed our resistance area by a thin margin, while 10Y yields continue to fight a long-term resistance trend that spans all the way back to October 2023. As 10Y yields set lower highs, we believe another bull run could be on its way.

The Federal Reserve

Crazy that the Fed meeting was one of the least interesting parts of the week! It cut rates on Thursday.

The following chart showcases an equally weighted average yield that combines 2s, 5s, 10s, and 30s. We stacked this singular yield on top of the Fed Funds rate, and you can start to see a closing gap between reality (market yields) and the Fed’s policy rate.

What does this mean? We are seeing firsthand just how much Powell lags behind the market. During yesterday’s FOMC meeting, there were many attempts at trying to get the Chairman to say anything about the immediate rise in rates after September’s 50 basis-point cut, but he refused to answer—he also refused to answer any Trump-related questions, but that’s a story for another day. Point is, the Fed listens to the market, and right now, much like Michelangelo’s Creation of Adam painting, the Fed’s policy rate is merely a product of the divine Treasury market.

Next Week with Nik

While economic releases and all-time high territory for stocks and bitcoin might be on the minds of many, we will have our eyes and thoughts on the Trump administration’s plans and announcements. In just a few days, we are getting the sense that at least one war could be wrapped up sooner than later due to the change in American leadership, but the more material financial markets driver is what a GOP mandate will bring for the fiscal situation.

Tax cuts will not be met by an according spending cut, which means the deficit will expand. Treasury issuance will expand. The Fed might have to play a different game in 2025 based on changes at the Treasury Department. We also know that tariffs might be destructive to forward inflation, but that won’t change Trump’s desire to affect the relationship between the US and China. He’s not looking to get the cheapest goods, and if he was, he wouldn’t be putting tariffs on imports. Robert Lighthizer is back in the mix, and we’re certain that fairness will be placed before the impact on prices—trade, to Donald Trump, is national security, not economics.

With our focus on the administration’s plans, we’ll look at our TBL Liquidity metric for improvements to see if we can better capture the latest spike in stocks and bitcoin. Bond volatility has had a wild ride in October and November, but the forward expectation for a larger financial system hasn’t shown up on the index because it hasn’t happened yet. This shows the limit of the model and forces us to decompose the run-up in stocks to changes in the spot banking system, forward banking system, rates, and rates volatility. Monday’s report for TBL Pros will have our most comprehensive decomposition and 2025 outlook yet.

In case you missed it: TBL on YouTube

BITCOIN SPECULATORS ARE BACK: Inflows & On-Chain Analysis

In this episode, Nik Bhatia and James from Checkonchain dive deep into Bitcoin's current market landscape, breaking down the driving forces behind Bitcoin's recent volatility. This in-depth analysis covers the role of options trading, the impact of ETF inflows, and the latest on-chain data insights. As speculators return to the market and "hodlers" hold steady, Nik and James discuss how the tug-of-war between short-term traders and long-term investors shapes Bitcoin's price movements. With the upcoming election adding a layer of uncertainty, Nik and James also talk about trading dynamics, discuss market mechanics, and explain why understanding these dynamics is key for bitcoiners today.

Here are some of the key insights:

Volatility Surge with Election: With high uncertainty surrounding the election, speculators have increasingly turned to Bitcoin due to its liquidity and 24/7 trading environment. Options demand has spiked as investors seek ways to place "binary bets" without large losses, leading to a rise in implied volatility.

Strength of Hodlers: Checkmate explains the dynamics of “strong hands” who hold through volatility. Indicators like MVRV (Market Value to Realized Value) show many long-term holders view price pullbacks as buying opportunities, stabilizing the market despite swings.

Options and Institutional Interest: Bitcoin’s options market, now nearly as large as the futures market in open interest, is attracting institutional attention. Checkmate notes that options enable big funds to manage large positions, paving the way for increased institutional allocation in the future.

ETF Inflows and Price Dynamics: Inflows into Bitcoin ETFs signal growing investor interest, yet prices remain balanced due to short positions in futures markets. These dynamics reflect the maturing nature of Bitcoin’s market structure.

Market Resilience and Speculative Shifts: Checkmate predicts increased volatility as speculators re-enter the market and options activity spikes. With strong foundations built by hodlers, Bitcoin is poised to weather significant swings, underscoring its role as both a speculative and enduring asset.

Store Your Bitcoin SECURELY: Multi-Sig & Key Control

In this episode, Nik sits down with Unchained co-founders Dhruv Bansal and Joe Kelly to unpack why Bitcoin security demands a unique approach—far different from traditional financial services. They discuss why bitcoin's structure requires holders to prioritize collaborative custody over standard methods. Dhruv and Joe also provide technical insights behind multi-signature (multi-sig) security, key management, and inheritance planning. The logistical background behind managing your bitcoin illustrates how this asset is reshaping our understanding of security and protection in the world of personal finance.

Here are some of the key insights:

Bitcoin Custody Challenges: Bitcoin’s decentralized design introduces specific risks, especially around key management and the potential for loss through a single point of failure. Self-custody requires technical know-how, which can be challenging for new users or families managing inheritance.

Multisignature Models: Multisig custody solutions offer a middle ground by requiring multiple keys to authorize transactions. This model distributes control, making it harder for any one party to lose or compromise funds, which aligns well with the security preferences of many Bitcoin holders.

Long-Term Asset Protection: For investors thinking about retirement or estate planning, multisig offers added flexibility. Some setups allow holders to retain significant control while having backup options in place, which is particularly relevant for those looking to pass on assets securely.

Risks of Centralized Custody: Centralized custodians can offer convenience but also carry risks, like potential restrictions on access or loss due to hacking. The discussion emphasizes the importance of weighing these risks, especially in a decentralized ecosystem like Bitcoin.

Why Bitcoin $77,000 Is Just The Warm-Up Act

In this episode, Nik analyzes the historic market movements following Bitcoin’s surge to an all-time high of $77,000 amidst Donald Trump’s return to the White House. He explores how the election impacted financial markets, focusing on prediction markets like Polymarket that signaled Trump’s victory early. Nik examines the S&P 500’s reaction, shifts in U.S. Treasury yields, and projections for upcoming tax cuts, deficit spending, and increased liquidity. He wraps up with insights into the U.S. dollar and Trump’s likely fiscal moves, revealing how these shifts could fuel Bitcoin’s next explosive run.

Here are some of the key insights:

Prediction Markets and Election Insights: Platforms like Polymarket successfully predicted Trump’s victory, reflecting market confidence through high-volume, real-time betting. Bhatia highlights how price signals in these markets gave insights into election results even before official tallies.

Treasury Market Adjustments: U.S. Treasury yields rose in response to expectations of increased deficit spending and tax cuts under a Republican-controlled government. Bhatia discusses how these developments could signal higher inflation and growth, with yields aligning closer to Federal Reserve policy rates.

Impact on the U.S. Dollar: Bhatia anticipates a weaker dollar as the Trump administration may prioritize a competitive exchange rate to support growth. He suggests that policy shifts could lead to increased Treasury issuance and sustained borrowing, potentially expanding U.S. bank balance sheets.

Bitcoin’s Breakout and Future Projections: Bitcoin’s rise past $73,000 positions it for a potential climb to $96,000, according to Bhatia’s technical analysis. He notes that Bitcoin’s price is now in “resistance-free territory,” signaling bullish momentum amid the broader macroeconomic landscape.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week dive deep into Donald Trump’s win this past week, as well as the reasons why the Democratic campaign fell short.

Check out TBL Thinks here:

For TBL Pros this week:

Nik also published his TBL Pro weekly letter to start speculating on what a GOP consensus could do to Treasuries and risk assets.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

If treasuries look less attractive than investing in BTC, as its price appreciates, how will this effect US debt and the domino effect in other areas.

when you mention options on Bitcoin, are you referring to options on Bitcoin ETFs?