End of QT is near, Bitcoin ETFs are here

Fed looks to pump the brakes on QT as liquidity risks emerge

Dear readers,

After a two-year campaign to wind down the balance sheet, the Fed has all but confirmed to slow the pace of quantitative tightening to minimize the risk of a liquidity crunch in financial markets, while lengthening the time it can maintain a tightening stance. In the days since December’s FOMC meeting minutes have been released, the market has rebounded off of the Fed’s latest comments that it will not only slow and eventually stop running down its balance sheet, but also plans on one or many 25-bps rate cuts in 2024.

In the Fed’s oxymoronic pursuit of quelling runaway inflation expectations while maintaining loose monetary policy, bitcoin stands primed and ready to benefit from the monetary tomfoolery. The Fed wants to have its cake and eat it too, and the biggest winner may be you.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

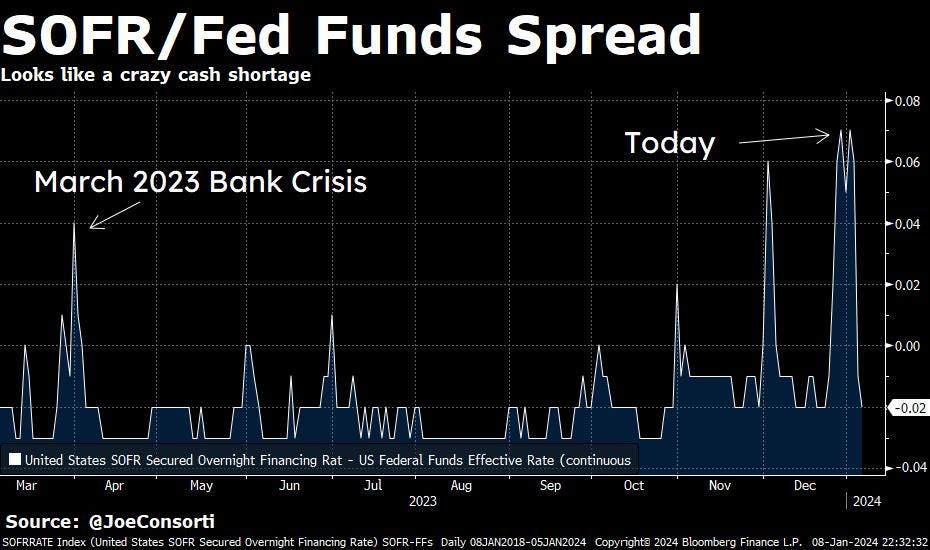

Markets have been the beneficiary of excess liquidity for a little over four years thanks to the Fed’s reversal of policy tightening in September 2019, followed by the unforeseen economic throttling of COVID and the stimulus that succeeded it. Just as we’re on the cusp of entering an era of constrained liquidity, familiar tremors arose around year end in SOFR. The key overnight financing rate in US dollar money markets spiked above Fed Funds into December 31st as well as for a few days after, a dislocation that indicates a cash shortage in overnight lending which also occurred in September 2019 and caused the Fed to blink: