Fed-day recap, inflationary recession?

The Fed hikes rates by a sizable 75 basis points. Markets behave relatively calmly.

Dear readers,

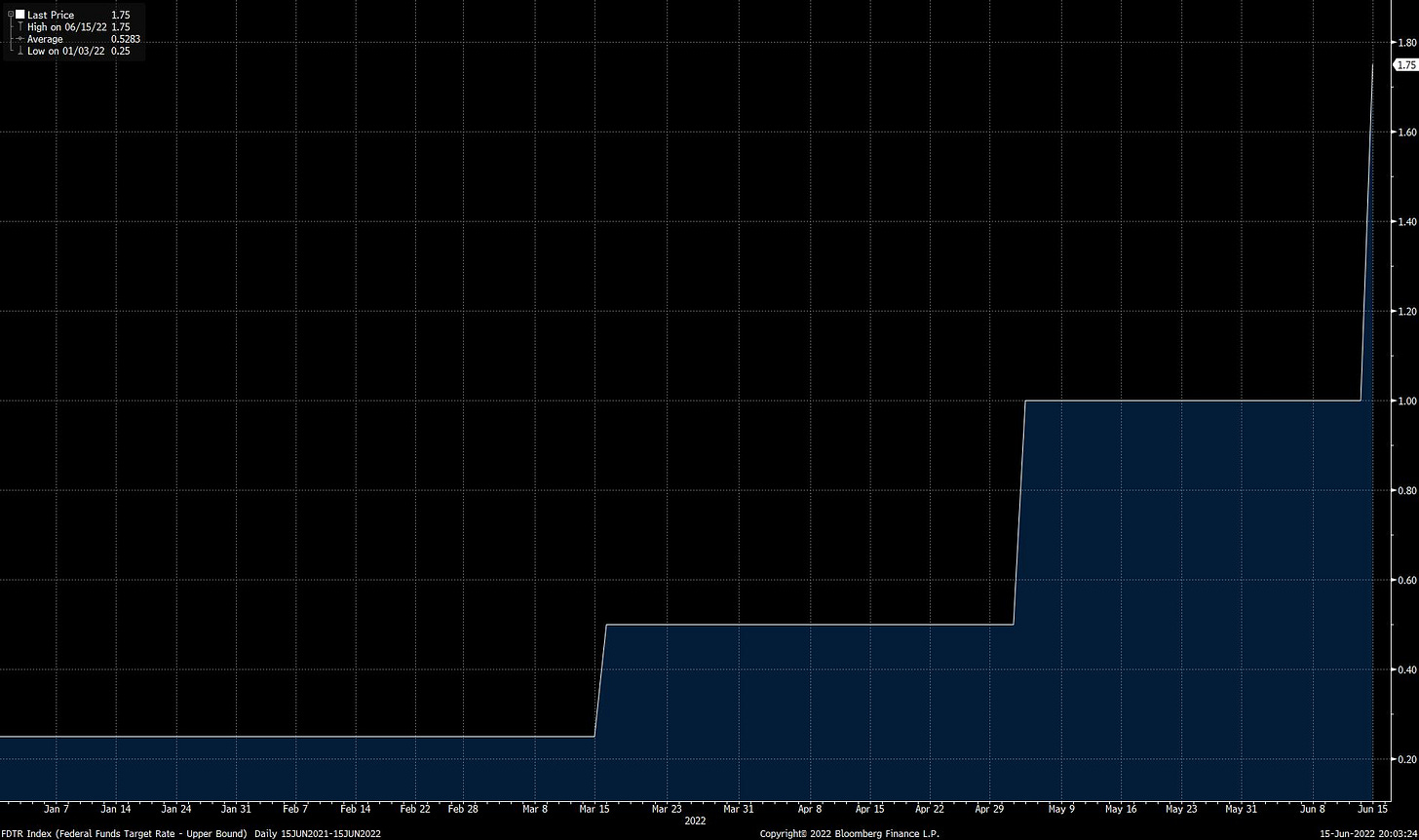

As expected following its leak to the WSJ on Monday, the Fed announced plans to hike its policy rate another 75 basis points, raising the upper bound target rate to 1.75%.

Raising this reference rate lifts rates across the real economy, such as mortgage rates, credit card APY, and corporate borrowing levels—the tightening effects are becoming a reality as the Fed destroys demand to fight inflation.

Tonight, we’ll be doing a quick, bullet-form recap of the markets following today’s Fed hike and set some expectations for the next six weeks until the Fed’s next meeting.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud.

Fed talks, markets respond

The Fed announced a 75 basis point increase of Fed Funds—target range now 1.50-1.75%. This is the steepest single hike since 1994. The current hiking cycle:

The Fed is getting aggressive in its stated objective of normalizing Fed Funds to 3.4% by end of year, and a 3.8% peak rate by next year.

The market-implied policy rate is signaling a peak rate of 3.86% one year from now. Take a look at the parallel shift in policy rate expectations (dotted line represents market expectations as of March 15th versus the green line today).