Fed Finally Pauses, Damage Already Done

FOMC decides to maintain the current policy rate, failing to raise at a meeting for the first time in 14 months. Here's what happened and our most important takeaways.

Dear readers,

At last, the ears of FOMC members heard the cries of inverted yield curves and decided to play along. After a few months of severe inversion, specifically of 2-year yields to Federal Funds, Jerome Powell adheres to the rates market. We break down the actions and words from Fed day, toy with the idea of $50 trillion in unmonetized national debt, and explain why despite the Fed finally waking up to disinflation, economic damage has already occurred.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

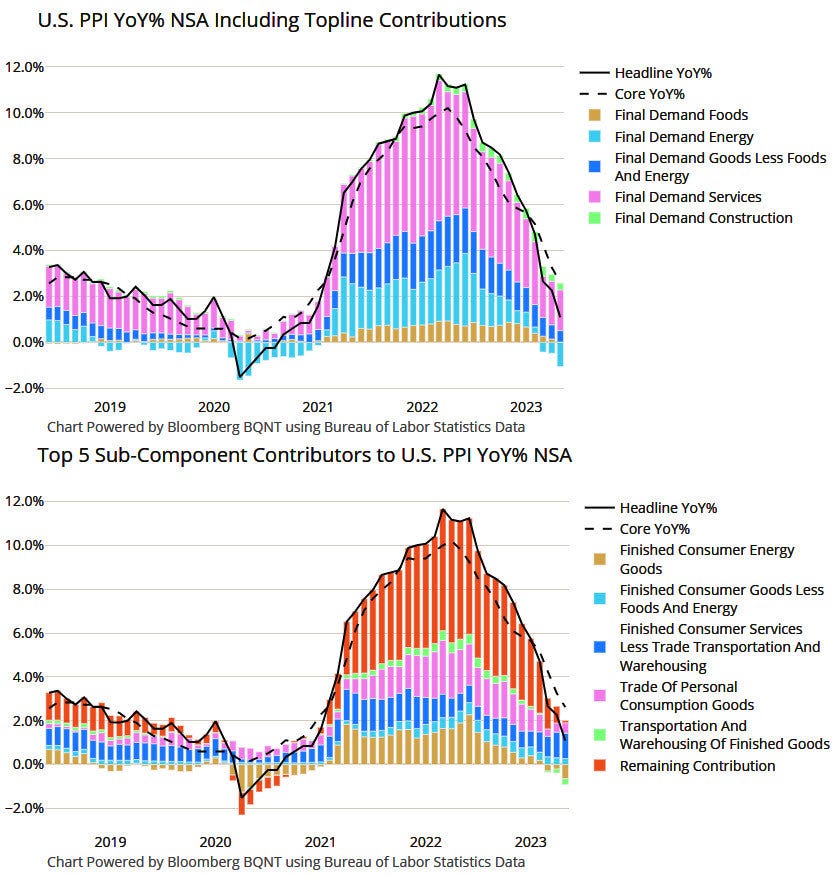

Fed pauses as producer inflation collapses

Before the spotlight hit Powell and his FOMC backup singers, we received both consumer and producer price inflation data series, and each showed disinflationary trends have continued. Take a look at just how fully prices have unwound their spectacular rise in 2021-2022. Calling it as we see it, inflation has left the building:

With the Fed hiking interest rates by 5% over the past 14 months, enough was enough, and if you’d like a single economic data point to explain why, look no further than producer prices. In April 2021, inflation had already showed its hand—PPI registered at 6%. By the end of 2021, PPI had risen to 10%. It peaked at 11%, and now over the past year has utterly collapsed to 1%. A massive wave of inflation, now entirely reversed.

Unfortunately, it’s not that simple, and policymakers look at many more aspects of the economy and of financial markets, including consumer prices, the labor market, and Treasury yields. Policymakers also use a combination of feel, gut, and reputation management, also known as public relations, to enact decisions. In our opinion, the Fed has transitioned to a feel-dependent framework, one in which it knows it has succeeded in slaying inflation by damaging the economy, even when consumer inflation remains at 4%, well above its 2% desired target.