Full Blown Banking Crisis Is Here, Nationalization Underway

Nobody is safe, and the FDIC has already assumed the role of unlimited backstopping of deposits.

Dear readers,

In the hierarchy of money, instruments are ranked. Why it took Americans until 2023 to fully realize this is a longer study, but with Treasury bills and money market funds yielding 4% more than traditional bank deposits, deposit flight became the “rational” financial behavioral impulse, leaving us in the middle of an absolute meltdown of bank equity values. Only a few weeks removed from the failure and FDIC backstop of Silicon Valley Bank, we witnessed yet another similar move in First Republic. Now PacWest, First Horizon, and Western Alliance are begging to join the club. And the only reason the entire financial system isn’t melting down alongside them is the implicit nationalization of the bank deposit as a monetary instrument itself.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Jerome Powell, the egomaniac

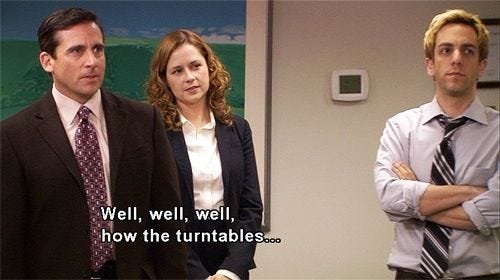

In the words of the great Michael Scott of the Michael Scott Paper Company:

Over the past several months, Jerome Powell has asserted himself, at least in the eyes of the financial media, as the second coming of Paul Volcker—a central banker who viciously sought out the destruction of inflation via the channel of a higher policy rate. But after yesterday’s second consecutive hike into a banking crisis, that Volcker-esque characterization has rapidly shifted to one of narcism, and it happened incredibly quickly.

With several more banks on the brink this week, the crowd is no longer praising aggressive hikes to fight inflation, but instead left wondering just why Powell continues to hike rates while the evidence is clear that US banks are not well. Within hours of its latest hike, at least two more banks had “entered talks,” which is code for “are in the process of failing.” Today, we see that equity prices of larger banks, notably US Bank and Wells Fargo, are also materially underperforming the broader market. And the net result is an investing public horribly confused about why the Fed would accelerate the banking crisis. It hiked in March, days after the crisis began, but jawboned about how everything was fine—“sound and resilient” being Powell’s preferred moniker. Then, despite the fall of First Republic and trouble brewing elsewhere, the Fed went again.

I’ll explain why.