Getting bullish on miner capitulation

Publicly traded bitcoin miners are relatively new. They've never faced a bear market like this. Analyzing current bitcoin mining market dynamics.

Dear readers,

We’ve covered forced selling among many leveraged players in the broader bitcoin ecosystem, but a dynamic you may be less familiar with is the capitulation of publicly traded bitcoin miners. These companies are unplugging inefficient machines, selling bitcoin from their reserves in order to fund operations, and sometimes selling simply to meet margin requirements or make interest payments on loans.

This is taken from Nasdaq-listed Core Scientific’s June 2022 Update:

Bitcoin Sales

During the month of June, the Company sold 7,202 bitcoins at an average price of approximately $23,000 per bitcoin for total proceeds of approximately $167 million. As of June 30, 2022, the Company held 1,959 bitcoins and approximately $132 million in cash on its balance sheet.

Proceeds from bitcoin sales in June were primarily used for payments for ASIC servers, capital investments in additional data center capacity and scheduled repayment of debt. The Company will continue to sell self-mined bitcoins to pay operating expenses, fund growth, retire debt and maintain liquidity.

You read that correctly. Core Scientific announced they'd be selling 7,202 bitcoin, representing 78.6% of their bitcoin holdings to cover capital expenditure as well as financing costs incurred since borrowing against their ASICs heavily in 2021. And Core Scientific is not alone. Public miner capitulation, especially among the heavily debt-financed firms, is setting in after this recent dramatic price drawdown.

Let’s explore the relevant data to examine when and why this takes place, and how the bottom is usually in when miner capitulation has fully exhausted itself.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud

Miner profitability taking a nosedive

Miner revenue per terahash (Th) per day, or hashprice, has steadily decreased since the November top—all the way from a cycle high of $0.42/Th to a mere $0.09/Th at the time of writing.

Hashprice breaks down in every bear market, forcing unprofitable miners to gradually log off as their revenue/Th decreases below their mining cost/Th.

For context—the last time miner profitability was this low was October 25, 2020, when the bitcoin price was $13,000; and we’ve dipped below profitability levels of March 2020 when bitcoin tanked nearly 50% in a single day. The longer this revenue decline occurs, the more likely it is that miners fully capitulate and leave the network. We believe this would mark a bottom for bitcoin, as mining economics would once again be favorable.

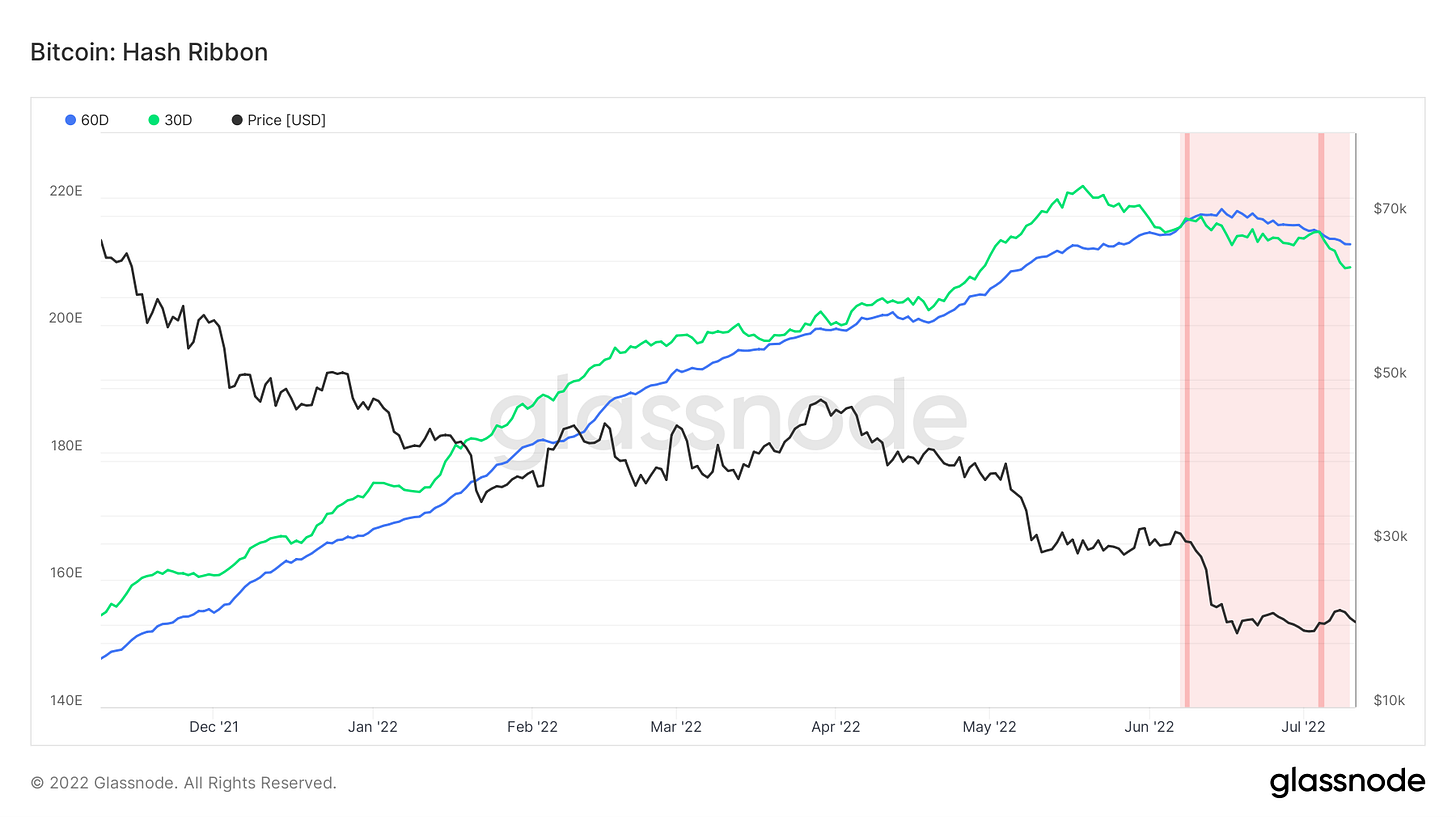

Hash ribbons give us a more accurate sense of this unplugging dynamic, and in the past, hash ribbons have helped us identify that bitcoin reaches a bottom after miner capitulation occurs. Hash ribbons are the red shaded areas created to represent capitulation—hash ribbons occur when the 30-day moving average of hash rate crosses below the 60-day moving average of hash rate.

We can think of these hash ribbons in a behavioral context—a cross of the 30-day below the 60-day means that short-term penchant to mine not only declines, but declines in a way that bucks the trend of more medium-term focused miners. Remember, changes in hash rate precede difficulty adjustments, which materially affect miner economics.