Growing conviction on type of landing

I genuinely heard a leading money manager claim "no landing" last year to a live crowd of retail investors last year. Part of me died inside.

Dear Readers,

I can’t name the manager or event, but it is true. Late last year, to a full room of pre-retirement wealthy retail investors, a portfolio manager said he saw the economy in a no-landing scenario. The cringe was painful, but we stand here half a year later with 4% GDP. Was he correct or wildly irresponsible for such a claim? I’d claim the latter. Today I’ll break down my extremely traditional albeit somewhat out-of-consensus view that 5.5% policy rates are sufficiently restrictive to cause a recession, independent of the path of inflation.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

16 charts to paint the macro picture

Inflation is all anybody can ever talk about. Including us. Inflation is fundamentally a tax. Wages and prices don’t always move together, making inflation an extremely uneven tax. At its root, this is why inflation causes discontent. Here we stand today on the brink of another US election cycle in which the populace might trade one spender for another—the only guarantee we have is that the next four years will be just as fiscally irresponsible. Sure, we have our political preferences and hope to not be subject to the specific brand of intelligence-insulting and anti-bitcoin policies put forth by the incumbent, but that doesn’t mean we are in some delusion that Trump fixes the dollar or the monetary system. Bankers and central bankers are in control, fear not. Now to the markets.

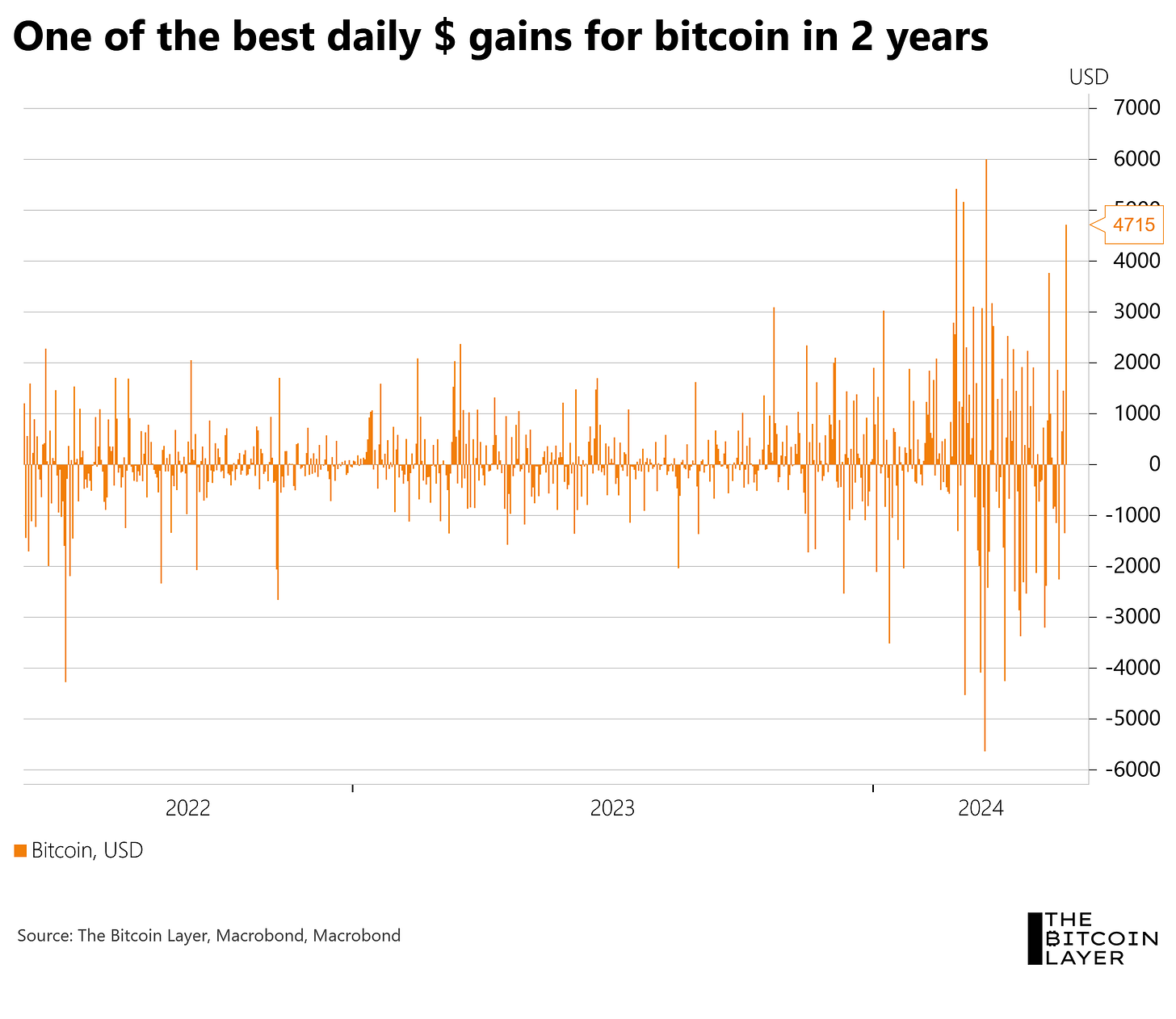

Bitcoin had one of its best days in the past couple of years, and the reasons are quite obvious to us: