Have you recognized this warning sign?

It's not just 10-year yields. Twos and German bunds are also collapsing in yield. Bitcoin trades magnificently.

Dear readers,

Earlier this week, Joe welcomed us all back from the Thanksgiving holiday with a takedown of CZ and Binance. After all, Joe had been banging the table that Binance as it currently existed would succumb to charges of fraud or failure—criminal prosecution was the ultimate route.

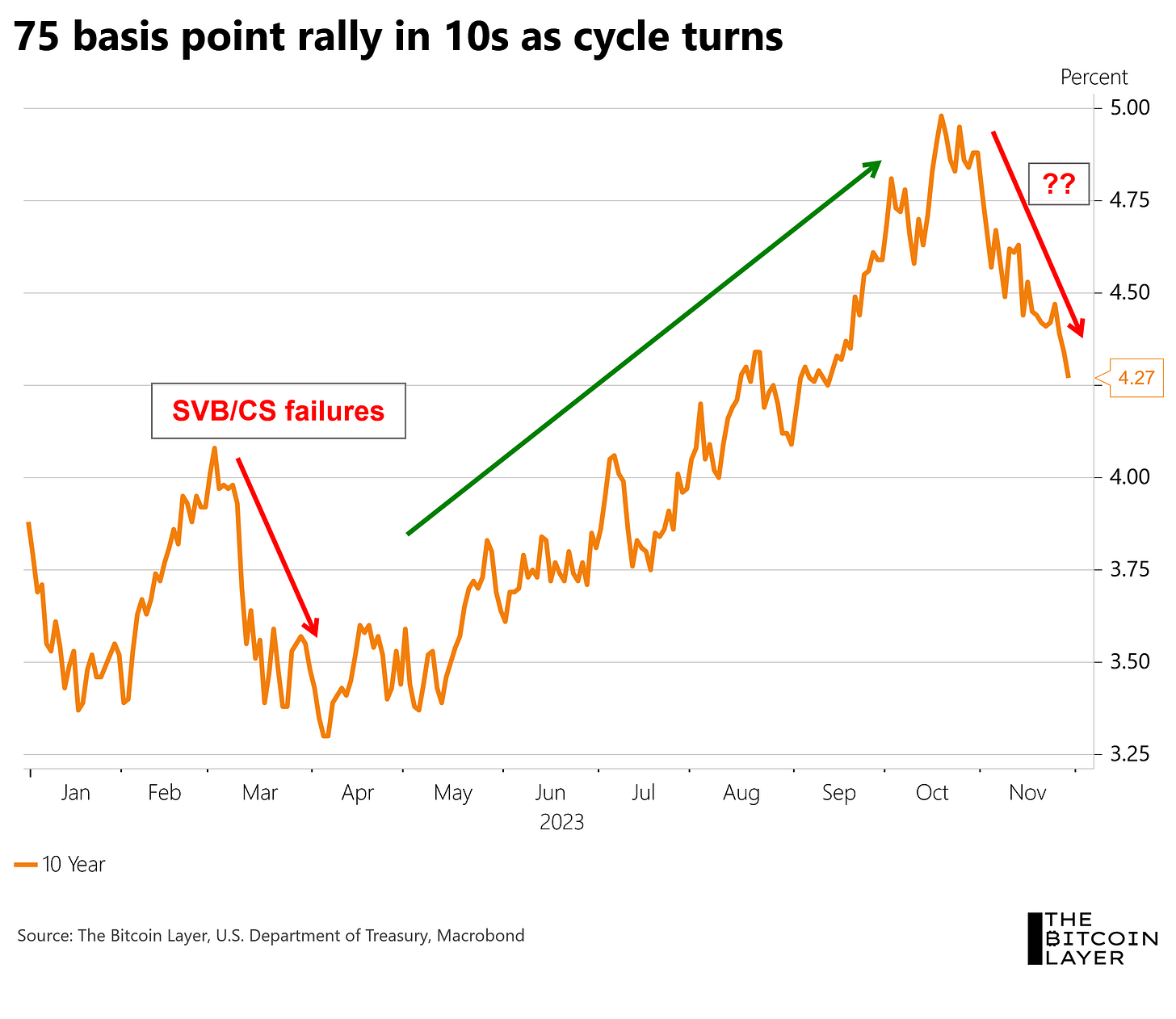

Today, I’d like to take the wheel with a timely chart pack. Momentum in rates shifted in November—a stunning move that has left many speechless. Not this writer: while I easily admit that early calls to a Fed pause and early calls for a rates peak were not my most accurately timed predictions, they were simply early. The Fed has now been on pause for the back half of 2023, and rate cuts are right around the corner. How soon? Again, we might be early, but we won’t be wrong.

Over the last month of the year, Joe and I will continue to provide you with the latest research and analysis in both bitcoin and global rates markets. Readers’ most frequent questions are often answered via this platform—I have a pair of pieces underway on liquidity (following up with more on RRP and China) and on the top economic indicators to watch heading into a 2024 recession that I’m excited for you to read. While we produce a ton of written and video/audio content every week, our Tuesday and Thursday publications—only available to paid subscribers—really drive TBL’s core research. By joining that contingent, you are sending us a signal.

Lately, I’ve been slightly dumbfounded at the speed and strength of the global bond rally—these types of moves often happen right in front of our noses. But when they do, we must recognize them for what they are: a warning sign.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Today’s topics

Global bond rally underway, led by 10-year US Treasuries.

The biggest warning sign, however, is in 2s.

German yields confirm the move.

The US housing market is freezing up.

Bitcoin is setting up for another 100%+ YTD gain in 2024.

A crisis-type move

Part of your own framework must be: March was a preview. With this understanding, you already have insight as to how the market will behave in any crisis, whether protracted or proper. Too much credence is given to the US fiscal position’s influence over interest rates—rates are driven by expectations of growth and inflation which also drive policy rates, which are driven by expectations of the policy rate. What I mean to say: rates are driven by the economy. While many factors, such as the fiscal deficit, supply, and international demand fluctuations, can have an outsized effect and even be the main driver of real rates for an extended period of time, the ultimate determinant is the pace of the global economy. In March, rates collapsed in a short timespan on fears of a banking crisis and credit contraction. In November, rates had a very similar move, but nobody is talking about a crisis—that’s because there is no crisis present. So why the move?