Higher for (not much) longer

Jerome Powell's mission to keep the Fed's policy interest rates high clashes with the funding needs of the federal government, interbank liquidity, and credit market functioning.

Dear readers,

As the end of the hiking cycle draws near, whether February marks the final hike of the cycle or we witness multiple 25 bps increases, the longer stage of higher for longer is about to begin. As the Treasury is faced with record-high interest expense and a wall of maturing debt that needs to be refinanced, it doesn’t seem tenable for government financing to have the same elevated price that the Fed intends to maintain with its suite of policy rates. Despite Jerome Powell’s hawk talk and inflation-busting mission, he may not be able to hold policy rates as high or as long as he’d like.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself.

Create a node in less than 2 minutes, just visit voltage.cloud

Credibility, credibility, credibility

The aggressive policy tightening witnessed since March 2022 can only be described as a desperate attempt by the Federal Reserve to reestablish credibility after originally writing off the sky-high inflation that is now decimating consumers. At the center of this initiative is a man committed to cementing not only the Fed’s reputation as the proverbial adult in the room, but his own.

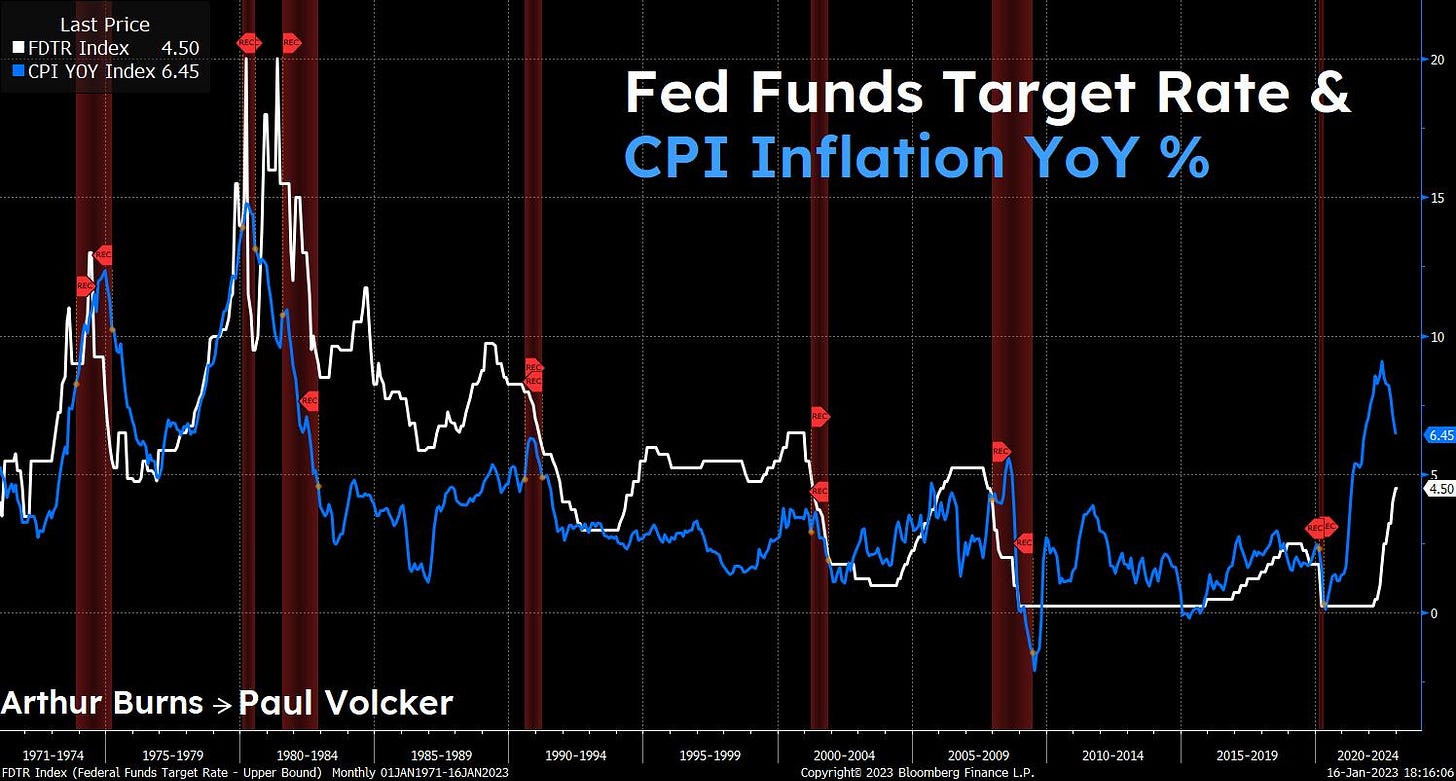

Jerome Powell wants his name echoed in the annals of Fed Chairs alongside the great hawks of Paul Volcker and Arthur Burns. Both of these Fed speakers raised the Federal Funds rate tit-for-tat with CPI inflation; their outright hawkishness and aggressive tightening were so unwavering that they caused three recessions between their combined 16-year tenure. This is what Jerome Powell aspires to.

Powell is 0 for 2. He infamously reversed course on tightening in 2019 after the stock market fell massively in what is now known as “the Powell Pivot” which then turned to rate cuts, balance sheet expansion, and liquidity injections into a dysfunctional repo market. Then throughout 2021, as CPI inflation soared, Powell stated it was “transitory” and failed to tighten policy until it had risen to 7.9% YoY—another infamous remark that has indelibly stained the Fed’s reputation. Simply, inflation that lasts for at least two years should not be considered transitory, even if it’s not entirely cyclical. That’s two strikes. The bases are loaded, and Powell has made the decision to grit his teeth, put his head down, channel his inner Burns & Volcker, raise rates, and keep them there regardless of the financial market fallout and economic recession he may cause.

If rates are kept higher for longer, everybody from Main Street to the halls of power will be disturbed. The federal government may face the highest net interest payments ever, interbank liquidity may dry up to critical levels, and credit markets may cease properly functioning.

The federal-government-sized elephant in the room

Rates cannot be kept at elevated levels lest they wreak havoc on the United States’ debt burden. Government interest outlays, the payments it makes to lenders on outstanding debt, have rocketed past $736 billion as of Q2 2022: