Higher rates, bitcoin on the cusp: TBL Weekly #116

Good morning Readers! Welcome to TBL Weekly #116 — grab a coffee, and let’s dive in.

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Weekly Macro Monitor

Weekly Analysis

At TBL, US rates lie at the center of every analysis. This past week, 10-year US Treasuries experienced an enormous selloff as we approach the election. Importantly, the Treasury will release its financing estimates for the current quarter this coming Monday, October 28th (yes…QRA is here already), and Wednesday will bring an announcement for coupon auction sizes, as well as future issuance guidance. Quarterly refunding announcements are material to all financial markets—as the Treasury issues more or less debt, as well as more or less long-term debt, markets react. This is because more long-term debt coming to market needs to be attractive to investors, who end up demanding a “term premium,” or a premium for lending money to the government for so long. When Treasuries are scarce, the term premium disappears. But that can only last for so long, especially with the US’ current fiscal situation (dumpster fire).

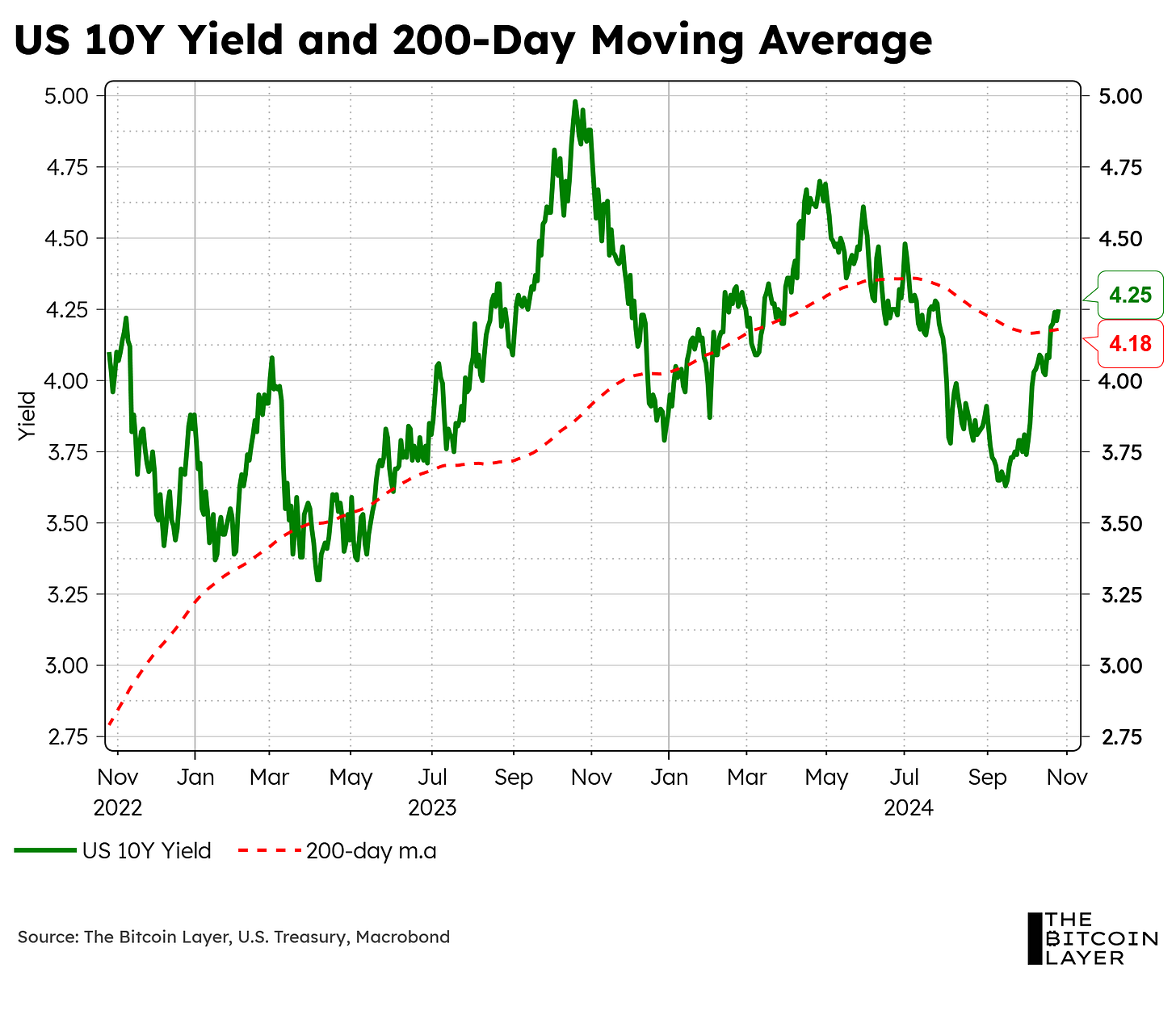

Our current bearish economic outlook lies in labor markets and the real estate sector. Real estate is back under pressure as this past week saw growing sell pressures for 10s as we extended our ascend to the 200-day moving average support.

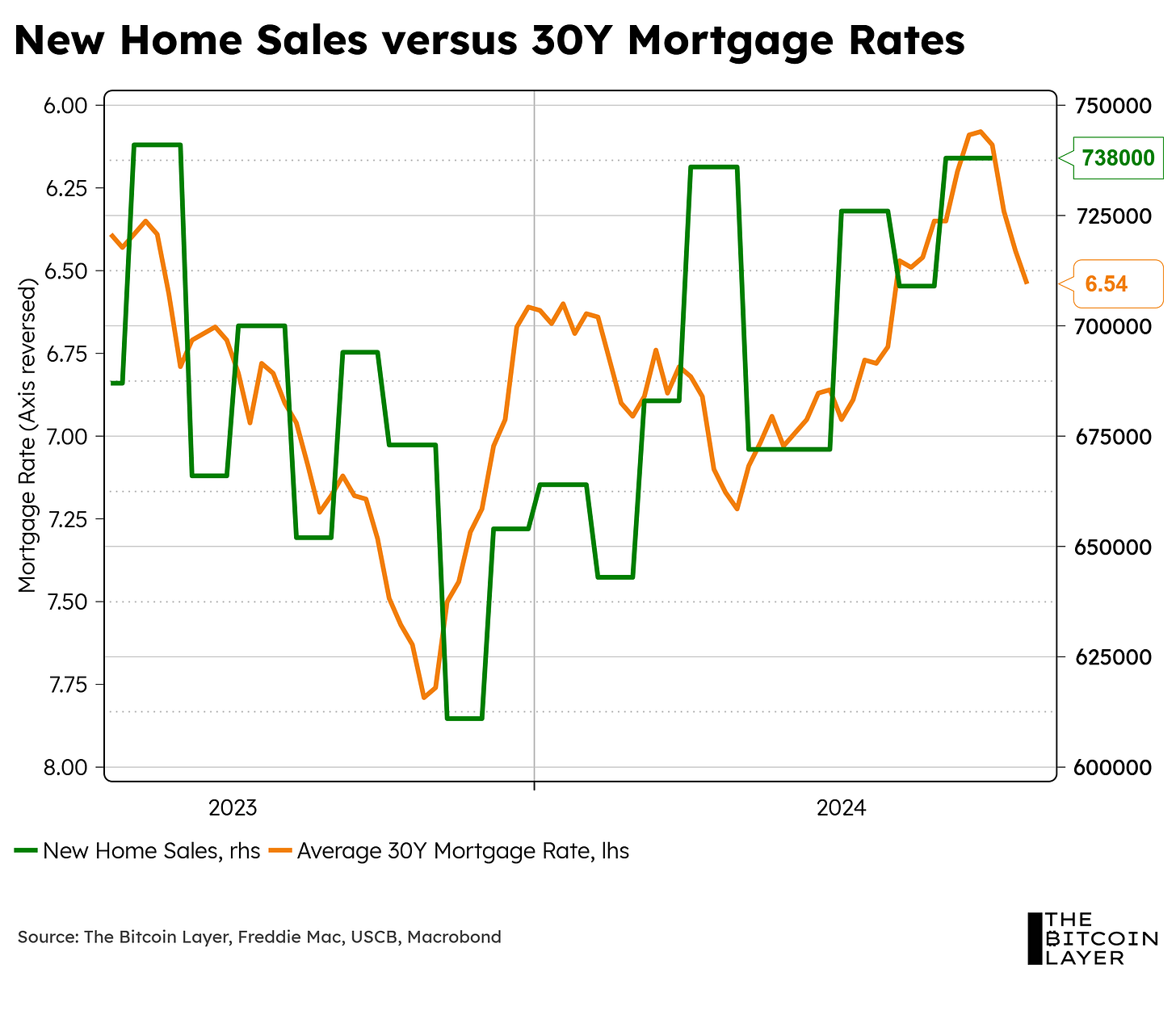

With these mounting sell-off pressures on 10s, yields on mortgages also rose materially. Home sales, which have tracked mortgage rates closely, will slow at the margin due to this week’s price action alone.

As higher risk-free rates begin bleeding into every financial valuation model out there, we reasonably saw some pullback on equities after their seemingly never-ending winning record since September. In fact, looking at the daily changes in the S&P 500, Wednesday came in as one of the worst days of the past two months.

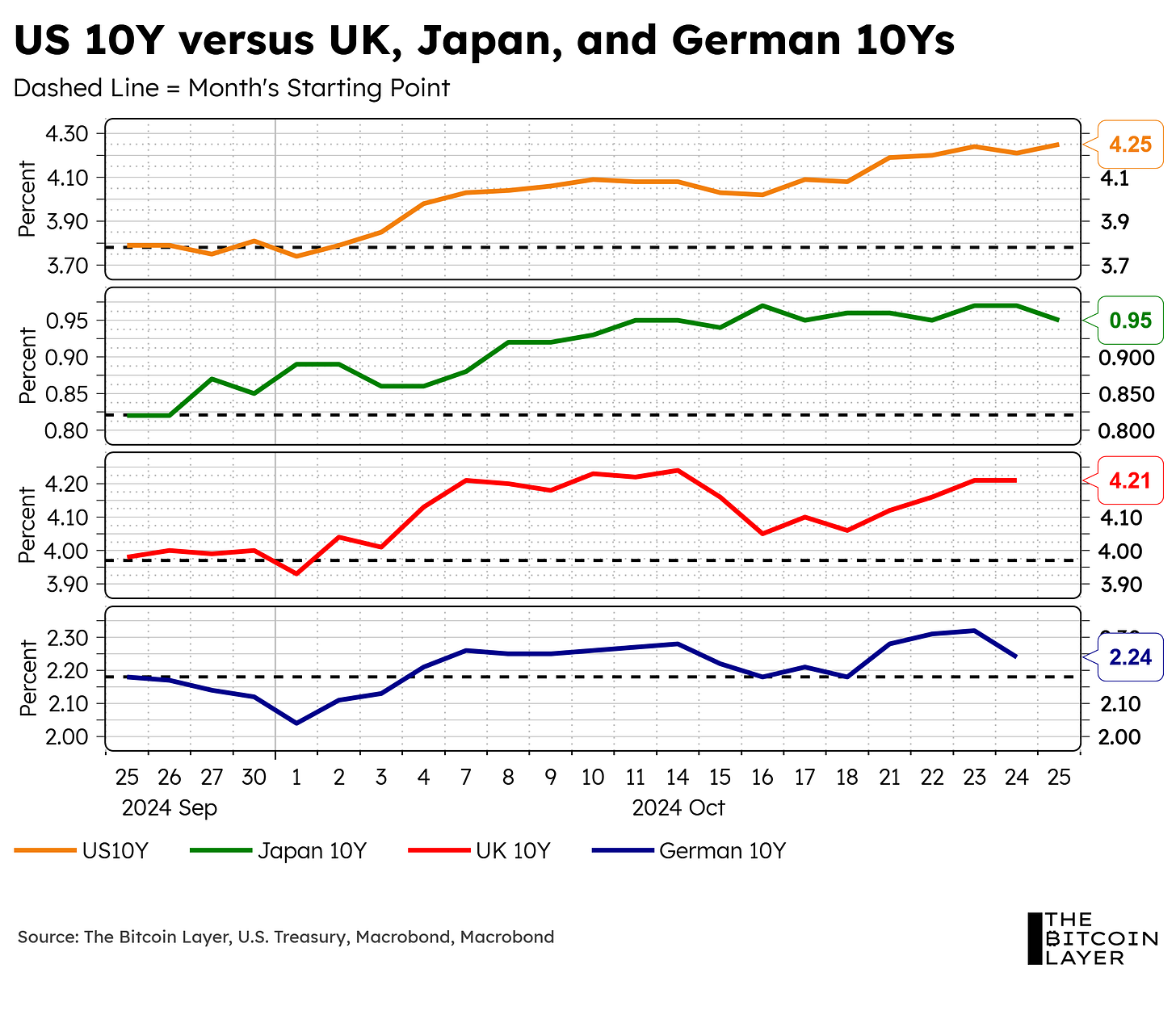

The effects of higher US benchmark rates were also felt at the international level, with bonds all across the board extending losses. A global consolidation in government bonds was expected after such an extreme summer rally, but will buyers emerge now that profit-taking is complete and the election’s result is perhaps priced in?

Across FOMC board members, we’ve started to detect some (relatively) hawkish talk to slow down the pace of cuts given resilience on spot economic data. One thing we’d like to add regarding this hawkish narrative is that 2024 has been a year of data dependency (for both markets and the Fed). Just look at the following chart:

In Q2 (where the first dashed vertical line lies—from left to right), we saw four consecutive months of a rising unemployment rate, which had markets and the Fed panicking about having potentially overtightened. As a result, 10-year yields began their descent. Then, August and September (second dashed vertical line) saw a decline in unemployment, which has now flipped sentiment into ‘the Fed cut pre-maturely.’ Consequently, 10s bottomed. All this to say, at TBL, we remain data dependent, as markets have throughout the year—who knows, we might get a bad unemployment print on Friday next week and markets we’ll be back in panic mode.

We also saw some major drawdowns in the tech-heavy NASDAQ last week, as 10s crossed solidly above their 200-day moving average to reach one of TBL’s key swing levels of 4.25%. This level brought about dip-buyers, but despite the support at 4.25%, yields still proved too high for tech equities to handle in the short term, and so a sell-off occurred. In short, Treasuries and equities were briefly selling off simultaneously, which is why we saw the slightest uptick in what is now a negative 3-month rolling correlation between 10s and the Nasdaq (yes, you’ll have to squint to see it, but welcome to our lives).

Another major thing worth noting from last week, given all these bond sell-offs, one of TBL liquidity’s key components—the MOVE Index—reached its highest level since December 2023. Treasuries must find buyers here or else the market might get sloppy.

Going back to our main pillars of economic bearishness (labor and real estate), we saw jobless claims and housing data on Thursday. To start, initial jobless claims ticked down, but continuing jobless claims climbed to multi-year highs as people under claims find it difficult to get back into the workforce. Moving to real estate, new home sales came in hotter than expected as the pain from higher 10-year yields (which drive mortgage rates—look at the chart below) is yet to be felt.

Lastly, although we prefer and use ISM services and manufacturing as the foundation of our framework, this week’s S&P PMI prints provided a peek at what we can expect. As per the common theme these days: manufacturing weak and services strong.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your bitcoin and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

In case you missed it: TBL on YouTube

Bitcoin ETFs: The Death Knell for Crypto VC?

In this episode, Galaxy's head of research Alex Thorn helps Nik unpack the evolving landscape of crypto venture capital and Bitcoin's unique position in today's market. They discuss how, despite Bitcoin's impressive price recovery, VC funding in the broader crypto space is drying up, highlighting a significant shift in investment trends. Alex explains the growing interest in Bitcoin ETFs and what this tells us about changing institutional sentiment, as major players like pension funds now have easier access to Bitcoin exposure. The conversation explores the emergence of a "barbell market" in crypto, with Bitcoin representing long-term value on one end and meme coins dominating speculative trading on the other, leaving little room for traditional VC-backed projects. Nik and Alex also touch on the importance of Satoshi's anonymity following a recent documentary and discuss how factors like rising interest rates and stablecoin demand are reshaping the market landscape. Throughout the episode, the focus remains on Bitcoin's growing divergence from other cryptocurrencies, both in performance and investor perception.

Here are some of the key insights:

Crypto venture capital investment has seen a dramatic decline, dropping to less than $2 billion per quarter in Q3 2023 from $8-12 billion quarterly during 2021-2022, despite Bitcoin's recent price increase – a departure from their historical correlation.

The downturn in crypto VC funding can be attributed to multiple factors, including rising interest rates, losses from failed crypto startups, and institutional investors shifting their focus toward Bitcoin ETFs as a more direct investment route.

The current crypto VC market is displaying a "barbell market" structure, with strong interest concentrated in Bitcoin at one end and meme coins at the other, leaving limited space for traditional VC investments in the middle ground.

Introduction of Bitcoin ETFs has created a more straightforward path for institutional investors to gain crypto market exposure, potentially reducing the historical role of VC investments as a proxy for crypto market participation.

Recent market indicators show high borrowing rates for stablecoins, suggesting increased demand for leverage in crypto investments, particularly in Bitcoin, while discussions about Satoshi Nakamoto's identity continue to miss the point about anonymity.

Treasury Freefall: What Surging Yields Mean for Bitcoin, Gold, and Markets

In this global macro update, Nik covers the Treasury market selloff and its impact on global markets. With U.S. Treasury yields hitting new highs, driven by fiscal concerns, strong economic data, and political uncertainty, Nik explains what this means for Bitcoin, risk assets, and the broader economy. He also discusses key levels in the bond market, S&P 500, Bitcoin, gold, and the dollar, while examining the role of fiscal deficits and Fed policy. As Trump’s return to the White House looms, Nik highlights the risks to watch in the months ahead.

Here are some of the key insights:

Treasury yields have experienced significant movement, with 2-year yields returning to approximately 4% from previous 3.5% lows, while markets are pricing in multiple Fed rate cuts over the next six months.

A notable shift has occurred in market correlations, where rates and stocks are now moving in tandem, contrasting with their previous inverse relationship during 2022-2023, marking a fundamental change in market dynamics.

Market signals, including Treasury movements and prediction markets, suggest a potential Trump return to the White House, which could lead to increased deficits and tax cuts, though rising 10-year Treasury yields above key resistance levels could pose significant market risks.

Gold continues to demonstrate strong bullish momentum, supporting Nik's earlier prediction of reaching $3,000, driven by robust global demand, while Bitcoin shows a technical breakout above its descending trendline on weekly charts.

However, Bitcoin's breakout is described as minimal and requires further confirmation and validation over time, suggesting a cautious approach to interpreting this technical signal.

Global Macro Update: Treasury Yields Hit 4.25% & Bitcoin’s Path Amid Rising Market Fear

In this episode, Nik delivers a global macro update covering the economy and every asset class. He analyzes Bitcoin’s performance versus Ethereum as ETH faces steep declines and unpacks TBL Liquidity, focusing on key indicators like 10-year Treasuries, real yields, inflation breakevens, and the 2s10s curve, while highlighting the MOVE index as a sign of rising market fear of inflation. Nik then explores the impact of spiking mortgage yields, the Fed’s balance sheet, QT, and the ongoing RRP decline. Wrapping up, he explains how the upcoming election won’t necessarily affect the debt-to-GDP ratio or inflationary pressures in the months ahead.

Here are some of the key insights:

Bitcoin is showing mixed signals with a brief breakout above its descending trend line followed by a retreat, though its market dominance over Ethereum has significantly increased from 2x to 4.3x, while the treasury market raises concerns as 10-year yields reach the critical 4.25% resistance level amid increased bond volatility.

Markets are adjusting to potential political changes, pricing in expectations of a Trump presidency that could bring tax cuts, higher deficits, and increased tariffs, while the labor market shows concerning signs with continuing jobless claims reaching a new cycle high of 1.9 million.

The TBL Liquidity metric, while indicating generally easy financial conditions, is showing a decline due to bond volatility, just as the Federal Reserve's reverse repo program suggests an earlier-than-expected end to quantitative tightening (QT).

The U.S. debt-to-GDP ratio has reached approximately 120%, leading to suggestions that higher inflation might be necessary for effective debt management.

The Federal Reserve appears to be shifting its monetary policy approach, with the declining reverse repo program potentially signaling a transition from QT to what could be a new form of quantitative easing (QE).

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we covered the struggles that Boeing and Intel—two superpowers in US manufacturing—are currently going through, the IMF’s concerns about a global $100T debt bomb, and TD’s money-laundering scandal.

Check out TBL Thinks here:

TBL Thinks: Boeing & Intel Crises, $100 Trillion Public Debt, and TD's Money Laundering Shenanigans

What TBL Pro Is Reading

Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Nik also published his weekly letter, "What does the GOP actually mean for bitcoin? Applying for a loan: ETFs or self-custody?” where he discusses the influence that politics has on bitcoin (and why TBL has closely followed this upcoming election), as well as the careful approach one should take when considering using bitcoin as an asset to prove your credit-worthiness in this fiat system.

Read more by going TBL Pro.

Exclusive content: access to the weekly "Mean, Median, Mode" risk report

More in-depth analysis not available in free content

Timely information for assisting in investment decisions

Monthly Q&A sessions with the team

Community access to a network of like-minded Bitcoin investors

Full access to our proprietary metric TBL Liquidity

Next Week with Nik

We finally get back to top-tier economic data next week, with unemployment on Friday as well as JOLTS earlier in the week. With the election only days away now, market participants will mostly be concerned with any indication there, but the Treasury’s announcement has the potential to move the needle as the quantity of duration will matter for markets, which must absorb all that new risk in the Fed’s absence. We’ll also see a month-end repo market to gauge if reserves are scarce or just not available in all the right places at all the right times.

Finally, bitcoin’s price couldn’t possibly be at a more dramatic level heading into some large market-moving news over the next couple weeks. It continues to display lackluster price action at the key resistance areas, leading us to lean on hope rather than the tape for a true breakout. It’s one of those things where you’ll know it when you see it.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.