Is Bitcoin Overheating? Is the recession watch over? TBL Weekly #119

Good morning Readers! Welcome to TBL Weekly #119 — grab a coffee, and let’s dive in.

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Weekly Monitor

Weekly Analysis

After nearly a year of bitcoin consolidation (which seemed like an eternity for some of us), new all-time highs are not something the newest cohort of buyers is used to. Over the past year, we have spent so much of our time dollar-cost-averaging that we’ve forgotten what it’s like to live through a bull run. Rightfully, then, we’ve put ourselves in the shoes of a new bitcoiner who has one main question that, admittedly, even we are asking ourselves: is bitcoin overheated?

In doing so, we will take a look at:

Bitcoin’s price and some on-chain metrics.

TBL Liquidity

Bitcoin’s correlation to equities

US rates’ key levels

Fed and economic expectations

Bitcoin:

Let us first start with our beloved wedge (yes…even though it has resolved, it’s important context for the current move). As you can see from the chart, we are currently a 10% gain away from our price target of $96,000 and practically achieved it in intraday price action. As mentioned last week, it was reasonable to assume that some healthy pull-backs would take place during this run-up—profit-taking is inevitable. Thus, we saw some sellers on Thursday that made our initial stay at $90,000 short-lived. Regardless of this pullback, buyers managed to stack some more sats to close out the week above $90,000. Something worth noting here is the time period over which this graph is drawn. Having three years’ worth of data makes it difficult to know whether this current parabolic wave to $90,000+ is an outsized return or not—remember, we are trying to figure out whether bitcoin is overheated. For better context, we turn to the log chart:

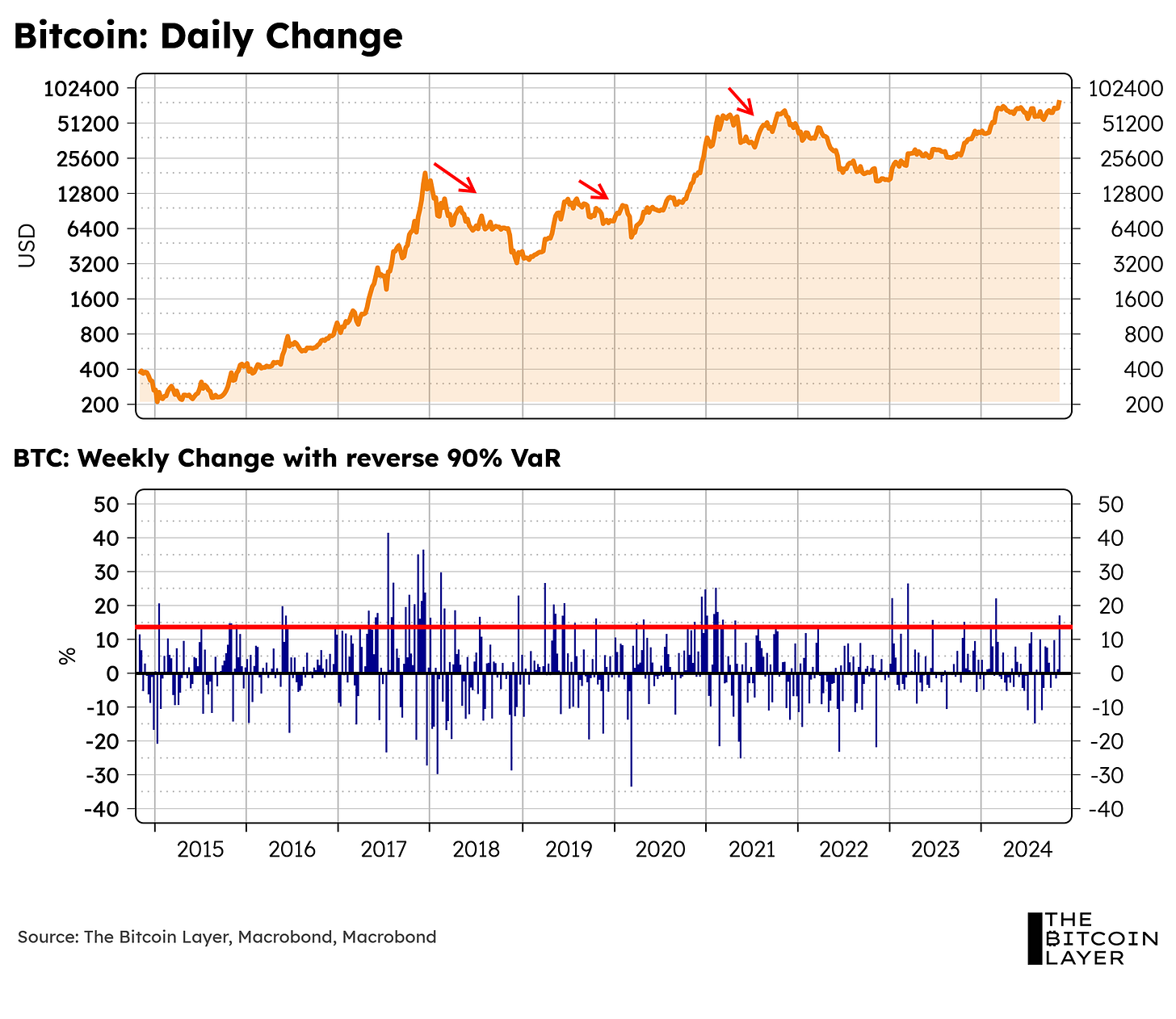

The chart above shows 10 years of data, log-scaling bitcoin’s price. Log-scaling allows us to compare prices in relative terms so we can visualize how today’s run-up compares to historical price movements. Are you able to see the current run to $90,000 all the way to the right? Try squinting your eyes a little more. All we are trying to point out here is that we have seen much greater bull runs in the past.

Now, when looking at the second pane of the chart above, you can also see bitcoin’s weekly changes, as well as a horizontal line drawn at a 13.6%-gain mark. Over the past 10 years, we have had 52 weeks where the weekly return touched (or surpassed) the 13.6% mark. We want you to take a look at what happens to bitcoin’s price during times when we see a cluster of tall vertical lines surpassing this horizontal red line (in other words, look at bitcoin’s price soon after groupings of tall blue lines). Do you see it? That’s right, bitcoin becomes overheated, and then price subsequently falls. The takeaway: watch this chart for the cluster to appear for a warning sign. Currently, we don’t see one.

As of late 2024, we only have a single “outsized returns” week, but no sign of groupings just yet. It’s worth noting here that this is a historical statistical model, and we are extrapolating historical patterns into the future, so take this model with a grain of salt. That being said, this does not necessarily scream “bitcoin is overheated!”

Now, let’s move on to short-term holder and long-term holder MVRV values. Currently, short-term holders lie at levels not seen since March of this year.

All of their coins are, on average, 26% above the cost of acquisition. Historically, levels above 1.4 start tempting profit-taking (i.e., market tops). Thus, doing some quick math, if the current short-term holder realized price lies at approximately $70,000, and we are wary of a 1.4 MVRV, that would give us a price target of $98,000—I guess $96,000 is in context.

Looking at long-term holders, on the other hand, an MVRV level of 4 in 2021 was followed by a fall in price, but long-term holders simply cannot be characterized as profit takers unless we get to extreme levels (9 or above).

Regardless, playing the conservative game by placing faith in the 4X level would give us a target price to watch of about $99,000 per coin. So, again, no signs of overheating just yet.

TBL Liquidity:

Despite some increases in bond volatility at the start of the week (which pushed liquidity lower), the MOVE index continued its path downward from yearly highs to close off the week.

If you look at the month just past, you see just how closely risk assets have followed TBL Liquidity. November’s overall fall in bond volatility has led to a rise in both liquidity and equities.

What does this have to do with bitcoin? Bitcoin’s current 3-month rolling correlation with equities lies at nearly 50%—the highest it’s been since early 2023; this means that any moves that happen to liquidity that in turn affect equities are likely to affect bitcoin in a similar fashion.

After a period of relatively volatile bonds over the past month, the worst of the restrictive conditions might be behind us, although with the new administration, all bets are off in terms of what to expect from Treasuries.

Fed and US Rates:

In an interview this week with Yardeni researcher (and former repo trader at the Fed) Eric Wallerstein, Nik discussed the importance that the Fed places on repo markets (if you thought Nik was obsessed about repo, wait ‘til you hear what the analyst has to say about how closely the Fed watches this stuff).

This past week, we saw the 30Y yield cross above the Fed Funds mid-target rate briefly for the first time in 2 years. What does this mean? Well, the cost of financing is no longer higher than the yield that assets bring—that is, no more negative carry on these assets. This could bring in buyers to hold Treasuries again, creating some price resistance at the back end of the curve.

Now, although the Fed is looking at this, they are also looking at the rest of the curve and where it stands in relation to its target. So far, it is only 30s that lie close to the target rate, while the rest are at least 20 basis points below it.

This, by itself, is reason for a December cut. But the market has eliminated much of the probability for one. We are asking ourselves why.

After last week’s sticky inflation data (both in CPI and PPI), as well as many data revisions upward for retail sales, the market is starting to flip a coin on cut expectations (…yet again). There is the inflation explanation, but there also might be a hidden one on financial conditions.

We have been on recession watch since the middle of the hiking cycle, but a longer-term narrative is starting to evolve now that we are at the end of 2024 with no recession in sight. Here is a summary of our evolving view:

The recession we were watching for was really a credit crisis, and it happened already in March 2023 with Silicon Valley Bank’s failure and unlimited deposit insurance bailout from the US government via the FDIC (and Treasury).

Going from 0% rates to 5% restricts some borrowers, but it is having a positive impact on investment impulses—there was a hoarding of capital with low rates that is being reversed, as well as an enormous segment of the economy well positioned to handle rates where they are.

The increase in the unemployment rate and decline in quits over the past year have been persistent. Might those trends be over?

Technology-led equities and profits margins are making the stock market an untouchable asset class. AI is driving cost savings to a degree we never thought possible on the labor front, while it is spurring an investment wave in the semiconductor and compute arena that the world has never seen before. This is not to mention the infrastructure needs of the US to support this wave, something that Luke Gromen had us obsessing over earlier this year.

MAGA legislation is going to include a lot of new credit for American projects, and we see Treasury issuance coupled with tax cuts to match. New money galore. It’s hard to not be bullish on nominal growth given what we saw in 2021 and 2022.

Housing slowdown isn’t moving the needle. Existing home sales are at very depressed levels, but GDP is coming along just fine. It’s just very difficult to find the recessionary impulses that push the economy down when so many factors are driving the boom.

With all of this recession-cancellation discussion, weighing the impact of higher growth, possibly higher policy rates, political influence on the Fed to lower rates, Treasury policy around deficits becomes a tall task. We are doing our best here to stay afloat, and it would be amateur of us not to recognize the enormous market shifts. Drawing narratives is tough, but we will eventually come around to the proper explanation as markets battle their support and resistance levels from now until the new administration gets going on policy. Do not miss our conversation with Eric Wallerstein if you are curious about the bullish economy outlook.

Much like TBL, the Fed is also dialing back the recessionary worries that we’ve had on for the past two years. The US economy has largely switched from a manufacturing machine to a services engine, and ISM services has proven resilient throughout our recession watch. What’s more, the US labor market lies pretty much at full employment (notwithstanding frictional unemployment). This soft-landing scenario is, in fact, what has created coin flips on cuts over the past two FOMC meetings—and now the upcoming one. Growth expectations are as good for equities as they are for bitcoin, so even a pause in cuts could be bullish for bitcoin.

All in all, $96,000 bitcoin is still our target. We simply can’t seem to find a solid reason to believe that we are in an overheated bitcoin bull run just yet. We also don’t feel that $96,000 is the last stop. Buy your spouse something nice for $100k!

In case you missed it: TBL on YouTube

The Math Behind Bitcoin's Move to $96,000

In this video, Nik discusses bitcoin's recent path to all-time highs as it surges above $85,000. Nik breaks down why his technical analysis points to $96,000 as the next major target. Bitcoin's exit from a $23,000 consolidation funnel has pushed its current market cap up to $1.5 trillion, and Nik dives into what it means for bitcoin to approach 2% of the value of total global equities. He also discusses traditional markets and explains why money market parity suggests a potential upside to $300,000. Lastly, given this historic move, Nik also discusses halving cycles and probability-weighted targets to deliver a more comprehensive analysis.

Here are some of the key insights:

Technical Breakout to $96,000: Using a simple yet effective technical analysis method, Nik identifies Bitcoin’s consolidation range of $23,000 and projects a short-term price target of $96,000. He emphasizes the significance of Bitcoin’s move into “resistance-free territory.”

Election Results and Fiscal Policy: The GOP’s electoral mandate is expected to lead to tax cuts and deficit expansion. Nik notes how these policies could shape market dynamics, influencing both Treasury yields and Bitcoin’s macroeconomic appeal.

Bitcoin as Free Speech: Nik underscores Bitcoin’s alignment with First Amendment principles, framing it as both a tool of financial freedom and a nonpartisan expression of digital rights.

Nationalist Economic Agendas: Anticipated government-backed lending programs for domestic businesses could spur credit expansion, indirectly supporting Bitcoin through broader financial market liquidity.

Strategic Reserve Possibility: Nik speculates on the likelihood of a U.S. Bitcoin strategic reserve, which could trigger unprecedented FOMO among global nations, further accelerating adoption.

Cyclical Price Patterns: Consistent halving cycle trends suggest Bitcoin’s 2024 halving will lead to another parabolic move, making it the fourth consecutive cycle to align with this pattern.

Fair Value and Long-Term Potential: Nik compares Bitcoin’s current market cap to the U.S. money markets ($6 trillion) and gold ($17 trillion), estimating fair value at $300,000 to $800,000 over the next several years.

Building a U.S. Strategic Bitcoin Reserve: A New Era in Bitcoin Policy

In this episode, Nik welcomes David Zell, co-founder of the Bitcoin Policy Institute, to analyze the shifting tides in Bitcoin policy and the regulatory challenges posed by Operation Choke Point 2.0. As the post-election landscape evolves, David shares what these changes mean for Bitcoin advocacy, the institute’s strategy with lawmakers, and the push for Ross Ulbricht’s freedom as part of broader policy shifts. He and Nik discuss a Strategic Bitcoin Reserve (SBR) as a priority for the new administration, its potential to align government incentives with Bitcoin’s growth, and the need for a de minimis exemption to simplify transactions. Together, they underscore the importance of bipartisan support and clear policy to secure Bitcoin’s role in the U.S. economic future.

Here are some of the key insights:

Post-Election Bitcoin Strategy: With a pro-Bitcoin administration in power, the Bitcoin Policy Institute is focused on ensuring Bitcoin’s interests are prioritized amid competing narratives from centralized cryptocurrencies. The shift presents an opportunity to establish long-term alliances and policy frameworks supportive of Bitcoin.

Operation Chokepoint 2.0: David explains how prior banking regulations targeted crypto companies through undemocratic mandates. While this crackdown is expected to subside under the new administration, transparency and accountability are critical to preventing similar actions in the future.

Strategic Bitcoin Reserve (SBR): The proposal involves transferring seized Bitcoin from the U.S. Marshals Service to the Treasury and initiating a phased accumulation strategy. By aligning U.S. government interests with Bitcoin, the SBR could reduce the likelihood of future unfavorable policies.

Legislation Priorities: David emphasizes the importance of pardoning Ross Ulbricht, implementing a de minimis tax exemption for small Bitcoin transactions, and securing strategic reserves. These steps are seen as foundational for Bitcoin’s integration into U.S. policy.

Bipartisan Bitcoin Advocacy: The institute aims to bridge political divides by framing Bitcoin as a nonpartisan issue tied to economic and individual freedoms, advocating against regulatory favoritism while supporting equal energy taxation across industries.

Mastering Bitcoin Self-Custody with BTC Sessions

In this episode, BTC Sessions, a seasoned Bitcoin educator, dives into the essential skills and tools for achieving true self-custody and financial sovereignty in bitcoin. In this insightful conversation with Nik, BTC Sessions shares his personal journey, highlighting how he learned about self-custody, using hardware wallets, and running Bitcoin nodes. They also discuss the evolution of the hardware wallet ecosystem. This episode comes in an effort to help our viewers understand the practical aspects of living in a bitcoin standard, and how to overcome the challenges involved in doing so. BTC Sessions helps Nik discover the empowering tools that can streamline bitcoin transactions and enhance privacy.

Here are some of the key insights:

Starting with Bitcoin: BTC Sessions emphasizes the importance of learning how to obtain, use, and secure Bitcoin. Beginners are encouraged to start with a mobile wallet, such as Aqua Wallet, to familiarize themselves with sending, receiving, and managing Bitcoin before advancing to hardware wallets.

Self-Custody Practices: Practicing self-custody includes setting up a wallet, sending a transaction, and recovering it using the seed phrase. These exercises build confidence in managing Bitcoin while reinforcing the critical importance of securing recovery phrases.

Hardware Wallets and Multisig: Hardware wallets are essential for users holding significant amounts of Bitcoin. Multisig setups provide additional security by requiring multiple keys, reducing the risk of a single point of failure and offering plausible deniability in coercive scenarios.

Advanced Tools for Bitcoin Security: BTC Sessions highlights tools like Tap Signers for mobile security and Coldcard Q for efficient hardware-based transactions. He also discusses using Bitcoin nodes and Lightning nodes for privacy, security, and transactional efficiency.

Bitcoin Education and Resources: BTC Sessions shares his journey into Bitcoin education, creating step-by-step video tutorials to simplify complex processes. He also underscores the importance of finding the right storage and management solutions tailored to individual needs.

Goodbye Recession: Welcome to the 2025 Economic Boom

In this episode, Nik Bhatia sits down with Eric Wallerstein of Yardeni Research to dissect the forces driving today’s financial markets. They explore how rising interest rates and evolving monetary policy are reshaping recession expectations and the resilience of the corporate bond market, dive into the Fed’s cautious balance sheet management, the risks of private credit, and the impact of bond volatility on equity returns. The discussion highlights the effects of a strong dollar, the Treasury’s strategy to manage the yield curve, and the interplay between the Fed and Treasury in shaping future policy. Eric draws from his experience at the New York Fed to analyze how these factors influence stock market profit margins, the housing market, and the global economic outlook, offering key insights into the shifting dynamics of financial markets.

Here are some of the key insights:

Treasury Yields and Inflation Expectations: Eric highlights the bond market's recalibration as growth expectations rise and long-term inflation proves sticky. He anticipates a range-bound 10-year yield between 4.5% and 5%, with bond volatility persisting due to fiscal deficits and a steady treasury supply.

Yield Curve Pressures: The flattening yield curve reflects mixed signals, with economic strength driving bond yields higher while the Fed’s rate cuts attempt to ease financial conditions. A potential steepening could occur if inflation expectations continue climbing.

Impact of Fiscal Policy: The administration’s approach to debt management, including reliance on short-term treasury bills, is mitigating financial tightening but raising concerns about long-term refinancing risks and fiscal sustainability.

Private Credit and Market Dynamics: The opacity of private credit markets introduces potential risks, though Eric notes their capacity to absorb debt reduces pressure on traditional banking systems. He also underscores the shift toward productivity-driven investments in technology and automation as a structural tailwind for economic resilience.

Stronger Dollar and Global Effects: A stronger dollar, bolstered by high U.S. interest rates and economic outperformance, is containing inflation but straining foreign markets. Eric discusses the potential for multilateral currency coordination under the new administration to align fiscal and monetary goals.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we discuss post-election Trump decisions regarding the next wave of government changes.

Check out TBL Thinks here:

What TBL Pro Is Reading

Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

excellent and complete review