Good morning Readers!

With January a wrap, we had to peek at the monthly candles. Bitcoin and the S&P 500 both look strong, so we start there and back into the narratives. This week’s market action did not disappoint, featuring a tech route, AI reexamination, a Fed meeting, tariffs on China, Mexico, and Canada, tariffs proposed for Europe (!!), and a head-spinning number of topics to analyze. In today’s TBL Weekly, we will cover:

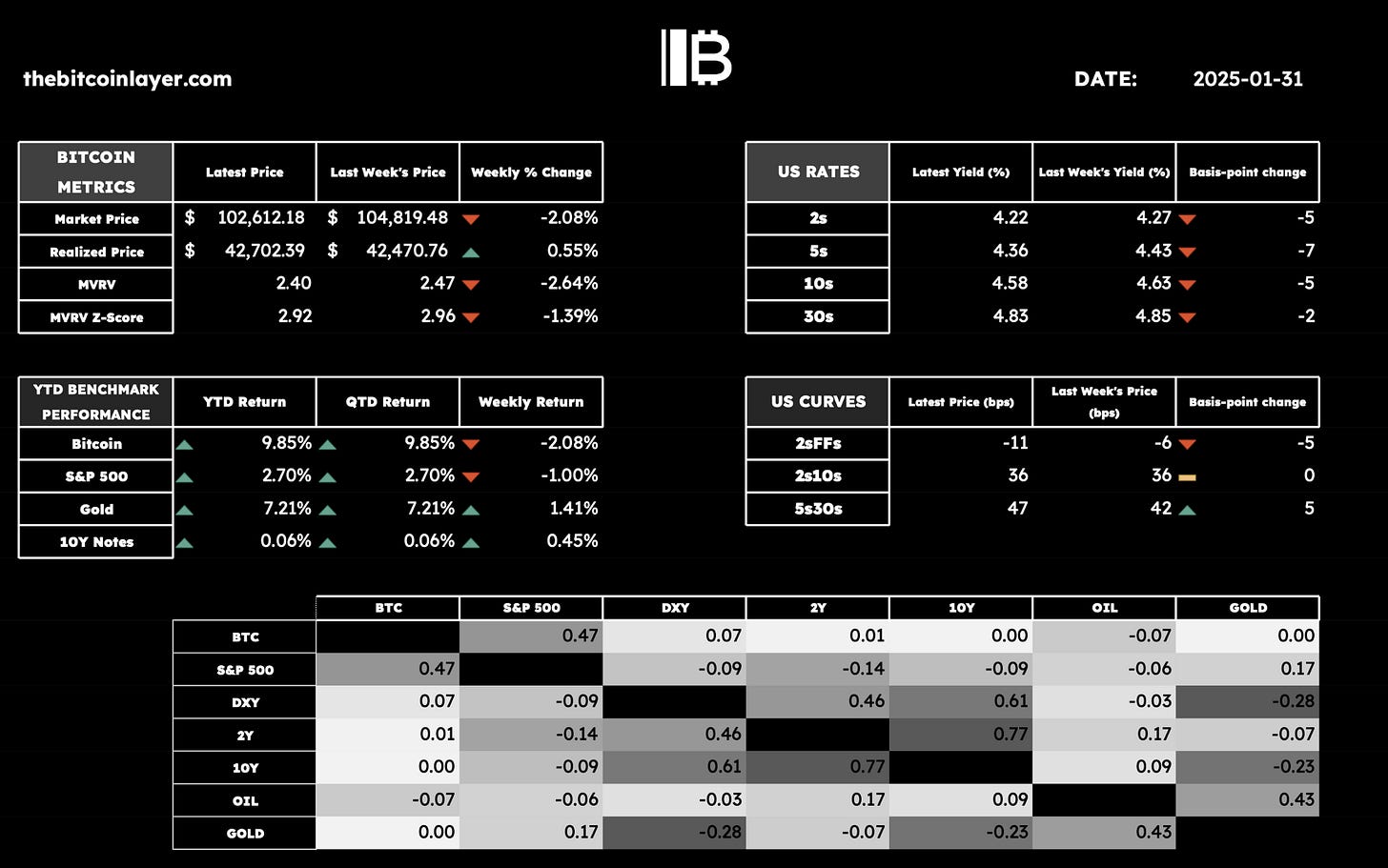

A TBL Liquidity update

Sustained bullishness in risk assets

US dollar geopolitics

US rates and conditions for credit expansion

FOMC shows its hand

So, without further ado, grab a coffee, and let’s dive into TBL Weekly #127

As bitcoin's role in the global financial landscape evolves, understanding its potential impact on your wealth becomes increasingly crucial. Whether we see measured adoption or accelerated hyperbitcoinization, being prepared for various scenarios can make the difference between merely participating and truly optimizing your position.

This is why Unchained developed the Bitcoin Calculator – a sophisticated modeling tool that helps you visualize and prepare for multiple bitcoin futures. Beyond traditional retirement planning, it offers deep insight into how different adoption scenarios could transform your wealth trajectory.

What sets this tool apart is its integration with the Unchained IRA – the only solution that combines the tax advantages of a retirement account with the security of self-custody. In any future state, maintaining direct control of your keys remains fundamental to your bitcoin strategy.