Jackson Hole Chart Pack

Jerome Powell speaks tomorrow in Wyoming. What are prices doing in preparation?

Dear readers,

As we approach the annual central banking symposium at Jackson Hole, economists and the financial media will focus on 2% inflation targets, 3% inflation targets, and central banking divergence. At The Bitcoin Layer, we’re more focused on prices, but that doesn’t mean Wyoming comments are superfluous. While we looked at weekly candles and longer-term charts last week, today’s chart pack looks more closely at daily candles and looks to identify key swing levels ahead of any market-moving words in Jerome Powell’s speech.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Today’s Charts

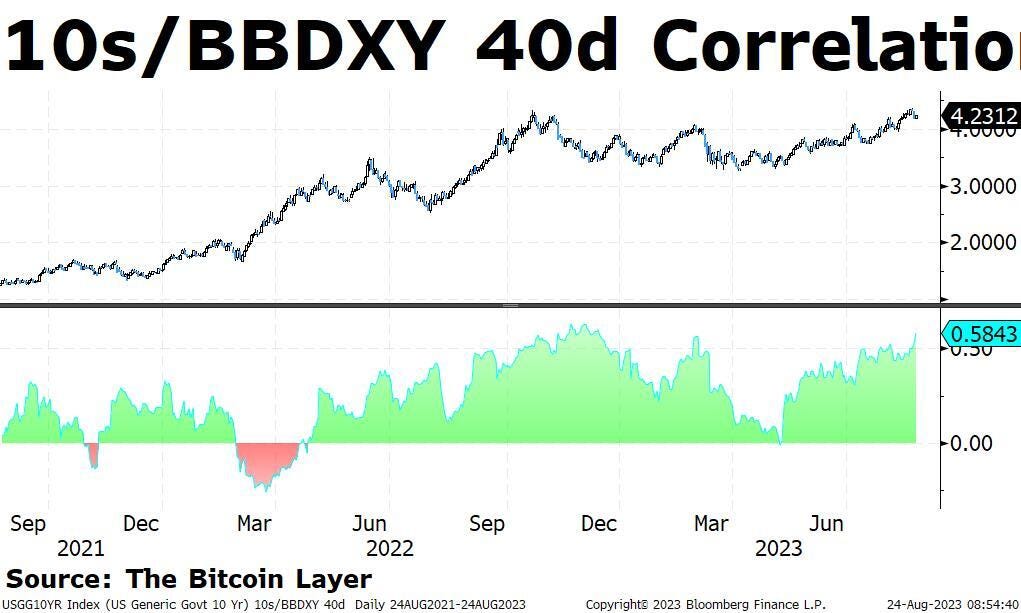

Treasuries/Dollar correlation

US Treasury 10-year yields

US Treasury 2-year yields

Dollar Index (DXY)

EURUSD (Euro)

Germany 10-year yields

Crude Oil

Equities/Treasuries correlation

S&P 500

Bitcoin/Equities correlation

Bitcoin

Treasuries/Dollar correlation

Correlations of 2022’s raging bear market in bonds are back. As yields have retreated over the past could months and prices of Treasuries have declined, the relationship between the dollar and Treasuries has strengthened significantly. We are now seeing the dollar gain strength as yields move higher—this is a first-order effect of higher yields, they attract investors to convert to the higher-yield from other lower-yielding currencies. But this is only looking at the two assets in isolation.