Japan Back To QE After 48 Hours, US Banks Tighten Lending, and Bitcoin Is A Stablecoin

A cross-market update to kick off your week.

Invest in Bitcoin with confidence at River.com

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Markets are relatively quiet in keeping with the more tempered summer months. In the same vein of keeping it brief and getting back to the pool, today we bring you an update on all of the relevant happenings in markets—with explanations of what it means for our favorite asset classes, and our place in the cycle.

Japan abandons YCC, resumes it 48 hours later

Just like the US, Japan’s central bank plays a role in its own government bond market. The Bank of Japan uses what’s called Yield Curve Control (YCC).

Yield Curve Control (YCC) sets a specific range for the yield on a specific tenor of bond—for example, the Bank of Japan has targeted 0.25% to 0.5% on the 10-year Japanese government bond, allowing it to fluctuate in that range and buying/selling if it breaks above/below.

Last Friday, the Bank of Japan announced that it would loosen its interest rate target on the 10-year JGB from 0.5% to 1%.

This action promoted a swift selloff that caused the BoJ to intervene with an emergency bond-buying operation. Recall that fast government bond selloffs can leave some important owners unprepared for the volatility and lead to important financial institutions such as pension funds failing—think last September in the UK before the Bank of England intervened.

Low collateral volatility is important.

Government bonds, including Japan’s, are used as collateral for borrowing all around the world. If the value of that government bond collateral drops too much, it may cause a loop of selling as borrowers rush to meet margin calls.

TLDR; it is in the country’s best interest that this does not happen in its own bond market, and can result in central bank intervention in government bond markets.

This may be the catalyst that takes the USD/JPY exchange rate to ¥200—Japan cannot stop supporting its bond market, so it is choosing to sell its FX reserves and buy JGBs, at the expense of the yen.

For now, this is a relatively small $2.1 billion emergency purchase and is considered “slope management” — where the BoJ is simply slowing the sell-off rather than abandoning its goal of loosening YCC.

The fact remains that we believe this is an inevitability for all central banks that do QE, YCC, and similar government bond-buying operations.

What begins as a crisis response takes on an increasingly large role in government bond purchases over time. As central bank demand usurps buying that used to come from external sources, the market grows reliant on the steady central bank bid—it can never stop, or else risk the solvency of financial institutions that hold these bonds.

A government funded increasingly by its own central bank—a sovereign debt ouroboros.

What impact will the Bank of Japan’s intervention have on US markets? We will have to watch USDJPY to see if the dollar warrants any relative strength; we’ll also have to keep our eye on Japanese holdings of Treasuries, which can be an jeopardy in interventionist times like these.

US loan demand falls to post-2008 low

The Senior Loan Officer Opinion Survey on Bank Lending Practices for Q2, or SLOOS, was released today—and with it, data showing the tightest lending standards since COVID, and the weakest post-2008 business loan demand.

Forty-six percent of survey respondents tightened lending somewhat, 4.8% tightened lending considerably, and across all banks surveyed a -51.6% drop in Commercial & Industrial (C&I) loan demand was reported in Q2:

Consumer loan standards for credit cards tightened on average, while lending standards for automobiles and other credit loosened but remain elevated:

Digging into the details more —

Business Loans = Tighter Standards & Weaker Demand for C&I loans to small, mid-sized, and large businesses

Household Loans = Tighter Standards & Weaker Demand across all categories of residential real estate loans

Commercial Real Estate Loans = Tighter Standards & Weaker Demand

Consumer Loans = Tighter Standards across credit card, auto, and other loans, with Weaker Demand for auto and other consumer loans

Home Equity Lines of Credit = Tighter Standards & Weaker Demand

Survey respondents mostly cited a less favorable economic outlook, expected deterioration in collateral values, and falling credit quality of loans as reasons for tightening standards.

TLDR; the Fed’s 14-month worth of rate hikes are, after long and variable lags, translating to tighter borrowing and falling loan demand for businesses, households, and consumers.

In a credit-based economy, this inevitably translates to an economic slowdown, otherwise termed a recession. Lending standards lead the unemployment rate by roughly 18 months (ignoring the COVID spike). Looking ahead over the next 6-8 months, unemployment is going to head much higher:

For the time being, the market will probably not care about SLOOS all too much. It only cares about headline economic data like CPI inflation, unemployment, jobless claims, PMI surveys, and where the Fed takes the policy rate. Until the majority of these headline signals are flashing red, the market has no catalyst to reverse off of its post-strong-earnings rally continuation.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

The Treasury will borrow $1.89 trillion in 5 months

As is always the case when the US raises the debt ceiling, or in this case it has suspended the ceiling, it will borrow as much as it can until it can’t any longer.

Its latest borrowing estimate outlined $1.007 trillion from July–September, and another $852 billion from October–December. That’s an addition of $1.89 trillion in debt over the next 5 months:

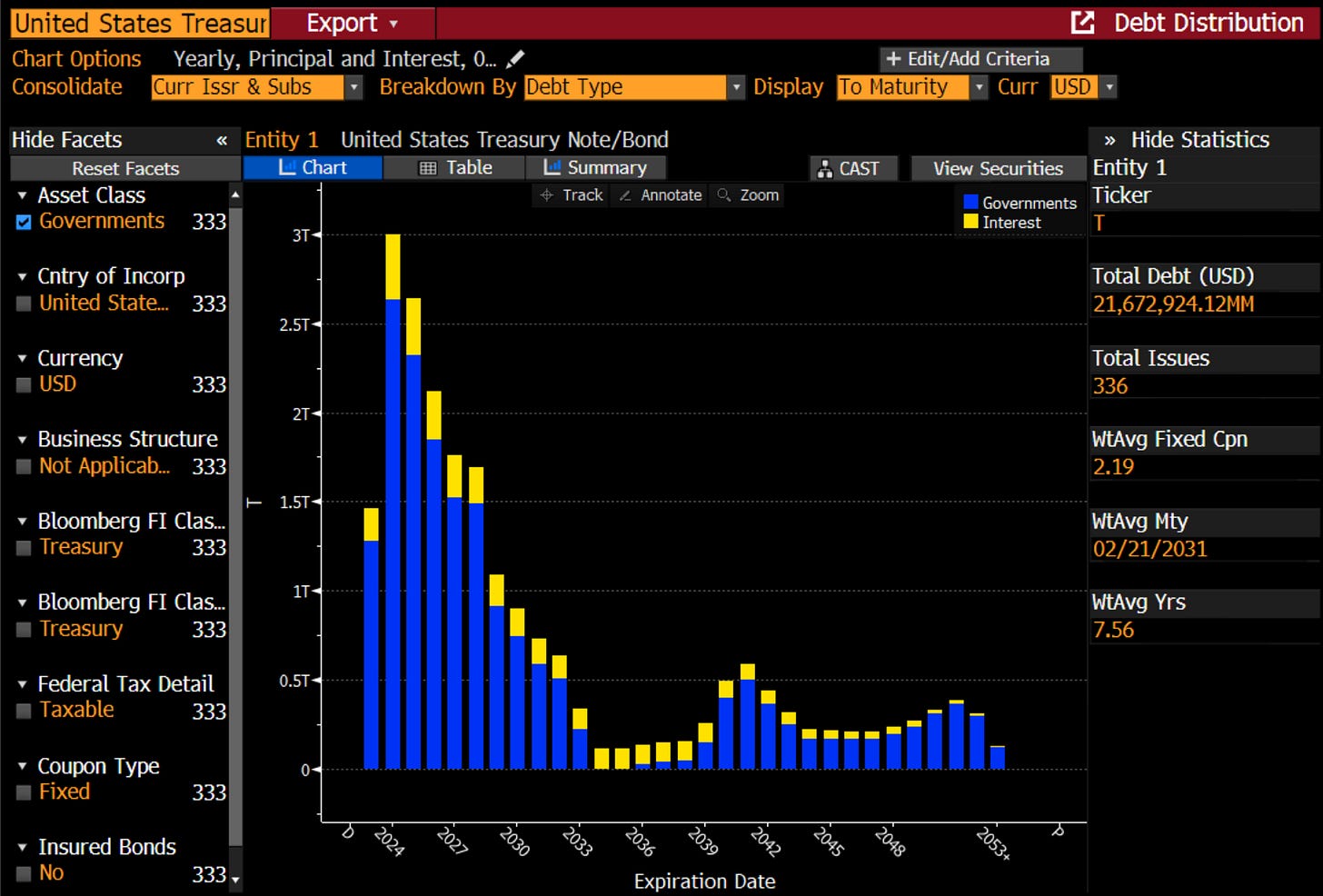

The majority of the US Treasury’s outstanding notes and bonds mature between now and 2028—some $12 trillion in debt that will need to be rolled from 2.19% to 4% or higher where current US Treasury rates sit:

The average interest rate on US Treasury debt, including bills which is excluded from the above diagram, has breached 2.9%—the highest since 2009, and heading much higher as debt matures and is rolled at 4% or higher:

Another view shows just how gargantuan the interest expense on US government bonds has become—it hit $970 billion, and at the pace with which this debt is maturing and rolling into debt at a twice-as-high interest rate, it will reach $1 trillion before the year is over:

That nearly $2 trillion in fresh US Treasuries will need to be purchased. While the Fed’s ON RRP facility will likely be drawn down as money market fund managers shift into higher-yielding T-bills, liquidity for these USTs will come from other sources given that this borrowing estimate is roughly the entire size of that facility. Like oil in water, we anticipate a crowding-out effect from other assets as USTs absorb liquidity that would otherwise be allocated to them, including stocks, monetary metals, and bitcoin:

The more disconcerting long-term issue is that of the federal deficit. We have consumed far more than we have produced for too long at the government level, recently hitting a $1.39 trillion funding deficit for the first time ever. Austerity or an extreme increase in productivity is needed to get the government’s funding situation back on track. Ideally, this happens soon before we go off the rails.

Risk-taking is alive and well for now

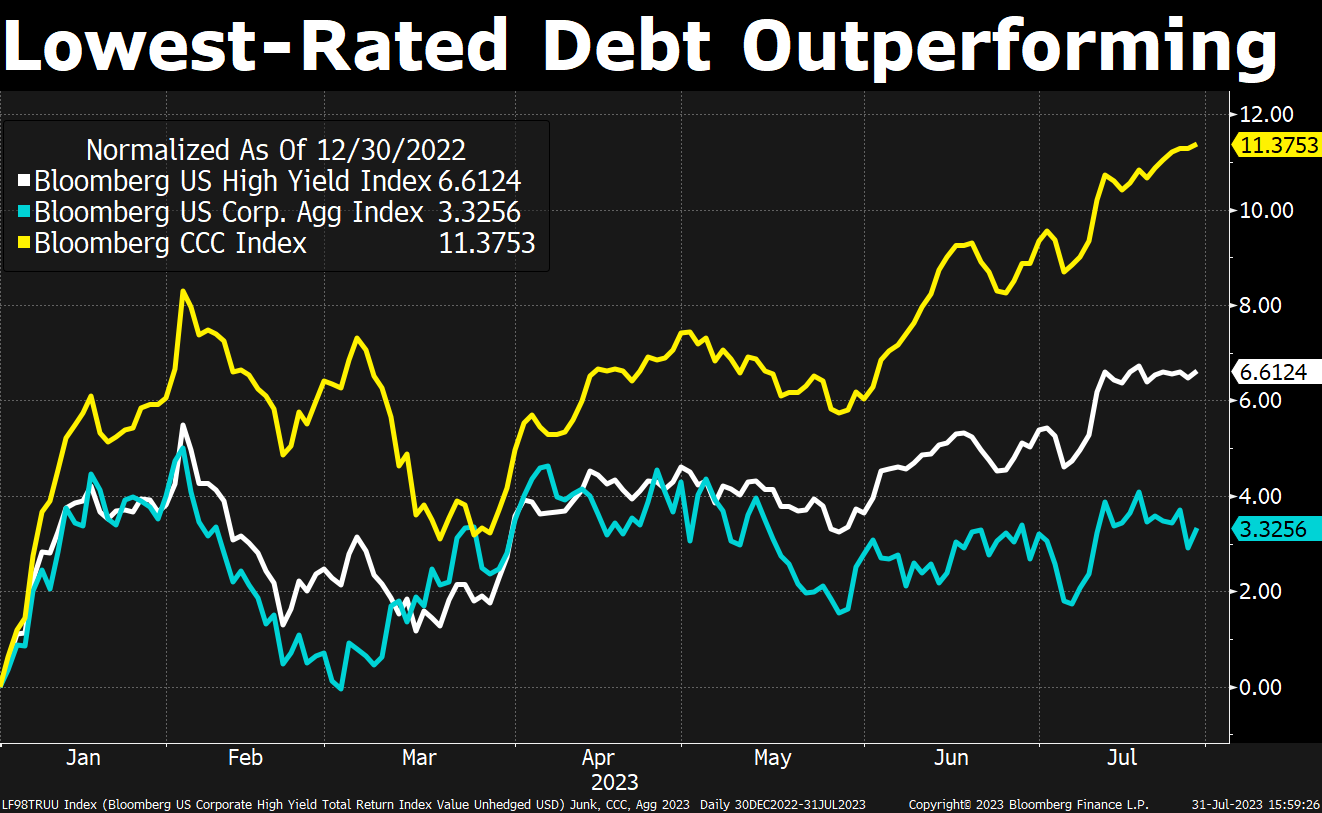

Credit is still holding up, and even the lowest-rated borrowers are doing well. The Bloomberg US High Yield Index is up 230 points off its September 2022 bottom:

Here is the CCC index of the lowest-rated corporate debt compared to the aforementioned high yield in white and corporate aggregate in teal. You don’t see this kind of outperformance in riskier debt during a recession:

Credit spreads have reached their tightest since last April, with 82% of last week’s reporting companies beating earnings expectations, driving up risk sentiment even further.

With tightness of business, household, and consumer lending standards mentioned up top, we are on the cusp of the labor market unwinding. Again, there is an ~18-month lag from when lending standards tighten and the unemployment rate rises to follow it, and we are 12 months into tightening lending standards. We can’t fight cycles—by identifying historical patterns, we can write with a recessionary slant even as headline data suggests extreme, unabashed strength.

Jim Cramer has said a recession is no longer in sight, while “soft landing” segments have engulfed the entirety of CNBC and Bloomberg’s programming.

That’s the headline data. Behind the curtains, CVS is cutting 5,000 jobs amid tweaking consumer demand. Other slashes are waiting in the wings—just ask Jerome Powell his intent.

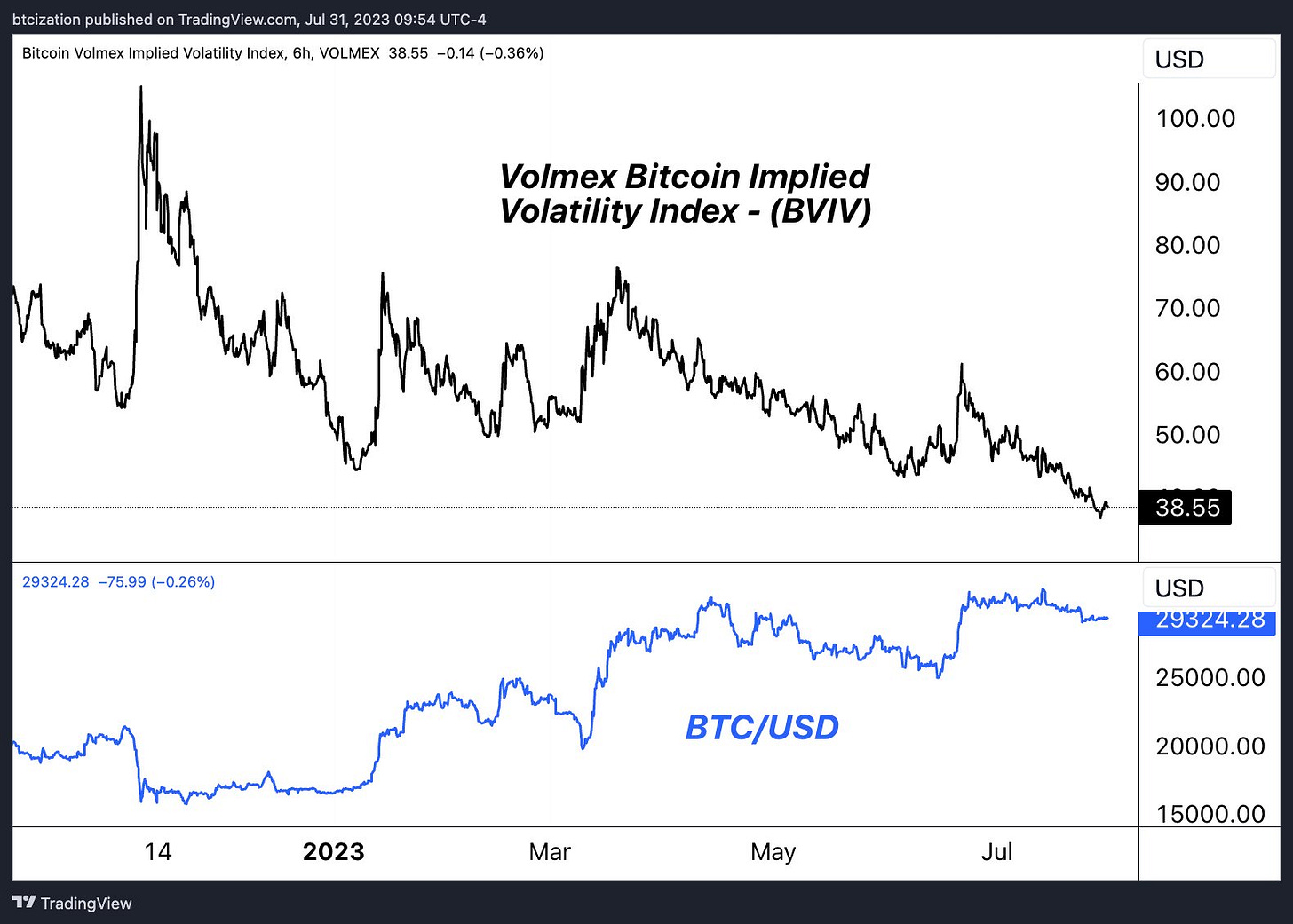

Lastly, we look to an oft-reliable orange compass for guidance. Bitcoin has historically been a leading indicator for the direction of other risk assets. Its low liquidity and high-beta make it a reliable gauge for where markets are heading. As the S&P 500 has rallied in euphoric up-only fashion, bitcoin has done absolutely nothing for weeks, reaching historically low levels of volatility, closely reflecting the cautious tone in lending standards discussed above:

Is bitcoin trying to portend cautious risk sentiment as we head into the final five months of 2023? Considering its predictive track record, it’s not too farfetched.

Until next time,

Joe & Nik

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com

👏👍

Very nice analysis. Thank you for your insights!