Japan Scraps Yield Curve Control As England Eyes Cuts & Powell Panics

The Bank of Japan drops its yield-control program, the Bank of England's inflation battle is almost over, and the Fed is floundering.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Global central bank week

Today, we’ll take a timely look at what central bankers have in store and how their decisions will impact the global economy.

We have a huge lineup of central bank meetings and interest rate decisions, starting off with the Bank of Japan and Reserve Bank of Australia on Tuesday and proceeding with the Fed, the Bank of England, the Swiss National Bank, and more. For our purposes today, we will be focusing on Japan, the UK, and the United States.

Japan

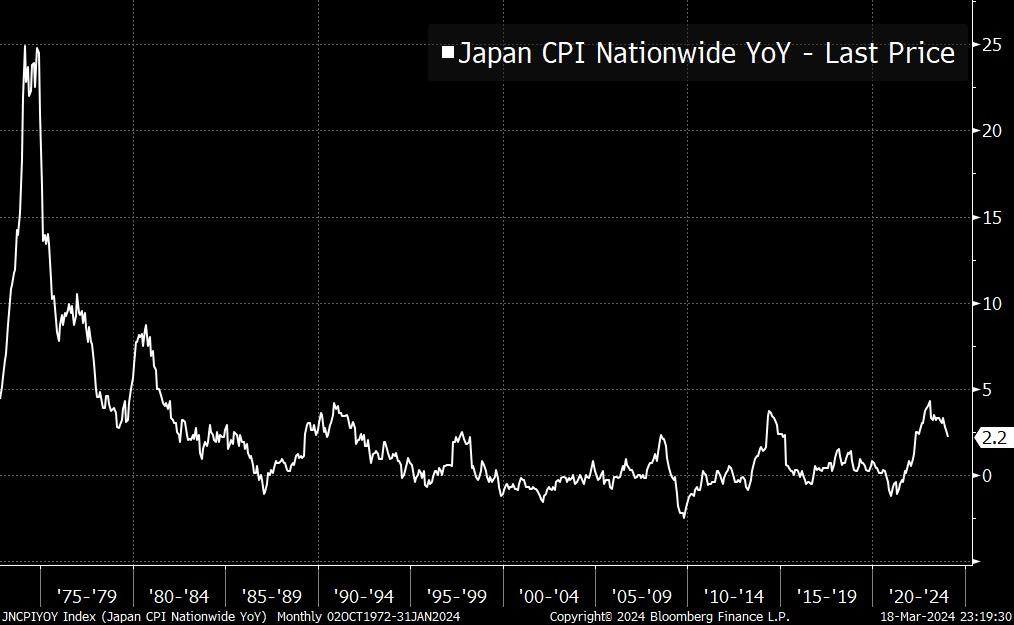

The BoJ on Tuesday decided to scrap its yield curve control (YCC) program that it’s had in place for over seven years now. Through this program, the BoJ has bought and sold government bonds in an unlimited quantity in order to maintain a tight range for yields, thereby stimulating economic activity. It has pinned short-term yields below 0%, making it unprofitable for banks to hold reserves idly, in an effort to push them to extend loans and spur economic growth and spending, fighting deflation, in theory. In practice, it has been relatively ineffective, as Japan has still struggled with low inflation for decades and the problem of poor economic growth has persisted:

Today, it is abandoning its current approach to try something different. This new approach is focused on getting employers to raise their wages to encourage household spending:

A new wage regime could bring material and permanent changes to Japan, while we continue to think about Japan as a US Treasuries net seller.