Jerome, Our Skipper

Monetary policy's captain made sure markets received the message not to expect a June rate increase. Bitcoin's biggest test ever.

Dear readers,

It’s over, finally. You might have become tired of our constant warnings, from “hikes slowing from 75 to 50 basis points” to “a pause has likely arrived,” this publication hasn’t been short of descriptors (and posts) for this hiking cycle’s demise. And when my birthday rolls around on Wednesday just in time for the next FOMC meeting, I might not receive that gift certificate I wanted for a round of golf at Pebble Beach from Jerome Powell, but I’ll settle for what real estate agents are probably begging for: a reprieve.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

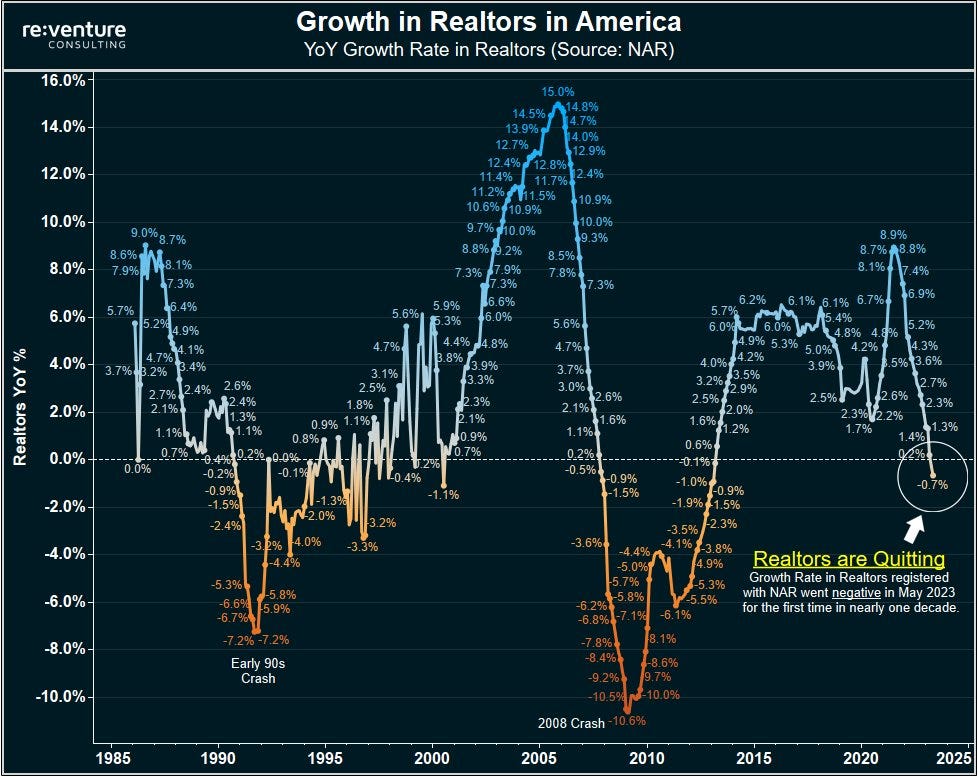

Realtors are quitting

Home prices are now in decline on an annual basis for the first time in over a decade. It shouldn’t shock you what other metric is also declining YoY for the first time in over a decade: the number of realtors. Using data from the National Association of Realtors, the number of realtors is now negative versus May of 2022:

By itself, we could isolate and discard this corner of the employment picture. But common sense tells us instead that recessionary forces are at hand. Extremely high interest rates relative to the past 15 years are annihilating support for real estate as an asset class, where the marginal borrower and buyer usually set prices. Pockets of America, especially in the starter home range and in markets with limited supply, are seeing very stable markets, but the aggregate data tells a story of punitive mortgage rates, falling sales volumes, declining prices at the median, and a lack of confidence. Realtors quitting echoes this, but the scarier proposition to this segment of the economy is just how long these punitive rates can hang around. If Jerome Powell has his way, it will be a while, but June’s “skip” suggests a not-so-quiet whisper of fear at the Fed. Allow us to explain.