JP Morgan & Rothschild Now Own Bitcoin ETFs... You Read That Correctly: TBL Weekly #93

No need to pinch yourself, this is real.

Welcome to TBL Weekly #93—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning everyone, happy Saturday.

At long last… THE INSTITUTIONS ARE HERE.

We don’t often use all caps, as we are not sensationalists, we are analysts. However, this development is not only years in the making, and one that many doubted would ever happen, but a seismic shift in the way traditional markets view and invest in bitcoin as an asset. No longer snake oil, it is finally, albeit slowly, winding up on the balance sheet of the United States’ largest banks thanks to its outsized positive contribution in creating the best risk-balanced investment portfolios.

The 13F filings are coming in before the May 15th deadline. Here’s the breakdown:

JPMorgan has $760,000 in BTC ETFs — 1st largest bank in America

Wells Fargo has $143,000 in BTC ETFs — 4th largest bank in America

US Bank has $14 million in BTC ETFs — 5th largest bank in America

PNC Bank has $10 million in BTC ETFs — 8th largest bank in America

William Blair, an investment bank with $142 billion in client assets, has $6 million in BTC ETFs

Blackrock has $5.5 million in its own IBIT bitcoin ETF

One of the Rothschild family’s banks has $3.6 million in BTC ETFs

First they laugh at it, then they fight it, then they allocate to it and are forced to report it in their 13F filings. The banks have figured it out, have you?

Special thanks to Julian Fahrer from Apollo for compiling this data.

Flows underperformed this week, with the one upside being that GBTC outflows have also tamed, no longer making for consistent selling pressure for spot bitcoin:

One word for bitcoin’s price action, and the price action across all of risk lately…YAWN. Not to be curt with my language, but, seriously. This is the stuff that 10-hours of sleep without the need for NyQuil are made of. Good reason for it too: it’s May. The age-old adage “sell in May and go away” is being felt in earnest right now. Summer is right around the corner, trading floors are thinning out and taking liquidity and leverage with them, and we’re left with a bland malaise for the month of May:

Zooming in further so I can prove this to you. Here is a liquidation heatmap of BTC/USD; essentially, price levels where lots of leverage exists and lots of people become forced buyers/sellers, shooting the price in a feedback loop up or down. It is a hallmark of bitcoin, and one of the many reasons behind its oft erratic price action. Any big liquidation levels? Zero. Zip. Zilch. Nada. It is a no-man’s land between $50,000 and $67,000. There will be no major catalyst up or down as long as we are rangebound, at least not from derivatives. Further choppiness or a slow climb higher is the path of least resistance. Look at you, bitcoin, following in the steps of your older brother equities by having a very boring late Spring:

Commercial real estate is experiencing haircuts across the country as defaults on loans rise due to tenants abandoning ship. Burnett Plaza, the tallest building in Fort Worth, was sold this week at foreclosure auction for $12.3 million back to the lender. It previously sold in 2021 for $137.5 million. A massive haircut, symptomatic of the shift to remote work and all of the havoc it is wreaking on physical office space and all lenders exposed to it, or owners of those securitized mortgages, CMBS, further down the line:

Google also announced it would not renew its lease in April 2025 and would be leaving its 300,000 ft² San Francisco office. The reason cited was improving efficiency by scaling back physical office space for its now largely hybrid workforce, a trend with much of corporate America post-COVID, particularly tech companies. However, it did just open a massive tower (bigger than this one) of its own in El Salvador, a country that has been sprinting after global capital investment. Clearly, remote work isn’t the only culprit, and the competitiveness of the US on the world stage is being challenged at the margin. Small potatoes for now, but the US should not get complacent here. In a digital economy with location-independent companies, you can lose and lose fast.

The descent of core CPI inflation down to the 2.5% upper target is taking much longer than the Fed would like it to. It is expected to make some more incremental progress next Wednesday. Headline CPI is expected to decelerate from 3.5% to 3.4% annual pace, while core CPI is expected to decelerate further from 3.8% to 3.6% annually. Upside surprises have been a trend for the last few months’ CPI prints, and another one next Wednesday is not out of the question. As consumer expectations for prices on a 1-year and 5-year horizon remain elevated, and leading indicators like service business prices paid are on the rise, another upside shock would likely not spook markets as much as prior prints. It is now the trend:

Prices are the only component sharply reflecting upward in the ISM Services survey:

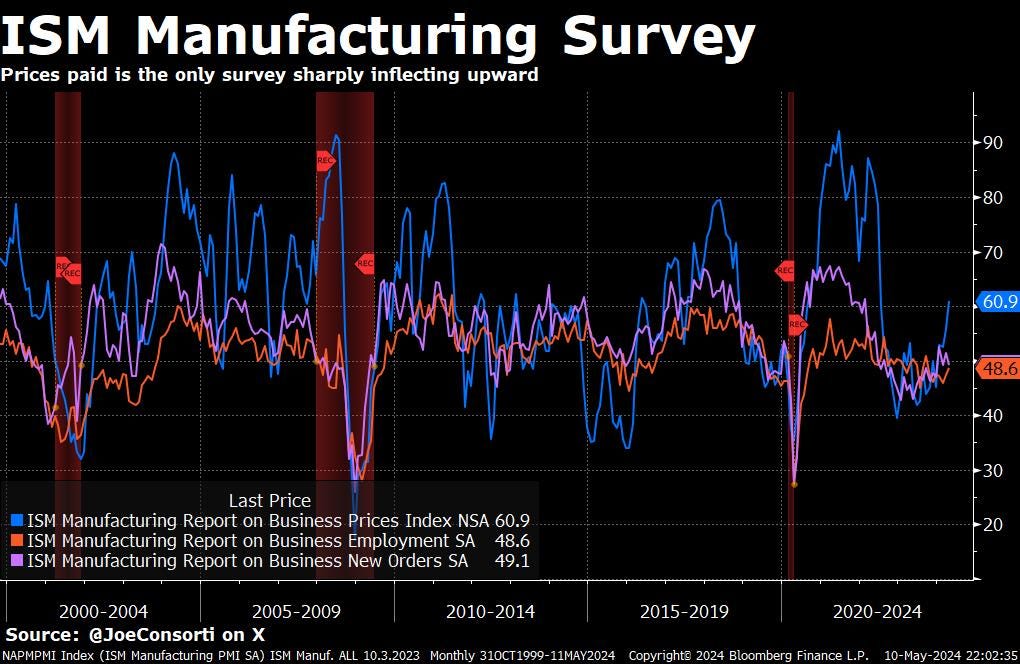

Prices are the only component sharply reflecting upward in the ISM Manufacturing survey, too:

The best way to describe this economy would not be stagflationary, it’s just not accurate. Economic growth is still nominally positive, and claims are rising marginally but the unemployment rate is still low and jobs are still being added on net to the US economy. The better way to describe it, in my view, would be uncomfortably inflationary. Times are hard because wages simply aren’t keeping up with hot price growth. You’re not quite thrown out of work, but it's getting more difficult to get by. This is a better position to be in than stagflation, because there are two clear outcomes instead of muddy uncomfortability. Eventually, employers will have to make a choice: raise wages, or lay people off. We hope that the former would raise wage growth in line with prices without generating a wage-price spiral, where if the latter happened, then you’d see a typical recession and Fed easing on the other side of it.

Next Week with Nik

In the week ahead, Wednesday’s CPI discussed already by Joe will dominate traders’ attention, but Tuesday’s PPI and Wednesday’s retail sales will both give the market some additional signal on the economy. It’s clear the Fed isn’t winning on inflation, but it must at least show it’s not coming under pressure on the economy as some including us flagged with ugly April employment readings across JOLTS and both ISMs. Hot CPI will spike rates and hit risk—interestingly, bitcoin’s price showed a fair amount of weakness late into the week leaving us curious about its divergence with stocks that held on much better.

Of course, it wouldn’t be a Treasury settlement day (May 15th) without us flagging it. This will be the second-to-last Treasury QT day at the current clip before falling in June. We strongly believe balance sheet expansion is a mathematical inevitability, and the reduction of QT was a sign that we are heading back up in balance sheet size. Much like the Fed, we understand that ample reserves no longer ample will trigger money market troubles. But much like the Fed, we don’t know at what level of reserves that occurs. Trial and error, anyone?

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

Finals have been graded and summer break begins! Statistics from the exam perfectly threaded the needle between too easy and impossible—two out of 51 students scored higher than 96%, while the median registered at a comfortably cool 64%. Why so icy? My class gets slightly more difficult for the average student as the years go by, as I am inclined to squeeze in each new global macroeconomic facet to the required knowledge set. New, as in newly teachable from my perspective, and this semester had its fair share of new components thanks to The Bitcoin Layer, which drives my research quality higher with each subscription, question, and comment from you, the loyal reader. This year, the inclusion of shadow money balance sheet mechanics tripped up more than a few of these grads.

One of the two students that aced the exam also wrote a phenomenal position paper on Basel III, why small banks dying isn’t necessarily bad for financial stability, and how shadow banks could trigger the next global financial crisis. His thesis on how risk is being stuffed into shadow banks and completely escaping the very spirit of Basel regulations will give me nightmares.

Check out—Next Financial Crisis In The Shadows

In this episode, Nik is joined by veteran investor Craig Shapiro. Craig breaks down why he is short small cap stocks by explaining how Powell is gaslighting the markets, why Yellen continues to dump Treasuries on the investing public, and how profit margins will struggle considering policy rates remain above 5%. Craig also explains why he is long bitcoin and gold.

Check out—Wall St. Trader: Fed Is TRAPPED, I'm SHORT Small Cap Stocks

Tuesday

Today I have an overview of bitcoin’s current price action and on-chain spending behavior to determine where we’re at in the cycle and what the next few months might look like. I wrap with some disconcerting excess cash and bank deposit data that paints a risk-off picture and further adds to the deteriorating macro outlook.

Check out—Smart Money Hints Bitcoin's Top May Already Be In

In this video, Joe walks through 4 bitcoin charts and 1 chart about excess savings. He breaks down the near-term price action and why we have been consolidating for 10 weeks in a row, the broader macro factors at play for the rest of the year, why the smart money have taken profits but are now holding onto their coins, and why you should zoom out and observe that the bull market is likely not even close to finished just yet.

Check out—Bitcoin Update: Older Coins Are HODLING, But Bull Market Is Not Over

Thursday

Everybody has their idea of how Yellen and Powell and Biden all want this, that, or the other. It becomes confusing, especially when theories that sound feasible in isolation contradict each other. My goal today is to flesh out the various theories, some more conspiratorial than others. Hopefully, we emerge less confused. Either that or we’re wearing tinfoil. And I am pretty good at distinguishing conspiracy from fact—for example, Bill Gates and Bill Clinton taking several trips to Epstein’s island isn’t a conspiracy thanks to eyewitnesses and unsealed court documents. Just so we’re clear.

Check out—I'm drowning in (conspiracy) theories

In this episode, Nik and Joe are joined by CrossBorder Capital founder and Capital Wars author Michael Howell. In a wide ranging discussion on liquidity, the global monetary system, and bitcoin, Michael shares his theories on how this year will play out in financial markets. We ask him about debt monetization, currency devaluation forces on Japan and China, the impact of cross-border capital flows, why bitcoin is an excellent barometer of global liquidity, and much more.

Check out—Global Liquidity Update with Michael Howell

Friday

We are excited to announce our latest installment, TBL Thinks! This is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise.

Check out our first issue here—TBL Thinks: SPR drain, TikTok ban, & Saudi woes

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Finally we have analysts who are not jumping on the stagflation train!

I'd kindly ask if you could please explain a certain part of the Michael Howell interview from the other day.

When he and you talk of commercial banks (credit providers) increasing liquidity in the system by having their balance sheet expand by absorbing T-bills...I'm not quite clear where on their balance sheet do they go. Asset side? Don't they have to swap reserves for them, which keeps the asset side the same.

He talks of expanding the balance sheet when the banks liability side also expands by rising deposits (checks issued by the government to the depositors), but that isn't the case now like it was in 2020. Or is it, because of the government deficit?

Or is the funding for banks purchases of T-bills coming from repo markets, as Nik implied? If that's so, I still don't understand why does that expand the balance sheet of the banks? Isn't it just a swap?