Know What You're Holding: Digital Gold

Combining the BTC/Gold ratio and on-chain analysis to measure Bitcoin prices.

It is an absolute honor to regularly write about Bitcoin and financial markets for The Bitcoin Layer. This note will be the first of hopefully many that I'll write for TBL’s valued readers. I've decided to introduce some frameworks I use to analyze markets, allowing you to become acquainted with my approach to anticipating future price developments.

I promise to go step-by-step, spreading different frameworks across multiple notes, and I'll avoid overwhelming you with too many topics at once.

In the current environment, it's crucial to address the fact that Bitcoin has been trading closely with the US stock market. During periods of high correlation, traders even started referring to it as "BTC 500," likening it to the S&P 500. The narrative of Bitcoin behaving like a "high-beta tech stock" is currently holding it back.

In these uncertain times, we've witnessed gold outperforming other assets, which is remarkable. I genuinely tip my hat to everyone who had some allocation in gold for precisely the reasons unfolding now. Additionally, I've received anecdotal evidence of Bitcoin holders questioning their positions, occasionally reaching out to seek my perspective on Bitcoin versus gold. There is a growing fear among some that they might have backed the wrong horse.

I've formed an opinion regarding the current scenario of gold outperforming Bitcoin and Bitcoin's correlation with the US stock market. I want to clearly emphasize that this is my opinion, and readers should treat it accordingly. This opinion is built upon various sources, basic reasoning, and is partially supported by data and technical analysis, which I will share with you.

Michael Howell, a good friend of TBL, conducted research on the systematic influences on Bitcoin's price. According to his findings, only 22.2% of Bitcoin's price is influenced by investor risk appetite. I highlight this because, in my view, if Bitcoin truly behaved like a "high-beta tech stock," this percentage would likely be higher. Howell's research suggests that Bitcoin's price is largely driven by global liquidity. Another significant factor is gold, which he further divides into the gold price itself and the BTC/Gold ratio.

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Global Liquidity

To be honest, I'm a bit out of my depth regarding global liquidity. Nik does an excellent job balancing his role as both a student and teacher on this topic, regularly updating the TBL Liquidity Index and sharing valuable videos with Michael Howell for anyone interested in a deeper understanding. Although I won't spend much time on global liquidity here, it's important to mention briefly, given its significant 40% systematic influence on Bitcoin's price.

Bitcoin news mainly focuses on the United States, which is understandable and valid. However, Bitcoin is fundamentally a global asset. This global nature suggests that it shouldn't necessarily trade in lockstep with US stocks. For instance, if Germany significantly increases its defense spending through higher deficits, it will impact the global money supply. Additionally, China's role as a major driver of global liquidity can't be ignored, especially in the context of US attempts to isolate it from global trade.

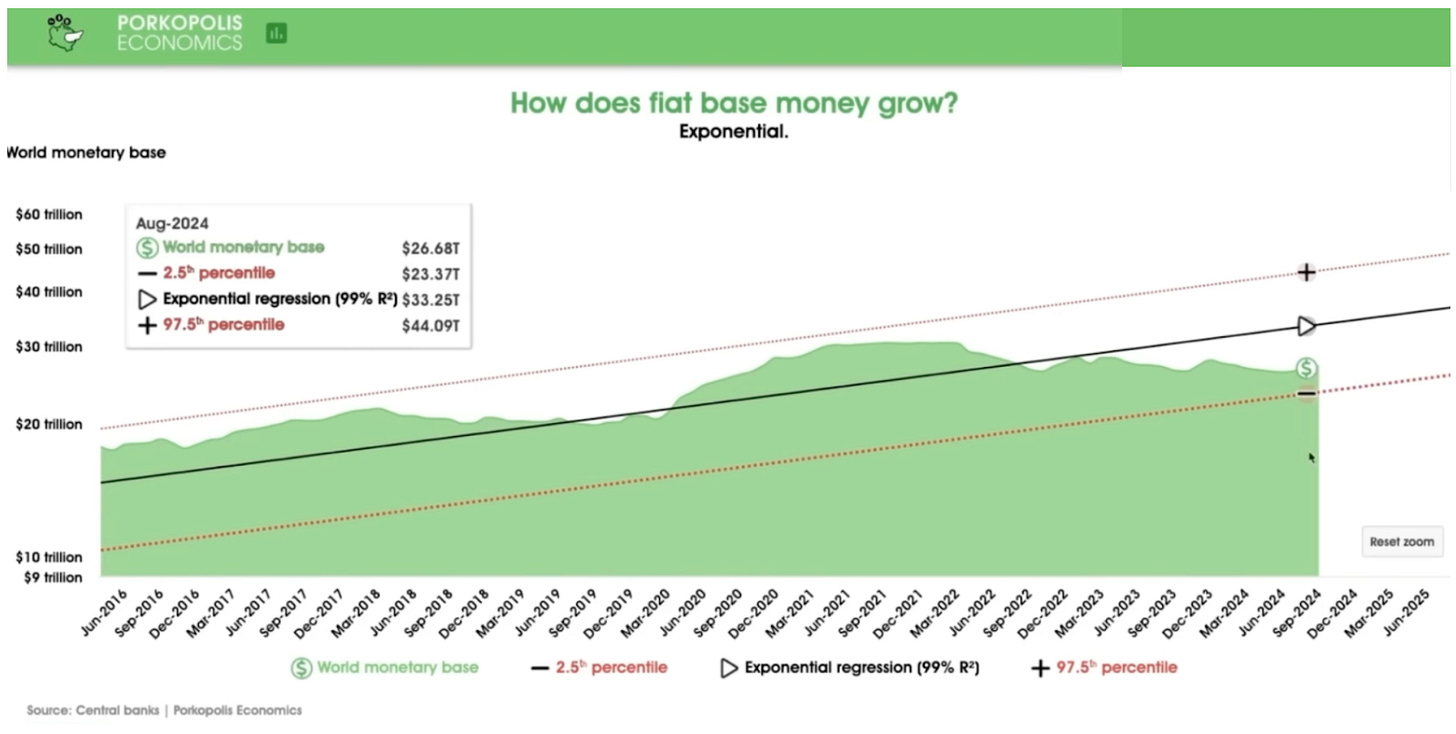

Matthew Mezinskis has conducted impressive research on the growth of base money, sovereign debt, Bitcoin, population, and other economic topics. Recently, he highlighted that the money base has been declining since 2022 due to central banks tightening monetary policy after expansive measures during the COVID period aimed at curbing inflation. The World Monetary Base (WMB) is trending towards the lower bound of his growth model. He expects that this decline will come to an end soon and that the base money supply should rise again in the near future. Historical data indicate that the WMB could increase by 50% and still remain within historical ranges.

Michael Howell wrote in his weekly Global Liquidity Watch: “A typical liquidity cycle lasts 5-6 years from trough to trough, and based on the October 2022 low point, we expect the current cycle to peak around Q4 of this year.”

Tying this all together…