Merry Christmas, Rate Hikes Are Over: TBL Weekly #24

Recapping the action in bitcoin and macro.

Welcome to TBL Weekly #24—here are your highlights!

Markets Analysis

Our monitor for the week ending Saturday, December 17th, 2022:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

The 2s/FFs curve has finally inverted, and with it, the end of the hiking cycle is upon us. Regardless of the Fed’s dot plot or Jerome Powell’s HawkTalk rhetoric of 5%+, the front end of the yield curve is no longer obeying the Fed’s guidance to reprice upward past the latest hike. The rates market is leading the Fed, and the sustained bid for the 2-year US Treasury has set its yield at ~4.2% - below the Fed’s upper bound of 4.5%. The question has shifted from how high to how long will the Fed hold here.

Now that we have presumably arrived at the terminal rate (or thereabouts), we watch for deteriorating underlying economic data, financial markets oddities, and labor market strength as our primary answers for when the Fed moves from an extended pause into rate cuts. (Deterioration that threatens deflation in the real economy, illiquidity in the money markets or a dried-up credit market, or the labor market unraveling would drive the Fed to ease.)

Inflation falling without turning into outright deflation is the non-cataclysmic scenario that the Fed hopes for—this “soft landing” is incumbent on the aforementioned economy, money, credit, and labor markets holding steady under the crushing weight of a 425-basis-point increase in the cost of capital in nine months.

As cracks start to form in the underlying data, the crushing weight across global and domestic dollar markets of a swiftly-repriced risk-free rate may induce a hard-landing pivot rather than the Goldilocks-soft-landing pivot the Fed is shooting for.

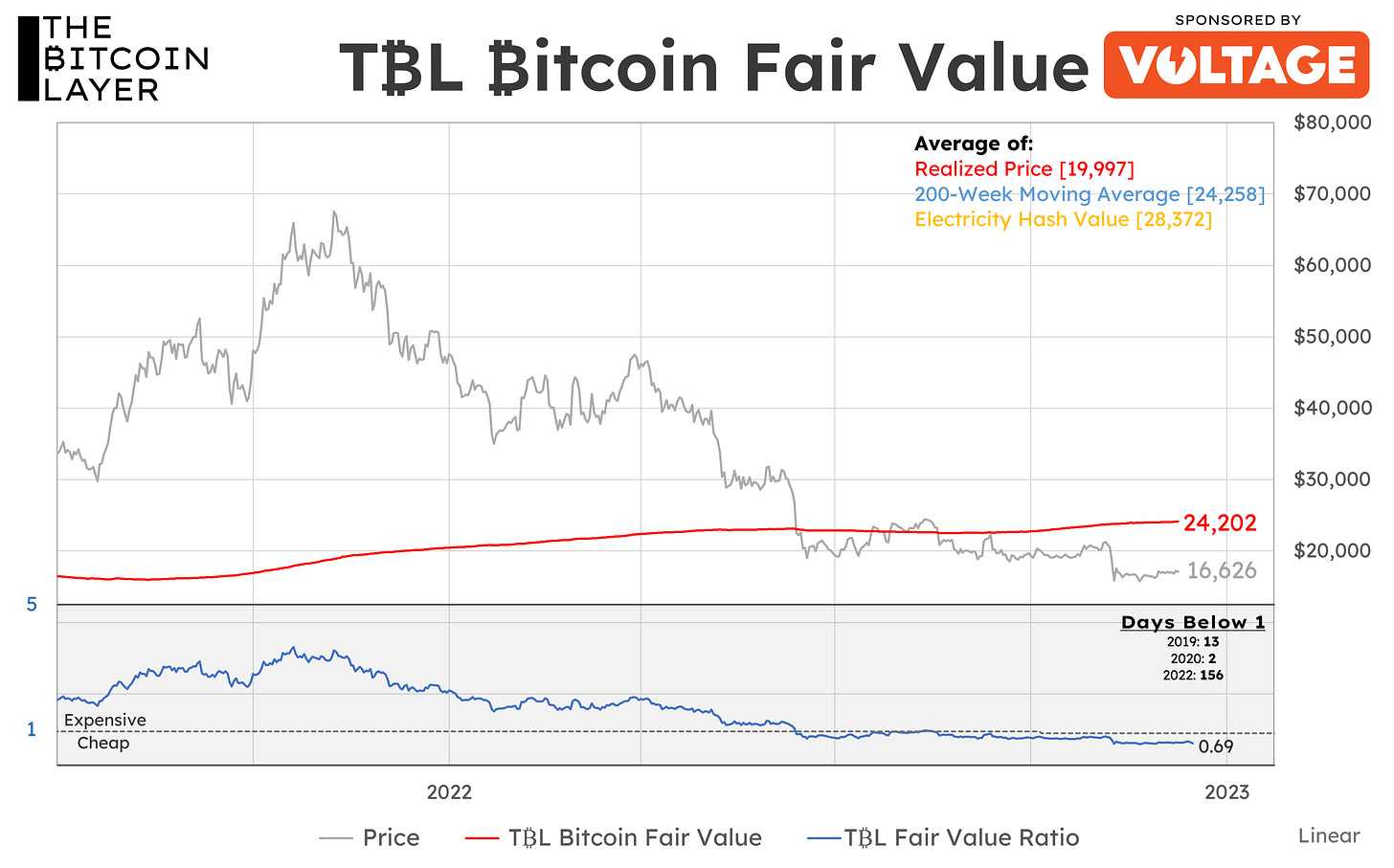

Also, for those interested in what a staircase looks like, here’s bitcoin’s price action mapped against our fair valuation model. To channel Bill Murray in the film Groundhog Day: Bitcoin is cheap, again:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Now, here are your quick links to all of the TBL content for the week:

Tuesday

Civil unrest has once again swept across China in a coordinated manner and scale not seen since the student-led protests that culminated in Tiananmen Square in 1989. This time, the CCP has decided to gradually give the people what they want: phasing out the stringent and inhumane zero-COVID policy that has kept citizens sequestered in their homes for three years now.

We analyze the CCP’s purported changes to the zero-COVID policy, the likelihood and timeline of a China reopening, and the impact it will have on global growth and inflation. Oh, and somebody got arrested.

Nik and Joe break down:

Scam Bankman-Fraud has been arrested in The Bahamas, finally.

The CCP’s plan to gradually relax its zero-COVID policy.

A downtrodden consumer, poor growth outlook, and aging demographics paint a dreary picture for China.

It’s unlikely for now that China’s eventual reopening will exacerbate already-elevated domestic price inflation.

Check out—

SBF Cuffed, China Reopening, Implications for Global Growth & Inflation

Wednesday

Nik sits down with James Palmer, an author of several books and the Deputy Editor at Foreign Policy Magazine.

James discusses the major set of crises facing China ranging from COVID and reopening, to property and demographics, and the implications each has on the growth story for China and the world at large:

Thursday

The Fed is frozen in its own tracks. It took about 24 hours for us to finally realize what happened at yesterday’s FOMC meeting. Oh shit, we thought, they’re petrified.

Also, we owe it to ourselves to protect bitcoin, users, and builders from the new Digital Asset Anti-Money Laundering Act.

Nik breaks down:

Rates markets are coming for Powell & Co.

US Senators make new political enemies in the form of bitcoiners.

Check out The Fed Is Petrified, Protect the American Right to Bitcoin

Friday

Joe sits down with Lawrence Lepard, an Investment Manager at Equity Management Associates LLC, sound money advocate, and Austrian economist.

Lawrence discusses the pitfalls of central banking, how price signals are distorted, the immense government debt problem, and why gold and bitcoin function as debasement insurance in your portfolio:

Our videos are on major podcast platforms including Apple Podcasts, Spotify, and Fountain.

Holiday Merch Sale!

Ever wanted bitcoin merchandise that looks like normal, stylish clothing, and will not elicit strange looks out in public? You’re in luck!

For a limited time through the end of the holiday season, enjoy 15% off all TBL merchandise.

Use the promo code: XMAS15 for all merch at our store: TBL Merch Store

Keep up with The Bitcoin Layer by following our social media

YouTube — Twitter — LinkedIn — Instagram — TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud