MicroStrategy Joins Nasdaq 100, Bitcoin Chases Money Markets: TBL Weekly #122

Good morning Readers!

Friday evening’s release of ETF rebalances never graces our radar. Except last night, when the well-forecasted move of Michael Saylor’s MicroStrategy joining the Nasdaq 100 (QQQ) triumphantly ascended bitcoin another rung higher on the global financial ladder. We ponder the accelerated large-scale adoption in a post-$100k world.

Given the outperformance of bitcoin over the past month, it is easy to forget that cash still exists. In fact, demand for cash and cash-like assets, measured using Money Market Funds’ assets (MMFs), is over 3X the market capitalization of our precious orange coin. We analyze today’s demand for cash, and what signal we may derive from it—here’s how we’ll do that:

Current returns from holding cash

The dollar and US rates

And bitcoin’s decoupling from equities

So, grab your morning coffee, and let’s dive into TBL Weekly #122.

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Weekly Monitor

Weekly Analysis

Next week, the Fed will be cutting rates for the third time this cycle, taking the trustworthy spread between Treasury 2-year yields and Fed Funds to almost nil. Currently at -37 basis points, a 25 basis point cut takes most of that out. In short, this means that the market and the Fed are finally together in the medium-term outlook on policy rates. The market is saying that the policy rate should average about 4.25% over the next couple of years, while the Fed is about to lower the lower-bound of the policy corridor to 4.25%. This means the Fed is likely heading for more of a “wait and see” approach, as are investors.

On the margin, this should put a ceiling on bond volatility with a more certain and mild approach to changes in monetary policy. Inflation certainly lurks, and we won’t dismiss major signs of its persistence, but a disinflationary presence finds new life at TBL—we cannot ignore technology’s deflationary powers, and the current AI boom is bringing unprecedented investment as well as disrupting entire industries and the corporate relationship with labor.

Positive returns from holding cash

This week, we received an important piece of information for the Fed’s upcoming meeting, which is that CPI remains in its range of moderate:

The print came in as expected, which allowed the market to confirm this month’s rate cut. This boosted bitcoin’s price in the middle of the week, as risk markets like certainty, and they certainly like lower rates.

What does this have to do with cash? Cash in the investment sphere means short-term, risk-free assets like Treasury Bills. If you are a corporation with millions or billions of dollars in cash, you expose yourself to your own bank’s credit risk by leaving all your uninsured deposits in a bank account (we hear Trump may have something to say about the FDIC, but that’s a story for another time). Thus, leaving cash in a bank account is a big ‘No, No’ in the grand scheme of things; this is the main value proposition for T-Bills. Let’s now look at another chart:

As of November, holding a cash-like 3M-Bill returns approximately 4.60% on an annualized basis, while YoY Core CPI lies at 3.30%. In other words, your real rate of return for holding a bill is 1.3%, and looking at the time series, real returns on cash haven’t been around since pre-Great Financial Crisis. We can’t ignore that recessions are associated with the Fed lowering overnight rates, which usually eliminates any positive return on cash, so we’ll be watching for that.

As it stands right now, though, holding bills is not a bad proposition for capital preservation when using CPI as an all-encompassing measure of inflation—which it isn’t, but we digress. In fact, let’s look at MMF-asset growth rates in times when this real return is positive (chart inspired by Bravos Research):

Since 2006, the YoY growth rate of assets in MMFs has been positively associated with positive real returns in cash-like assets, which makes sense, but why do we care? Demand for cash means potential headwinds for risk assets. From 2008-2018, when this real return was negative, we saw steady growth in the S&P 500. Then, in 2018, when the real return turned positive, the S&P started experiencing some pullbacks, only to continue growing in 2019. The relationship is evolving, but again we can’t ignore the relationship between attractive cash and selling risk assets.

Eyes on the dollar

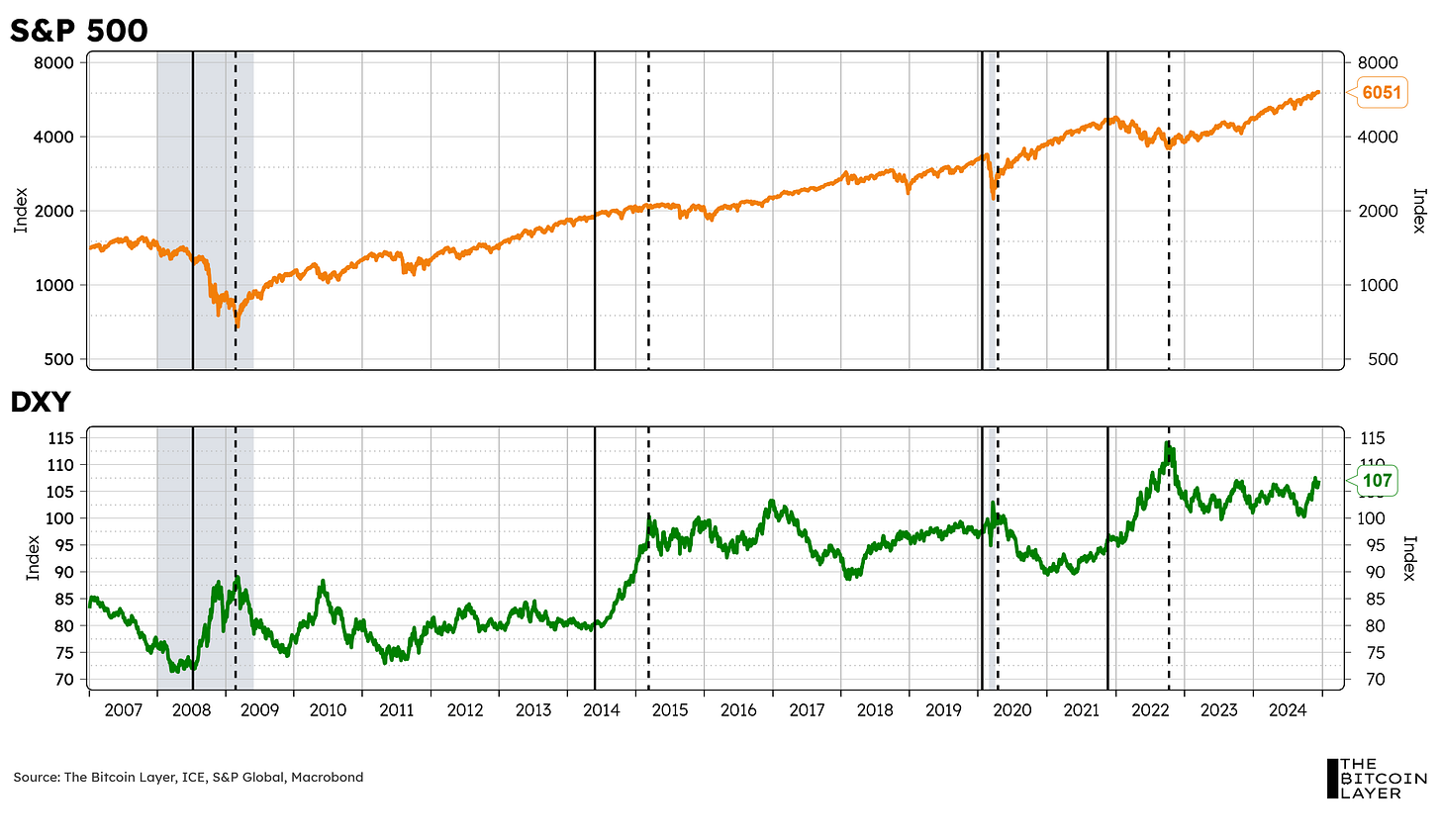

Inspired by Tuur Demeester’s presentation during an Unchained webinar this past week, we looked at the demand for dollars (the ultimate form of cash), and how equities behave during high dollar-demand times. For the most part (except for 2014), when the dollar rallies, we see a decrease in the S&P 500:

Currently, we understand that a strong dollar is a potential threat to stocks. At the same time, the rally in stocks alongside the dollar since the return of Trump might mean the penalty of a stronger dollar on risk markets is at the very least delayed. With cash looking like an attractive option—especially if we get Bessent to issue more bills next year—we may be in for some pullback, and we see the S&P 500 as about 5% extended beyond its blistering trend over the past year.

Another thing to note here is the realized volatility in the US rates market:

US 2Y yields have seen violent moves up and down over the past 3 years when looking at the daily 30-day trailing percentage-point changes. When observing the wide ranges from 2022 to 2024, 2008’s volatility seems like an ant-hill in comparison. Think about it: given the Fed’s current indecision, almost every economic print we’ve gotten this year drives a violent weekly move up or down. This data dependency has been going on for way too long.

Is bitcoin cash or a risk asset?

Bitcoin is often associated with tech stocks (or risk assets more generally) given its high correlation with them—even we, at TBL, associate bitcoin with risk assets for the most part; however, looking at this chart (another one inspired by Tuur), we notice periods where decoupling happens:

If these two were perfectly coupled, this logarithmic chart would not have periods wherein bitcoin grows at an increasing rate in relation to tech stocks, such as in 2017, 2020, and now late 2024. Obviously, many things skew these decoupling patterns, mainly bitcoin’s emerging-asset characteristic; however, this simply goes to show that bitcoin is still different from equities. Here’s another chart to bring this point home, but in a worldwide scenario:

Bitcoin recently shot through its 120 ratio to global equities, an extremely bullish picture that showcases how bitcoin is outpacing equities in general.

So then, where do we place bitcoin as an asset? The fact that we don’t have an answer to this means that we are still so early.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Economic events next week

Important Economic Charts from Last Week

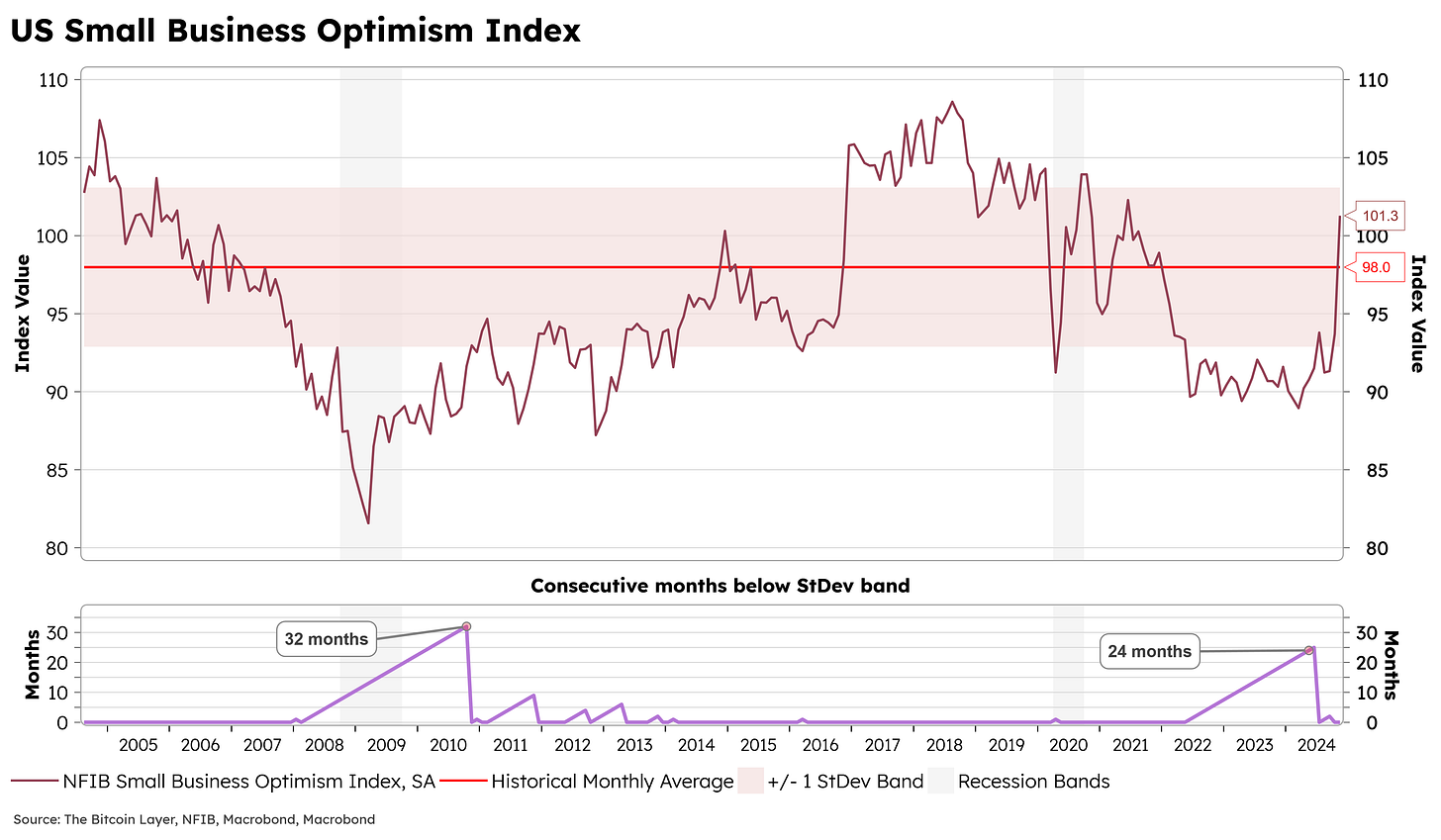

A very large jump in small business optimism surely has something to do with the election, tax cuts, and deregulation.

In case you missed it: TBL on YouTube

China’s Money Printer Set to Explode: Massive Stimulus Amid Trump’s Trade War 2.0

In this video, Nik unravels the complex dynamics between the United States and China, exploring the profound shifts in the global monetary system triggered by Donald Trump's return to office. Drawing on insights from Russell Napier's groundbreaking thesis, Bhatia touches on China's strategic response to changing geopolitical tensions, revealing the complex dynamics between Chinese ownership of U.S. Treasuries and money printing. In that same vein, Nik also explains the intricate manipulation of currency markets, as well as the emergence of dual supply chains and escalating trade wars. This video is part of Nik's research to better understand how China is preparing to navigate Trump's nationalist policies and what this means for international trade, monetary policy, and asset liquidity in the coming years.

Here are some of the key insights:

Napier’s Thesis on Currency Manipulation and Low U.S. Rates: China’s past strategy of buying U.S. Treasuries suppressed U.S. interest rates, indirectly supporting inflation control and shaping Federal Reserve policy through market-driven mechanisms.

China’s Shift to Domestic Bonds: China is moving away from U.S. Treasuries, investing in domestic bonds instead. This marks a significant pivot as the PBoC engages in quantitative easing to stimulate the Chinese economy.

Dual Supply Chains and Nationalist Policies: The trade and technology wars between the U.S. and China are driving the creation of separate supply chains. Nationalist borrowing and spending policies are reshaping global trade and economic strategies.

Global Liquidity Expansion: China’s domestic monetary stimulus and the U.S.’s deficit expansion are forecasted to drive substantial global liquidity growth, impacting financial markets worldwide.

Currency and Inflation Implications: China’s increased fiscal deficit is expected to devalue the yuan marginally, while global credit creation is likely to boost asset prices more significantly than consumer inflation.

Tech Cold War and AI Rivalry: The U.S. and China are escalating their competition in AI and semiconductor development, further embedding dual supply chains and intensifying economic tensions.

MicroStrategy Wants All the Bitcoin—And Their Stock Is Exploding Because of It

In this episode, Nik Bhatia sits down with Jeff Park to dissect MicroStrategy’s bold strategy to dominate the Bitcoin market. They explore how the company’s use of convertible bonds and debt-fueled Bitcoin accumulation has made it a unique force in the financialization of Bitcoin. Delving into the mechanics of MicroStrategy’s stock performance, they analyze its correlation with Bitcoin’s volatility and the opportunities it presents for retail and institutional investors alike. Nik and Jeff also discuss yield generation strategies and the role of options trading, offering insights into navigating crypto investments in an increasingly complex and evolving market landscape.

Here are some of the key insights:

MicroStrategy’s Bitcoin Acquisition Strategy: MicroStrategy recently added $2 billion worth of Bitcoin, bringing its holdings to over 400,000 BTC. This aggressive accumulation is facilitated through convertible bonds, which allow the company to leverage its clean capital structure to acquire Bitcoin at scale.

Convertible Bonds as a Financial Tool: Convertible bonds enable investors to trade fixed yields for the potential upside of equity. MicroStrategy's bonds have been highly profitable, with some issues seeing returns of 200%-300%. This has created demand among credit investors who prioritize yield over understanding Bitcoin itself.

MicroStrategy’s Role as a Volatility Proxy: MicroStrategy’s stock serves as a leveraged bet on Bitcoin’s price and volatility. This dynamic has made it a popular tool for investors seeking exposure to Bitcoin’s price movements with additional upside potential through equity.

Volatility Harvesting Strategies: Jeff emphasizes the potential of volatility harvesting, where investors sell options to capitalize on Bitcoin’s high volatility. Bitcoin’s unique volatility profile makes it lucrative for such strategies, though proper risk management is essential.

Institutionalization of Bitcoin Options: The growth of MicroStrategy’s options market and the broader adoption of Bitcoin options is reshaping how investors access leverage and manage risk in crypto markets. Options offer a more stable alternative to perpetual swaps, which have dominated crypto trading but carry significant liquidation risks.

Trump's POTENTIAL Economic and Dollar Playbook REVEALED by Former Treasury Official

In this episode, Nik Bhatia welcomes Stephen Miran, a PhD economist and senior strategist at Hudson Bay, to uncover the potential economic playbook of the Trump administration and its transformative policies. They dive into the strategic use of tariffs to reshape global trade, the implications of a strong U.S. dollar on the economy, and how tax cuts and deregulation fueled economic growth. Stephen reveals insights on the Federal Reserve’s evolving role, industrial policies targeting national security sectors, and the challenges of reshoring critical industries like rare earth production. Closing with a discussion on inflation, interest rates, and financial innovation, they outline the policies that could define America’s economic future.

Here are some of the key insights:

Trump’s Tariff Policy and Global Trade Restructuring: President Trump’s second term is expected to focus on restructuring the global trading system, emphasizing fairer burden-sharing among trade partners. Stephen highlights how tariffs on Chinese goods during Trump’s first term raised $500 billion over a decade, helping fund the 2017 tax cuts while reducing economic burdens on U.S. workers and manufacturers.

The Role and Impact of the Strong U.S. Dollar: A strong dollar benefits U.S. consumers by lowering import costs but tightens global financial conditions, potentially destabilizing foreign economies. The administration’s pro-reserve currency stance reflects its commitment to maintaining dollar strength for geopolitical and financial advantages, despite potential trade competitiveness concerns.

Tariffs as a Tool for Economic Resilience: Stephen argues that tariffs primarily shift the economic burden to foreign producers, such as China. By increasing tariff revenue and supporting domestic industries, the policy aims to boost U.S. manufacturing competitiveness while reducing reliance on adversarial nations for critical goods.

Industrial Policy Priorities Under Trump: Anticipated industrial policy shifts will prioritize national security sectors such as defense, AI, and medical supplies. Unlike previous climate-focused initiatives, these efforts will aim to fortify America’s economic independence and resilience in critical industries.

Deregulation and Economic Growth: Stephen emphasizes deregulation as a cornerstone of Trump’s economic strategy, reducing barriers to production and fostering competition. He highlights the disinflationary or deflationary potential of streamlining regulations, particularly in construction, energy, and financial sectors.

Tax Cuts and Deficit Management: The administration plans to extend and expand tax cuts, while targeting a 3% fiscal deficit by 2028. This balanced approach aims to sustain non-inflationary growth, ensuring investor confidence and stable bond markets.

Alignment Between Treasury and Fed Policy: Stephen discusses the expected shift in Treasury policy under Scott Bessent, focusing on longer-term bond issuance and tighter fiscal discipline. This approach aligns with Federal Reserve objectives, fostering cooperation to manage inflation and promote economic stability.

Bitcoin’s Fight for Freedom: U.S. Regulations, Court Battles, and the Future of Financial Privacy

In this episode, Nik Bhatia speaks with Yaël Ossowski of Consumer Choice Center and Bitcoin Policy Institute to explore the intersection of Bitcoin and U.S. banking laws. They dive into how regulations like the Bank Secrecy Act have shaped Bitcoin's evolution, the impact of financial surveillance on privacy, and the growing issue of debanking for cryptocurrency entrepreneurs. Yaël breaks down key controversies, including legal cases involving Tornado Cash and Samurai Wallet, and explains the proposed Savings Privacy Act, which could redefine financial privacy for Bitcoin users. Together, they examine the challenges and opportunities for Bitcoin in an era of increasing regulatory scrutiny and highlight the future of decentralized tools in a rapidly changing landscape.

Here are some of the key insights:

Bitcoin’s Alignment with U.S. Constitutional Values: Yaël highlights the parallels between Bitcoin and the First and Fourth Amendments of the U.S. Constitution. Bitcoin’s decentralized nature exemplifies the principles of free speech and property rights, making the U.S. a natural hub for its adoption and innovation.

Historical Context of Bitcoin Regulation: Bitcoin first came under U.S. regulatory scrutiny in 2013 when the Financial Crimes Enforcement Network (FinCEN) distinguished between decentralized and centralized virtual currencies. Decentralized protocols like Bitcoin were excluded from money service business (MSB) regulations as long as users retained control of their private keys.

Challenges to Bitcoin Privacy: Cases like Samurai Wallet and Tornado Cash test the boundaries of privacy and decentralization in Bitcoin. These cases raise critical questions about whether non-custodial protocols require money transmission licenses and how far the government can go in enforcing financial surveillance.

The Bank Secrecy Act (BSA) as a Dragnet: Yaël critiques the BSA for enabling mass financial surveillance through suspicious activity reports (SARs). The act’s low reporting thresholds ($10,000 for banks, $2,500 for money service businesses) create databases ripe for abuse, bypassing Fourth Amendment protections against unreasonable searches.

The Saving Privacy Act: A Legislative Solution: Senator Mike Lee’s Saving Privacy Act proposes to eliminate SARs entirely, requiring government agencies to obtain judicial warrants to access financial data. This bill aims to restore Fourth Amendment protections while safeguarding the privacy of Bitcoin users and financial institutions.

Global Trends in Bitcoin Regulation: Countries like the Czech Republic and El Salvador are experimenting with innovative Bitcoin policies, such as tax exemptions for long-term holdings. Meanwhile, the U.S. remains a global leader in regulatory influence, with other nations often emulating its approach to Bitcoin and cryptocurrencies.

Bitcoin Privacy Tools and the Future of Decentralization: Emerging privacy protocols like silent payments and advancements in Lightning Network technology highlight the importance of preserving Bitcoin’s peer-to-peer ethos. The outcomes of current legal battles will significantly impact the future of Bitcoin’s usability and privacy.

Bitcoin’s Path to MILLIONS: Strategic Reserves, New Money Creation, and Unprecedented Growth

In this episode, Nik delivers a global macro update as Bitcoin consolidates around $100,000, signaling what could be its most explosive setup yet. Expanding on his bold thesis for Bitcoin’s path to $1 million, he examines the unprecedented drivers behind this moment, including Bitcoin’s evolution as a strategic asset and the transformative role of new money creation. Connecting the dots between market momentum, institutional strategies, and the global macro landscape, Nik shares why he’s never been this bullish on Bitcoin—and why its future has never looked more promising.

Here are some of the key insights:

Bitcoin as Strategic Collateral: Nik argues that Bitcoin’s true value lies in its ability to act as pristine collateral, outperforming traditional assets like gold and real estate. Bitcoin’s digital and global verifiability makes it the ultimate settlement tool in modern financial systems.

New Money Creation Driving Adoption: Bitcoin is increasingly being monetized through new credit creation. Nik explains how mechanisms like bond issuances and repo financing are creating fresh capital for Bitcoin acquisition, similar to how real estate markets operate.

Institutional Demand and Limited Supply: With only 450 Bitcoin mined daily, institutional purchases far outpace supply. This dynamic accelerates Bitcoin’s price appreciation as a result of intense demand pressure.

Strategic Bitcoin Reserve (SBR): Nik highlights discussions led by Senator Cynthia Lummis advocating for the U.S. to establish a strategic Bitcoin reserve. This initiative aligns Bitcoin with national policy to address geopolitical challenges, fiscal sustainability, and technological dominance.

Bullish Technical and Market Dynamics: Bitcoin’s price consolidation at $100,000 demonstrates strong market resilience, with dips consistently bought. Nik sees this behavior as indicative of another parabolic move, projecting substantial price gains ahead.

Global Implications of U.S. Policy: The U.S. interest in Bitcoin, framed as a geopolitical necessity, sets the stage for global FOMO among nations. Strategic adoption by the U.S. could solidify Bitcoin’s role as a reserve asset and global financial standard.

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we analyzed the importance of lithium in Europe, as well as the AI chip boom in Asia.

Check out TBL Thinks here:

What TBL Pro Is Reading

Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Zoom Q&A:

The Zoom Q&A registration link for TBL Pro members can be in our Mean Median Mode post:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Michael Saylor is an analog to Laszlo Hanyecz