Monitoring the Situation: TBL Weekly #167

Is global macro currently a headwind or tailwind for risk?

Dear Readers,

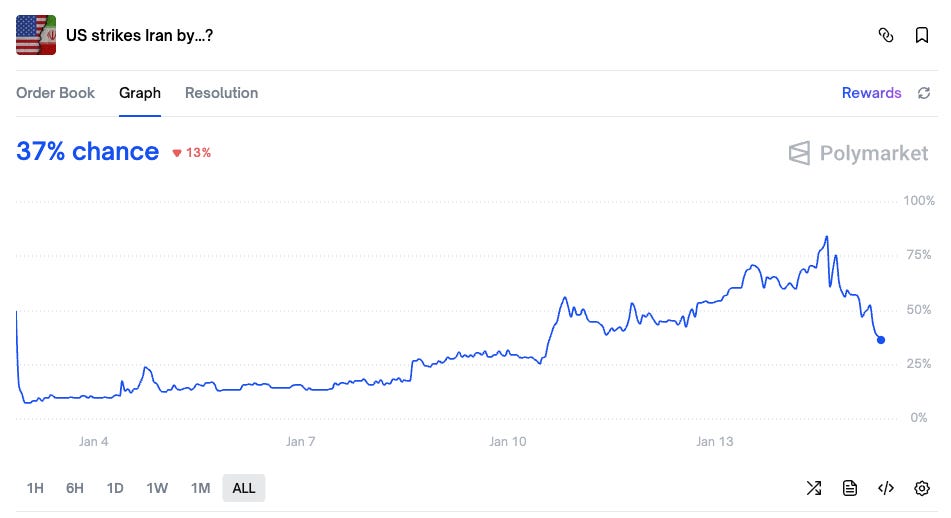

As has been the case ever since the current Trump administration took over, months' worth of news have been jam-packed into just a few days. The extraction of Venezuelan President Maduro, Fed-Trump drama, talks of a ‘Greenland’ deal, and what just two nights ago Polymarket was pricing in as an 85% probability of US intervention in Iran by January 31 (chart below)—that was until President Trump came out to say that “the killing in Iran is stopping,” plummetting the odds back down to 38% (as of this writing):

All this to say, the “monitoring the situation” meme has become very real for all of us over the past year, which is why we believe in the importance of narratives. Anchor points on what we expect to see this year should help us find a semblance of peace in today’s noisy environment.

The saying goes, “If you stand for everything, you stand for nothing.” Direction, right or wrong, is more valuable than no direction at all. Just ask the makers of the ‘Inverse Jim Cramer ETF’ (ticker: SJIM)—not a great performance, but you get the point.

Today’s narrative-building question:

Is global macro working in favor of or against risk assets in the US?

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

On January 28 at 1PM CST, James Lavish joins Unchained for a live conversation on currency debasement, why traditional portfolio assumptions are being tested, and how gold and bitcoin fit into a changing monetary landscape.

The discussion will cover:

Why debasement is structural, not cyclical

How inflation and financial repression challenge familiar portfolios

Why gold tends to move first—and bitcoin often moves further

Wednesday, January 28 at 1PM CST — online, free to attend. Register now and get early access to the report:

❌ DON’T WRITE YOUR SEED ON PAPER 📝

Why? Because securing your generational wealth on paper is risky.

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why.

This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Use code TBL to take 15% off your purchase.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

The AI / Tech Bet

The S&P 500 is dominated by seven companies: Google, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla (i.e., technology).

Since November 2025, we have seen the S&P 493 outperform the tech-heavy S&P 500, as can be seen by the performance of an equal-weighted S&P 500 (chart below):